Readers who have followed me long enough would know why I said the path to getting wealthy can be attributed to doing three important things right in my Wealthy Formula:

- Earn more

- Optimize your expenses well

- Build wealth wisely with the difference from #1 and #2

And if you have followed what I explained in my building a good wealth foundation series, you should do pretty well.

So could you make a career switch to another industry by taking a much lower pay?

Four years ago, I received this question from one of my users about his financial situation back then. He wrote such a long email to me that I almost didn’t want to reply to him (if you have a similar situation, you can write in as well!)

My reader would like to seek employment that is more meaningful. He did his numbers and the numbers seem to tell him that he has a sound plan that allows him to actively pursue a change in his career.

But he would like to get a second opinion about his situation and his possible plan going forward, so he wrote to me. Here is my initial analysis and subsequently a few years later, I also helped him recalculate whether he has reached coasting financial independence when we revisited his case. You can read about the subsequent analysis in the link from this article as well.

Out of all the financial independence lifestyle schemes, coasting financial independence is the one that I feel is the most attainable, at a faster time, and give the most value to a family.

So here was the analysis.

A Breakdown of His Family Situation in 2018

So in 2018, when he wrote in, the situation was like this:

- He was 33 years old, didn’t reveal the age of wife, one daughter that is 3 years old

- Worked in the industry of choice for 8 years

- A diligent Saver and have built up his Nest Egg using Exchange Traded Funds (ETF). The rate of return in the form of XIRR is 6%

- Assets

- Emergency Cash: $30,000

- Stocks/Bonds/ETFs: $520,000

- CPF SA: $110,000

- Liabilities

- Not revealed or doesn’t have much (we later know that he has an existing HDB mortgage)

- Current Liquid Net Worth Revealed (Assets – CPF SA – Liabilities): $550,000

- Since 2014, or 3.5 years ago he has been posted overseas for his job with a decent allowance package

- Cash Inflow: $11,500/mth or $138,000/yr

- His Base income: $5,375/mth (After CPF: $4,300/mth)

- His Allowance: $5,300/mth

- Rental Income (I assume is his flat): $1,900/mth

- Cash Outflow: $4,500-$5,500/mth on Parents, Food, Transport, Insurance etc

- Net Cash Flow: $6,000 – $7,000/mth or $72,000 – $84,000/yr

- His Ultimate Goal:

- Attaining Financial Freedom

- Definition: Retirement at 65 years old with $5,000/mth cash flow or $60,000/yr

So he feels like he would like to switch to pursue some work that he likes. This is likely to entail a drop in income.

Based on his research, the starting pay in the industry that he wishes to switch to could be $3,500/mth. He thinks that with his wife’s income when she goes back to work (she should make ($3,000/mth), their monthly savings is likely to drop to $1000/mth. This is after deducting expenses, especially their daughter’s early years of schooling.

My reader thinks his plan is doable.

He is not sure if Kyith can raise any red flags or provide a different perspective.

So let me try.

Based on the Conservative Estimate, His Family Should be able to Coast or Barista FI

This family is awesome.

To reach this state at the age of 33 years old, with a child, is a good balance of having wealth and having family pursuits.

A lot of people will die to be in their position I feel.

There is some information that I do not have:

- Do they own an HDB? I think they do, else the rental income might not be possible

- Do they still have a mortgage? or any other liabilities

- Was his wife working before going overseas?

He wishes to:

- Safely have wealth to retire at 65 years old

- Ensure that the family lives well (not stated but I assume most of us would want this)

- Pursue meaningful working

The best kind of financial independence scheme this fits into is Coasting Financial Independence or Barista FI (I explain this concept here)

In this scheme, you accumulate wealth aggressively, by taking advantage of your good earning power. Usually, our pay increment is the best in the earlier years. We also have the most energy to dig deep and work longer working hours, to improve work performance, to gain a better salary.

We do this for 10 years, then we take a step back, to work in a job that we find more comfortable with.

For a lot, it is to have a work-life balance and find meaning in work, especially if what you are originally trained in pays well, but soul-sucking.

As you have already built up your wealth aggressively for 10 years, your wealth on its own will continue to accumulate on its own without cash flow injection towards your retirement at age 55-75 years old.

The cash inflow from his meaningful work will just need to pay for their expenses without needing to worry about saving.

His $550,000 Will Grow on Its Own to Fund The Target $5,000/mth Cash Flow When He Eventually Stops Work at 65 Years Old

The key to working this out is to find out:

- when you need the money: 65 years old or 32 years later for him

- how much cash flow you need then: $5,000/mth or $60,000/yr

- what is the rate of return of his wealth growth: this is debatable and he has achieved an XIRR of 6% in the past. We can work out a range

With this, we can work out the sums using the Time Value of Money Calculator.

How much should my reader need?

According to the 4% Safe Withdrawal Rule, which is to withdraw an initial cash flow equal to 4% of the portfolio, and then subsequently, their family expenses will increase annually based on inflation.

If he needs $60,000 a year at the age of 65, he will need 60000/0.04 = $1,500,000 in 32 years’ time.

If he would like to make his plan to be more conservative. Instead of a 4% safe withdrawal rate, he could reduce the withdrawal rate to 3% instead. He will need more capital than $1.5 million but his plan will buffer for more market and spending scenarios that he has not anticipated.

He will need 60000/0.03 = $2,000,000 in 32 years time.

1.5 mil or 2 mil looks doable because 32 years is a long time for the power of compounding to work and his original capital of $550k is large enough.

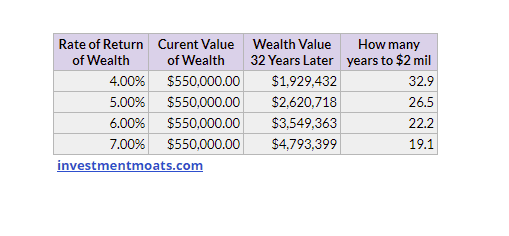

The table above shows whether my reader is able to grow his $550,000 to $1.5 mil or $2 mil by 32 years later.

I have listed out 4 different rates of return of his investments in the long run from 4% to 7% a year.

In 32 years, the range of wealth he would have built up is $1.9 mil to 4.8 million.

Thus, it will be able to hit a conservative withdrawal rate of 3% for his initial annual expenses.

Kyith in 2022: When we use a lower planning growth rate such as 4-5% a year in our planning, we can be more conservative & realistic in our expectations. Technically, he would expect that based on his allocation, his portfolio should do higher than that (he did, his portfolio in 2021 was closer to $850k together with the regular capital injection). A more conservative and realistic growth rate means a great degree of confidence that he would hit it.

Could he speed up his retirement plan?

I have listed in the last column in the table above how long it will take for the respective rate of return to hit $2 mil, the conservative future wealth amount.

If the return is 5% on average, it will take them 26.5 years. If it’s a 7% a year return, it would take him 19 years.

If his portfolio is allocated to higher risk assets (which he has), it gives him the probability of hitting the 7% return and greatly speeding up his eventual retirement.

He could Delay his Coasting Plan and Barista FI Plans for X Years

My reader could increase his free cash flow injection from his work to his portfolio by $72,000 – $84,000 a year. This would make growing to $1.5 mil and $2 mil easier.

Increasing injection makes him work harder and spend less today, but ease the burden of saving for retirement from his investments.

My reader does not have to aim for a higher rate of return. (read the section of My Wealthy Formula, where I explain that if your savings rate goes up, you do not need higher risk higher return assets to reach your wealth objective)

However, there is a balance, because if you keep searching for that buffer, he will keep extending and extending.

If he does that, he increases his angst in the current job and loses out on what is precious which is time.

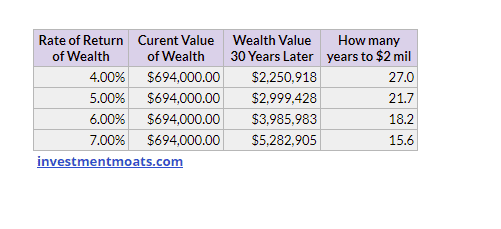

Here is the table revised, if he is able to bump up his portfolio from $550k to $694k over the next 2-3 years:

If he works 2 more years and saves $72,000/yr, he would start off at 35 years old with $694,000 instead.

Instead of 32.9 years, he would take 27 years or 6 years less to reach $2 mil. Even at a rate of return of 6%, the difference is 4 years. The difference is not a lot.

Spend 2 years to save 3 to 6 years.

I cannot say whether that is worth it or not. Perhaps the current job is struggling more, perhaps it’s just boring and not too challenging.

What Will Make Up his Future $5,000/mth Monthly Expense Target?

My concern here is that my reader is aiming for a $5,000/mth expense target 32 years from now.

By 32 years later, that might not be worth a lot.

From what I gather of their cash flow while he is attached overseas, his family monthly expense is $4,500 to $5,500/mth now.

So either he forgot to plan this or the items that make up the expenses now and 32 years from now will be different.

As a rule of thumb $4,500/mth at 2.5% inflation 32 years is $9,916/mth.

We should always think about what makes up our expenses not just for ourselves now, but to see perhaps, our end wealth goal is closer/further than we think (I explained about the items that make up my annual survival expenses here)

What about his Income Starting Over? Does it Cover?

I think based on his income and his wife’s income, if she goes back to work, it should cover the expenses.

If both of them back $6,500, after CPF they will earn $5,200. This will cover the upper bound of their current monthly expenses of $5,000.

It may be more comfortable if part of the monthly expenses is a mortgage payment, paid through CPF.

In that case, the cash outflow is less.

Any increases from his work can be used to tackle the increased costs of living.

Would $6,500 be good enough? Let us look at the floor.

In this article, a single income father with spending of $3,000/mth and assistance can bring up 7 children with the oldest being 16 years old.

If a person can work out the math as diligently as my reader, I am sure he should be able to raise one child on a much higher income.

They will have Another Cash Flow at 65 Years Old: CPF Life

Judging by the $110,000 in my reader’s CPF SA, I would think he has done some CPF transfer.

This makes me suspect whether he owns an HDB at all because most of us would use our CPF to service our mortgage so how come his CPF SA is more than myself.

The current CPF Full Retirement Sum (FRS) is $171,000. So at my reader’s age 55 years old, which is 22 years later, the FRS can be estimated to be $294,388.

Would his CPF SA hit the FRS when he is 55 years old?

Assuming his income base now is $3,400/mth or $40,800. His pure CPF SA would be around $3,770/yr.

Together with the $111,000, in 22 years’ time, the sum would be $392,175.

This would exceed the future FRS.

At 65 years old, my reader and his wife can look forward to another income stream to supplement the $5,000/mth he is looking for.

I suspect the cash flow from CPF Life then is $1,933/mth. (Don’t take my word for it)

3 Years Later, How is his Coast FI Financial Situation?

In 2021, I updated my Coast FI calculator and took that opportunity to reworked this reader’s numbers to see if my original assessment was too optimistic.

I realize his situation has gotten better and he might be officially Coast FI.

You can read my update on this reader here: Pursuing Coast FI with $550,000 – 3 Years Later

Savers will likely be Savers. His Family Should be able to Find Cash Flow and Opportunities from the Unlikeliest of Places

Here is the thing.

To be able to reach where my reader is currently, you would have to be rather conscientious and you will have to live a life of the agency.

My friend Chris said that, when you settle your wealth foundation well, it gives you confidence. It feeds back to how you carry yourself at work and your level of commitment.

In Your Money or Your Life, Vicki Robins talk about your Life Energy Exchange.

When you coast, you are really optimizing your life energy exchange. You will wish to finely tune your income, versus all your expenses related to your job, and the number of hours spends on the job.

You would not want a high income, and in return, you would expect the number of hours spent on the job to be much less.

However, the conscientious you might eventually develop whichever new career you venture into something that earns well.

However, this time it is something that you might find that matches your values better. It will make you look forward to working more.

My reader probably feels weird not to save any money. If I were in his position I would feel weird to considering this is what lead him to be in this position.

Is Building $550,000 in Wealth by 33 Years Old Not Doable?

Now you may find it unconvincing, without external support, how can someone who worked for 8 years is able to build up to $550,000.

This amount of money is likely to be funded by the job of 2 people.

He did say his XIRR is 6%.

We can assume his wife and he worked for 4.5 years. Then he got posted overseas for 3.5 years. His wife joined him and stopped working.

Given that my reader says he saves between $72,000 – $84,000, at a 6% rate of return, his overseas stint would enable him to accumulate $271,470.

Since his basic salary is $4,300/mth (after CPF), we can assume his average income for those 4.5 years is around $3,800/mth (his earlier salary should be lower before increments).

If his wife was working earning $2500/mth, we can assume her average income for those 4.5 years is around $2500/mth.

That is a combined average of $6,300/mth.

Let us assume the couple is conscientious and saves 50% of this $6300/mth or $3150/mth.

After 8 years, this $3,150/mth is estimated to grow into $231,600 in 2018.

If you add this 2 sum together you will get $231,600 + $271,470 = $503,070

This is pretty close to the $550,000 in portfolio and emergency fund my reader told me.

A 50% savings rate will allow his wife and himself to accumulate and spend on the big-ticket items that a young couple needs such as weddings and renovation.

There were fewer details about the home provided but he should have a mortgage loan that he is paying through his CPF. However, if he is transferring to the CPF SA account, how is the funding his mortgage.

Having $550,000 at 33 years old is possible but not simple for many.

This is because you need to be very cognizant about what you want early in life, and be frugal and save, expand your income accordingly. This is simple but not a lot of people can execute (often because they cannot visualize the end result, which is what we are seeing here today)

I think the advantage for my reader is that when he took the overseas stint:

- they lost the wife’s income

- the gain in a good allowance

- they can rent out their Singapore home thus cash flowing an asset that otherwise they were not able to

Kyith in 2022: With a better lens today from working with the high net worth clients and prospects, I would say we may have more people who have built up $550,000 by 33. There are some jobs that a young adult could scale up his or her income so that $550,000 is quite possible, even without diligent investing.

Putting Yourself in the Same Situation as My Reader

If you are starting your working career not too long ago, my reader’s situation might be something that you identify with at the start.

You may see no reason why an active individual like yourself should stop contributing to society but you do wish for some form of financial security and financial independence.

Coasting FI is front-loading your wealth machine to create a machine that can generate cash flow should it be called upon. Coasting FI basically front-load and save for your retirement so that you have one item less to worry about for the rest of your life.

To do that, here are some things to think about and competencies required to build up over time:

- Reflect and discuss with your future spouse the kind of life you wish to live

- How money supports or does not support this kind of life

- Take note of your spouse and your current earnings power and future earnings potential

- Draw a 10 to 15-year cash inflow progression. For example, year 1 combine income after CPF is x, then year 2, then year 3

- Simulate the eventual wealth in 10 to 15 years time (or somewhere in between) if you channel an absolute amount (e.g. $3,000/mth) or a % (40% of combine disposable income) into an investment portfolio at a conservative 3-4% return (note: unless your rate of return is very high, majority of the wealth 15-20 years time will come from your combine income)

- For the other portion that you do not save, does it match a good life you can live?

- Play around with #1 to #7

Early awakening, conscientious behaviour and an agency life can be rather powerful.

If you wish to explore further into how wealth can support the life you live, or be relatively right in the way you manage your money, you can read my expansive section:

If you have unique financial independence or lifestyle planning questions that you would love to hear what I think, you can write to me at [email protected].

Here are some of the through-provoking, financial planning questions or case studies readers have asked me and I have done a deeper dive on. They may trigger some reflections about your own financial situations and help you live a better life:

- The best strategy to save up $80,000 in 4 years to pay for the downpayment on a home

- A mid-35-year-old couple planning to have $2 million for retirement and getting one of them to stay-at-home

- Having a $550,000 portfolio, reaching Coast FI and thinking about making a risky career switch

- 3 years later, we relook the case of that $550,000 Coast FI situation

- Early retire with a $2.5 million dividend-focused portfolio due to health and stress at work

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- The Cheapest Way to Extend Your Laptop to TWODisplay that I Can Find. - April 29, 2024

- My Quick Thoughts on the Net Cash, 4% Yielding Boustead. - April 28, 2024

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

Ben

Sunday 7th of January 2024

Hi, I'd like to get your email updates. Thanks!

Kyith

Tuesday 9th of January 2024

Could you subscribe to me email list?

Revhappy

Saturday 19th of March 2022

Hi Kyith, I am looking at your portfolio transactions. I have to tell you, you are over trading man. You have to reduce your trading frequency. Your articles are all awesome, really brilliant stuff. But when I look at your trades, it just doesnt look like the same person. You need to set your allocation right and then just leave it and forget it. I am not telling this as some kind of expert, but I have myself succumbed to over trading and my aim is to just reduce the number of time I actually trade.

Kyith

Saturday 19th of March 2022

Hi Revhappy, thanks for the comments.

V

Saturday 19th of March 2022

Hi Kyith,

Thanks for sharing.

Quick question... how did you get to $231,600? I calculated ($3150*12)*(1+6%)^8 = $60,247.

Perhaps I miscalculated...? Thanks

V

Sunday 20th of March 2022

@Kyith, thanks for the correction.

I'm sorry, but I still couldn't get to your $231k. Using the FV calculator in Excel, I got to $374, 124. FV = (rate, nper, pmt) = (6%, 8, -37,800) ...pmt was calculated based on annual savings of $3,150*12 = $37,800.

Thanks in advance, Kyith!

Kyith

Saturday 19th of March 2022

Hi V, i think your formula only calculates 1 year of savings, which is compounded over 8 years. This reader will have 8 years of savings coming in. You should use the PMT portion in those time value of money calculator to compute it. Hope it helps.

Roy

Sunday 15th of July 2018

Hi Kyith,

One thought about your reader’s plan.

His retirement cash flow of $5000 per month. Is that $5000 just the nominal value or it’s $5000 of today’s value?

Because $5000 in 32 years time is actually present day value of $1940, based on 3% inflation.

Just my thoughts.

Kyith

Sunday 15th of July 2018

Yup I did put that down in my article (i think...) its up to him to think about. In our evaluation of CPF Life, the government also use a very survival based computation.