In some of my past conversations with a couple of my friends, I thought a better way to carry out dividend investing for them is to let a fund manager execute their dividend strategy for them.

The problem with that approach is that a particular friend may consider a fund manager is better than another or that the return performance of a fund manager is too uncertain that he would not feel confident about it.

News flash: If you invest in a portfolio of equities, your returns will be uncertain whether you like it or not. Even bond returns are uncertain due to reinvestment risk.

Nowadays, we can invest in a systematically active ETF that expresses our investment philosophy by investing in high-dividend securities.

In this video, I deep-dived into one such ETF, the Vanguard FTSE All-World High Dividend UCITS ETF:

I made a rather long video because I went in-depth into a lot of areas:

- How you would run a portfolio as a dividend investor

- Introduction to the fund

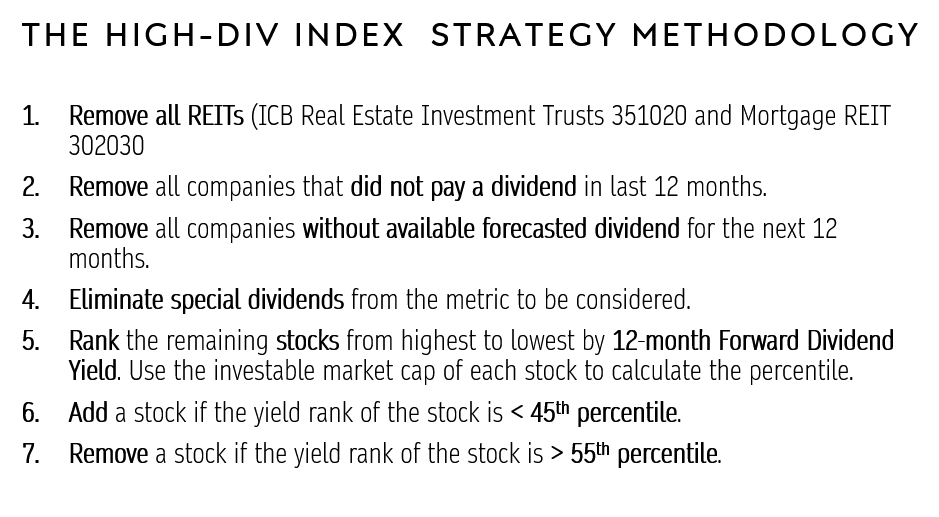

- How VHYL & VHYG systematically invest in high-dividend companies

- The Benefits of Implementing Your Dividend Strategy with an ETF

- What do we call this kind of ETF?

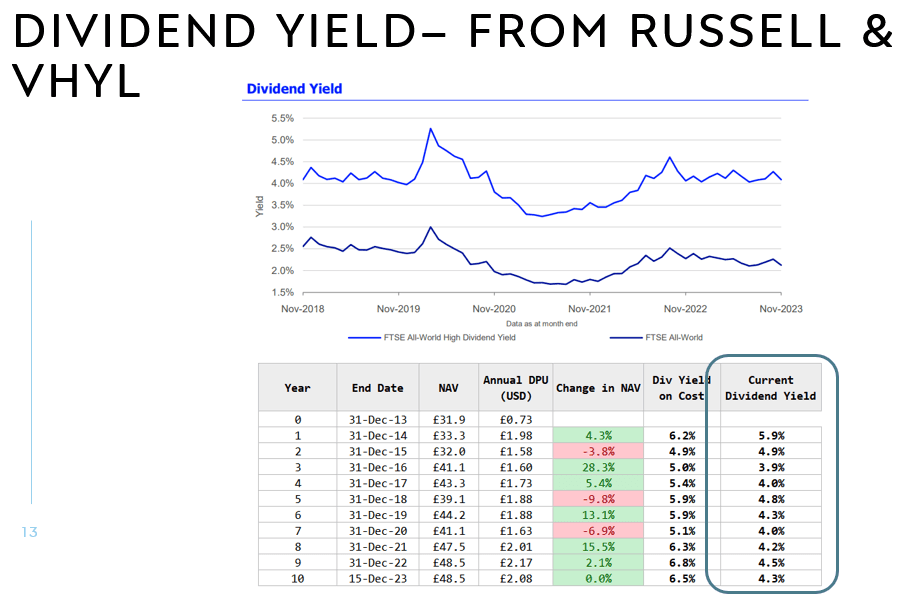

- Going through some of the VHYL/VHYG fund characteristics such as returns, dividends

- Accumulating vs distributing funds price performance

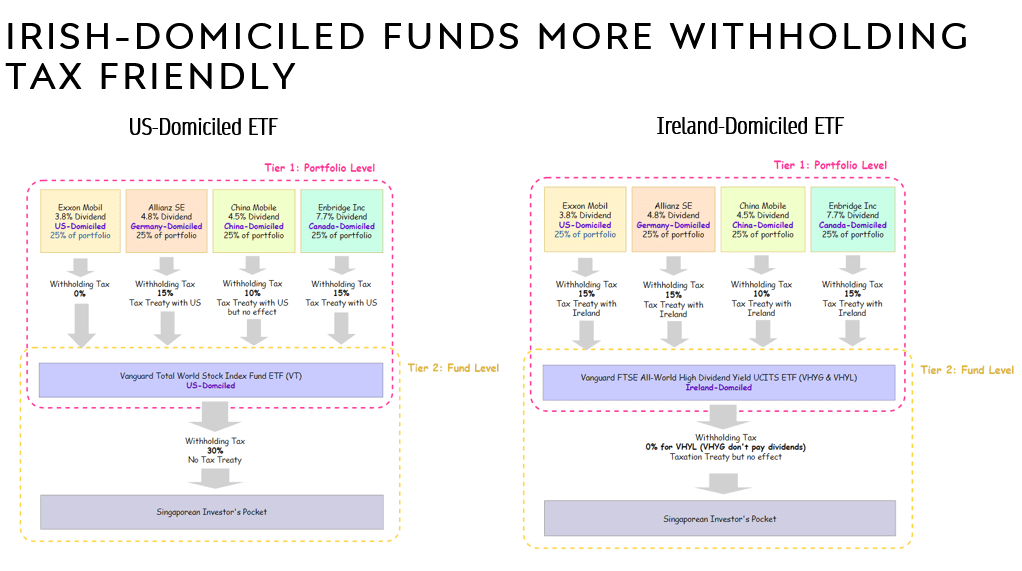

- Why Irish-domiciled ETFs are preferred. Illustrating the Withholding Tax difference between a US-domiciled ETF and an Irish one.

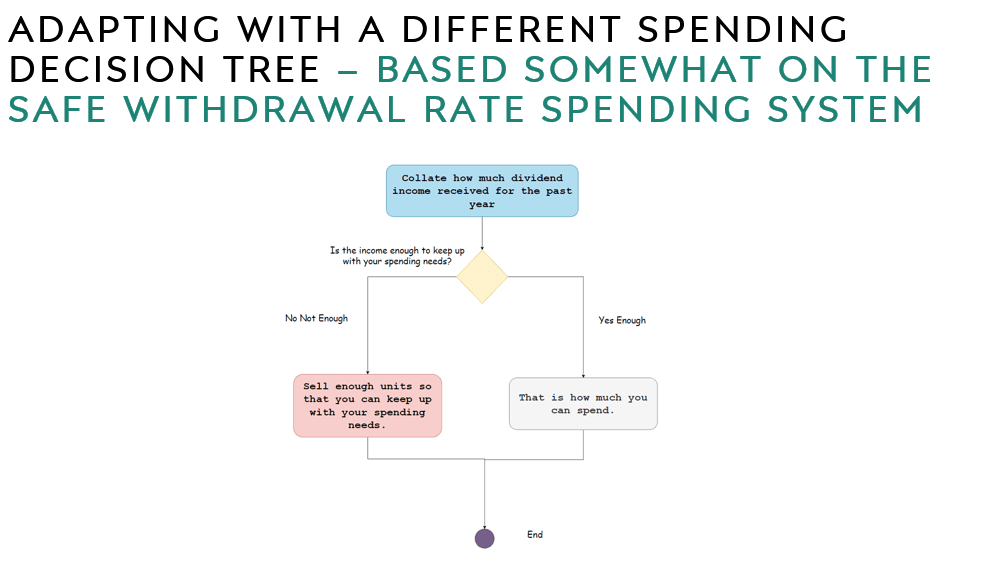

- Crafting a spending plan around VHYL by just spending the dividends paid out

- So, can we make the income more consistent and preserve our purchasing power?

- Combining the accumulating and distributing funds into one plan.

I made the video not for you to complete in one sitting and if you are interested in such a subject. If you are, do spend some time on it and don’t force yourself to finish watching in one sitting.

Here are some thoughts further thoughts about what I presented.

We can have an option of wearing the portfolio manager hat and being directly involved with the securities selection and decision-making, but to simplify things and live an easier life, we might want to delegate the responsibility away into a Smart Beta High Dividend strategy embedded within an active index.

Other divided ETF may run a different strategy from this but if we review its methodology, you might realize you are doing a lot of similar things to this mechanical strategy.

This is the potential dividend yield, if you manage to buy it at various years from 2013 to 2023. The dividend yield might be high enough for you but it varies.

I tried my best to explain withholding tax to the audience again. Took a bit of time, but you may appreciate fleshing this out since this was asked quite often.

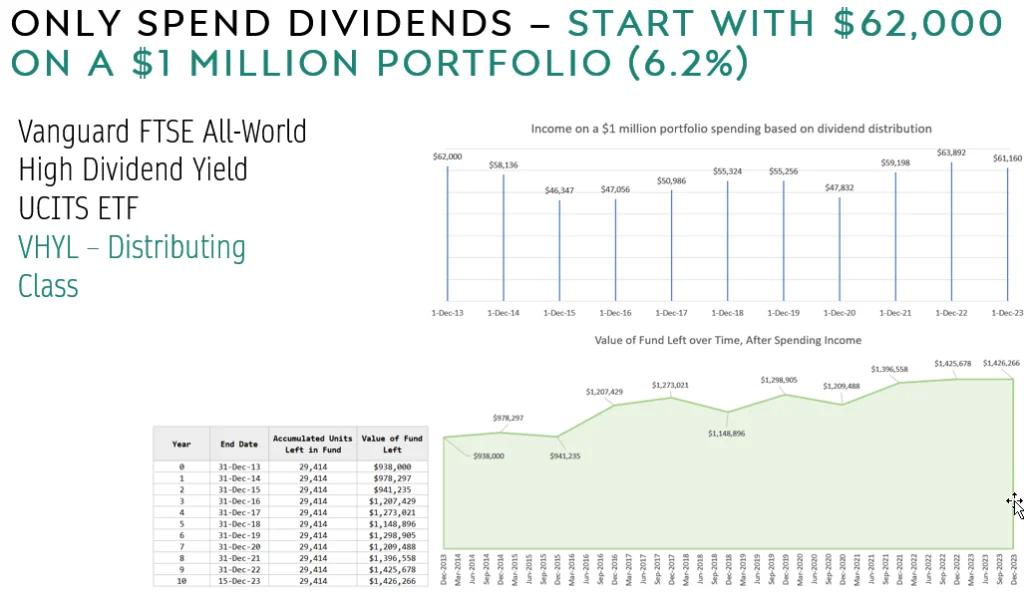

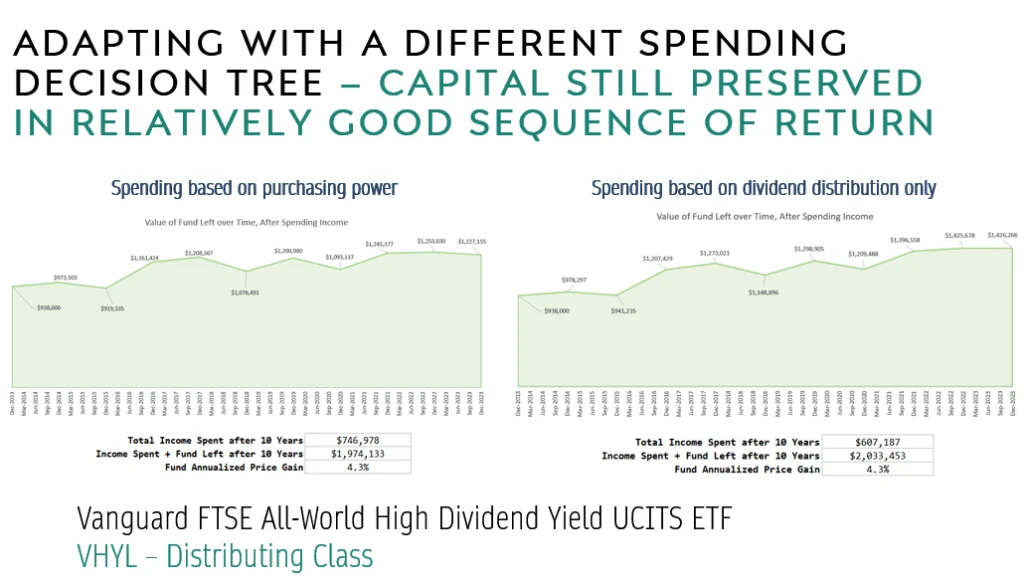

How does the portfolio look if we manage to spend only the income of the portfolio?

The period is rather short, but we can see how things are if we spend at a relatively high SWR.

The income from spending dividends only is less consistent, but can we build around more income consistency but still make use of a distributing ETF?

It turns out it is workable in the short time period that we have. By no means does this mean adopting this strategy will work with all historical 20 or 30-year periods you might live through, but I show that you can get consistent, inflation-adjusted income and still preserve your capital when compared to a spend-dividend-only strategy.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Daniel Choy Kwok Kai

Wednesday 20th of December 2023

Blessings and thanks 🙏👍!