Some Singaporeans may have heard of the term SA Shielding term and wonder what that is. They vaguely think the term is somewhat related to the CPF but are curious why we need to shield our SA.

Basically, Singaporeans who have accumulated quite an amount in their CPF Ordinary and Special account hope that there is a way of reserving most of their CPF Special account money after their 55th birthday so that overall, their wealth can grow at a higher rate of return.

The lovely thing is that after 55, if you still have ample money in your CPF OA/SA, your CPF is like a liquid, higher-yielding, non-volatile savings account.

In this article, I will explain what is CPF SA shielding, how it works, why and how to perform SA shielding with Singapore 6-month Treasury Bills.

What is CPF SA Shielding, and How Does SA Shielding Work?

CPF SA Shielding was first introduced by Lorna Tan, a former senior journalist at SPH, as a way to retain more of your monies in your CPF Special Account (SA) after the mandatory transfer of your CPF monies to your CPF Retirement Account (RA) at age 55.

You will then enjoy earning a higher 1.5% a year interest rate if you have more money in your CPF SA than in your CPF Ordinary Account (OA).

Let me try to explain.

Currently, you earn 2.5% a year on the monies in your CPF OA and 4% a year on the monies in your CPF SA. On the first S$60,000 ($20k in OA, $40k in SA in the illustration above), you will earn an extra 1%, which will be credited into your CPF SA account. (Both OA and SA interest rates are subject to change in the future, as the government may eventually revert the rates to be pegged to floating government rates).

There are two points where CPF will do a mandatory transfer from your CPF SA and OA into your CPF Retirement Account (RA). Those two points are on your 55th and 65th birthday. CPF will attempt to fill your CPF RA up to the full retirement sum (FRS) for your age group.

CPF will first empty your CPF SA and transfer it to CPF RA; if that is insufficient, they will empty your CPF OA.

In the illustration above, this retiree has $200,000 in her CPF OA and $192,000 (equivalent to the full retirement sum) in her CPF SA before her 55th birthday. In reality, you will likely have more than the FRS due to the interest accumulated in the CPF SA through the years.

On her 55th birthday, $192,000 will be transferred to her newly-created CPF RA. Her CPF SA can fully fund her RA in this case, leaving the monies in her CPF OA intact.

However, most of her monies will be in CPF OA, earning 2.5%.

If she can shift her CPF OA monies into her CPF RA instead of CPF SA monies, her existing CPF SA monies can earn an extra 1.5% a year.

We considered CPF SA Shielding to allow us to shield our SA monies so that during the mandatory transfer process, our CPF OA monies get transferred instead.

Here is how a generic CPF SA Shielding work:

Before your 55th birthday, find a provider and invest the monies in your CPF SA.

You can invest in specific securities/instruments with your CPF SA. Take a look at this list provided by CPF on the specific types of investments you can invest with your CPF OA and SA.

You cannot invest the 1st $40,000 of the monies in your CPF SA. That will remain in your CPF SA.

On your 55th birthday, $40,000 from your CPF SA will be transferred to your newly-minted CPF RA. But that is not enough to fulfil your full retirement sum, so CPF will look into your CPF OA and transfer $152,000 out of the $200,000 into your CPF RA.

After your 55th birthday, you can sell your investments. The monies will be transferred back to your CPF SA. The residual money in your CPF SA ($152,000 in the case study) would earn 4% yearly instead of 2.5% yearly if you didn’t SA Shield.

Why Singapore Treasury Bills (T-bills) Are Ideal for CPF SA Shielding

We can only invest in limited types of products with our CPF SA monies, but in my opinion, we have to consider which products fit our SA shielding needs:

- Relatively liquid to move in and out of. It also means that the investments better be relatively short-term in nature.

- It can be executed comfortably.

- The value of your investments should not be too volatile.

- The degree of positive returns is not necessary here.

If we look at the list, unit trusts, Singapore government bonds, and treasury bills fit the criteria better.

Most who know about CPF SA shielding would shield with short-term bonds purchased through a unit trust provider such as Dollardex, Poems or Fundsupermart. I think shielding with the short-term bonds is still a sound option.

However, if you implement short-term bonds, your investments would still experience some value volatility.

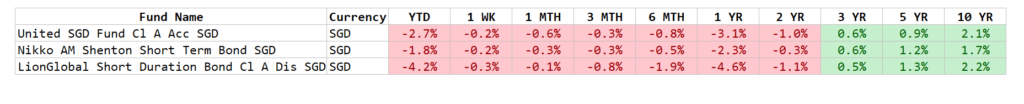

Here are three short-term bond unit trust that is available for CPF SA investment and their recent performances:

The recent performance has not been good, but if you are only shielding for a brief period, such as 1.5 months, the potential value loss should be okay, relative to the 1.5% yearly that you could earn if you successfully shield.

But if you want a better option, then shielding with Singapore T-bills is better because:

- Singapore treasury bills are short-term enough (6 months)

- Bond has a contractual obligation to return you the principal (unless the issuer, in this case, the Singapore government, defaults)

- The Singapore government is a AAA issuer.

- You can execute by going down to any branch of the bond dealers (DBS/POSB, OCBC, or UOB)

- The Singapore Government issue a new 6-month Treasury bill every two weeks. Very frequent enough.

- You don’t have to open an investment account with a unit trust provider.

The downside of using the Treasury Bill is you will have to sacrifice time to go to a bank branch to get this done. But if you wish for a safe, peace of mind and access to an extra 1.5% yearly interest, I think even taking a day’s leave to do this once in your life is worth it.

Another potential downside is the risk that you might not get all the Treasury bills you subscribed to. The risk of this is very low because of how many Treasury bills are issued fortnightly. If you are conservative you can always first go for an issue that is two issues from your birthday. If you fail to get what you need in the first issue, you have another issue to complete the shielding (more on this later).

What are Singapore Treasury Bills (T-bills)?

Treasury bills, or T-bills in short, are short-term securities that the Government of Singapore issues.

They have a very short tenor, typically six months to one year, and they do not give you a coupon. They are issued at a discount to their face value. For example, if you apply for $1000 worth of T-bills and successfully get it, your cost will be $985, and when it matures, the government of Singapore will give you back $1000.

So it is like you are buying something at a discount.

When you buy a Singapore treasury bill or SGS bonds, you are lending money to the Singapore government on a short-term basis. The Singapore government have an obligation to pay you interest and your principal back.

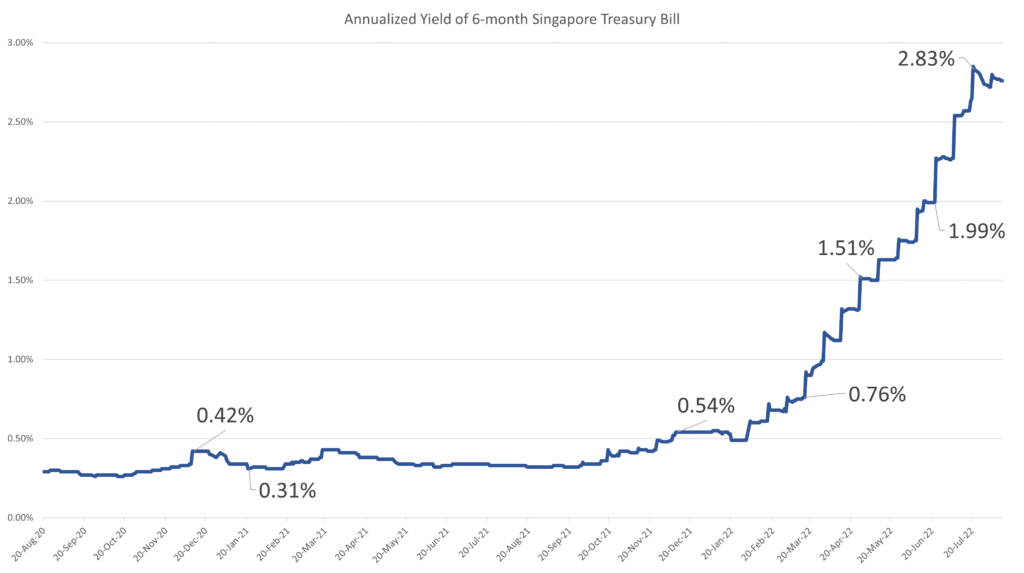

Singapore T-bills are very attractive currently because, with the recent rise in interest rates, you can get very decent returns by allocating your spare cash to them.

But this is not the primary consideration for SA Shielding. Returns are a good-to-have.

For those who would like to find out more about how you can buy Singapore Treasury Bills or Government Bonds with your cash and other monies, you can read my article here: How to Buy Singapore 6-Month Treasury Bills (T-Bills) or 1-Year SGS Bonds.

What You Will Need to Implement CPF SA Shielding with Singapore Treasury Bills?

The nice thing is you do not need much.

You will need to subscribe to a Treasury Bill auction by going to a branch of DBS, UOB or OCBC. You cannot do this online.

Per MAS’s guide, opening any CPF Investment Account (CPFIS) is not needed if you wish to invest CPFIS-SA funds. This means that your CPFIS provider does not constrain you.

In my experience with UOB, the bank representative told me that I had to open a CPF SA investment account, but she could open it for me on the spot.

You would need to bring your NRIC down.

One of my readers told me you would need to have taken a CPFIS Self-Awareness Questionaire (SAQ) to buy T-bills, but my colleague and I were not asked for proof that we successfully completed the SAQ when we placed out Treasury bill application.

You can tell me if you were asked about your SAQ status in your experience.

In any case, you can do the SAQ over here.

You will get a simple PDF like the one above. If you did the SAQ, do have it around maybe in your phone or somewhere in case the person asks.

All in all, the beauty of shielding with the Treasury bill is the lack of hassle in signing up with a provider.

Planning and Shielding Your CPF SA

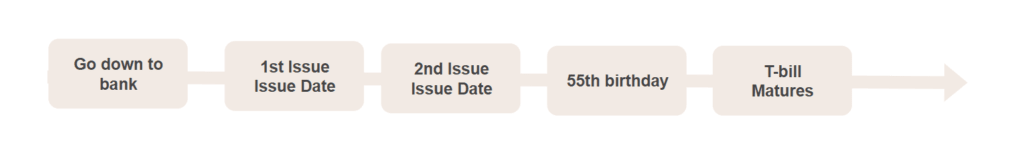

As a recap, here is what we want to achieve:

Everyone tries to delicately balance between not missing out too much on the juicy CPF SA interest but successfully buying the investments so that the monies is transferred out of their CPF SA before their 55th birthday.

What you want to do: Subscribe to a 6-month Singapore Treasury bond so that monies leave your CPF SA before your 55th birthday.

My advice is to do it at least a month early or put two t-bill issues between your 55th birthday and execution and not wait until the last minute because if you get the Treasury bill auction dates wrong and there are no issues, you can use to shield, you might panic.

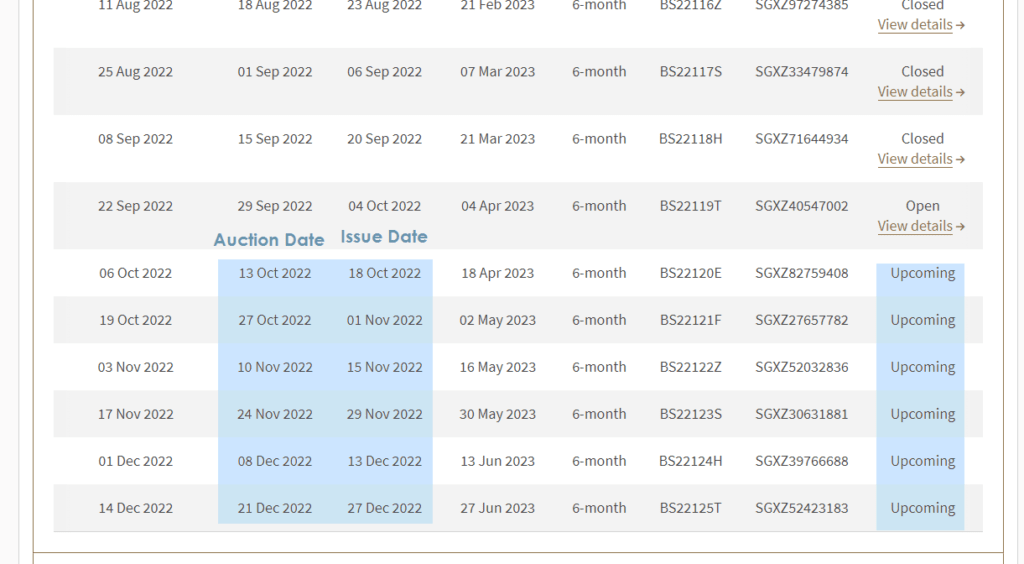

You can find more information about Singapore Treasury Bill issues on MAS’s site here.

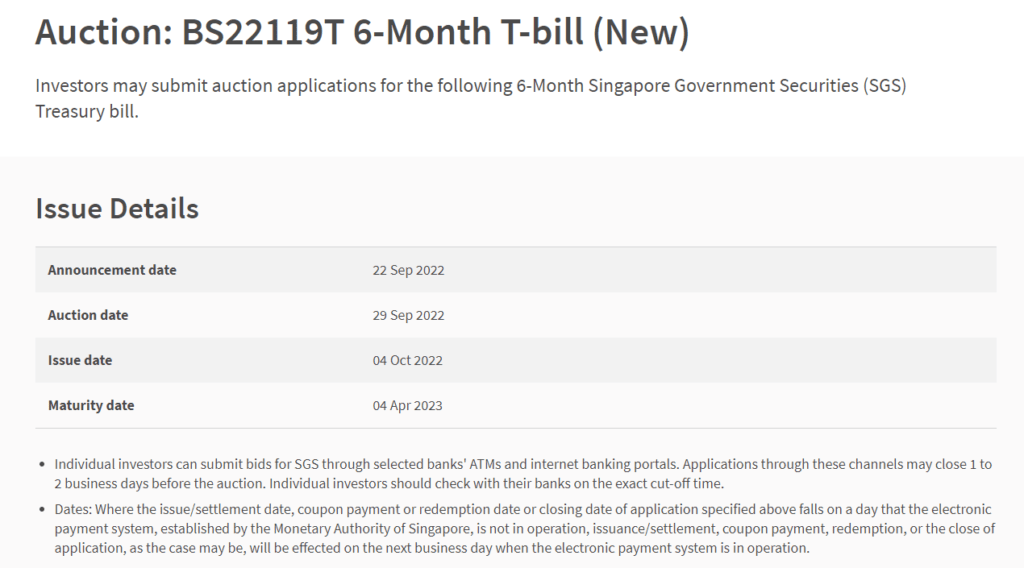

A typical Treasury bill issue will have the following information:

You will need to get in at least one day before the auction date if not, you will miss the bill subscription. You will only know how much is deducted from your CPF SA on the issue date.

From my experience, the money is shown to leave your CPF SA one day before the issue date.

- Auction date: go to the bank and do it before this date.

- Issue date: make sure this is before your 55th birthday.

If you are micro-managing this and do this very close to your birthday, then you might run the risk of only knowing if your SA is fully used (less the S$40,000) and successfully allotted the T-bills only after the birthday.

For that, I feel that you should plan to go down with at least two issues in between. You will subscribe for the 1st issue, and if something goes wrong, or you are not fully allotted, you have a second issue to fall back upon.

Ensure that the issuing date of the second issue (in the diagram above) is before your 55th birthday.

MAS publishes the upcoming bond and treasury bill issue calendar here.

You will be able to see the auction date and the issue’s name (the column with BSXXXXXX).

For example, if my birthday is on the 30th of November 2022, I will plan to subscribe for the BS22122Z issue auctioning on 10th November 2022. If I fail to get enough of the allotted, I could subscribe to the BS22123S issue auctioning on 24th November 2022.

I will most likely know the result on my second attempt one day before the issue date of 29th November 2022.

Once you have identified the issues to subscribe to, arrange to go down to any branch of UOB, OCBC and DBS.

I advise going to the main branch as the staff might be more familiar and maybe fewer people. Try to take leave and go down during a more obscure hour.

Once you reach your turn, you can tell the representative which Treasury bill issue you wish to subscribe to and how much.

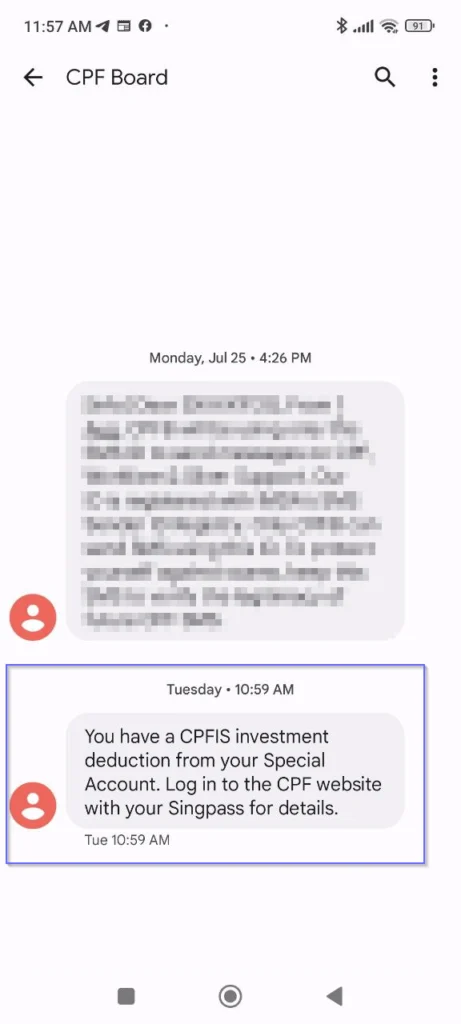

How Would You Know You have Successfully Subscribed to a Treasury Bill?

You will only know when the bill is issued to you. I received an SMS on the issue date:

Sure enough, a check of CPF shows that the money were deducted a day before the issue date:

You should be able to find the balance.

Upon maturity, the monies should flow back to your CPF SA account.

DBS: Buying a Secondary Treasury Bill Issue Instead of a New Issue

One of my readers shared that you can buy an existing treasury bill that is traded on the secondary market with DBS.

If you do that, your money does not need to wait for six months and can return to your CPF SA account earlier. You can choose a bond with a maturity date just after your 55th birthday.

After the reader told the DBS staff the T-bill issue she wished to buy, the bank representative called her Treasury desk for a quote. Based on the quote, the reader tells the representative how many units to buy. The base price is $100 per unit.

If you wish for the transaction to occur on the same day, It will be better to go in the morning.

I asked whether UOB could do this for me, but they told me they could only perform the new issues.

Conclusion

I hope that this guide helps you understand how CPF SA Shielding works. Personally, I don’t think that going down to the branch or the main branch of a bank to implement this once in your life is that big of a hassle because if you successfully shield your CPF SA, an extra 1.5% yearly potentially is worth $2,850.

That can buy you a few more packets of chicken rice!

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

- The LionGlobal APAC Financials Dividend Plus ETF Won’t Give Singapore Investors 5% Dividend Yield Always. Further personal thoughts (with some data). - April 13, 2024

K

Monday 18th of December 2023

Would you still say it is better to shield with 6M Tbills compared to Nikko AM UT, now that interest rate for Tbills could be 3.65? Thanks.

Mich

Thursday 26th of January 2023

The Breakeven point for 6 monthtbill needs to be 4.67% to shield SA.. anything less we making a loss. Will the tbill cutoff yield hit this magic number at all?

Kyith

Tuesday 7th of February 2023

When you are shielding SA, you think less about that. The reason you want to shield SA is so that you can earn 1.5% more, over a longer period of time, with no volatility of the capital that you are trying to shield.

If you really want to think about the returns... maybe just don't shield.

AL

Friday 25th of November 2022

I'm hoping I have my age cohort's Enhanced Retirement Sum (ERS) when I turn 55 so I can use it for a higher CPF Life payout. But if I do CPF SA shielding, I may not have the ERS at 55. Is the way to get around this by doing a top up of the difference into my CPF OA with cash (eg: through a voluntary housing refund) before I perform CPF SA shielding?

Kyith

Thursday 8th of December 2022

HI AL, the objective of CPF SA Shielding is so that the SA monies are not automatically transferred to your retirement account. If you do not have ERS and that will come from other sources after age 55, then it does not affect things. What you are concern about is what happens on your birthday and what is affected, which is your moneis in CPF SA (or CPF OA if you wish to shield that as well).

So shield for those monies, then later on, you can think of where to fund up to your ERS. You could wait for the monies from T-bills to be funnel back to your SA and OA, and then fund to ERS with OA, or do it with cash.

gao

Friday 25th of November 2022

Hi Kyith,

Those who have invested using cash or CPFOA are able to see how many units they have in their CDP or CPFIA online, e.g. if $10000 will have 100units, what about CPFSA?

Thanks

Kyith

Thursday 8th of December 2022

I think that they will email you the statement. For UOB it is somewhere in UOB. I forgot where is it but if I remember I will show. They should create a UOB account specifically for this.

Sun

Tuesday 25th of October 2022

Hi Kyith,

Thank you for sharing!

I have opened a CPF investment account with OCBC Securities a long time ago. As I do not have a broker nor internet trading account, do I need to call their hotline if I am interested to use the savings in the SA to buy the T-Bill?

Thank you for your advice

Kyith

Saturday 5th of November 2022

Hi Sun, if you wish to use your CPF SA to buy, don't worry, just go down to a bank and tell them you wish to do that. You do not need a CPF investment account for this.