Since they started, I have been using Standard Chartered Online Trading as one of my main trading platform for the past 8 years.

Since then, a few other platforms have sprouted up, notably FSMOne and Interactive Brokers. They look to be competent platforms and would fit my needs, but we can observe high behavioral switching costs working here.

My rates are 0.18% for SGX Trades and 0.20% for other exchange trades with no minimum. This is because I am on Priority Banking. If not the rates are 0.20% and 0.25% respectively and there is a 10 dollar minimum.

While I should switch, as long as the platform is not too lousy, we find it a hassle to do a lot of things to move our funds over to another platform. FSMOne like many of the pre-funded brokerage accounts in Singapore, provide cheaper commissions if you pre-fund it.

The disadvantage for me is that currently, they do not allow us to trade in the London Stock Exchange. Interactive Brokers would solve this problem and they have very low commission as well.

Cheaper Currency Rates

Another notable advantage is that on Interactive Brokers, you can achieve close to spot currency rates. Basically, the platform allows you to navigate the currency markets as to how professional currency traders do.

The biggest gripe for Standard Chartered Online Trading has always been that if I were to purchase some stocks denominated in US Dollars, Hong Kong Dollars, or Australia Dollars, the rates can be as bad as 0.80% difference from what is listed in some sites such as XE Currency.

This differs from currency pairs to currency pairs. Some currency pair like SGD to USD has a tighter spread, some more obscure ones like SGD to HKD are wider.

Standard Chartered has sought to improve this over the years.

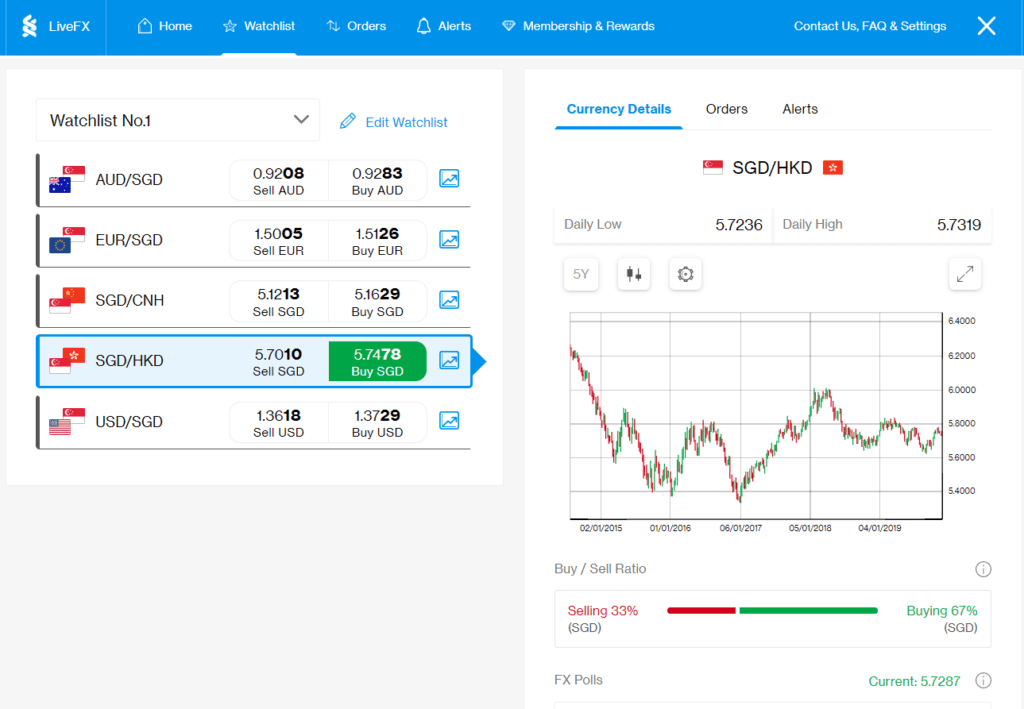

Recently, they introduce this LiveFX thingy.

It feels like a separate platform that allows you to exchange currency when the rates are getting better and to keep it.

Honestly, in my head, I wonder what is the big difference. Prior to this, we can also exchange when currency is better beforehand. Perhaps some of you could explain things better to me. It does look exciting though.

I just did a transaction for the first time on LiveFX a few days ago. I must say that it does not feel much difference.

Ultimately, it is whether you could narrow the spread.

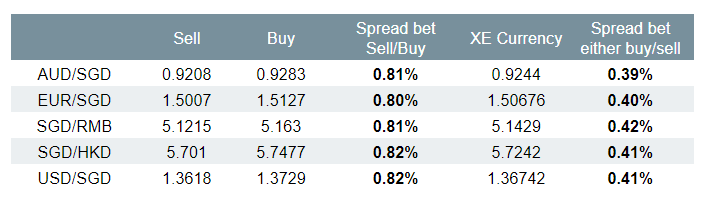

The following table shows the spread difference between LiveFX and XE Currency, a popular currency website which we get our currency data from:

While the Sell vs Buy spread is 0.8%, the difference between XE Currency is around 0.40%.

I like that the spread for most pairs are more equal now. It can be a pain wondering if you get a lousy or a reasonable spread.

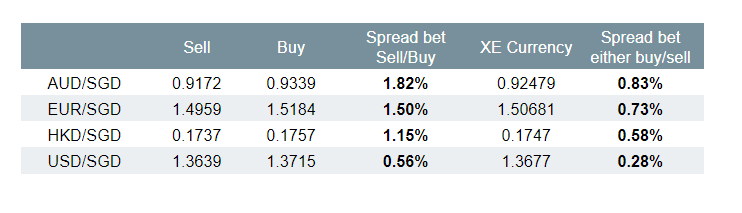

They say that FSM FX Rate is better so I have tabulated something similar to the one on top:

Hmm… seems that other than the USD to SGD, FSMOne’s currency conversion can be worse.

Does this Currency Cost Matter In the Grand Scheme of Things?

The debate for whether the currency cost difference between different platform matters or not depends on what is your investing strategy.

I have frequently given this reasoning that if each of your trade earns you 20%, a 0.4% cost doesn’t matter. I sort of survive on a not super efficient commission structure and currency rate because I made it up in the stock prospecting front (I am an active stock investor).

However, if you can, you could achieve better currency and commission efficiency by using a better platform and be a good investor at the same time. By all means.

How Stable are these Rates on these Platforms?

The other thing to think about is outside of Interactive Brokers what kind of rates can you get?

I do not use Standard Chartered Online Banking exclusively and used another traditional platform.

The spread I get from that platform in currency conversion for HKD can be 0.58%. I have shown you the rates for FSM FX. You can determine if it is worth it.

If these currency spread keeps changing, you and I are going to have a very tiring time chasing after the best currency rates.

That is one of my reasoning that maybe… if we place more effort on just ensuring we put our money in fundamentally sound financial instruments, stocks with a margin of safety, not scammy stocks, stocks with greater expected returns, it will be a better use of our time.

We try our best if we can to go with the best platform.

For Low Cost, Passive Investors

Low-cost investors are more cost-conscious.

Each basis points is a loss to them. I would think currency conversion may be a one-time thing.

It is not a recurrent cost so it is better.

You have to be aware as well that the currency your exchange-traded fund (ETF) trades in is just a middle man.

Ultimately it is between the currency you spend in and the basket of stocks or bonds in the ETF.

For example, if you buy a China ETF denominated in USD. You exchange $1,000 SGD to USD. The ETF then purchases a basket of China companies denominated in RMB.

Suppose in 2019, the returns of this ETF is 10%.

SGD <–> USD <–> RMB

If the USD weakens severely against both the RMB and SGD, the returns of the China stocks gets boosted to maybe 15%. What you see on paper is greater returns.

But this return will have to be converted back to SGD when you sell it so that you can spend it. The 15% gain might go back to only 11%.

Ultimately, it is between SGD and the basket of stocks. So if you buy a basket of world equity in MSCI World, it is how SGD move versus the earnings of those basket of stocks.

Summary

These currency costs do matter. Go with as good of a platform as you can. But these platforms do change their spreads over time so I am not sure if it is a good idea to keep switching.

Do they matter significantly in the grand scheme of things? Focus on the big wins.

Ultimately, the currency movement is volatile. It is like the debate over whether liquidity matters if you are a long term investor.

If you try to save on 0.3% in spread but the long term trend is that USD depreciates 30% against the SGD, then does it matter? Same for liquidity if we save on 0.2% and eventually markets do better.

Let me know what you think.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

tg

Friday 2nd of February 2024

hi i came across your post. when you trade on stanchart's livefx, do they have margin? for instance, should i borrow from the bank different currencies to trade? my friend does that but he said he is clueless and his banker tells him what to do. he has several foreign currency cheque and save accounts (usd, eur, chf, jpy) and borrows about $2m to trade about $100k each time.

Kyith

Sunday 4th of February 2024

hi tg, to be fair, i am talking about converting currencies to be use for investment and not that referring to livefx to trade currencies. I do not have a strong view over what the banker suggests.

Steve

Wednesday 25th of November 2020

Hi Kyith We can exchange SGD to another currency via:

1) Transferring from eSaver to the FCY Settlement account 2) LiveFX

Is there a difference in terms of the rate?

Thanks

Sharon

Wednesday 6th of May 2020

Hi Kyith,

Do you trade US stocks? If yes, are you using Saxo Markets for it? How do you fund it? I'm trying to see where to get the best deal for FX conversion (SGD to USD).

I came across your article and just wondered aloud if I can use FSMOne to convert, then I transfer the sum to my DBS Multiplier Account (or if they can go directly to Saxo). I can save a fair bit, since DBS T/T rate is 1.4271 vs. FSMOne FX rate at 1.421094.

Kyith

Wednesday 6th of May 2020

Hi Sharon, typically i use Standard Chartered Online Trading and now Interactive Brokers. SCB they say do not have a very good rate. If you have USD cheques you might be able to deposit directly. But usually, it is quite limited in deposit options.

Interactive brokers have almost spot rates. This means that can fund the account with SGD and I can convert with very little loss in exchange.

Isaac

Sunday 16th of February 2020

Yeah gonna use it for trading, since this article is about that.

I do know there is a min 3000 USD for example to maintain.

No worries, just getting your opinion. I think there is a forum about this, how best to achieve the right balance.

Cheers

Kyith

Sunday 16th of February 2020

the esaver maybe have but the settlement accounts there is no minimum.

Isaac

Sunday 16th of February 2020

Hi Kyith,

Thanks for the info.

Seems like we need to open a foreign currency acct to put the converted cash inside using LIVEX. Usually there is a min balance, is it worthwhile to still use it?

Kyith

Sunday 16th of February 2020

it would depend on what you wish to use it for. for me, i use it for trading so there is a real need. but if it is retail perhaps going by transferwise and revolute may make more sense?