Robin Wigglesworth, the author of the book Trillions, wrote a lengthy but great post about the 2018 to 2020 winter in quantitative fund investing.

This article is non-paywall.

I would pay attention to who can explain this investment stuff in a better way than I could these days. This is why I like this article. Most of the stuff is not new to me.

Robin also got on the Rational Reminder podcast to explain the thinking behind this article:

But I thought I will just note down the important parts from this article, so that I do not have to re-read again and for easy future reference.

History of Return Drivers

- 300 years ago – Sephardi merchant Joseph de la Vega wrote about a “new” phenomenon of navigating the financial markets in 17th-century Amsterdam:

- Have patience.

- Accept both profits and losses with equanimity.

- Benjamin Graham’s Value Investing

- Charles Dow’s Dow Theory -> Spawn modern technical analysis of chart patterns.

- 1952 – Harry Markowitz – Apply quant techniques to portfolio management.

- The market itself offered the optimal balance between risk and return when viewed in aggregate.

- 1960s – Computers allow more sophisticated and serious mathematical and data research into what actually would work. Some conclusions:

- Markets are pretty hard to beat.

- It can be so expensive to try to beat the market and it may not be worth it.

- Eugene Fama – Efficient Market Hypothesis:

- Thousands upon thousands of investors constantly trying to outsmart each other meant that the stock market was “efficient”.

- We should therefore just sit on our hands and buy the entire market.

- Part of the reason that spawn off the index funds in the early 1970s.

- 1977 – Sanjoy Basu – Companies with Low stock prices relative to their earnings consistently did better than Fama’s efficient-market hypothesis will suggest.

- Stephen Ross and Barr Rosenberg – Arbitrage Pricing Theory and Bionic Betas

- Returns of any financial security are driven by a multitude of factors on top of the market-risk factor.

- 1981 – Rolf Banz

- Outperformance for smaller listed companies

- 1992 – Eugene Fama & Kenneth French – Three-factor Model

- Value and Size were distinct factors from the market-risk factor.

- 1993 – Narasimhan Jegadeesh and Sheridan Titman – Market Momentum

- Buying stocks that were already bouncing and selling those that were sliding – could produce market beating returns.

- 1996 – Richard Sloan

- High-quality earnings outperformed.

- 2006 – Ang, Robert Hodrick, Yuhang Xing and Xiaoyan Zhang

- Less volatile stocks as a group actually outperform choppier ones.

How Well the Factors Have Done – When Data Mined

This chart illustration shows what we have always known:

The results are not to surprising if we start in the 2000.

In 2000 to 2010 most of the factor indexes (market risk + the individual factors) have performed better than capitalization-weighted.

The Fundamental Basis Why Factors Should Exist

Those who align with the idea that markets are efficient think that factors are compensation for some sort of risk we are taking.

We may not know what are the risks, but they exists.

Value stocks, for example, are often found in beaten-up, unpopular and shunned sectors, such as dull industrial companies in the middle of tech bubbles. While they can underperform for long stretches, eventually their underlying worth shines through, and they reward investors that kept the faith.

Small stocks do well largely because small companies are more likely to fail than bigger companies.

Then there are those who argue that factors exist because as human beings, we have our irrational human biases.

For example, just like how we buy pricey lottery tickets for the infinitesimal chance of big wins, investors tend to overpay for fast-growing, glamorous stocks and unfairly shun duller, steadier ones. Smaller stocks supposedly do well because we are illogically drawn to names we know.

The momentum factor, on the other hand, works in theory because investors initially underreact to news but overreact in the long run, or often sell winners too quickly and hang on to bad bets for far longer than is advisable.

AQR’s Asness studied under Professor Eugene Fama, who is synonymous with the Efficient Markets Hypothesis, leans closer to the behavioural camp.

He said that the market has become LESS efficient rather than more efficient:

I probably think markets are more efficient than the average person does — long-term efficient — but I think they are probably less efficient than I thought 25 years ago. And they’ve probably gotten less efficient over my career.

The world assumes that because of things like the internet that the ubiquity and immediacy of all information has to make things more efficient. But that’s never been the hard part.

The same people who think the ubiquity and immediacy of information must mean that prices are more accurate are the same people who 20 years ago thought that social media would make us like each other more.

Cliff Asness

What Mainly Differentiates the Quant Funds – Implementation

“Most of these are just semantic labels. They’re actually not that different,” says Asness. “I think most quants are picking among a set of factors that we broadly agree on, and then we’ll fight like cats about the best way to implement it.”

Cliff Asness

Asness also say that premiums come about because holding on to these investments are just uncomfortable…

To go back to the first point, the premiums exist because you are taking on some risks, which you cannot explain.

He cites what Newfound Research’s Corey Hoffstein say in No Pain, No Premium:

If it weren’t occasionally excruciating, it would probably get arbitraged away. Any strategy that’s rational, done in a diversified way and that has historically done well and never causes you any pain probably has a lot of people rush in and make it go away.

Cliff Asness

The Case Against Factor Investing

Some cited that investment strategies cannot work forever into perpetuity. Market regimes come and go.

When anomalies become well-known, they would often disappear.

Inigo Fraser-Jenkins, head of quant strategies at Bernstein, wrote a report here about the issue:

Quant funds have been undergoing something of an existential crisis . . . At their core, quant funds try to apply backtests to future investment decisions. But what does it mean to do quant research and run backtests if the rules have changed? There is a challenge to quant beyond a recent patch of poor returns.

If Covid doesn’t count as a regime change I don’t know what does. The nature of the policy response is a clear break from the past and directionally points to the possibility of higher inflation but without a commensurate increase in real rates. This is unlike recent decades, with profound implications for factors and asset allocation.

Inigo’s article has a few good nuggets.

He think’s government or political policies that prevent natural recessions have impeded reversion to the mean, and that is a big problem:

Others have pointed out that factor investing may be academics and their overzealous data mining. The asset management industry is always on the look out to see what can be packaged up and sell for big management fees.

Clif Asness has written a paper that provides a counterpoint to the idea that the most popular investment factors cannot be replicated.

There isn’t a clear reason for what resulted in Quant Winter, but…

Asness’ conclusion is that value did very badly.

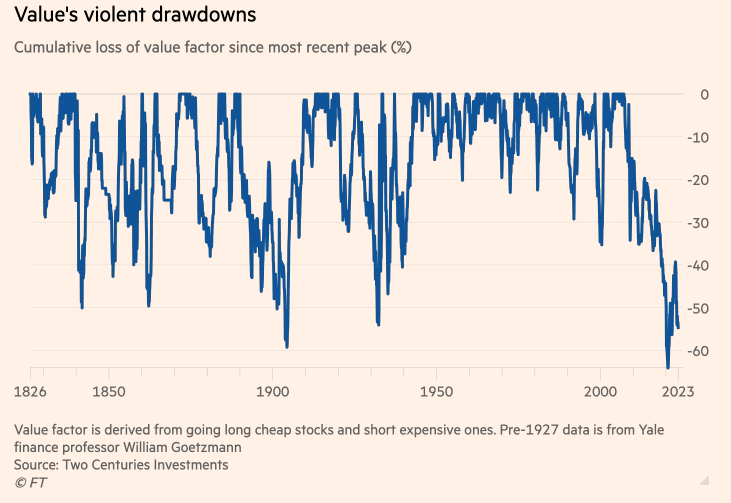

Value had one of the worse drawdowns in 200 years:

This chart above can also be found on Two Centuries investments, and they also have a momentum drawdown one. It shows that such loss in performance to growth is not out of the ordinary. Value premium doesn’t always show up.

Two Centuries, in their most recent post do have an explanation why factors decay: