It is Da Nian Chu Er of our Lunar Chinese New Year.

Here is wishing all the good health and good wealth. I hope all our portfolios don’t go to zero.

I want to take things slower this Chinese new year and since I receive a question from an earnest member of my Singapore Financial Independence Community (if you wish to join the Telegram group, you can join here.)

The person asks:

At the risk of sounding stupid, can you answer a question that has bugged me for quite a while.

The good old Singapore investment strategy of:

- $5,000 monthly CPF LIFE Payout (for a couple)

- Estimated $4,000 monthly property rental.

- Estimated $3,000 to $5,000 monthly dividend / interest / short term work.

How do you fit the Safe Withdrawal Rate (SWR) concept into the framework above?

I failed to see how to fit it in.

I do understand that the #2 and #3 above can fluctuate. But only in extreme cases it will go down to zero which exist in all market-based portfolio.

I called the safe withdrawal rate or SWR a framework to figure out the highest income you can have, for a given income requirement period, for a low-cost, diversified, strategic and systematic portfolio made up of equity and fixed income.

It is rational for some to be puzzled how to look at SWR if they are a dividend investor, a property investor or have a pension income.

Let me see if I can answer this.

Frame each income as an income with a unique characteristic.

He provides three income source and each of those income source has its own characteristics that make it difficult to group them together.

The dividend portfolio won’t have tenant vacancy to contend with. You cannot easily sell off a brick if the income is inadequate for your needs.

The best way is for each unique income, determine how much income you can have in a conservative manner (we will talk about this more in other parts of this article.)

For example, you wish all your income to adjust for inflation, so his income stream can work out like this:

- CPF: $5,000 x 65% = $3250 CPF LIFE (read my article about planning to inflation adjust your CPF LIFE income)

- Rental Property: $4,000 x 70% = $2,800 monthly

- Dividend Stocks: $3,000 based on a lower planning dividend yield.

Now, since all three sources have considered income volatility, and factor in the planning for inflation , this comes up to $9,050 monthly.

Is this adequate for your family’s spending needs?

If yes, then this should exit you.

The Essence of the Safe Withdrawal Rate Framework.

Many don’t understand why I am so focused on the SWR. If you admit that planning for income and making sure the income lasts long enough is a tough problem, would you want to know what is critical to making strategies work?

If we want to focus on the most critical stuff that would make or break the plan, then that is to focus on the ratio of the starting income/spending need to the value of the portfolio.

If we spend too much, relative to the portfolio at the start of the income, if you faced a poor market + inflation sequence, your plan may not work.

And you don’t have the opportunity to press the “Play Again” button.

This is what the SWR tries to get at:

- You can live through many different 30-year, 40-year, or 60-year periods.

- Each of these period has a unique market and inflation sequence. They are represented in lines above.

- You cannot relive and redo such long time period in your life.

- There is no way to predict what will happen going forward.

- The SWR tries to make sure the income plan for the most unlucky person works.

If you understand the above, you may have the following question:

- Will my CPF LIFE have a bunch of lines like above or there are no lines since there is no volatility to the income?

- Will my income from rental property strategy have a bunch of lines?

- Will my income from dividend stocks have a bunch of lines?

The conservative answer is YES.

And if so, how do you come up with a plan such that, if you are unlucky enough, your plan will still work?

Rich People Don’t Explain What Makes Their Plan Work Well

Many people try to explain why their plan is sound.

They may say they own a bunch of properties that generates income and this is a great plan. Or that they buy these blue chip stocks and REITs which generates this income stream and it is sturdy.

But what made their plan work is that their income/spending needs, relative to their portfolio value is very low. As this ratio is very low, in the event that they are unlucky, they are relatively unscath.

For example, if you have $20 mil in your portfolio of dunno-what and you $100,000 yearly, that is 0.5% of the initial portfolio value.

Let’s say you are too gung-ho in your investments and it resulted in the portfolio being down 50% or $10 million. Let’s say you underestimate what you need to spend on, and your spending is $150,000 yearly.

$150,000/$10,000,000 = 1.5%

If Kyith tells you a 2% initial SWR is very, very conservative, this should give you a good idea how safe is 1.5%.

The rich have a peace of mind because their plan “accidentally” fulfill the critical aspect of income planning.

Most Underestimate the Luckiest and Unluckiest Situations Their Income Plan May Subject to

What gets me more is that most expect:

- The number of lines to be lesser (in the chart above)

- Their unluckiest sequence is what they have seen or experienced in their investment lifetime (5 years? 20 years?)

And so I have a problem with your perception of what can be the most unluckiest.

You have a different strategy in property rental, investing for dividends, but you are still investing in risk assets and that translate to volatility in some ways.

I don’t have the data but we can describe some events.

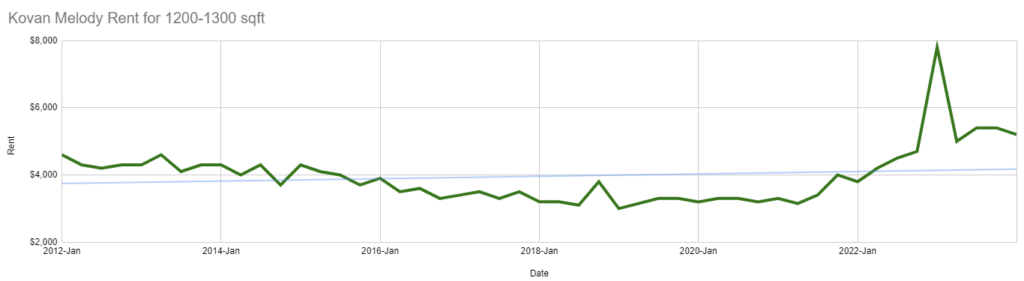

The chart above shows the monthly rental that can be fetched for Kovan Melody, which is next to the Kovan MRT station.

Imagine a retiree with the income coming SOLEY from one of this unit and he retired in 2012 fetching a gross rental income of $4,600 monthly.

How wide does he think will be his rental income fluctuation? How well does the income keep up with inflation? What will be the inflation going forward in the next ten years?

He cannot predict a lot of things.

Now he might set about his plan to be conservative and estimate that his spending needs of $3800 monthly (assume no cost here) should be lower than the $4,600 monthly and the plan is conservative enough.

Well at some point, the rent fell to $3,100 or 48% below.

And inflation is low but things are getting more expensive.

How will his plan work out?

If he survives till today, his rent will go up to $5,400 monthly.

But you look at the experience above and you can’t deny the volatility.

Now you know what is the scary thing? We are not talking about some more challenging scenarios.

The SWR brings us through first world war, Spanish pandemic, oil embargo, Great depression and see how the portfolio does in those situations.

The older folks who been through the Asian Financial Crisis will tell of the situation where banks really foreclose your property, even if you want to rent out, people don’t have the money to rent.

In the Kovan Melody example, would the $5,400 rent fall to $2,200 monthly?

Some may find it unthinkable but you might be lucky you are one who could secure a tenant and the tenant still has money to pay the rent.

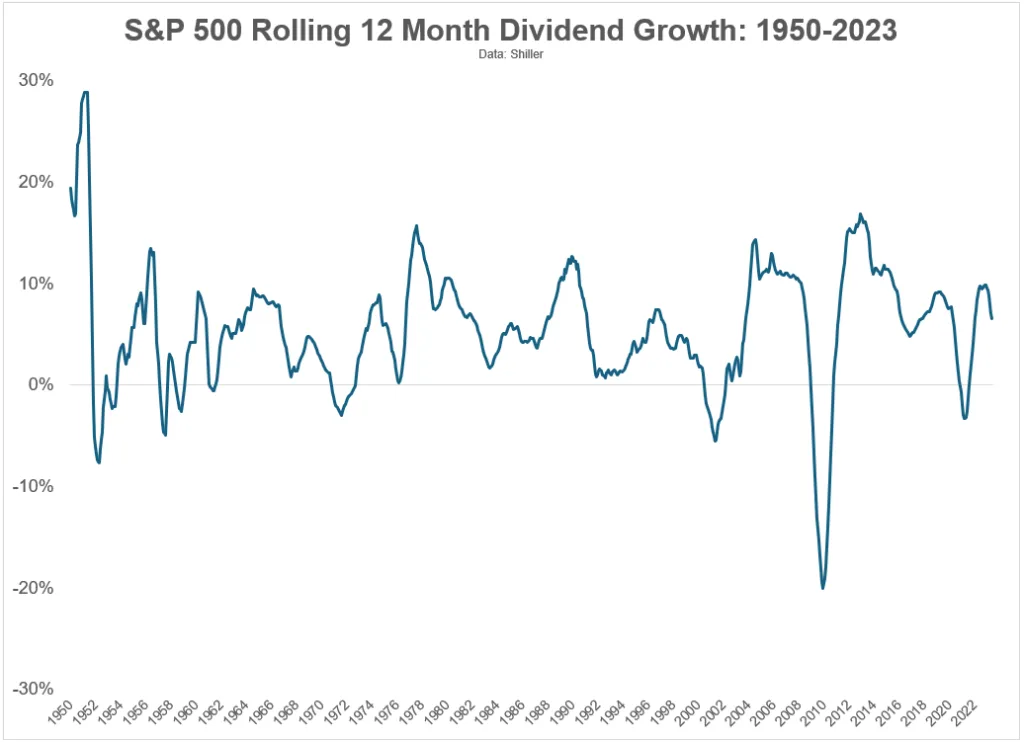

Ben Carlson has this chart of the S&P 500 rolling 12 Month Dividend Growth from 1950 to 2023 in his article Can You Live On Dividends from Your Portfolio:

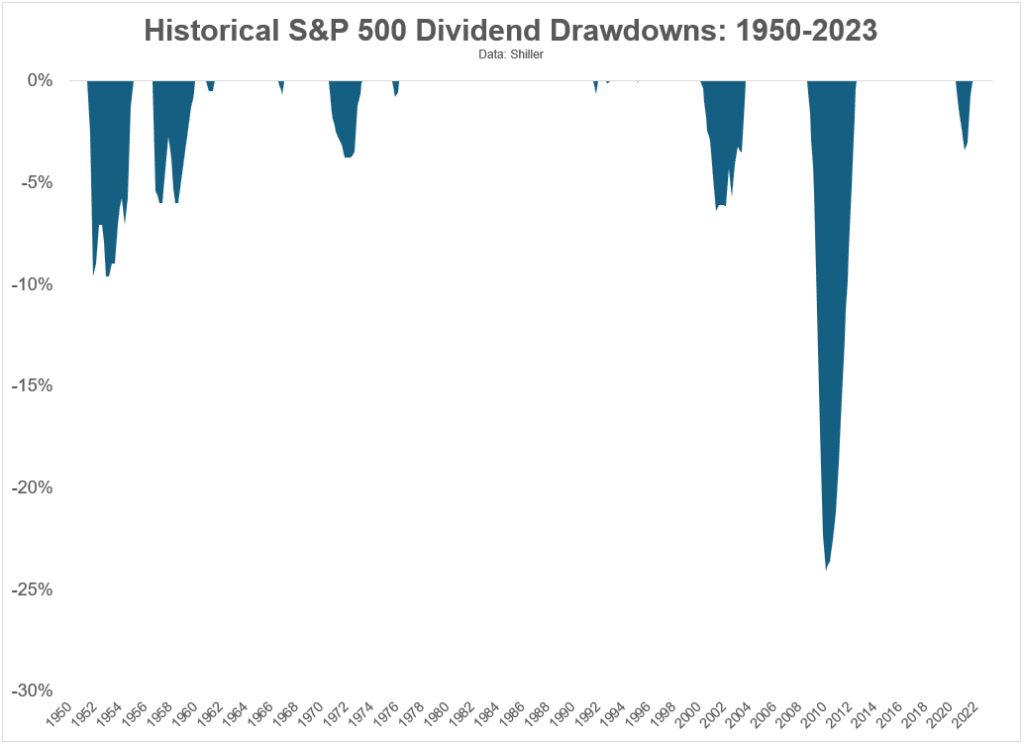

And here is the draw down in dividends:

These are the drawdowns in income from a portfolio of 500 stocks.

Now, I am not sure how you invest your dividend portfolio.

But I am quite sure your income aggregates to a certain amount. That amount is going to be VOLATILE.

The questions are always:

- How wide can the drawdowns be? This data might give you something to plan around.

- How different is your dividend strategy versus the one above?

- How do I build an income strategy around this investment I have high affinity towards?

You Will Need to Find A Way to “Feel” How Wide the Berth Is in Your Investments

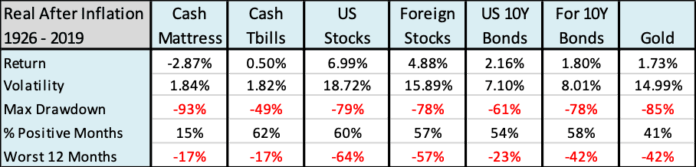

Meb Faber shows us this chart about the real returns of different US assets in his the Stay Rich Portfolio article:

To be honest, I was shocked by the maximum drawdown of cash under the mattress and treasury bills. How could this be?

There can be some rather challenging inflation sequences and you might not wonder about.

But that is the challenge for your strategy.

How bad could bad be?

I don’t have the answers to everything.

It brings us back to what I wrote up there:

- CPF: $5,000 x 65% = $3250 CPF LIFE (read my article about planning to inflation adjust your CPF LIFE income)

- Rental Property: $4,000 x 70% = $2,800 monthly

- Dividend Stocks: $3,000 based on a lower planning dividend yield.

Why do I use 65% for CPF LIFE?

I am planning an 30-year inflation income strategy that wraps around CPF LIFE.

Why 70% of the current property income? I don’t know but using 70% leans towards being more conservative than just plan assuming your future income from property will only go up.

If the average yield of your dividend portfolio is 4%, how low more should you plan for?

I have no idea really.

If a Great Depression hits Singapore, how much will dividend as an aggregate be slashed? I have no idea.

But if you plan for a dividend slash of 30%, I think that is reasonable.

So 4% x 70% = 2.8%. (See… in terms of capital needs, it always work out to be this 2-3% range. We can talk about a lot of these different strategies, but if we want to wrap a conservative income strategy wrapper around our investments, usually it comes to this small range of numbers.)

The Degree of True Flexibility in Your Lifestyle

While we can say a lot about investments, to many, the unknown is the volatility over their lifestyle.

That is something that many who plan thought they have mastery over.

Their spending today is fixed.

But they also have true flexibility over how they can adjust if faced with income challenges.

I question that a lot especially when I hear people comment “Kyith you spend so little!” That sounds more like “While I say I can be flexible, there is no way of cutting down my family’s lifestyle to your level.”

So how much could you cut down?

Not a question for me but for yourself.

You may need to know that for your own planning.

I spent time figuring out mine and realize I don’t really wish to cut down on a few stuff. You got to figure out whether your flexibility is real flexibility or fake flexibility.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- Should I Take Less Risk in My Fixed Income Allocation by Moving Away from a Global Aggregate Bond ETF? - May 5, 2024

- Singapore Savings Bonds SSB June 2024 Yield Climbs to 3.33% (SBJUN24 GX24060A) - May 3, 2024

- New 6-Month Singapore T-Bill Yield in Early-May 2024 to Stay at 3.75% (for the Singaporean Savers) - May 2, 2024

Ron

Monday 12th of February 2024

Yes, good explanation and examples on income & volatility of that income. And very similar to my situation.

One thing that runs constant is expenses and this is seldom given sufficient thought. We MUST know how much we spend, starting from the inescapable:

1. Utilities ( water/electricity/gas/home WiFi) 2. Groceries ( cooking at home/eating out) 3. Transport ( bus/trains/hail rides) 4. Sinking costs ( air-conditioners/fans/washing machines/refrigerator/etc) 5. Health care ( dental/general health/haircuts etc) 6. Children ( schools/tuition/extra-curricular/pocket money/insurance etc) 7. Parents ( care-giver costs/healthcare/ etc) 8. Insurances 9. Annual ang pau for CNY/weddings/birthdays or wakes

Once these costs are known, the estimation becomes so much clearer. And it does not include luxuries yet, which is:

- car - holidays - ??

Knowing expenses is the first step, only after this can we have a target for how much income is required. Doing the other way is putting the cart before the horse...

Kyith

Saturday 17th of February 2024

Hi Ron, thanks for trying to do this. after that step, i do contend what is just as challenging is to figure out the key characteristics of each spending that will affect your plan. i feel they are how flexible or totally inflexible is that spending, how recurring, you need that spending (some could just last for a few years in which case do you want to have it part of an income stream?).

If you cannot put some ideas around these characteristics... it would be a planning problem as well.

lim

Sunday 11th of February 2024

Happy CNY!

Adopting the 'simpler' dividend approach, the member's question is easy to explain. The member says he has $12k-$14k passive income. The missing piece of information are his fixed expenses + sinking fund cost (i.e. landed property, expensive branded appliances/lighting/fittings= larger sinking fund needed than HDB and mass market appliances)

After subtracting your fixed expenses and your "sinking fund" (for household repairs and appliance replacement), you are free to spend the rest of your passive income. If you can't spend all of it, even better, you can save some for future use.

In some years, your passive income may be less, then you spend a little less. Eg: 2020 COVID-19, my dividends went down by 20% but I spend on overseas travel. In other years your passive income may be more, you can spend more (or save the excess so that you can spend later).

Finally, I recognise that this dividend approach, as you have mentioned previously, has its own issues (which in my view are non-issues or issues that also affect any investment - like the risk of losing money when investing). But sometimes, having a simple approach makes it more likely that one will be able to follow the plan and make less mistakes.

Kyith

Monday 12th of February 2024

I think he has to figure ouit if the volatility of the income of 20% is wide enough. There is the assumption that in the past 20 years, we have seen a wide enough volatility to use that in his planning. I think he didnt say how flexible he can be with his spending so i cannot asusme that he has the same flexibility that you have.

This is the assumption there. Imagine you are planning for my spending of $850 a month that cannot be flexible in anyway. I cannot afford to have that income reduce by 20%.