I used to ponder about whether we can learn something from how some entities manage their investment portfolios so that the portfolios provide income for their spending needs.

If I want to make sure that my strategy is more well thought out, we can get some clues from people with more on the line.

So, I studied what strategy university endowments use to provide income for their budget needs. (Read Could we Model Our Retirement Spending like Endowment Funds?)

Turns out some endowments would rely on a returns-based spending strategy or a very generic 5% of the portfolio value spending strategy. However, I think the endowments now may have more well-thought-out income strategies.

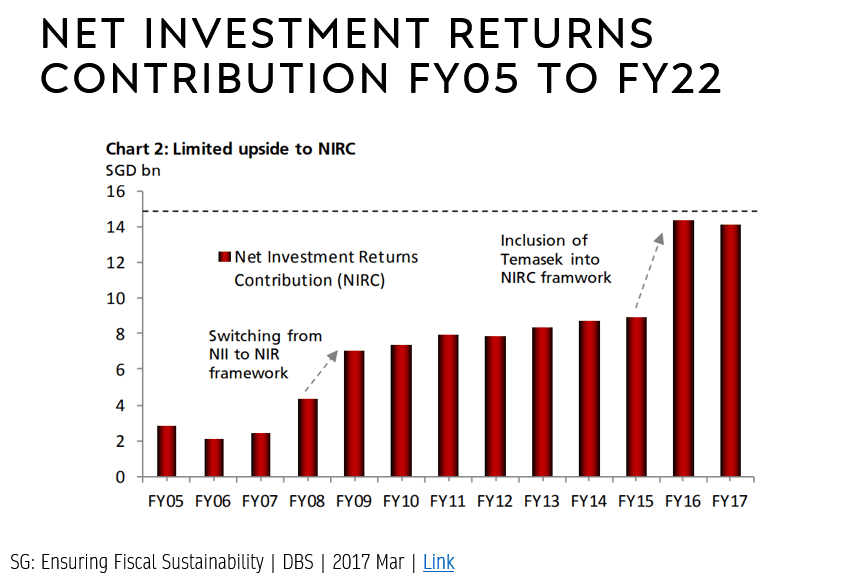

Somewhere in the middle of the year, I realised that the Singapore government also needed their investments to generate income for our budget. They eventually settled upon a spending strategy called Net Investment Returns Contribution for NIRC for short.

You may not be so sure about the characteristic of your own spending in retirement but the government should be very clear about how much they need, how much purchasing power they need to retain and how flexible their spending can be.

It is extremely challenging to still have consistent income despite the market uncertainty.

Many of us would like to rely on risk assets such as equities and bonds to be the basis of our income strategy. If so, I think we may be able to to learn a little from how the Ministry of Finance, Temasek, MAS and GIC work together to come up with a good income strategy.

You can watch the video here:

Most of what we have learn is in the video but I thought many of us wanted what the government wants of their income, which is to provide inflation-adjusted income that are consistent that last for a long time.

The government have more stringent income needs but you realize they don’t seek to only spend only their income from dividends, interest income only:

Well, they do in the past, but eventually, they have to incorporate an amount that is half of the long-term real returns of the portfolio.

Wouldn’t spending from returns be less prudent?

If this is the case, then maybe we should be more worried. But if someone needs the income to be more robust are fine spending 50% of returns, then you got to ask if you are not looking at income conservatism the right way.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- The Cheapest Way to Extend Your Laptop to TWODisplay that I Can Find. - April 29, 2024

- My Quick Thoughts on the Net Cash, 4% Yielding Boustead. - April 28, 2024

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024