There is this planning problem that some may face.

Out of the three different CPF LIFE Annuity schemes of Basic, Standard and Escalating, people prefer to choose Basic because, mathematically, it is the most “bang for the buck”. If you have other streams of income, then well and good, but I wonder if you don’t have are you okay with a couple of hundred bucks less.

Most also don’t like to select Escalating because they don’t think they will live that long. I am unsure what yardstick they use to tell them that. Escalating will give you less starting income but the income grows at 2% a year. If you live till 110 years old, Escalating will give you more income than the other two plans.

Given all this, people prefer to take Basic and manage their income on their own.

However, they run into a problem still: How do I have income that preserves my purchasing power?

My answer to that is a mixture of:

- You need to really know the time frame you are planning for. 30-years? 40-years?

- Your investments need to grow. When you make use of CPF LIFE, you have delegated that responsibility (willingly or unwillingly) to the government. The underlying investment needs to have a nature that can keep up with inflation (e.g. equities)

- If #2 is weak, you need additional capital to factor in inflation. Yes… this may be spending your capital… but at some point, the life decisions is more important than the financial decisions.

When people prefer CPF LIFE Standard and Basic but they are not inflation-adjusting, it presents a greater problem if for some reason people felt that $2,000 a month combined is not enough for retirement and they need to plan for more.

You face the problem that this stream of income is not inflation-adjusting but you are pairing it with an income stream that is inflation-adjusting.

Usually, planners look at this linearly and that presents a problem whichever way you look at it because if the client survives until the later years, the inflation-adjustment stress is passed to that third-party income solution to take care of, which is on top of its own stress to provide its own inflation-adjustment.

I wonder how many people see this problem… I suspect not many do.

The High-level Thinking

There are two implementations. The first is to come up with a comprehensive framework that encompasses this annuity income. This is what we do for our clients at work but that framework has to bother with many things that it complicates things if your situation is more simple.

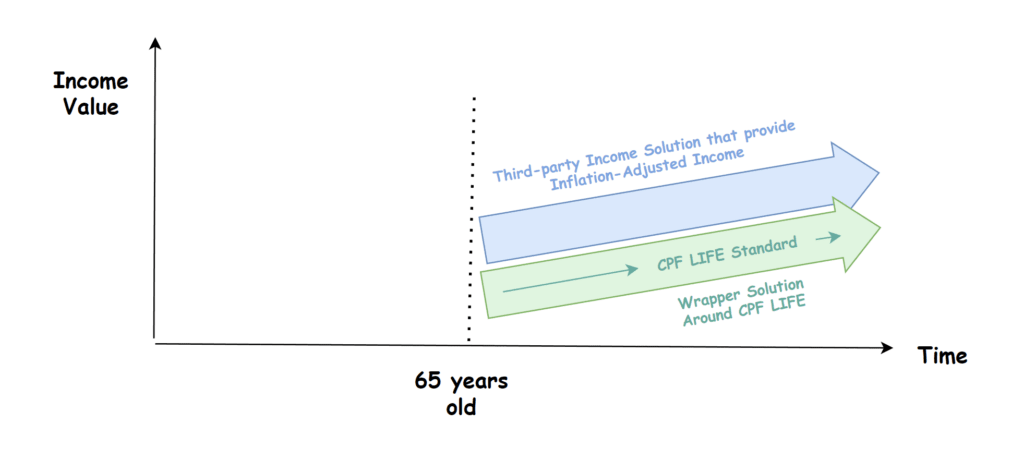

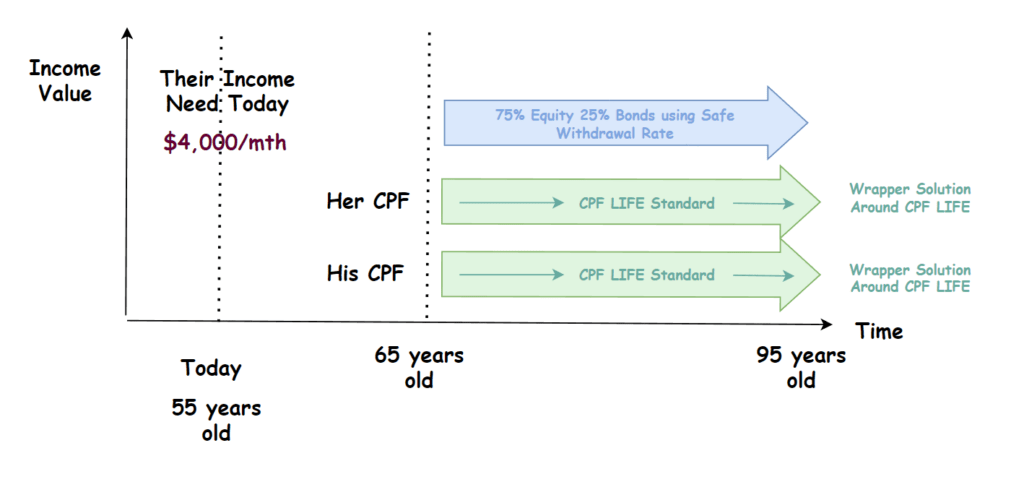

A better way is to think of a wrapper solution such as the one in the diagram above.

We design something around CPF LIFE Standard or basic that will result in the plan income to be inflation-adjusting.

But how does that translate to in real life?

One very simple plan is to just plan to start spending half of your CPF LIFE income instead of the full amount.

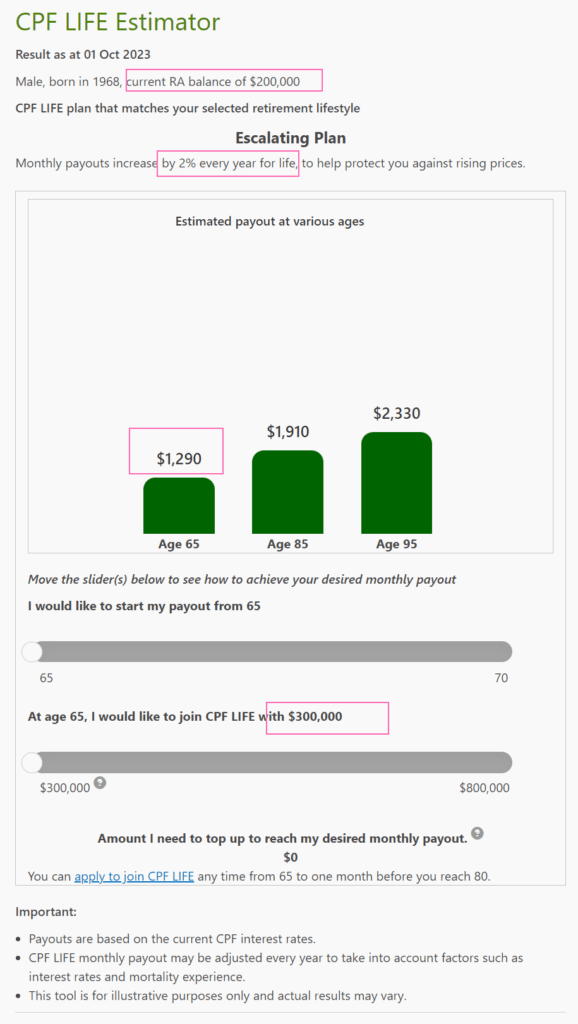

For example, suppose a 55-year-old today with $200,000 in CPF RA (I know the FRS is $198,800 but let us just use a whole number), at 65-years old the $200,000 will grow in CPF RA to $300,000 and give a projected flat $1,630 monthly income:

So… we just plan to spend half of it which is $815 monthly.

If we are planning for a 30-year retirement (65 years old to 95 years old), and you want an income to go up 3% annually, $815, will become $1,630 in 25 years.

(Go to your calculator and key in 1.03^25-1 and you should get 2.09 which means the income needs doubled in 25 years).

But Kyith, wouldn’t there be a lot of unspent income not doing anything?

Yeah, it is.

Not really the most efficient, but you have to admit it is conservative. Demoralizing but conservative.

It still does the job and you can have an easier time planning the third-party income stream.

What if We Start Spending Only 70% of our CPF LIFE Standard Income Instead?

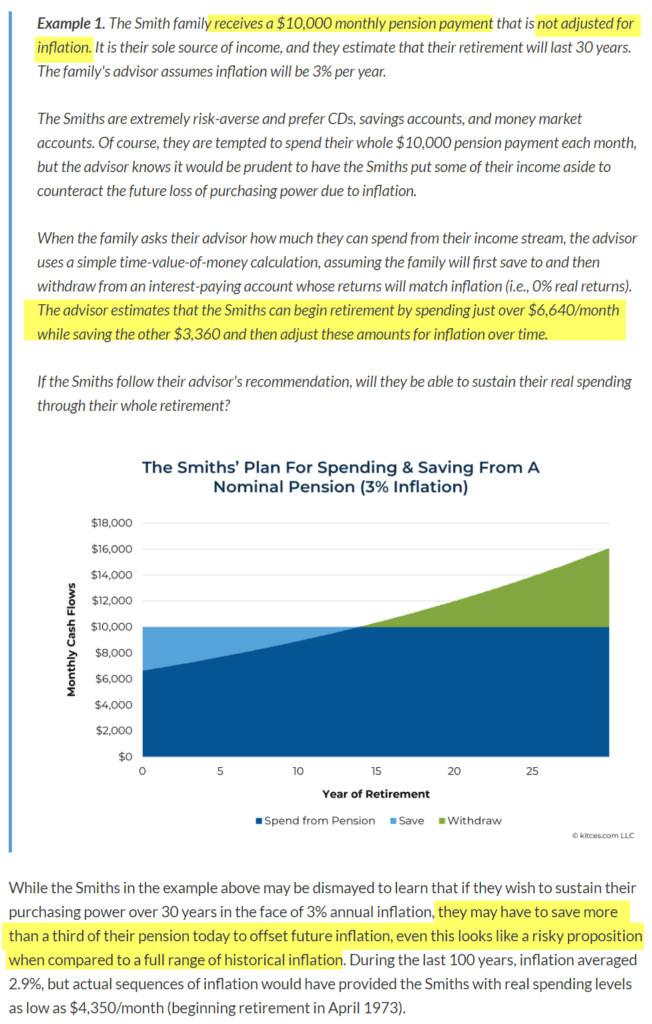

In my article The Dangers of Income Planning with a Fixed Inflation Rate (such as 3% p.a.), there is a part of the research piece that made me wonder if I can take that “start spending 50% of the non-inflation-adjusted income” idea and refine it:

In this example, the pension payment received by the Smith family is not adjusted for inflation. But if they need to offset future inflation, they may have to save a third of their pension today.

At least there are some numbers that I can work with. Why save 33%?

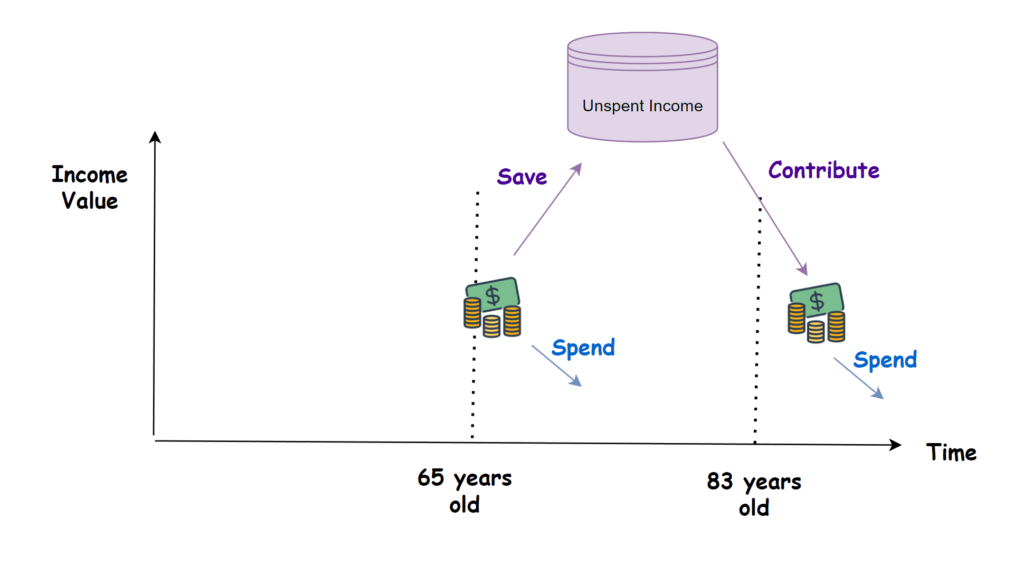

I guess the Solution in mind looks like this:

We save up part of the income which in later years will contribute to the spending when the $1,630 monthly income is not enough to keep up with inflation.

But how much should we save?

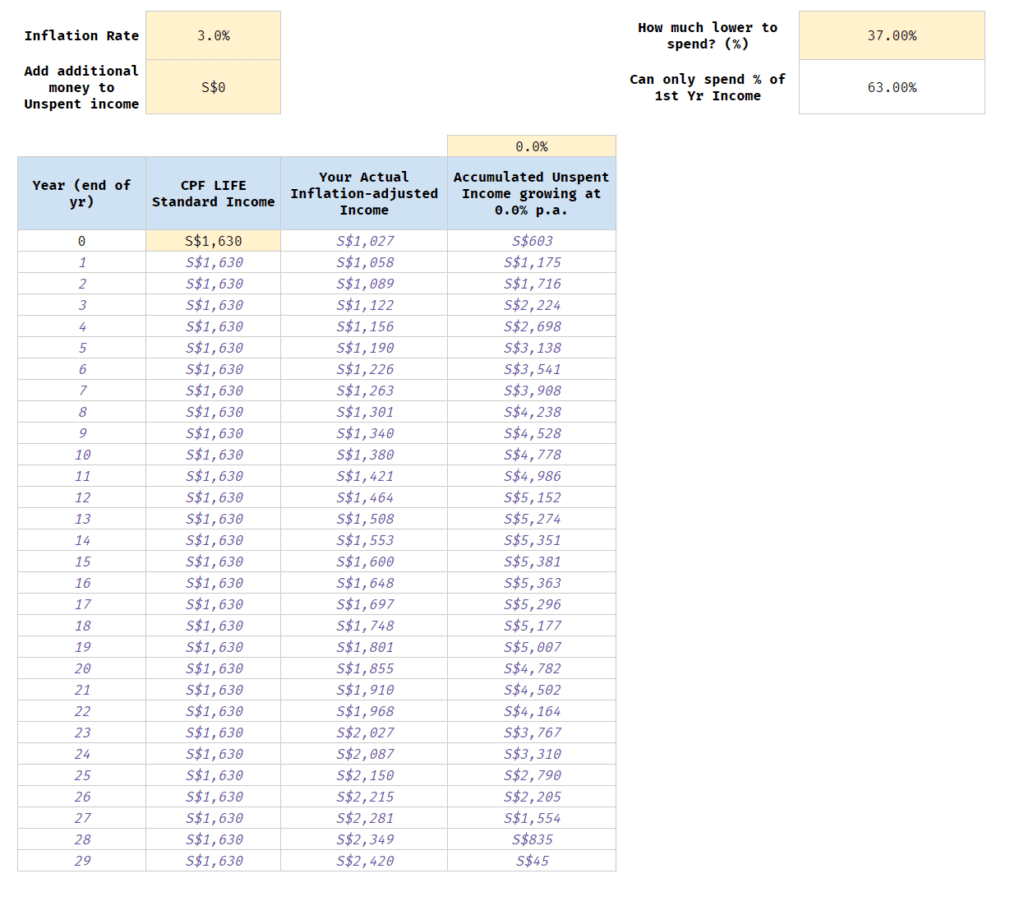

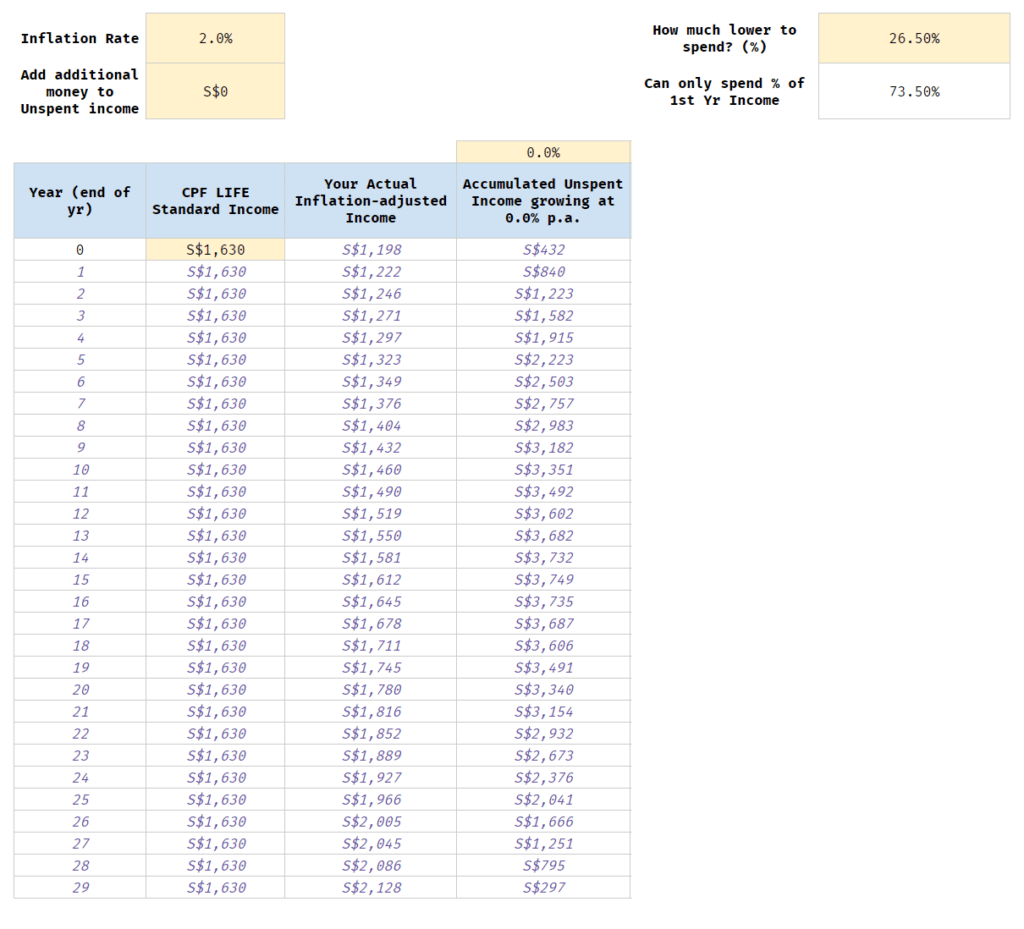

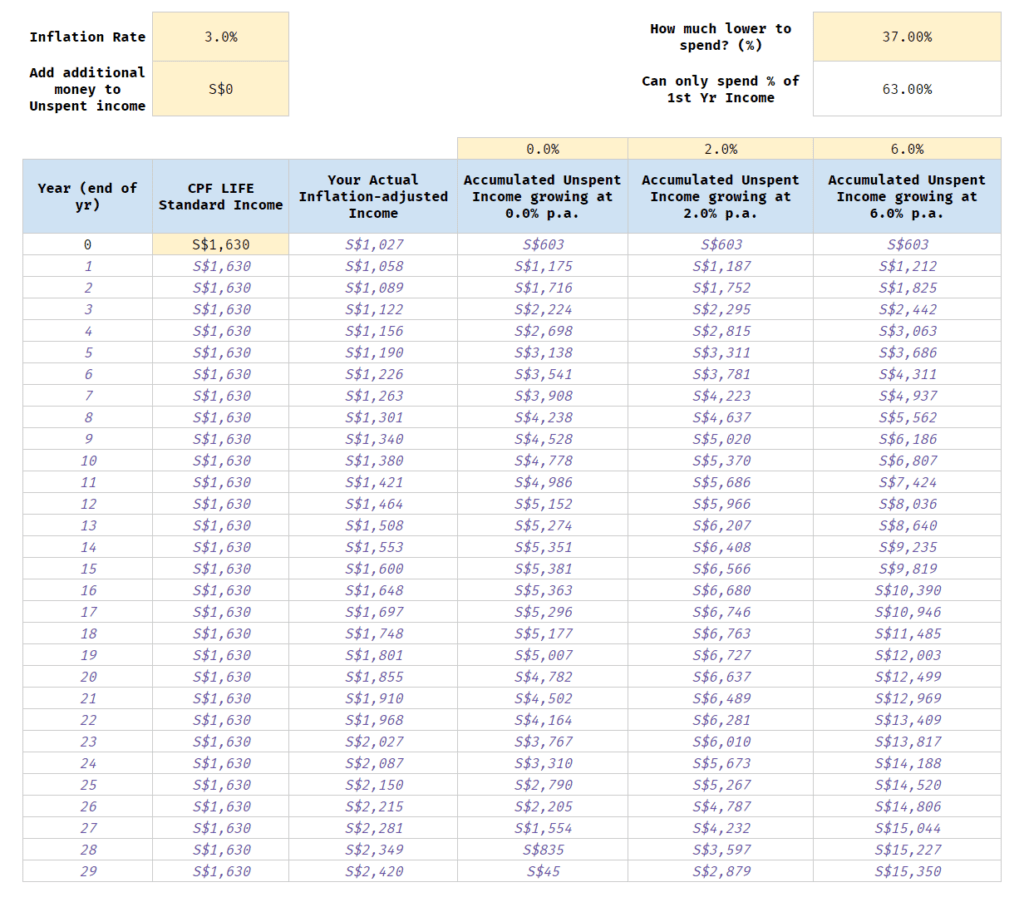

I have created a spreadsheet to help us determine this:

Suppose we want inflation-adjusted income for 30 years, and the inflation to plan for is 3% p.a. We create a pool called Accumulated Unspent Income that currently is growing at 0% p.a. At some point, this pool of money will be called up to make up for the shortfall. That is around year 16 when the actual inflation-adjusted income is more than what CPF LIFE Standard Income can provide.

This plan is sound if the pool of Accumulated Unspent Income is greater than zero for the duration you need.

In this example, observe that at year 29 the amount is $45 which means it can last exactly till the 30th year.

You can only spend 63% of $1,630 in the initial year, which works out to be $1,027 monthly.

Is that enough for you?

I don’t know. That is not the part of the problem we want to bother with today.

There are a couple of good points about this solution:

- Simple to execute. You can imagine just putting away the extra in a designated bank account and then supplementing your cash flow next time.

- If you don’t like a 2% p.a. inflation, you can use this calculator to change how much you can start spending more conservatively.

- The math is not too complicated for people to execute.

Let us look at this solution from different angles.

Shouldn’t We Just Rely on the CPF LIFE Escalating Plan?

If we put in the same date and similar parameters into the CPF LIFE Estimator, we get the following income:

Escalating plan build in an 2% inflation assumption, which is lower than the 3% inflation assumption in the previous simulation. Thus, the starting income is higher at $1,290 monthly versus $1,027 monthly if it is 3% inflation.

I tried to simulate a 2% p.a. inflation into my calculator to see how close is the starting income:

It looks like we are spending 73.5% of the income, and the inflation-adjusted income is:

- 65 years old: $1,198 monthly

- 85 years old: $1,780 monthly

- 95 years old: $2,128 monthly

Implementing such solutions means we have control but the payouts seem slightly lower. If we live beyond 95 years old, our income drops off, compared to CPF LIFE Escalating… which can continue to adjust for inflation.

There is no correct answer here.

You have to think about the trade-off:

Having more income and control versus having long-running inflation-adjusted income to take care of longevity risk

Which would you prefer?

Can Our Income Be Improved If We Invest Our Unspent Income?

Whenever I start going down these rabbit holes, I start not knowing if such a plan is viable or not.

But let us give it a try.

We go back to the first simulation, where we reduce our spending income from $1,630 to $1,027.

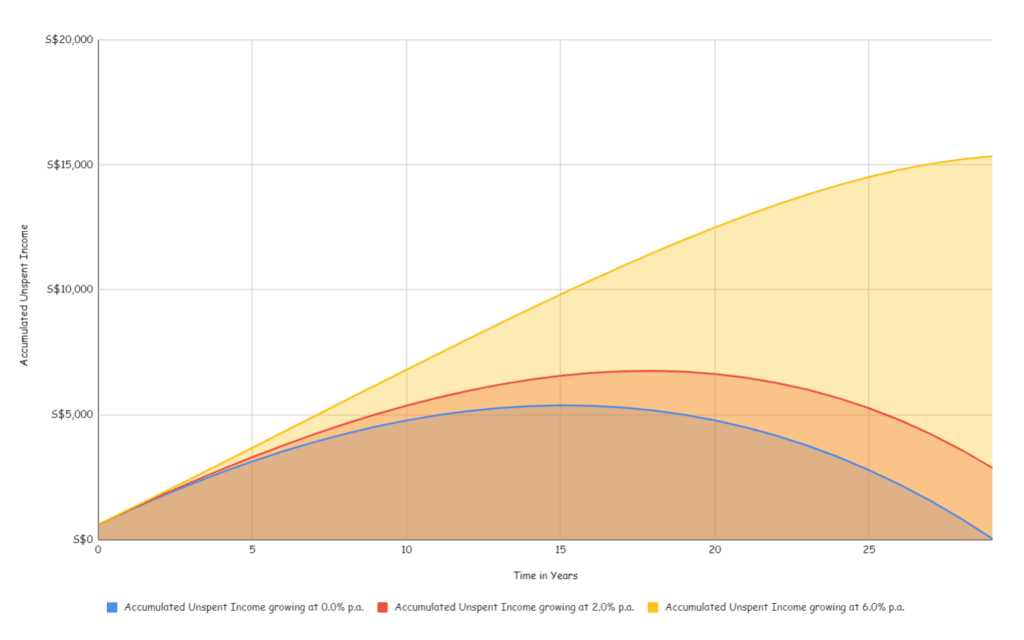

I came up with two more columns where you can try and grow the money at two different rates. In this case, it is 2% and 6% respectively.

Observe that if you manage to grow at 6%, at the end of 30 years, you have an unspent income of $15,350 a month. This amount may help quite a fair bit.

If we invest, we may be able to sustain a higher 30-year inflation-adjusted spending. But how much higher?

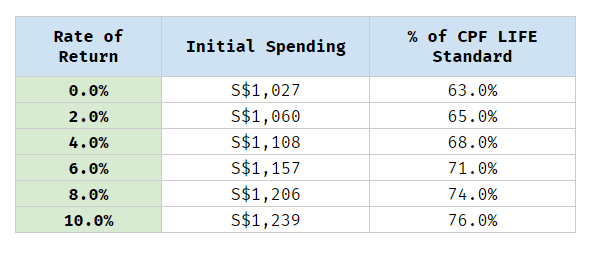

The table below show us how much higher the initial spending can be, given the rate of return you are able to hit:

I don’t know about you but it feels kind of deflating.

We have 15 years before we really need the money so technically we might be able to put in a high equity portfolio. However, it is a question if we can hit 6% p.a. or 10% p.a.

The difference is if we bump up the monthly income by $100 or $200.

I am not sure how you would look at it but I inferred that:

- It is uncertain if we will hit 2% or 10% p.a. for the next 15 years so income here is uncertain.

- It is better to aim for $1,027 monthly and hope for the best.

- Investing is not going to make that much of a difference that greatly changes the income.

How Does This Help Us Plan?

The most important thing is we eliminate the need to wreck our brains about how to tackle uneven cash flows.

Suppose we have a couple that is 55 years old or above with an income need of $4,000 monthly today.

At 65, their income is projected to be $5,376 monthly. If we know that both spouses have reached CPF FRS, they will have two streams of $1,027 monthly at 65 years old and that would mean that they have a shortfall of $5,376 – 2 x $1,027 = $3,322 monthly.

If we look up my SWR table:

| Initial Safe Withdrawal Rate | How long your inflation-adjusted income will last | E.g Initial Annual Income on $1 Million Balanced Portfolio |

| Above 7% | Less than 10 Years | $70,000 |

| 7% | 10 Years | $70,000 |

| 3% | 10 to 20 years | $30,000 |

| 2.8% | 20 to 40 years | $28,000 |

| 2.8% - 2.5% | 40 to 60 years | $28k - $25k |

| Below 2.5% | Perpetual | $25,000 |

We can apply a safe withdrawal rate of 2.8% for a projected 30-year retirement.

The couple will need to accumulate ($3,322 x 12) / 2.8% = $1.4 million at 65.

With 10 years to go, they would need $869,000 at 55 years old assuming a growth rate of 5% a year.

Spending down three different inflation-adjusted stream is clearer if we know what we are suppose to do for each stream.

Note: $1.4 million of needs at 65 years old looks high but if the couple can rationalize that their inflexible spending is only $3,000 and the other $2,376 monthly is more flexible, the $1.4 mil goes down to $970k. This means at 55 they just need $595k instead of $869k. If you are willing to be more mentally dynamic, the amount you need can be right-sized.

How much Real Income Do We Own Today If We Met the CPF FRS

In my past CPF articles, I have always been trying to predict if we reached CPF Full Retirement Sum (currently $198,800), and how much purchasing power we have secured.

What can that income buy us today, in line items?

Trying to explain to others has always been challenging. Given our discussion today, let me give it a try:

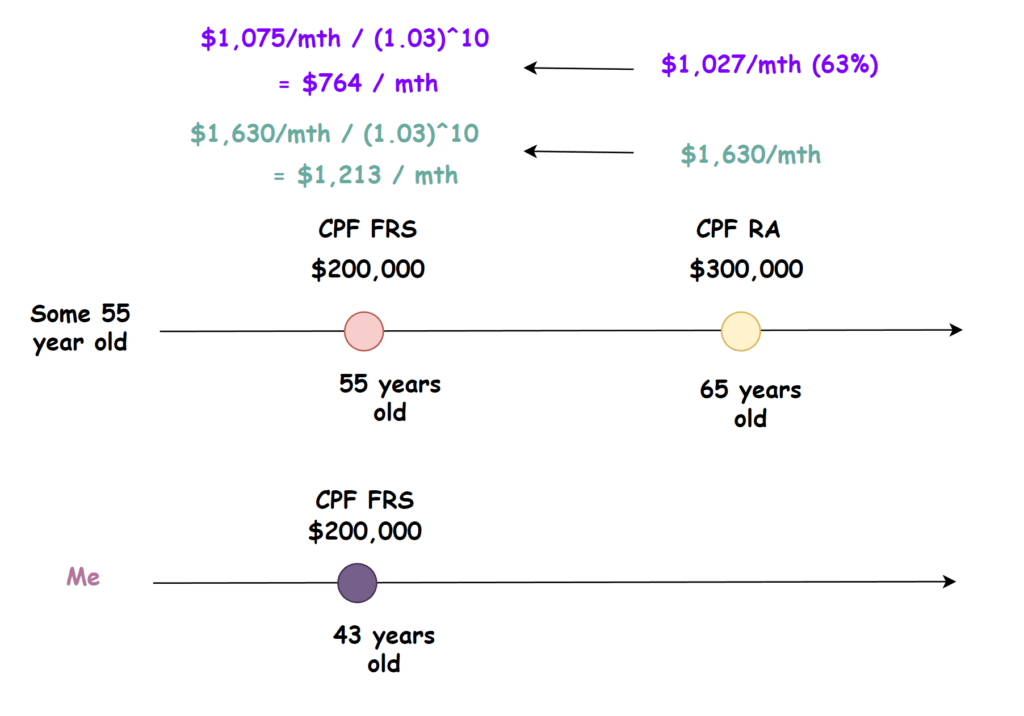

The 55-year-old today (the top timeline in the graphic above) has accumulated $200,000, more than the current CPF FRS. 10 years later, his $200,000 grows at 4% p.a. will become $300,000.

The $300,000 at 65 will give him $1,630 monthly, and if he wishes to implement a similar system as what I explained to have a 3% p.a. inflation-adjusted income, he will have $1,027 monthly.

But that is 10 years later. How much can the same $1,630 and $1,027 purchase today?

If we use 3% inflation, the equivalent amount today is $1,213 and $764 monthly respectively.

As a 43-year-old who has reached FRS, what I need to note is what I can buy with $1,213 and $764 today.

If I prefer an inflation-adjusted scheme, then I will work with $764 monthly today.

That will be

- Food & Groceries: $360

- Moving Around: $60

- HDB Conservancy: $80

- Gas & Electricity: $75

- Mobile: $10

- Broadband: $30

- Toiletries: $15

- Laptop/Computer replacement: $17

- Refrigerator replacement: $17

- Medical: $100

Surprisingly, it can cover most of my most essential, and inflexible spending with $764 monthly.

If you are a couple, you can work on how much of your spouse and your spending can be covered by $1,528 monthly today.

If you top up to Enhanced Retirement Sum, you could boost this sum to $2,292 monthly.

Major Learning Points

I have gone through a bunch of stuff today, and so the last portion is always the summary take-away for those who don’t understand what the fxxk I just went through.

- Spending a lower amount than the income given by CPF LIFE Standard looks like an intuitive way to solve the lack of inflation adjustment yet unwillingness to choose CPF LIFE Escalating plan.

- The income you can start with is about 63% of the income you received. This rule-of-thumb will change if your inflation expectation, and your longevity changes.

- Investing your accumulated unspent income helps but only about $100-$200 a month difference. The difference is smaller than if you plan for a 2% a year inflation instead of 3% a year.

- Your returns are also uncertain, which will make it challenging if you use an optimistic return in your income planning instead of assuming that your rate of return is very low.

Hopefully, this is helpful for some of you.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

ryan

Tuesday 13th of February 2024

Hi Kyith, Thanks for sharing. I'm wondering where can i find the link to the sheet on inflation adjusted calculator sheet?

Kyith

Saturday 17th of February 2024

hi Ryan,

I have not made my spreadsheet publically available because i thought the math i put there is rather simple. it is just some plus and minus and also inflating some figures by 2% or 3%. if you struggle to figure it out do let me know

Pete

Monday 2nd of October 2023

Some had thought about putting the unused portion of the payout back into RA which will earn 4%. It would provide some certainty though we know that 4% is not guaranteed compared to the OA 2.5%.

On your monthly essential expenditure list, do you have to include replacement cost of washer as well?