In 2019, OCBC started this Financial Wellness Index to understand the financial health of Singaporeans. They have four years of data.

But I just hope that they can present more coherently. You can review the past survey results here, and you may wish that much of the data presented in 2022 could build from the 2021 or 2019 data.

There are probably four areas in the 2022 results that caught my eye.

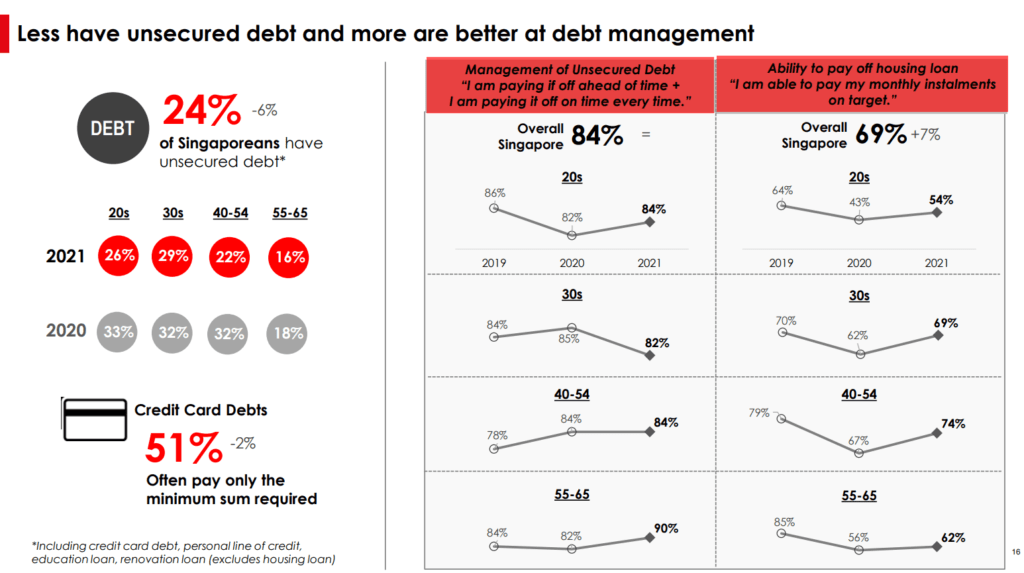

1. A Sizable Number of Singaporeans Often Pay Only the Minimum Sum on their Credit Card Debt

The slides below show the state of personal loans, which includes credit card debt of those surveyed:

The data is so incoherent from 2021 that we cannot really tell much of a trend. For reference, here is the slide from the 2021 Wellness report:

In 2022 report, they break it down by income level, yet in 2021, they break it down by age.

The only thing we can tell is that Singaporeans have more unsecured debt, but they belong to those with higher incomes. Those with lower incomes cannot borrow more, which is good as it shows we have good and reliable protective measures in place.

I think with income going up for those that has more income, the degree of unsecured debt will increase as well.

But what is more worrying is the second slide which indicates the percentage of people worried that they cannot pay off their personal loans.

43% of those earning $10,000 and above OFTEN pay the minimum sum for their credit cards.

There is absolutely no advantage to only pay the minimum sum… unless financially that is all that you can pay.

This is worrying to see.

The growth from 2021 is not significant, which means that in 2021, the percentage is about 39% for those earning $10,000 and above as well.

In the Singapore subreddit, someone working in a bank call center also commented that people repeatedly fail to pay these bills or were late.

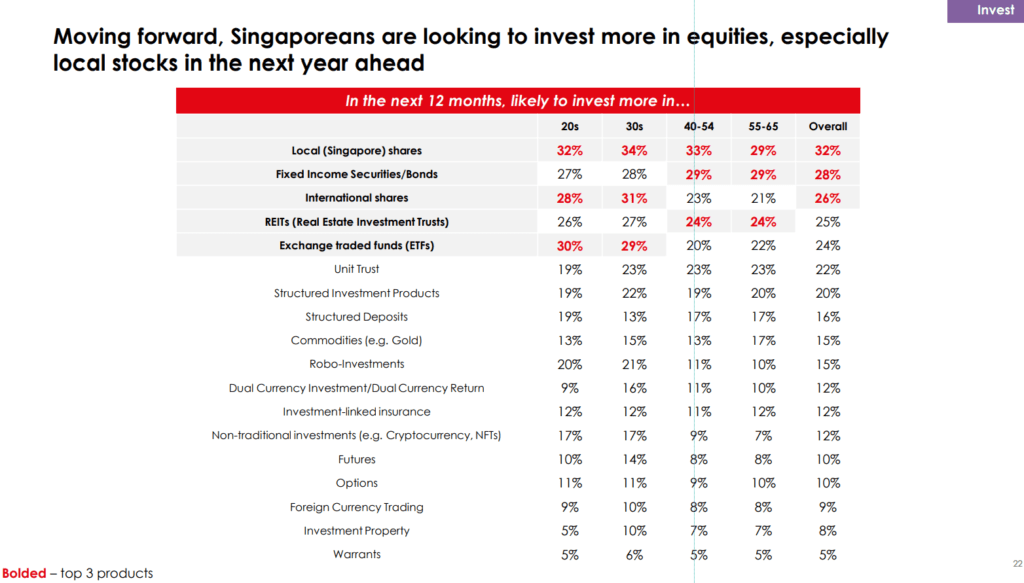

2. Singapore Shares Remained Popular Securities for Singaporeans

The survey also shows that wealth builders are still very interested in local Singapore shares, together with fixed-income, international shares and REITs.

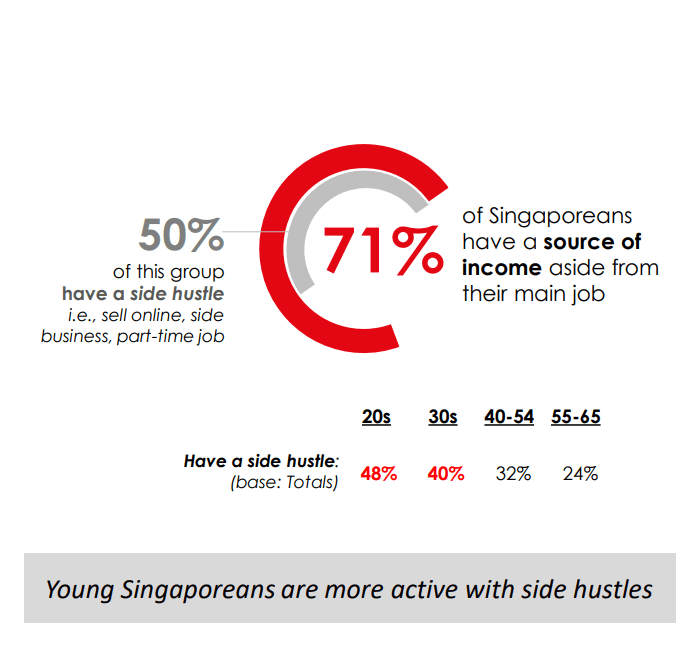

3. 71% of Singaporeans have Another Source of Income!

This one is quite a surprise to me.

I wonder if I sell the stuff that I do not want on Carousell, would that consider a side hustle?

Almost 48% of those in their 20s have a side hustle!

If you are my younger readers, do tell me if this is an accurate reflection!

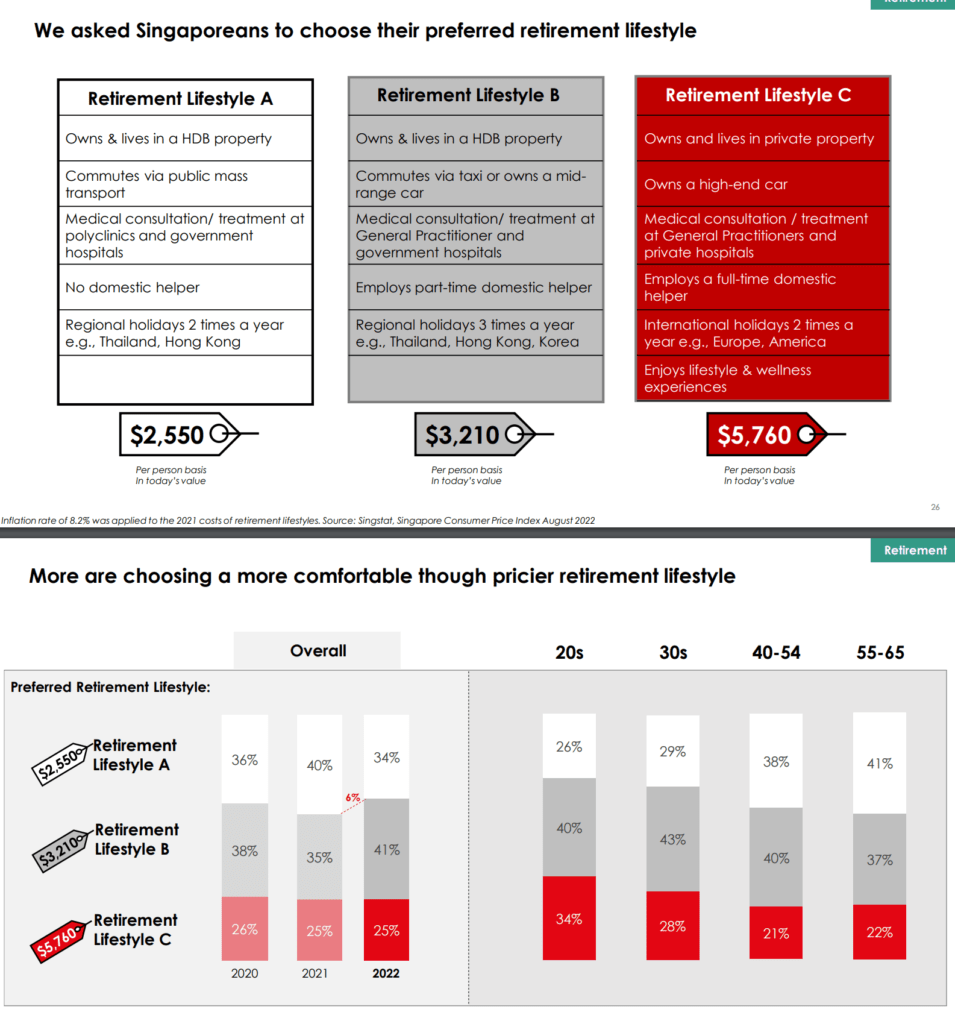

4. Singaporeans Consistently Underestimate the Cost of Their Retirement Lifestyle

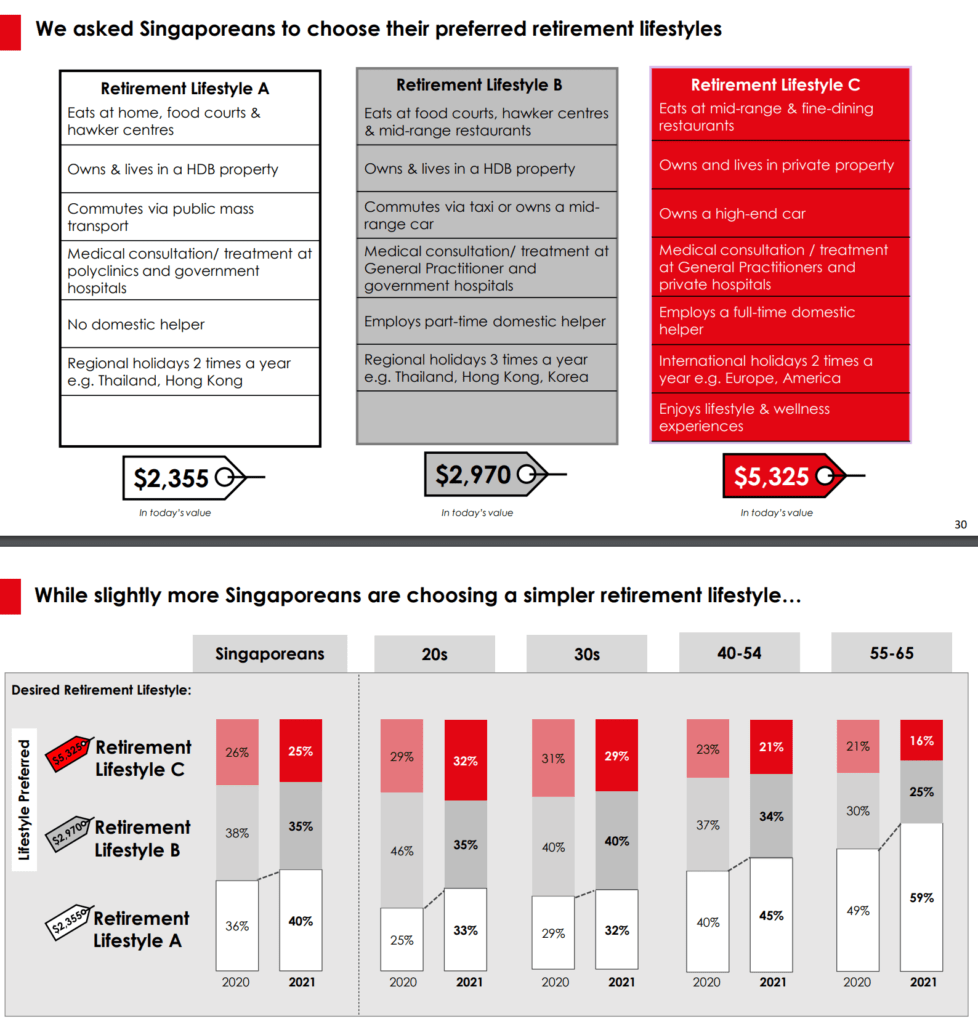

OCBC asks the respondents which is their preferred retirement lifestyle:

Most prefer Retirement lifestyle B, which includes a part-time maid, taking a taxi or having a car. Note: they were not asked about their preferred lifestyle while working but retirement.

Why is it that their retirement lifestyle feels like their current working lifestyle?

I often ponder this and think people cannot envision their retirement life and plan their retirement like they are working.

From the data, you can see the 20s and 30s are still hopeful they can live retirement lifestyles B and C. The 40-65 are closer to it, and perhaps more realistic that they can only afford Retirement lifestyle A.

Here are the results from 2021:

Noticed that the 2022 survey did not show the difference from 2021. If we viewed the data together, you would realize that for all age group, people preferred Lifestyle A and less Lifestyle C going from 2020 to 2021, but from 2021 to 2020, they all prefer Lifestyle B.

So here is the summary:

- Those in their 20s aspire for Retirement Lifestyle C over the past three years. It has been increasing.

- Those in the 40 to 65 changed from Lifestyle A to Lifestyle B over the past three years.

- Those in the 30s are largely consistent.

The data tells us that Singaporeans do not wish to settle for a bare minimum retirement lifestyle but a richer one.

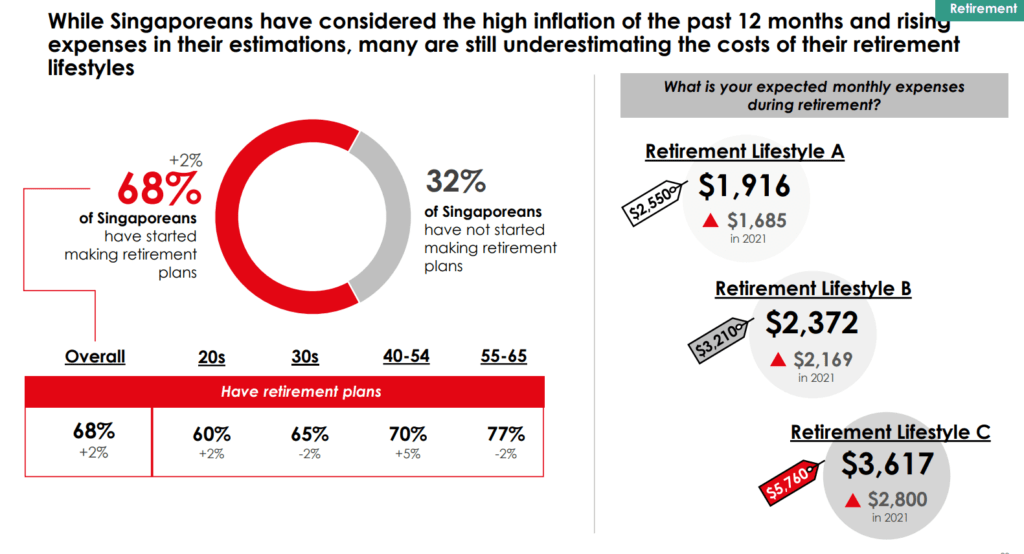

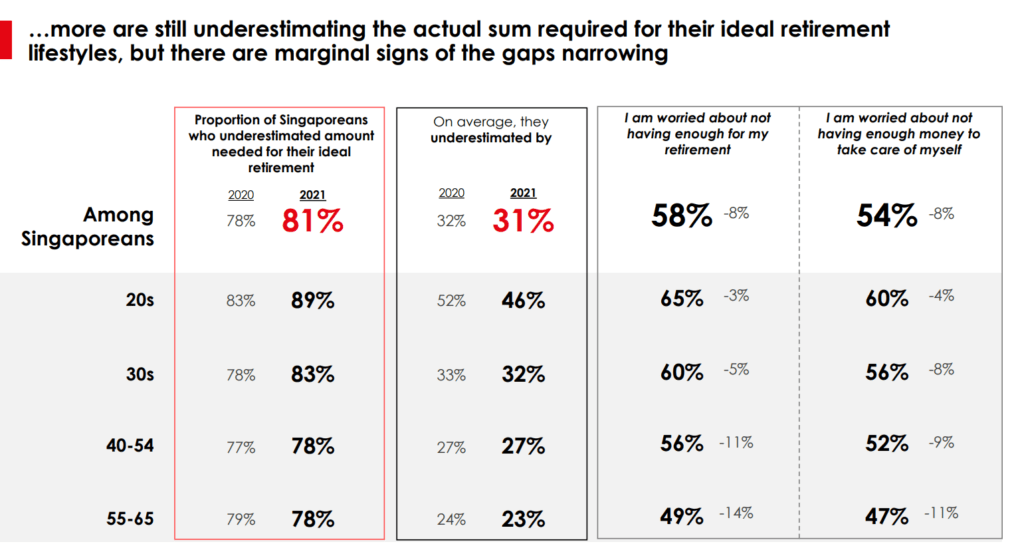

Singaporeans have aspirations for Lifestyle B and C because they think it is within reach. But as you see from the illustration on the right, they have consistently underestimated how much that lifestyle costs.

This underestimation is not new. Here is the slide from the 2021 survey:

On average, they underestimate the lifestyle cost by 30%. 80% of them underestimate the cost.

This should not come as a surprise because most of us are not in tune with what we spend on.

In my opinion, I feel that OCBC’s cost for Lifestyle A looks a bit high and Lifestyle B looks a bit low. I feel that with a mid-range car, the cost would be more.

I could be wrong here, so let me know.

Retirement Lifestyle A Looks Achievable (If the Price Tag is Correct)

But here is the thing: I think most people can have a decent chance of achieving Lifestyle A.

A would-be retiree that fulfills the CPF full retirement sum (FRS) with $192,000 at 55 would see his or her money grow to $285,000 at age 65 which would provide him/her an income of $1,550 a month.

If both spouse fulfills their FRS, then the income will be $3,100. But that is 10 years later and if we adjust the income with a 3% inflation adjustment back to today, the $1,550 a month income would be worth $1,153 a month today.

If we consider both spouses, then it will be $2,306 a month.

If we assume by your time the economic conditions worked out, fulfilling your CPF full retirement sum would enable you to have Lifestyle A.

If you need Lifestyle B, then save up additional for it.

As a 42-year-old that have been consistently being told I don’t get paid well, and have not top-up my CPF except for one $40,000 lump sum OA to SA transfer, I think it is reasonable to hit your FRS by 55 years old.

So take that piece of information and see what you can do with it.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- Should I Take Less Risk in My Fixed Income Allocation by Moving Away from a Global Aggregate Bond ETF? - May 5, 2024

- Singapore Savings Bonds SSB June 2024 Yield Climbs to 3.33% (SBJUN24 GX24060A) - May 3, 2024

- New 6-Month Singapore T-Bill Yield in Early-May 2024 to Stay at 3.75% (for the Singaporean Savers) - May 2, 2024

Sinkie

Thursday 1st of December 2022

I suspect is because most realise they won't be able to achieve the required retirement income, so they downplay it lol.

Easiest way to estimate the ideal lifestyle amount is to simply use the expenses while working, less the mortgage payments if home fully paid up. Expenses currently related to work, supporting children, supporting elderly parents ... have a funny way of being diverted to other things in retirement.

Kyith

Thursday 8th of December 2022

Hi Sinkie, their model of safety in their head is unique in that it is only fixed deposit-like or property that are safe. So they are forced to use these instruments and try to create a plan that work. Their buffer is having more capital.

Not wrong. It is like all my ideas, i try to make ETFs to work. If not a dividend investor try to use dividend stocks and cash. people only trust something.