It kinda sucks sometimes to receive a question wondering if their family has enough to completely stop work due to health and work stress.

But it turns out this is getting quite common given the environment we live in today.

One of our advisers also told me he is working on a case similar to this.

A reader read my piece about someone who wonders if he has enough to be Coast Financial Independent and make a risky career switch (read the article here) and wonder if I can detect any red flags in his plan.

The requirements in his day job are getting tougher and tougher and he is running into issues coping with that and some health conditions.

Quitting a high paying job can be scary primarily because you have that feeling you may never have the opportunity to earn that well again. So you are unsure if you are making a big mistake and whether 15 years down the road, you realized that you have erred in your planning, didn’t realize you have to factor in some stuff. By then, you cannot command as high of pay and perhaps you are not in a position to re-enter the workforce.

Sometimes, we do not have a choice over when we retire.

So here is what I can do by looking at his situation through my unique lens.

My Reader’s Current Life and Financial Situation

My reader is currently a 49-year-old, single income worker. His wife does not work and has a 15-year-old daughter.

Residential Property

Currently, they are living in an HDB flat with an outstanding loan of $65,000. He has already earmarked a portion out of his wealth to pay it off if he needs to.

Family’s CPF Wealth

I reckon most of his CPF is used to pay off his mortgage so he does not have a lot in his CPF Ordinary Account. He has $220,000 in his CPF SA and $66,000 in his CPF MA. His wife has very little in her CPF.

Cash Portfolio Wealth

This is his money that is compartmentalised away from other needs and solely meant to generate income for financial independence.

Currently, his portfolio is made up of cash, bonds and equities which is valued at $2.5 million. 20% of that is in cash and 8% of it is in Singapore Savings Bonds.

Based on the latest dividend announcement, he is taking in $54,000 a year in dividend income.

His portfolio is more geared towards dividend income stocks. He estimates that in the long run, his portfolio should be able to generate a total annual return of 5% from both dividend income and capital appreciation which comes up to be about $125,000 a year.

Medical Situation

My reader has adequately bought Great Eastern’s P Plus hospitalization plan for all members of his family as well as critical illness and cancer plans.

There were not many details regarding whether the plans were term or paired with a whole life but I suppose most of these plans by their nature, should be term plans.

Medical cost is one of the main concerns that feature in his thoughts.

Their Income Requirement

My reader estimates the expenses to be $8,000 a month roughly on a rolling basis.

This includes medical cost which is currently claimable, mortgage instalment and insurance premium.

I did ask him further about the nature of his $8,000. Are all the $8,000 rather fixed?

He updated that probably $5,000 is fixed and $3,000 is variable so that is a good situation to be in.

Lifestyle Wishes

He wishes to see if he has enough to quit soon due to the stress at work. They wish to keep this lifestyle configuration at least until their daughter is independent.

There are concerns over whether university tuition fees are properly accounted for and whether there are any major red flags in his plan.

So here are my thoughts.

Do They Have Enough to Quit Work Right Away?

I have written a fair bit about how to determine if you have enough to be financially independent and you can read in this article here: How Much Money do You need to be Financial Independent? A Deep Dive

His wealth machine is primarily a dividend stock machine.

I have no problems with the way he allocates his wealth.

However, to determine whether his family have enough to completely stop work, you may need to build in enough conservativeness in identifying whether you have enough.

At the very least, we want to know if the plan is conservative or not.

A good rule of thumb to figure out whether he has enough is through the safe withdrawal rate. If we understand the body of work behind it and know how to use it the right way, we are able to figure out the degree of readiness.

The safe withdrawal rate sought of answers the question of:

- How much is enough to retire with

- How much could they spend without running out of money

Those two questions are interlinked and also linked to the third question which is what is the ideal portfolio allocation they should have in retirement. For that last question, the reader is comfortable with a 72% allocation to dividend stocks (I suspect mainly Singapore ones) and 28% bonds and cash. Will go into this later.

In a safe withdrawal rate study, we need to figure out the ratio between the initial income requirement and the portfolio value on the first day. After the first year of income withdrawal, we will adjust the income based on the previous year’s inflation rate. This means that inflation can go up to 12% a year and the income will adjust by 12% and if inflation is -5%, the income will decrease accordingly. What we will get is a real inflation-adjusted income and not based on fixed inflation say 2% for 30 years or 3% for 30 years.

With history, we have a set of 30-year, 40-year, 50-year, 60-year market and inflation return sequences that we can see if our reader’s income will be able to last if the portfolio is 72% S&P 500 and 28% 1-month Treasury bonds.

Our readers have a desired lifestyle need of $96,000 a year but essentially what may be more important to the family is $60,000 a year, which is their fixed expenses.

We can evaluate whether he has enough, and how conservative is enough by looking at these two income requirements.

He Should Be Able to Conservatively Funded His Fixed Expenses With the Income from His Portfolio

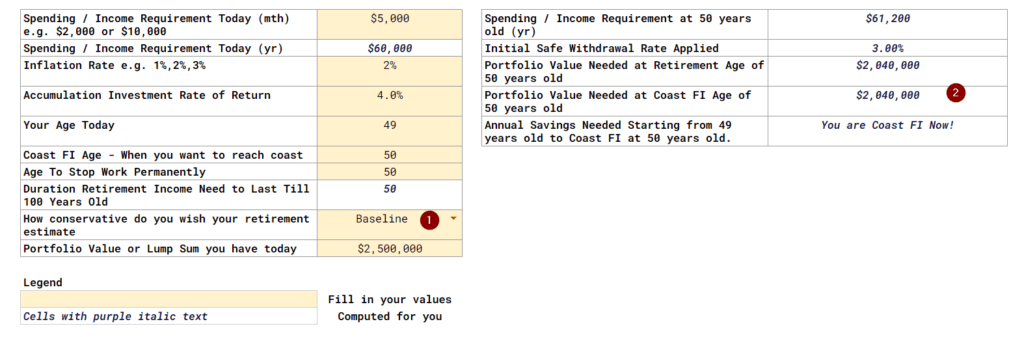

I made use of my Coast FI / Barista FI calculator to figure out if he has enough. While my reader is not thinking of Coasting, I find that my Coast FI calculator is flexible enough to determine if a person can retire immediately (you can read more about Coast FI and access the calculator here).

We wish to see if his current portfolio can provide a recurring inflation-adjusted income that covers his fixed $5,000 a month expenses (#4 in the diagram).

As he is retiring at 49 and possibly have a 50-year duration in retirement, we got to be more conservative instead of the standard withdrawal rate (which is based on a 25-30 year retirement period)

Based on my estimation, a conservative withdrawal rate to use for this longer duration is 2.75% (#2 in the diagram).

Since he is retiring 1 year later, the inflation-adjusted income requirement is $61k which is not too far away.

From the calculator, his $2.5 mil enables him to Coast FI but based on the configuration, it should enable him a full retirement if we only wish to cover his fixed expenses. The exact amount he needs is closer to $2.23 million.

By using a conservative withdrawal rate it means that with this $60k to $2.5 million ratio, the reader should have enough, factoring:

- Periods of the great depression and the challenging 1930s

- The high inflation periods of the 1960s (where the inflation average 5.5% for 30-years and what many fear we might be entering soon)

- Bull market periods

- Mediocre return periods

- Periods where there are war and conflicts

Instead of using a conservative 2.75% initial withdrawal rate, we can use a baseline withdrawal rate of 3.0%. Less conservative but based on my understanding it is still more conservative than what many planners used out there.

People have to realize that this withdrawal rate is like… in a very pessimistic scenario, that is the highest inflation-adjusted income to keep your real purchasing power you can get. It means that, for some of us, we might not live through a worst-case 50-year period and our money lasting is actually much higher.

The income requirement and most parameters stayed the same except we use a 3% initial withdrawal rate instead. Instead of needing $2.23 mil, $2 mil is adequate.

This risk assessment does not factor in the reader’s CPF LIFE annuity, which is another income stream.

If He Wishes to Fund All His Expenses in an Inflation-adjusted Manner, He Might Not Have a Good Outcome Always

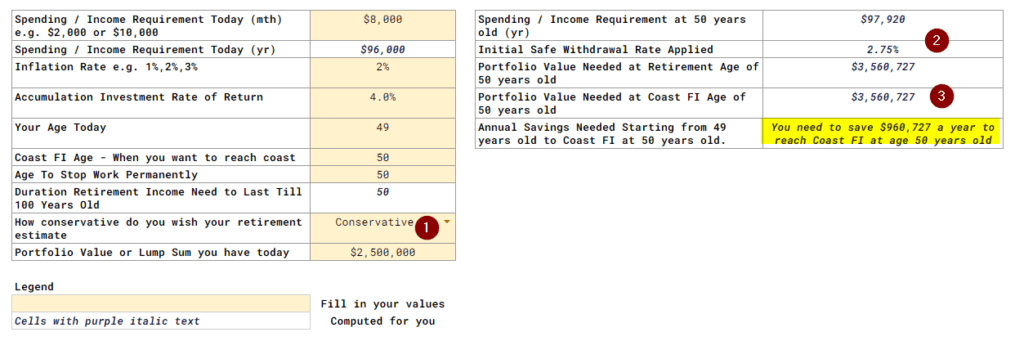

Instead of planning with $5000 but with $8000, we are able to see if my reader has enough to fund a full retirement.

In this simulation, we used a conservative 2.75% withdrawal rate and change the income requirement to $8,000 a month and fixed the rest.

What we notice is that $2.5 million is not enough. The $3k bump up in income requirement means that he may need to save almost $1 million more.

Now, I feel this may be overly conservative because the reader is open to being flexible with $3,000 a month. So in some situations, he must be open for that portion to go down to zero.

It may mean that we can bear the risk that in some really, really pessimistic situations, they won’t get to spend $8,000 in inflation-adjusted income. And in those circumstances, perhaps they would spend only $5,000 in inflation-adjusted income.

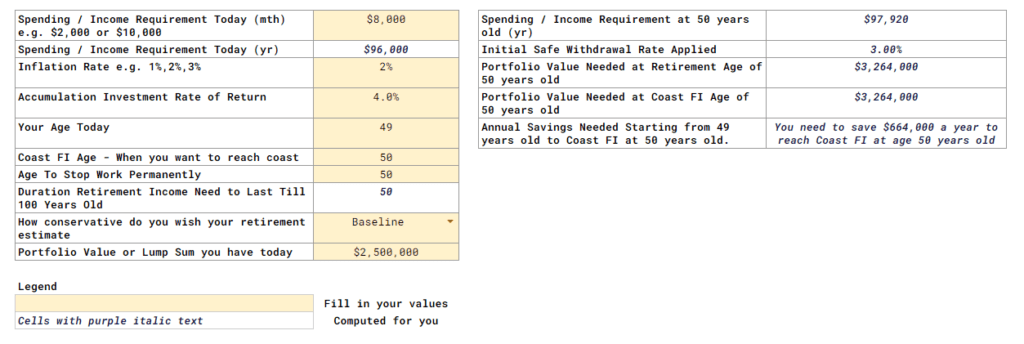

If we be less conservative, but still conservative enough to respect that the money needs to last 50 years at least, then he would need $3.2 million. Slightly less and he needs to save $664k in a year.

But still a better situation.

The Nature of Our Expenses Determine a Large Part of Whether We Can Retire Well Or Not

My reader’s spending would have to hover around an inflation-adjusted $5,000 and $8,000 a month.

If he built in some flexible spending system (You can read my article on flexible spending retirement income ideas here), he can have a floor income of $5,000 and be flexible with the rest in a systematic manner.

In my experience, people can look at their expenses differently and that would affect things.

Let me give my reader some examples:

- Their allowances, expenses on their daughter is not going to be needed for the entire 50-years. Objectively, it may be for 8 years more.

- If he owns some limited whole life insurance and is currently paying the premiums and may finish paying soon, and by then he would fully own the protection, then the insurance expense may not be for the entire 50-years.

- Mortgage if paid off when he stopped work, may mean some mortgage expense is reduced.

- Some of the current expenses are due to work and that would go away when he stops working.

- But it is also possible some other expenses are higher due to him having more free time.

- Have they taken out income tax expenses that won’t be incurred if not working?

It might make sense to use more of an asset-liability matching system to tackle some of those expenses of shorter duration (This article explains putting a name to a goal/liability and funding it).

The couple who understands the nature of their lifestyle the best, the cost associated with it, how much they need those lifestyles, have the best chance of right-sizing the amount of capital they need for their financial independence.

Those that refuse to go down that nitty-gritty will have to live with the answer from me that you do not have enough, your plan is not safe enough, and you live with more uncertainty.

Should They Top Up The Wife’s CPF?

My reader has the opportunity to allocate part of his capital to have a non-inflation-adjusted but perpetual income stream at age 65 by topping up his wife’s CPF.

That will net him some tax relief currently as well.

I think he would have to balance between a few pros and cons:

The positive about topping up CPF Special Account:

- Higher certainty that the income stream will last regardless of your longevity.

- The yield is higher because of resource-pooling and the survivors spend a higher income at the expense of those who passed away earlier.

- Ideal if the family have less conviction about generating income in other ways

The negatives about topping up CPF Special Account:

- If he has conviction in his portfolio strategy, the expected return of his portfolio is higher than the compounded average growth in CPF. Topping up means reducing the potential growth rate.

- The family would only get to tap that income 15-years later compared to tapping it today. There is a liquidity and optionality tradeoff for topping up his wife’s CPF SA

- The income stream is less inflation-adjusting. We traded off hedging longevity with the lack of inflation adjustment.

To be fair, the additional income stream from his wife’s CPF LIFE 15-years later may only alleviate a small portion of their income needs. And topping up may be within their resources. Since my reader have more or less accumulated enough, and if he wishes to work a couple of years more, he could channel the money to top-up the wife’s CPF SA.

For folks who have conviction in their investments, they have more options and will have less dilemma between this topping up or not issue.

Since he is 49 years old and is almost 6 years away from having full access to his CPF monies above the Full Retirement Sum, he can consider doing a voluntary housing refund (VHR) to put the cash in CPF OA and earning an automatic 2.5%.

This may be a better return for his cash. Of course, that gets locked up for a while.

Should He Pay Off His mortgage?

The quantum to be paid off is not the largest and it is prudent to plan as if the home is paid off.

By doing that, there will be one less fixed expense for him to worry about.

There are some who feels pretty comfortable having a mortgage and keep paying it in retirement, but I feel that it is comforting to not have to think about whether we will have a problem servicing the mortgage.

Setting Aside Money for Daughter’s University Education

My reader has compartmentalised money meant for his daughter’s university away from his portfolio.

His math is based upon my past guideline of $10,000 a year.

I think if he has set aside $40,000 a year today and can grow it decently, he should be ok.

The rest of the expenses will come out of his normal expense planning.

I think it might not be a bad idea to set aside $15,000 more today in this area.

Setting Aside Enough for Their Healthcare Needs

In my article on the Medical Sinking fund part 1 and 2, I shared that ensuring that we save up enough for our health insurance premiums is a challenging endeavour.

Our health insurance is partly paid through our Medisave but also partly in cash usually and when we are paying, they are usually at a stage where the premiums are more affordable.

So the premium expense would not constitute a large part of our expenses.

Because of that, we usually don’t think it is a problem. However, our shield plan and rider premiums go up as we aged and we may need to set aside enough.

This has got less to do with whether we early retire or not because the health insurance premiums escalate upwards over time.

The reader is likely on Great Eastern’s GREAT Supreme Health P Plus, which is the highest grade shield plan that enables the family to be treated at private hospitals. I did not ask whether they are under TotalCare Elite or Classic, which is the rider to enhance their coverage primarily so that the insured pays less out-of-pocket expenses and other perks.

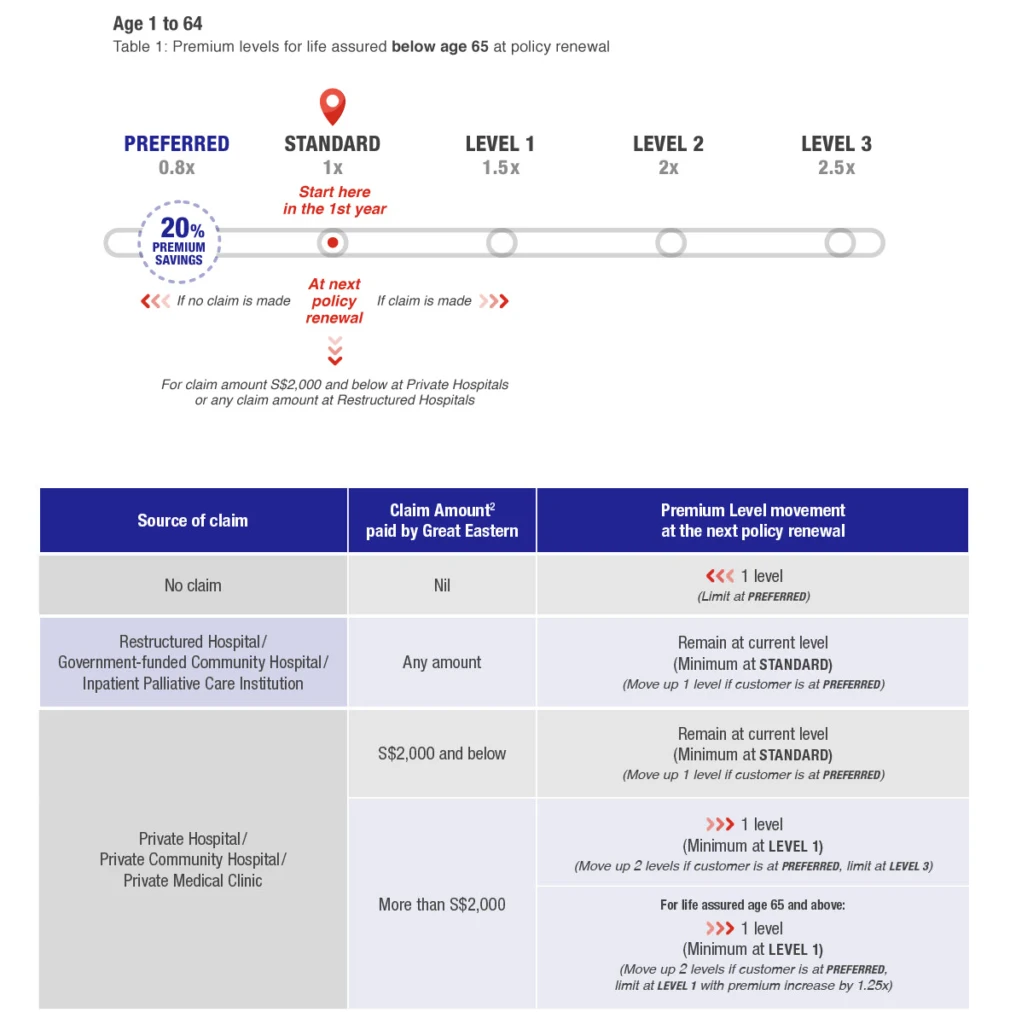

Great Eastern is one of the few insurers that decided to change to a claims-adjusted model. This affects the premiums of their TotalCare riders.

This illustration, taken from Great Eastern, may help:

If there are no claims, your premiums are 20% lower than normal. However, if there are claims done in government restructured hospitals, community hospitals, inpatient palliative care and private hospitals if the claim amount is less than $2,000, you will pay the Standard premium next year.

But if the claim amount is higher than $2,000 if you are admitted to a private hospital or clinic, the premiums start stacking up.

This introduces a lot of variability in their plans.

Of course, my reader might not be on this or that, the right way to look at this is that, if there is a need to pay for private hospital treatment, the default is to just pay the deductible and co-insurance through their own medical sinking fund.

This means that the reader would either:

- Need to estimate the frequency and magnitude of medical occurrence in the future and set aside capital in a sinking fund accordingly.

- Budget a fixed amount in their expenses to buffer for future out-of-pocket expenses.

How much to set aside in a medical sinking fund? Based on my last estimation, I feel that if we expect to

- Compound our medical sinking fund at 4%

- Preferred the medium grade of shield plan

They might need to set aside $120,000 more for two-person. However, if we wish to set aside the highest grade plan, it will cost like $300,000 more.

It is kind of a sick figure but I feel it is something that we should consider.

Think Through What Other Goals That Your Family Have In Mind that Remains Unfunded

Since you may not be having that good paycheck anymore, it may be prudent to take like a week to think through whether there are some goals/liabilities that have not been accounted for.

For example, the needs of parents may be one.

A third party like myself can only help trigger you to think about this area but it would be challenging for me to cover everything here.

Take a Six Month Break

Money buys us a different degree of optionality.

That is one of the biggest benefits I feel.

I don’t want to say I understood my reader’s situation but if stress and constantly unable to detach from responsibility is the main thing, then perhaps leaving the job, taking a six-month no-pay leave is an option to better figure out if its the work stress that is killing us.

We don’t have to think so far out whether we can fully retire without repercussions or not. Just not having responsibility for six months may change things a lot.

Conclusion

If we look at their family’s setup, I think my reader is in a good situation.

If this is planned by most financial planners, they would deduce they have enough to retire. I would say in some rather pessimistic cases, they can’t possibly spend an inflation-adjusted $96,000 a year.

I do detect that they can be rather sensible so this might be ok. We won’t know some family’s unique circumstances, but it’s kind of scary how my two-adult household spend less than $30k a year and in the other extreme a two-adult, one-teenager household jacks that up 3 times to more than $90k a year.

It made me wonder what could determine the difference between our spending.

A big part of retiring is your ability to live with your investments.

An investor who has not invested long enough may lack conviction or have enough anxiety about how it is like spending down the portfolio. It will be great that we are able to have invested for a while so that we do not have a clusterfuck of experiences such as market volatility, withdrawing from the portfolio, not having income coming in.

It will be good to at least experience market volatility first before the latter.

Lastly, by setting aside money for the larger financial goals such as paying off the mortgage fully, and a child’s university education, my reader has covered most considerations.

In a certain sense, setting a short timeline such as taking a six to twelve-month break allow the family to see if there are something not properly addressed in the plan. My reader is still young enough to get another job though the opportunities may depend from industry to industry.

What is Important Is Knowing the Degree of Safety or Lack of Safety in Your Retirement Plan

A key theme in how I look at things is not about numbers accuracy to the exact decimal but being clearer on whether the plan leans closer to very safe, safe, doable but with risks or too optimistic. And why do I think that way?

Knowing clearly and objectively how much “margin of safety” we have in our plans reduces as much uncertainty as possible. And in retirement planning, there is so much uncertainty.

But if you use the right framework to examine things, you can factor in enough uncertainty to know the degree of confidence in whether our plans will succeed and the degree of negative surprises we may get.

If you have unique financial independence or lifestyle planning questions that you would love to hear what I think, you can write to me at [email protected].

Here are some of the through-provoking, financial planning questions or case studies readers have asked me and I have done a deeper dive on. They may trigger some reflections about your own financial situations and help you live a better life:

- The best strategy to save up $80,000 in 4 years to pay for the downpayment on a home

- A mid-35-year-old couple planning to have $2 million for retirement and getting one of them to stay-at-home

- Having a $550,000 portfolio, reaching Coast FI and thinking about making a risky career switch

- 3 years later, we relook the case of that $550,000 Coast FI situation

- Early retire with a $2.5 million dividend-focused portfolio due to health and stress at work

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Kk

Wednesday 11th of January 2023

Hi Kyith, love it so much for the detailed analysis. Noticed that CPF SA of $220k (which is closed to 10% of his portfolio amount) is not included, which may affects the safe withdraw rate? Is there alternative to include CPF SA as part of the safe withdrawal calculation in your calculator?

Kyith

Wednesday 11th of January 2023

i did include that. that is part of his CPF Life. But the CPF life doesn't help much if he retires immediately. His income needs is so large and with inflation, it might mean CPF Life is less significant in changing the outcome.

klkk

Monday 28th of March 2022

Not sure what is meant by "cite your comment to make a comment with more thoughts". My comments are not targeted at you (or anyone) as I am saw your calculator(s) showing 2% in the inflation field unless I am looking at the wrong thing. Maybe it was left there but doesn't factor into the actual computation ... so not sure.

I know there is a PhD who owns a blog and has replicated/sliced and diced/torn apart Bill Bengen et a's SWR study in multiple ways. Quite intriguing i must say.

I think in short, SWR must at most equate or be lower than Inflation rate for the initial 2.5M to stay intact (unless your reader plans to draw down to zero X years later )... as to what the Inflation rate will be in the long run, its anyone's guess. But I would err on the side of caution to use at least 4% (if not higher given the current inflationary environment). YMMV.

Revhappy

Tuesday 29th of March 2022

@retirewithfi, @kyith, I feel the risk of inflation affects over long periods of time and the best and easiest way to protect against inflation, is to earn a wage that grows with inflation. Since most of us anyways retire by 60, the critical factor is how many years of inflation adjust wages are you giving up. If you retire 10 years early i.e. by 50, you are giving up 10 years of savings and you are also spending down 10 years worth of expenses from your corpus. If you add both together the impact is huge in terms of opportunity cost. I shudder to think even retiring 10 years early has such a big financial impact, hard to imagine, it wont impact our lifes.

Klkk

Tuesday 29th of March 2022

*whether not wherever

Klkk

Tuesday 29th of March 2022

@retirewithfi, yes I enjoyed his blog and detailed analysis though too much math and stats for me (I’m neither a CFA, PhD nor Math major). Reassuring to know inflation doesn’t factor much into SWR, but the higher CAPE is…. When will S&P and QQQ ever come down (seems to be unstoppable wherever it’s a financial crisis, pandemic or now a war)? Thanks

retirewithfi

Tuesday 29th of March 2022

@klkk,

If you are referring to ERN (he's a CFA with a PhD), he recently updated his blog to cover high inflation: https://earlyretirementnow.com/2022/02/28/retirement-in-a-high-inflation-environment-swr-series-part-51/ and his conclusion was to pick a conservative SWR not due to high inflation but due to high equity valuation or CAPE.

Another author wrote on inflation: https://justusjp.medium.com/sequence-of-returns-risk-decomposing-real-returns-into-nominal-returns-and-inflation-to-find-the-86a5921f546d and his conclusion was the long tail of inflation, inflation takes a longer time to impact compared to equity returns.

And for SWR withdrawals, there isn't a stated goal for the initial 2.5M to stay intact. If the intention is to leave a bequest, then by the math, the chosen SWR need to be lower: https://earlyretirementnow.com/2017/02/01/the-ultimate-guide-to-safe-withdrawal-rates-part-8-technical-appendix/

Kyith

Tuesday 29th of March 2022

ok thanks for explaining your influences. I think what happens is that my coastfi calculator is quite flexible so i used to for this case. because this reader is planning to retire today or in one year's time, usually we will use an inflation rate to inflate the expenses of $5000 to the future but in this case, there is no future there is not too much of a difference.

I think i will show the second part of that SWR in detail so that we can get a better picture. Not going to say anything negative just more to bring up more points for discussion.

klkk

Sunday 27th of March 2022

Hi, a well written article however I feel 2% inflation/yr is way too low.

I highly suspect we will continue to live in a high inflation era where prices just keep going up and up. I would recommend using 5% inflation at a minimum (ignore the Core Inflation stats published by MAS/Dept of Stats every year as the data tends to lag, skewed or conveniently excludes a few key critical/essential spend items). Also, shrinkflation is also very visible these days (a can of coke shrinks from 350ml to 330ml to 320ml etc. you get my point). These are NOT captured by headline inflation stats. Wonder why you spend the same amount of money on food but still feel hungry afterwards? That's shrinkflation!

Loaf of bread bought from HDB "old-school" bakery : $2 to $2.20 (10% inflation) Regular dental checkup (HDB types and cleaning/polishing only): $80-90 to $100+$15 "covid-cleaning" fee My fav hokkien mee has gone up from $3 to $3.50 - $4 (some places charge $5 min and I am talking about coffee shops) Public Transport including grab, gojek, tada recently raised their fees Healthcare including shield plans (same price but less coverage due to 10% coshare and $3k deductible ... shrinkflation?) Who wants to bet NTUC Income would NOT raise premiums after privatisation? Fuel prices (need I say more?)

I am not sure how the elites at MAS/DoS can get 2% inflation a year (even over an extended 1-2 decades). I just feel my purchasing power becomes smaller and smaller every day.

I would run a few inflation scenarios (3/4/5/6/8/10% inflation) and see what the fail-safe number ends up. 2% is not possible (not even in Japan where salaries don't rise even though the economy is officially in deflation) https://www.channelnewsasia.com/asia/japan-salaryman-us4-annual-pay-rise-wages-2567281

Kyith

Monday 28th of March 2022

Hi klkk, do you realize that i did not use that 2% inflation rate much in my CoastFI calculator? Do you understand how the Safe Withdrawal Rate study work? I think its important to understand that to know what entails in this analysis. Just as a gauge.... most of the response say that this number is way too conservative. I would probably cite your comment to make a comment with more thoughts.