Yesterday evening, First REIT announced a restructuring proposal with their master leasor Lippo Karawaci.

This proposal would still have to be approved by unit holders during an extra general meeting.

I am just going to do a short note here.

First REIT generally masters lease a portfolio of hospitals bought from parent Lippo Karawaci… back to Lippo Karawaci. The lease tenure is rather long at 15 years. The first set of hospital lease was during the IPO in 2006 (the lease term is almost up for the first batch). The actual operator of the hospital is PT Siloam International Hospitals.

PT Siloam do not pay the rent to First REIT. Instead, Lippo Karawaci pays the rent to First REIT. PT Siloam does pay rental expense to Lippo Karawaci but the rent in the past years have not equate to the amount Lippo Karawaci paid First REIT (there in lies the problem)

First REIT’s Problem

First REIT manager, Bow Spirit have like a few problems all coming together:

- The gross rent for each master lease is paid in SGD instead of Indonesia Rupiah (IDR). This means that Singapore investors are fortified against currency fluctuations. The rent was fixed based on the SGD to IDR rate in 2006. SGD has been strengthening against the IDR. This puts a lot of pressure on Lippo Karawaci to pay the rent. PT Siloam does not pay them a lot in IDR and they have to pay First REIT in SGD.

- Since First REIT’s master lessor Lippo is wobbly, First REIT runs into a problem trying to refinance their debts… and 80% are coming due in the next 18 months

- If the leases that are coming due are renewed at the current SGDIDR exchange rate, the rental revenue takes a massive fall. The value of the property, based on the aggregate of future cash flow, will fall as well

What This Restructuring Does

So Lippo is desperate to bring down the rent. The best outcome is not to pay it in that old SGDIDR peg.

If Lippo have some breathing space, they show that they can pay the rent, the banks would let them refinance.

The first proposal is that the rent is in IDR instead of SGD. The second thing you would notice is that the base rent is like 38% lower than current.

The rent payable is now calculated not based on base rent + variable incentive but the higher of base or performance base rent.

The rental escalation is not capped at 2% of Singapore’s CPI increase but a flat 4.5% a year.

This would renew the master lease for another 15 years.

In a way, the master lessor Lippo Karawaci would pay much lower rent and might help them a bit.

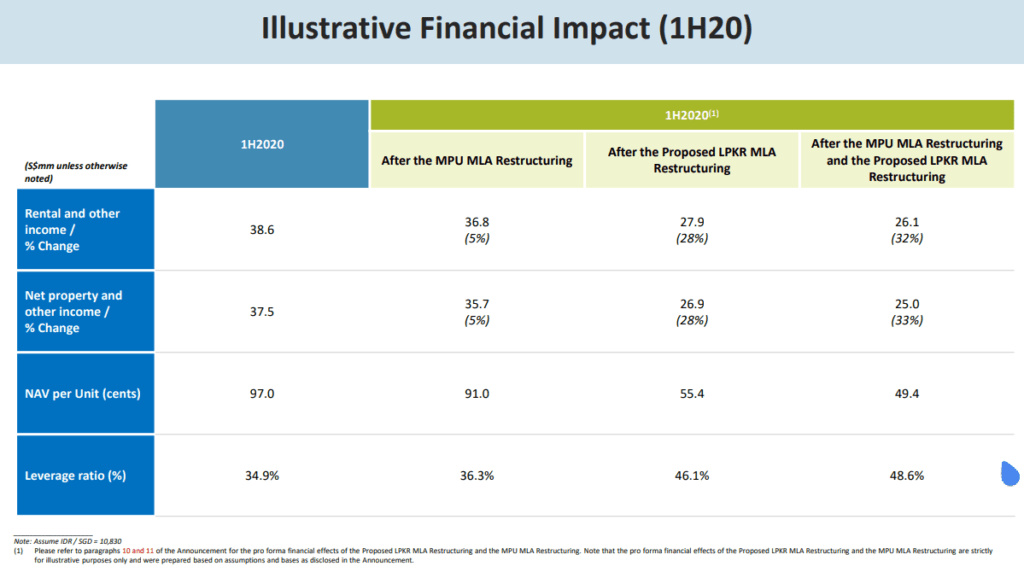

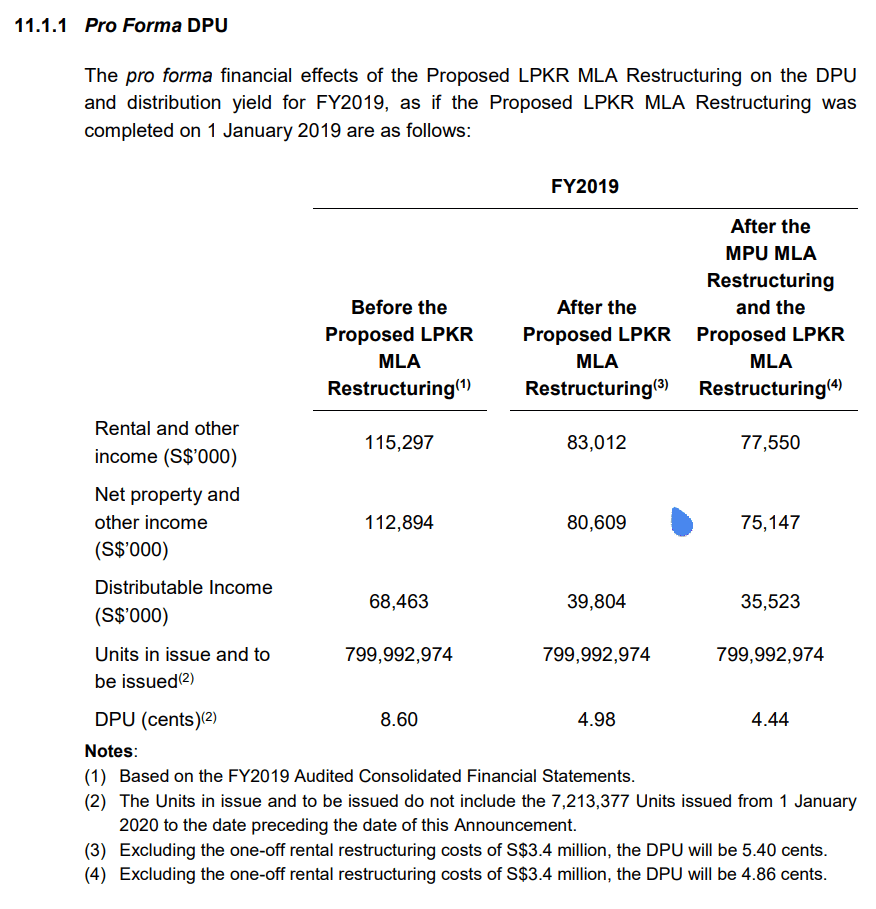

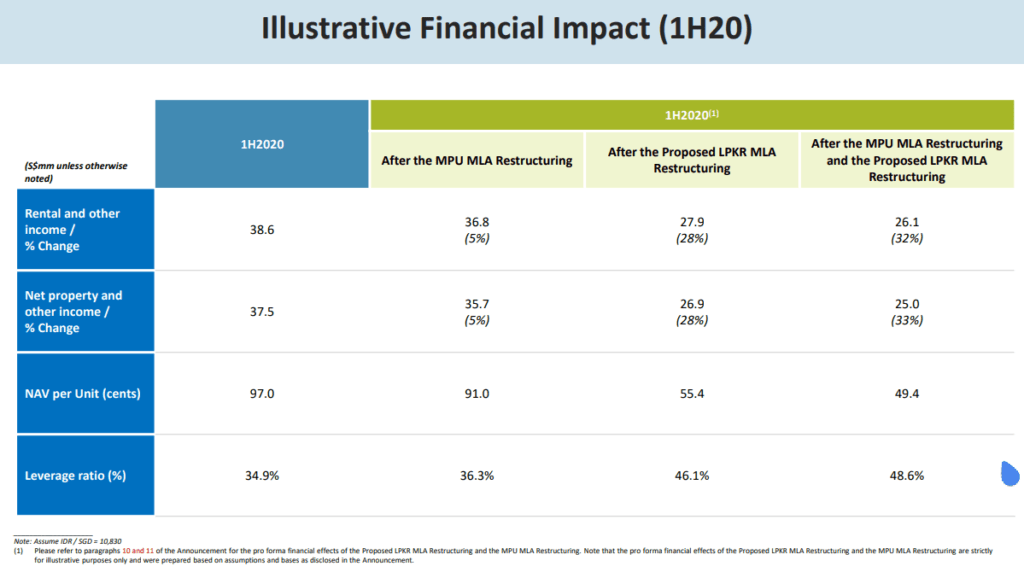

The net property income takes a 33% dive. So will the forecasted dividend per unit. Based on their forecast, the FY 2019 DPU will go down from 8.6 cents to 4.44 cents. ( at the current share price of S$0.475 this is a 9.34% dividend yield)

I used the FY2019 forecast by First REIT management instead of the 1H2020 forecast. The 1H2020 forecast is lower, because the rental revenue is also lower by 33% due to the two month rental relief extended to all tenants to alleviate the economic stress caused by COVID-19 pandemic.

The net asset value will also take a dive from 91 cents to 49 cents (future rental revenue fall, the property value is based on the aggregate of future rental income). Interestingly, it is pretty close to the current unit price of 47.5 cents.

Does the market know something that we don’t?

The leverage will shoot up from 34.9% to 48.6%.

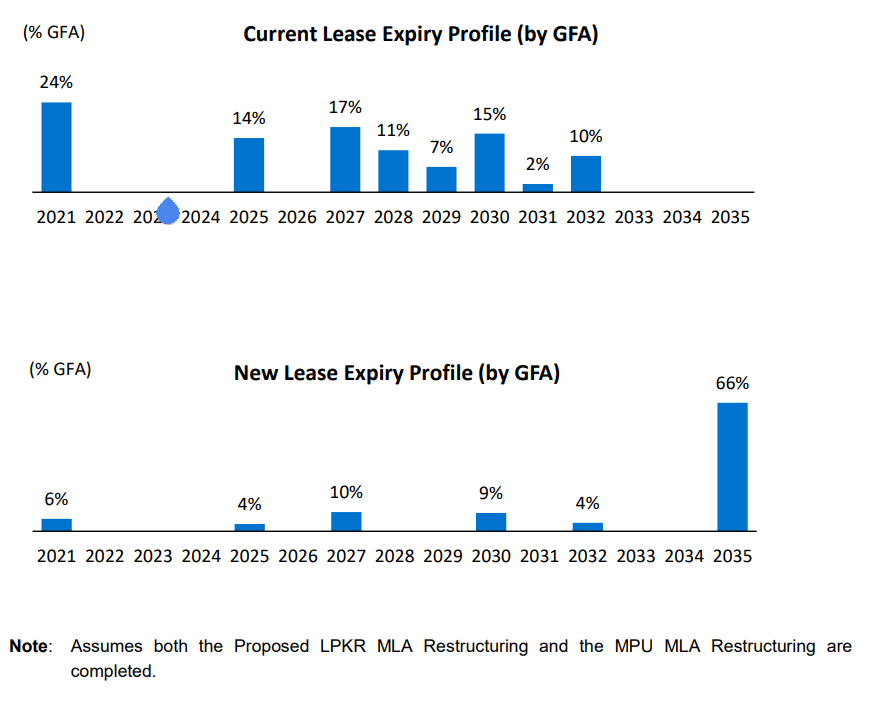

What this does is that it also extends the weighted average lease expiry to 12.6 years.

Some Thoughts

This is probably a one time pain for the REIT and unit holders. I think whether you are an existing unit holder or a prospective one, you need to look at the quality (or lack of quality) of this REIT going forward.

We gave up a lot when the rental revenue is converted from SGD to IDR. The existing rental revenue is like an emerging market bond hedged back to SGD. There was a rental escalation of between 0-2% at least.

With the rent now in IDR and a 4.5% a year escalation, whether this is good or not would depend on the SGD and IDR currency movement.

- If SGD weakens against the IDR, the investor enhances their purchasing power by investing in IDR. Additionally, they get a boost in a rental escalation of 4.5% a year

- If SGD strengthens against the IDR, the investor loses purchasing power by investing in IDR. The 4.5% a year escalation would try to balance things out and preserve your purchasing power. The extent of the loss in purchasing power would depend on the magnitude of the currency depreciation

- IF SGD and IDR are largely flat, the investor gains based on the 4.5% a year rental escalation.

So a lot depends on the currency movement.

I managed to pull some historical SGD vs IDR currency trend from Bloomberg:

The time period was from the point close to when First REIT IPO in 2006 till today.

During this period, the SGD appreciated 77% versus the IDR. That is an annualized 4.1% a year. Hey! quite close to the 4.5% a year under the new proposal.

If we measure from the halfway point in 2013 till today, SGD strengthens 3.95% a year against the IDR.

You can now understand why they give 4.5%. In this way, you are likely to maintain your purchasing power but also gain a little.

Are there a possibility that IDR will do well against the SGD?

Here is a longer SGD vs IDR chart:

This is from 1990 to 2020 or about 31 years. The annualized gain of SGD over IDR during this period is 7.73% a year. There are probably 1 to 2-year periods where IDR did well but largely, you know the trend.

First REIT leverage, due to the reduction in NAV looks very, very high. I wonder if they will have a problem refinancing the loan. This may not include the $60 million perpetual securities still on their balance sheet.

Depending on how that turns out, there might be a rights issue coming.

This definitely make acquisition difficult.

The saving grace is that the lease expiry is longer and First REIT does not have to worry so much about expiring leases.

But if you think about it, First REIT is at the mercy of the tenant. If Lippo Kawaraci and Siloam do not run the hospitals, who would run the hospitals?

In local boutique fund Lighthouse Advisers Q3 2020 letter, they mentioned this unique trait of healthcare REIT:

A lot will hinge on how well the hospital does. In a way, what may look ugly today could change if the hospitals become healthy. They have not perform well this year due to Covid but even before this, they were struggling.

The yield looks juicy but likely at this dividend yield close to 9% it will make future acquisitions hard. The growth would really need to come from the hospitals doing very well, IDR do not depreciate against SGD.

And of course if you trust the Riady family.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

S

Tuesday 29th of December 2020

Prophetic on rights issue.

Well done

Kyith

Tuesday 29th of December 2020

No lah... just guessing about the possibility

Leo

Friday 4th of December 2020

Wonderful article. First purchase FIRST REIT due to their excellent yield. They have been one of the higher yielding S-REITs for years. Even so, I refused to buy a lot, just wanted to buy a bit to enjoy the yield.

I was also reluctant to buy more when the price tanked. The place that I learnt investment from like to tout themselves and their students as market-beating, however, I was cautious, as the wider market is not stupid, it may be inefficient at times, but the wider market is not foolish.

I am prepared to write this off as a mistake and a loss, thankfully, I am not very exposed to it (2% of my portfolio). And this shows once again the importance of a portfolio.

Kyith

Sunday 6th of December 2020

Hi Leo, sorry to hear that you are underwater on this. I tend to think that we need enough active thinking of what we invest in. Most business should be progressive, and if we detect that they are not progressive, then we should do something about it.

Diversification prevents us from the risk that we do not know enough.

Wilfred Yang

Tuesday 1st of December 2020

Hi, could you share how you derive the 24% for my own learning?

LSJ

Monday 30th of November 2020

Perhaps you can also look at the 8% variable rent portion. I think it's a total cheat of minority unit holders. It's positioned as "enhanced upside sharing". but if you read the details, 8% of GOR is for the total base rental, not the increment. based on the figures shared in the same announcement, First Reit currently collects 24% of the GOR minimally. and they call 8% GOR enhanced upside sharing... the family are here to cheat minority holders.

Wilfred Yang

Tuesday 1st of December 2020

Hi, could you share how you derive the 24% for my own learning?

Kyith

Tuesday 1st of December 2020

Hi LSJ, thanks for raising that point. Totally missed this.

Sharon

Monday 30th of November 2020

Glad I didn't stay on for their drama. I've sold off First Reit in July immediately at a small loss, when news first broke that First Reit says Lippo Karawaci has not approached it about lease restructuring but LK just went to blare this in public. Goes to show how terrible they are. What it has taught me is that anything that has to do with LK and the Riady family are just bad news. Stay far, far away!