I hope to put something out here so that some of you could help one of our readers.

One of our readers signed up for Saxo Markets Online upon the glowing recommendation from some financial bloggers.

He wishes to use the account to trade overseas market and thus there is a need to convert his home currency (SGD) to USD or GBP.

For Saxo, there is a currency conversion cost.

At Saxo’s Commissions, Charges and Margin Schedule, they explained about this currency conversion cost.

From my understanding, each conversion will cost you 0.75%. This feels like a service fee, and I am not sure on top of this fee, the firm earns a bid-offer spread from the conversion.

For reference, you can compare against Standard Chartered Online Banking’s LiveFX spread, which I talked about here and here. They are not the best but they do not seem to come to 0.75%.

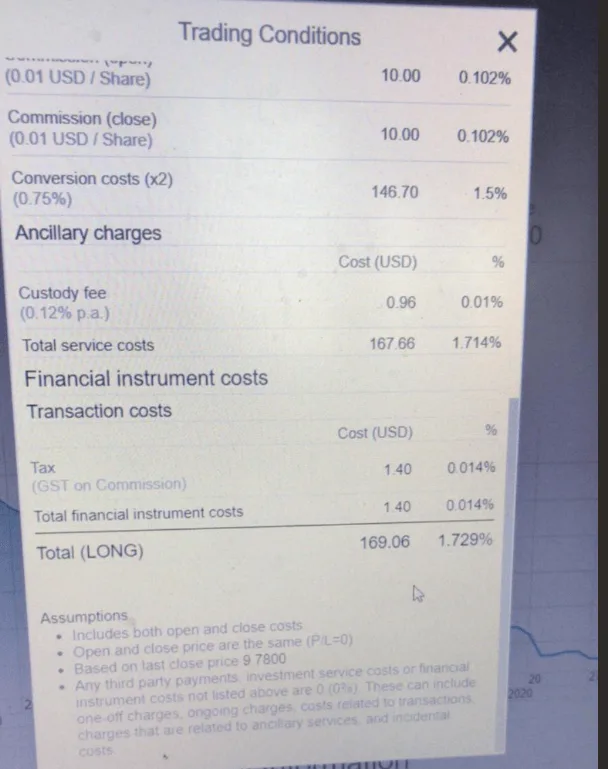

My reader attempted to convert SGD$10,000 into USD so that he can purchase the stock he wanted. However, he was astounded by the total cost of the conversion.

From what I can see on the screen capture, there were some commission costs of $10 each and then 2 times 0.75% worth of conversion fee.

In total, this adds up to 1.71%!

Personally, I am not familiar with Saxo Markets. I would like to think that if they wishes to operate and thrive competitively, the conversion cost will not be so high.

This might what we term in the IT world as a “user problem”.

If you are familiar with or are currently using Saxo Market to do retail trading, and can help me make sense of what you are seeing on your end, do comment below.

Thanks a lot.

- The Cheapest Way to Extend Your Laptop to TWODisplay that I Can Find. - April 29, 2024

- My Quick Thoughts on the Net Cash, 4% Yielding Boustead. - April 28, 2024

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

Craig D

Wednesday 9th of December 2020

I too opened a Saxo (UK) trading account about 1 month ago on a recommendation that it is a great platform. From a usability perspective I agree that it is, however at the time I wasn't aware of the high charges when buying US stocks.

As an example, I bought 200 shares in WFC @ 25.18 USD per share in Nov 2020. The price has since risen 15.48% which has my trade P/L showing as 779.48 USD (592.82 GBP). This seems ok.

Conversion P/L -108.56 GBP - can anyone explain they calculate this conversion cost?

P/L Total (incl. Costs) 749.35 USD (461.53 GBP)

So my profit have moved from 592.82 GBP to 461.53 i.e. Saxo are taking around 130 pounds of my 592 pound profit (approx. 22%)!!

It sounds like I can improve the situation slightly by requesting a sub account in USD.

This holding represents about 20% of my entire portfolio. Can anyone advise on a cost effective way to move away from Saxo completely to one of the other brokers mentioned in this thread?

many thanks :)

Amy

Thursday 8th of October 2020

I wish that I have read your post earlier! I also got shocked when i saw the conversion fee (0.75% each for both buy and sell). I feel that it is no difference from daylight robbery! I calculated that all the charges add up to 2.4% of about SGD10K of investment. It really sucks big time! Whoever that recommends Saxo to new users, i really doubt their credibility, seriously. But it is too late! Anyway, it is a lesson. I have transferred out all the remaining balance (good thing with Saxo is that transfer in and out is immediate and FOC, finally!) and opened TD Ameritrade, which is way way way better.

Bryan

Tuesday 15th of September 2020

I think I should add another perspective here as a happy user of Saxo (I'm sure there are many others out there) despite the high conversion fees.

The total spread of 0.75x2=1.5% to me is a paltry sum. I say that because the Saxo platform (both desktop and mobile) is really good. To me as a human trader I value my convenience and ease of use. If a tool charges me 1.5% I'd gladly accept it since it is well made and allows me to make great decisions at the right time.

Put another way, the power of the tooling enabled me to make decisions that well covered the 1.5%. I don't think I'd be able to make those decisions using IBs platform which as many have mentioned is very complicated. Of course you must be able to utilize all of Saxos charting functionality to appreciate the value, ie what you get for paying the 1.5%. The fact that no one here has mentioned the benefit of Saxo leads me to believe that most here are not utilizing the tool to its full potential, and then of course it makes sense that they are complaining about the rate, since they are getting nothing for the higher rate they pay.

Another related point, on top of the fees, I even pay them a monthly charge of about 30SGD to subscribe to real time pricing for Nasdaq and NYSE within Saxo. Penny Pinchers would tell me I am dumb to do so, I can get real time pricing from Yahoo Finance etc. I did try that for awhile, but the convenience of having the real time prices within the platform where you execute far outweighs the little 30SGD fee. Another way to look at it: the price subscription enabled me to execute my trades more efficiently, definitely saving me more than the 30$ I pay.

A final point is that I'm a software engineer by profession. That makes me appreciate and understand the difficulty and cost of developing and maintaining a great software platform, connecting all data sources, ensuring real time delivery of pricing and trade data etc. Most non technical people don't appreciate this, and think everything should be done for their (self entitled) selves at impossible prices. Hence to me the rate they are charging for currency conversion is fair when you take into account the great software they have. How else would they make money and survive if their trading cost is lower than other (less advanced) platforms? If you can't appreciate or don't use their advanced functionality then just switch to one of the local banks trading platforms which are cheaper but don't have such a good platform.

TL;DR: if you don't know how to use a chainsaw, just buy a saw. Don't buy a chainsaw and complain how it costs more than a saw!

Tan PJ

Tuesday 22nd of September 2020

I have a similar opinion as Bryan. I did a lot of trades with SAXO and was also initially unhappy about the currency conversion charges. After some research, I found out that I can definitely lower my costs by using the free TradingView and the american brokers. But after exploring those platforms, I still find that SAXO's interface is more user-friendly and allows me to make my trades more efficiently. For me, I do value the intangibles benefits of trading with SAXO, to me it compensates for the hefty currency charges.

Josh

Tuesday 22nd of September 2020

Cheers Bryan!

Im in absolute consensus with you. 1.5% is paltry sum compared to Saxo's clean, neat and intuitive interface coupled with its host of informative tools. Im from a technical background as well and I can really appreciate and attest your comments. The key here is to have 2 accounts in Saxo. I have my main in USD and sub in SGD.

At that time my account was empty and had not started trading. I made a call and explained my difficulty and a helpful assistant opened my sub SGD account immediately on the spot without the minimum of SGD10K (I am really thankful for this and I cannot guarantee that every SAXO assistant would do this). This allowed me fund into SAXO with SGD (at no cost/fee. just paynow from ur local sg banks into saxo sgd account) then convert to USD (one time 0.75%). Did my trades in USD with zero currency conversion fee. Extracting my profits from my USD to SGD account (another 0.75%).

That way I only incur one-time 1.5% for every "to & fro" of fund transfer between my SGD and USD accounts. Thus avoiding the 1.5% slapped on for every trade if trading US stocks with a SGD SAXO account.

Hope it helps ;)

Aqil

Tuesday 21st of July 2020

Hello would it be advisable for me to create a sub account n transfer my stocks over to my US sub account? And sell it from there? Or should I just find a new broker altogether

Deon

Thursday 16th of July 2020

I can confirm I got nailed for currency conversion costs with Saxo when I sold Volkswagen shares that was listed in euros but I had a GBP account.

So I took my pounds and bought the VW shares which was in euros.

I have screenshots I can forward of the actual trade with the details as proof.

Basically I made a trade P/L of 1626.56 (EUR) (1,443.37 GBP) when I sold my VW shares earlier this year. Saxo then did the conversion and added in the costs and it came out like this:

Conversion P/L: (-602.20 GBP) Costs: -52.05 EUR (-45.58GBP)

Total P/L (incl. costs): 1,574.51 EUR (795.58 GBP)

So as you can see when I sold my VW shares which was listed in Euro, Saxo converted it back into pounds and in the process I paid 602.20 GBP for the conversion.

I emailed them to understand what is going on as I was so baffled, I mean sure I expect some costs, but that amount is huge. I still cannot understand this, I also use IG to trade with but IG does not do this to me nor charge me such excessive fees.

I have two ISA accounts, one with Saxo and one with IG. Saxo has a nice platform, but I have found you can really only trade stocks denominated in GBP for anything else you will be robbed when they come to do the curency conversion. Interesting that so many others commented on it too.

Anyway, below is their bog standard reply: ------------------------------------------------------------------------------------------------------------------------------------------------------- Dear client,

Thank you for your query.

When investing in instruments which trade in a different currency than your account currency, there are two main factors to consider when calculating Profit&Loss.

One is of course the movement in the share price. The other is the difference in currency conversion rate from the time you opened the position to the present.

For example, if your account is in GBP and your stocks are in EUR, a share price increase in EUR can be negated by a decrease in currency conversion rate of GBPEUR (and vice versa).

Please see attached trade details for the full breakdown of this trade.

Your Sincerely, Andy Pearce Client Account Services -------------------------------------------------------------------------------------------------------------------------------------------------------

Bryan

Tuesday 15th of September 2020

You didn't mention all details. What is the entire position size? So we can judge the percentage paid for currency conversion. You only mentioned PL but currency conversion only makes sense to compare to entire position value not relative to PL. What is the entry date and forex rate at that time? What is the exit date and forex rate at the time? A lot of currencies have devalued due to Central banks printing money, don't mistakenly put the blame on Saxo. Sure they charge higher spreads, but I am pretty sure you entered when the currency was high and got out when it was relatively lower.

Kyith

Friday 17th of July 2020

Hi Deon, I was wondering if there are some errors there. It seems the Client Account Services rep did not deny the extent of the 602 GBP. I thnk even the 52.05 EUR is excessive.