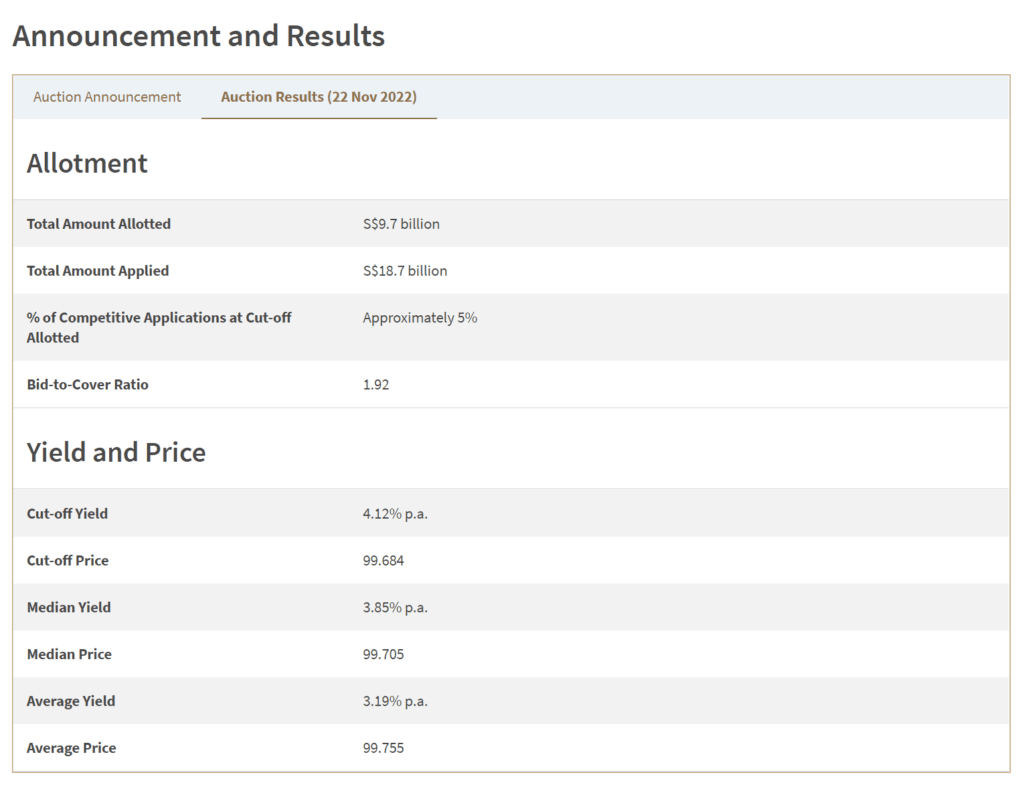

The result of the most recent Singapore 6-month Treasury Bill auction was announced yesterday, and the cut-off yield is a tad lower than what I predicted:

Compared to past issues, only 77.8% of the non-competitive bidders were successfully allotted. This is likely due to greater awareness of Singapore Treasury bills as a very competitive savings vehicle such that it has reached more than 40% of the final allotment. Non-competitive bidders will get part of the allocation.

The cut-off yield is lower than the market yield of a Singapore government bond, of similar duration and credit risk.

Why is there a deviation from past Singapore Treasury auction issues?

In this article, I do a deep dive.

The Difference Between Competitive and Non-Competitive Bids

If you look at the quality of the issuer and find that the yield of 3.9% is very good, and would like to know how to buy, here is my guide on how to buy Singapore Treasury bills from the comfort of anywhere.

In the introduction, I mentioned that you could submit either a competitive or non-competitive bid for the Treasury bill auction.

But what is the difference?

Here is how MAS explain it:

In a non-competitive bid, you do not specify what the yield that you want is and accept the prevailing yield, which is the cut-off yield in the result. This is simpler if you do not know what yield to bid for. Non-competitive bids will be allotted first, up to 40% of those who are successful in their application. As you will see later in this article, the downside is that you might be pro-rated if too many people bid non-competitively.

In a competitive bid, you put in a minimum yield that you want. If you put a yield of 5%, and the cut-off yield is 4%, then you get zero allocation. If you put a 3% bid instead, then you get 100% of your allocation.

So there is a chance you are too greedy and you do not get your allocation.

Hope that helps.

Let us move on to review some data.

Interest in Six-Month Singapore Treasury Bills has picked up but is Not Too Different From When Yields are Low

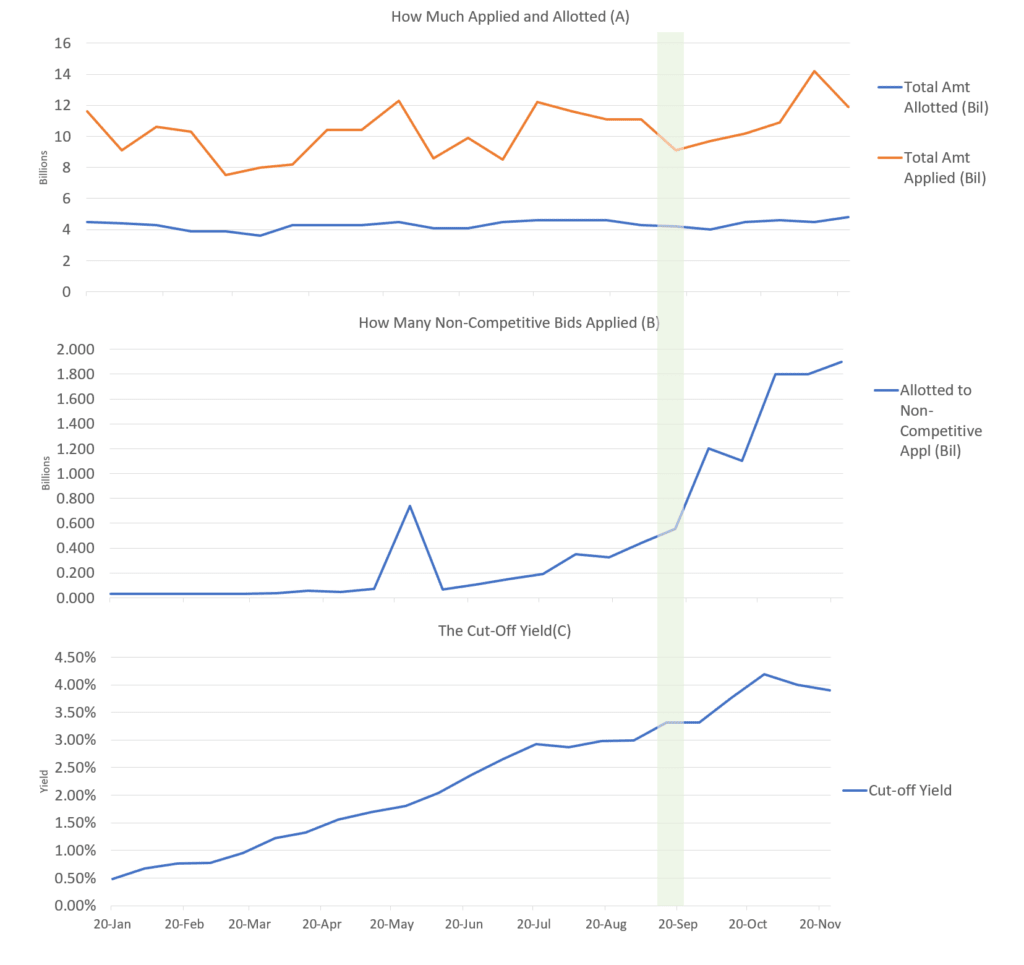

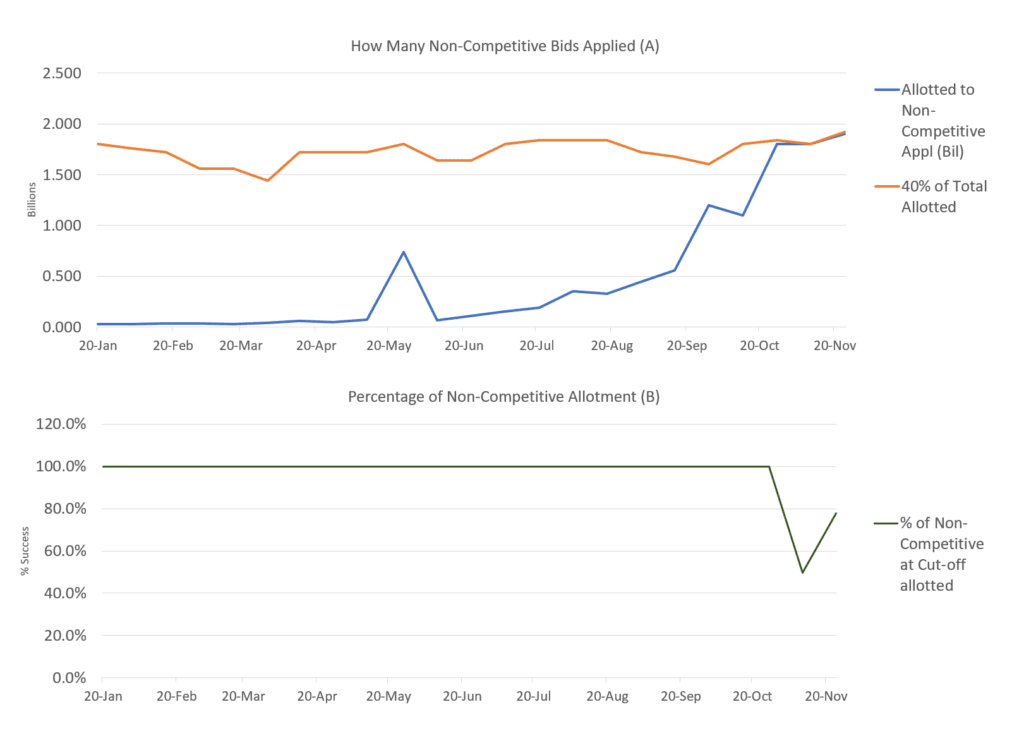

The first set of charts shows us some 6-month Singapore T-bill data for every auction during the year:

The last graph (C) shows that over this period, the cut-off yield of the 6-month Treasury Bills (which is the yield most of you will get) started climbing steadily from 0.48% to 3.9% currently.

The total amount applied (A) has been steady at between 8 billion and 12 billion. Even when the cut-off yield was low, parties were interested in whatever reasons. The amount allotted is relatively constant, between 3.6 billion to 4.5 billion.

But the big difference was the growth of the parties putting in non-competitive bids, which has climbed, followed by a big explosion in mid-September.

That seems to coincide when the cut-off yield hit more than 3% for the first time.

Those who put in non-competitive bids are willing to accept any yields that come their way initially to get the allotment. You also realize that with the attention increase, the allotted amount bumped up by 1-2 billion. That is not all that surprising because even when rates are at 0.48%, there were an equivalent number of people applying on 20th Jan 2022 and today.

Has the Greater Retail Participation Affected the Treasury Bill Yields?

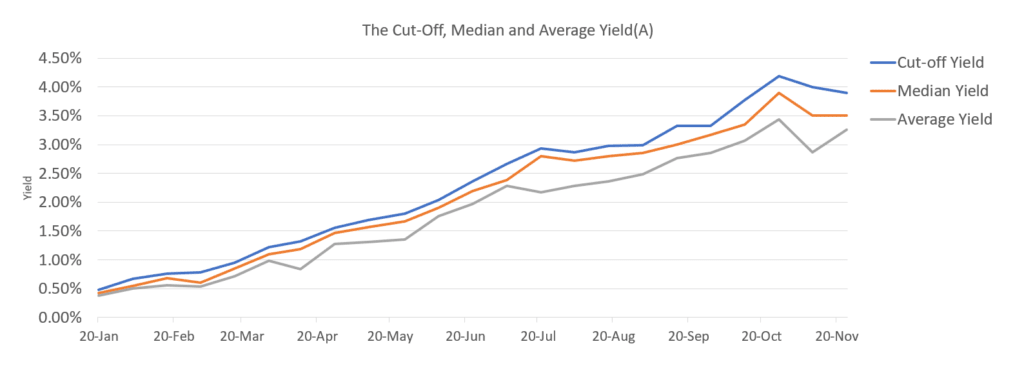

The chart above plots the cut-off yield (what most of us eventually get), median, and average yield.

The median yield will show the mid-point of all bidders, while the average yield includes the weightage of the bid. The average yield will reflect the decisions of those with more money, which is less likely to be retail people like ourselves.

We see that the relationship is intact.

Those with more money bidding are at the lowest (average yield), and the cut-off yield is pulled up because parties are bidding up for the T-bills. These people are proving price discovery.

I took a look at the spread when yields are low and high and didn’t find that there are meaningful relationships.

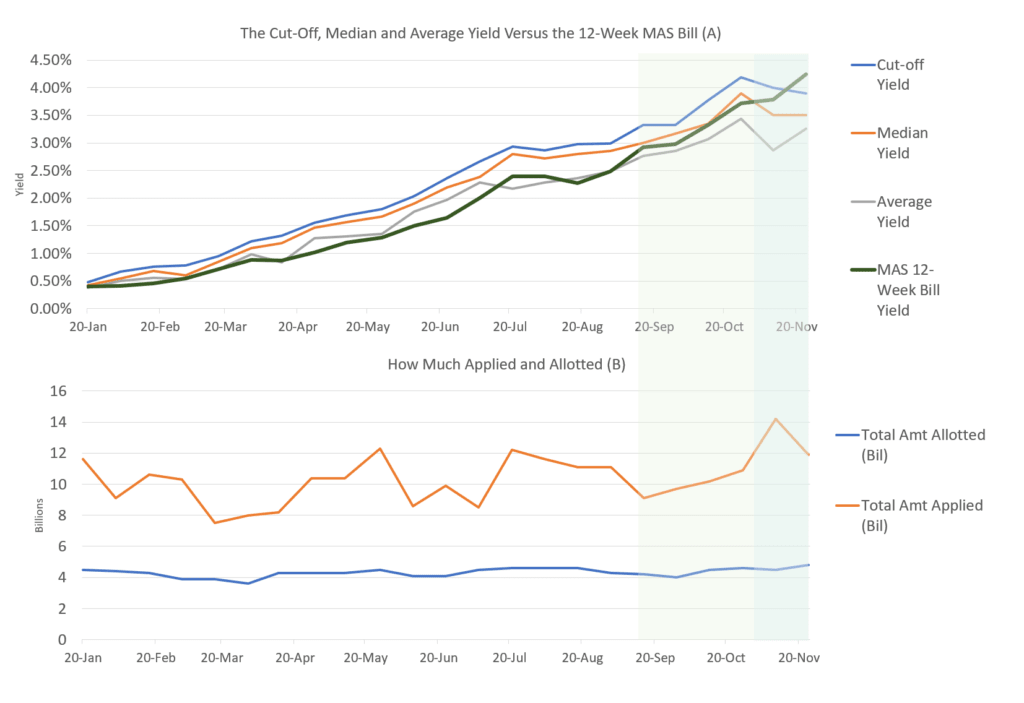

Now, let us overlay the last chart with the yield of the 12-week MAS Bill. The MAS is mainly issued to institutions, and through the yield, we can observe how the institutions value a risk-free bond of this duration. Since 12 weeks (3 months) is slightly shorter than 6 months, typically, the yield of the 12-week MAS bill should be lower than the yield on the 6-month T-bill.

You will realise that the average yield of the 6-month T-bill tends to track the yield of the MAS 12-week bill pretty closely. If institutions mainly bid on the MAS bill and the Singapore T-bills, they should be close together (which they are).

But since Sept, when the overall participation picked up, we started to see some significant deviation between the average yield and the MAS bill yield. In the last two auctions, we see a more considerable disparity.

It is likely the new participants since September are collectively:

- Not participating in price discovery (the non-competitive bidders)

- Bidding lower than the true yield to get the Treasury bill successfully

And this may affect the yield.

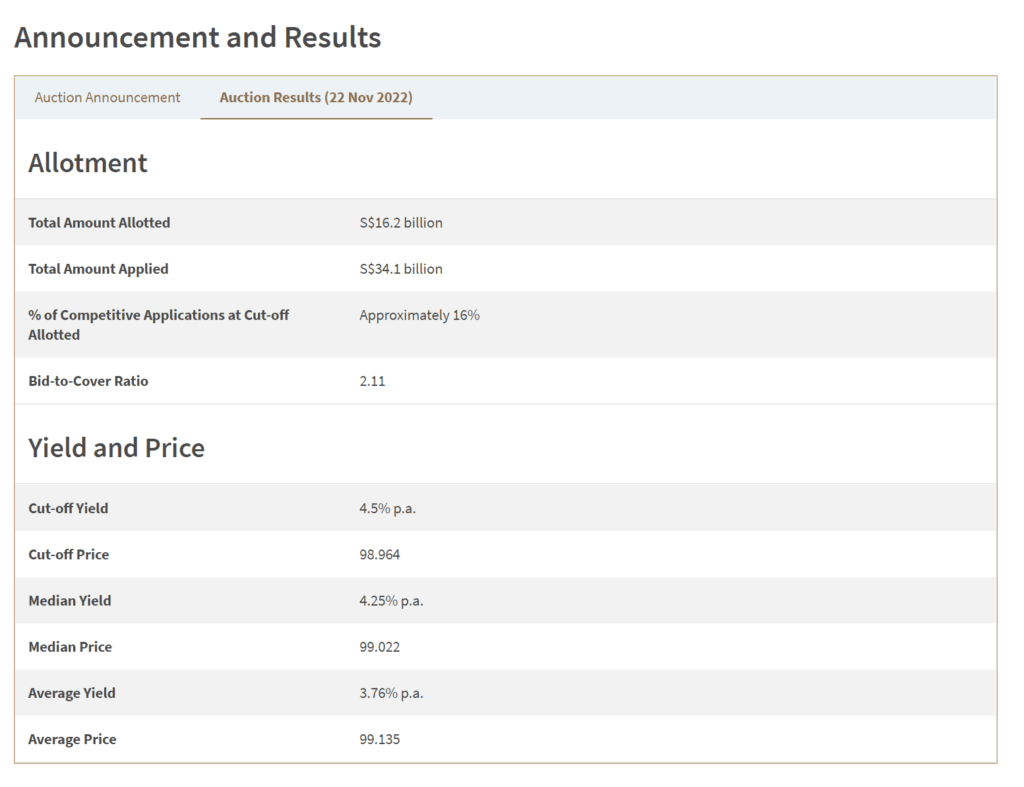

Yet, I feel that I might be reading too much into the effects of new retail money participation. If we take a look at the result of MAS bill auction, which are free from retail participation, you can see that the cut-off, average and median yield result is not too different from the six-month Singapore Treasury Bill:

With or without retail participation, the outcome looks pretty similar. Perhaps, we need to accept that this is the uniqueness of an auction system to determine prices.

Perhaps the real reason is that the yield curve has inverted at that part of the curve.

Non-Competitive Bid Allocation Are Not a Given

The non-competitive bids will be allotted first, up to 40% of the total amount allocated (roughly 4.X billion). So that usually works out to 1.4 to 2.0 billion.

But with the popularity of T-bills, participation is high so the allocation limit is hit. This means that you may not get all the amount you bid for and will be allocated a pro-rated amount.

What You Should Do Depends On Your Financial Goal?

My conclusion is that the nature of an auction system and the interaction of monetary policy as a collective determine the current yield.

This is not something we all can control. We have to recognize that.

A lot of the answers to your question depend upon what it is that you want to achieve.

Too many people don’t ask that question which is why they have a hard time making sounder financial decisions.

Often, this relates to whether you wish to reach the highest yield or achieve a certain financial problem/goal/requirement.

If your goal is to park money that earns a decent return, that is risk-free with six-month liquidity, then make a competitive bid low to ensure you get a higher allotment. Accept whatever cut-off yield because, relatively, you feel the returns are decent relative to the effort to shift money around.

If you wish to do CPF SA Shielding with greater success, also do the same thing as the previous goal (You can read my comprehensive guide to CPF SA Shielding with Singapore Treasury Bills here).

If you have a particularly high hurdle rate, that is closer to where the market yield is, then evaluate well and make a competitive bid.

Please recognize that you are participating in an auction system which means it is not 100% you will get what you want, and the market determines the outcome.

Collectively, by not participating or bidding lower, we affect the outcome versus the true yield, but that is not something as an individual can change easily.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- Should I Take Less Risk in My Fixed Income Allocation by Moving Away from a Global Aggregate Bond ETF? - May 5, 2024

- Singapore Savings Bonds SSB June 2024 Yield Climbs to 3.33% (SBJUN24 GX24060A) - May 3, 2024

- New 6-Month Singapore T-Bill Yield in Early-May 2024 to Stay at 3.75% (for the Singaporean Savers) - May 2, 2024

Revhappy

Sunday 27th of November 2022

Hi Kyith,

I have a question for you, since you are quite sophisticated investor, I wonder how do you manage your cash allocation? Since you are using IBKR, have you tried keeping your money in USD and investing in US T-bills?

It seems to be a much more fuss free option than trying to bid for SG T bills.

Lot of bloggers blog about SG T-bills, but I am yet to see an SG blogger blog about buying US T-bills using IBKR. I hope you can create an article, since I believe your advisory firm has sophisticated investor clients who would want to invest like this.

Cheers! Revhappy

Kyith

Thursday 8th of December 2022

I tried to invest in US Treasury but did not work. IBKR has higher interest as well. There are not much money market except the CSOP money market in hk I think. If not... you can put in 1-mth US treasury ETF.

Pete

Saturday 26th of November 2022

Good analysis. CPF recently replied in newspaper's forum stating that sometime in Q1 2023, the 3 local banks will allow electronic application of T-bills using CPF monies, if the rate held up (above the breakeven 2.5% CPF interest rate plus the 1 or 2 months interest calculation gaps), then you can expect more retail participations.

Alan

Friday 25th of November 2022

Hi Kyith Using CPF if I bid higher than the yield (example 4%) for 24/12 I will have nothing. But if I bid for 200k will the fund be deducted for the failed bid. If yes then I will lose one month interest. Also will there be a 2 dollars deduction for it. If not then there is nothing to lose by bid high. If yes then we must be more careful. And if yes alot of people will be bidding lower as they don't want to lose one)two months interest if it fall near end of month. Please advise Thanks

S

Friday 25th of November 2022

Too much advertisement!