Not too long ago, I have introduce you to a free value added component of your DBS planning platform called Financial GPS.

The Financial GPS allows you make sense of your net worth status and your cash flow status and with that, you can pretty much have a better idea about your own financial bearing.

I didn’t share with you their Nav Community because it wasn’t ready yet.

Well, now its ready and its a community that if you do not have much friends who you can confide and discuss all things about money, it is an avenue to turn to.

It is even better if you have some banking questions that you would like to ask them.

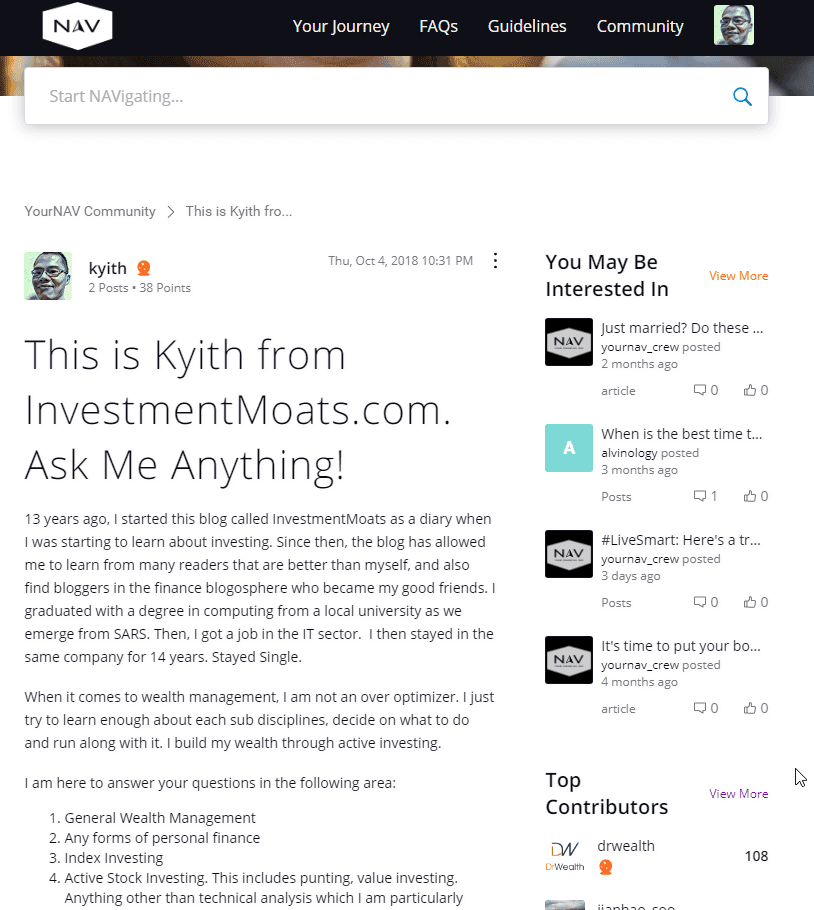

Come next Wednesday I will be doing a questions and answer, and you have the chance to ask me about all the things I covered on my blog and more.

I will be answering your questions at this thread over here.

All you need to do is to register for a community account and you can start posting your questions.

The questions and answer session will be hosted on 10th of October at 8 pm to 9 pm.

However, if you already have some questions that you wish to ask me, that I have not address them, you can post it over there today and I will try my best to answer them.

Some sub topics that you can ask includes:

- General Wealth Management

- Any forms of personal finance

- Index Investing

- Active Stock Investing. This includes punting, value investing. Anything other than technical analysis which I am particularly weak at

- Insurance (not a whole lot but on certain philosophies and my opinion on some type of insurance)

- Unit Trust

- REITs

- Retirement, financial independence

- All things Cash Flow

- Alternative form of investing

- About Life

- Singapore Current Affairs and some of my views.

Come come don’t be shy.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

assiak71

Friday 5th of October 2018

I ask first. Can you work with the right guys to create a low cost, market cap weighted S-REIT ETF. TER not more than 0.40%. Quarterly dividend. This will do a lot of good to layman retail investors. Thank you.

Kyith

Friday 5th of October 2018

Wah lan ask in the thread can!