After working out my FREE Coast FI Google spreadsheet, I thought it is a good idea to revisit one of the readers case studies and check out how his numbers looked right now.

If you are interested in the case study, a reader of mine wrote in 2-3 years ago in 2018, asking me to double-check whether, with his then-current finances, he can switch to another industry, starting with lower pay and still be retired at 65 years old.

Have I reached Coasting Financial Independence at 33 Years Old with $550,000 – Reader Question >>

I wanted this post as a way for him and myself to do a stock-take on our analysis from 2-3 years ago and see if there were any flaws in that analysis and whether he is progressing well financially.

Made the Career Transition and currently doing well

I have managed to keep in contact with him and learned that he has taken the leap.

Making a leap into something new can sometimes feel a bit scary, so it is good to hear that he is progressing well and matches most of what he hoped for.

Everyday, he looked forward to waking up and going to work (well now its more work from home) and spending time with the family.

His wife is currently not work, taking care of his child.

Revisiting his goal to Retire with a $5,000 a month income at 65 years old.

My reader’s ultimate goal is to ensure that whatever choice he takes, he wants to give his family enough security.

Enough security means more predictability to be able to retire at the traditional age of 65 years old.

His definition of retirement is to plan to really not work.

He tracks his expenses well, so he is able to determine that based on the spending categories, he would need $5,000 a month in today’s dollars.

I clarified with him that if he takes out his mortgage, as we assume he would have paid off his HDB flat by then, he would need $4,000 a month in today’s dollars.

Back then in 2018, his liquid net wealth is roughly $550,000 (Liquid net wealth means taking his liquid assets such as investments and cash minus liabilities).

Since then, his liquid net wealth is roughly closer to $880,000 now.

His portfolio is more streamlined as he mainly invests in one exchange-traded fund: The Vanguard FTSE All-World UCITS ETF USD Accumulation class or ticker symbol VWRA. He still has some of the same funds but distribution class before switching to his. (You can read more about VWRA’s returns versus the MSCI World ETF IWDA in this article here)

He has a deep understanding of low-cost, passive index ETF investing and channelling his wealth into VWRA, it allows him to concentrate on his job and family.

And yes, he has a small allocation to crypto.

Updating his Coast FI Model – No CPF Considerations

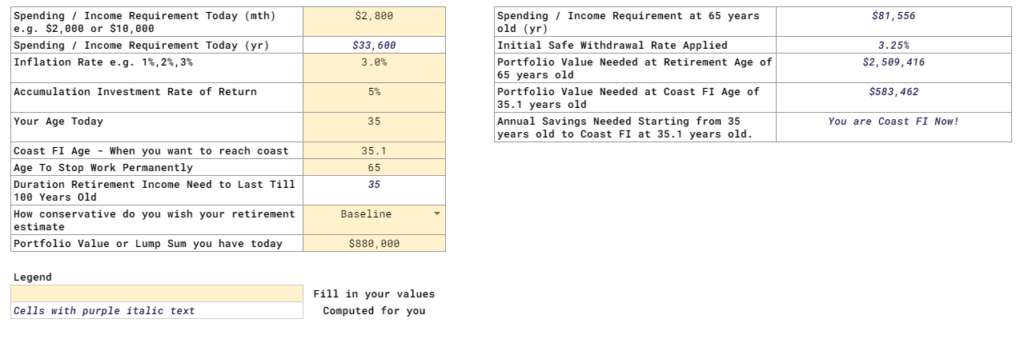

Let’s update his data into the Coast FI Calculator.

To make things simple, let us take his future CPF LIFE out of the equation and estimate whether he can Coast FI.

My reader is still picking up from his work and thus, he does not have much surplus from his work income to save & invest.

Assuming a compounded rate of return of 5% a year, I think realistically, he can reach Coast FI at 45 years old.

His 880k will grow to $1.69 mil at age 45, which will grow on its own to $4.48 mil at age 65, providing him with an initial income of $145k a year.

He would just need to put about $20,030 a year more from his salary into his portfolio to reach that. It should not be too tough.

The initial withdrawal rate we use is 3.25% which should be pretty conservative if the retirement duration we need income is 35 years.

Using 3% a year inflation to adjust the income requirement is also conservative enough.

Thus, he has not reached Coast FI yet and if I were to be honest, needing more contribution means he would still need to succeed in this career , so that it earns back the amount in the old job.

In any case, full retirement is 20-30 years away. A lot of things can change and his actual situation at 65 could look vastly better.

He should revisit the nature of his retirement spending needs in five years to see if we need to bump up the amount or lower it.

Reducing his Income Requirement from $5,000 to $4,000 a month by Eliminating the Mortgage allows him to Coast FI today.

I do believe that he has provided buffers and considered his mortgage. If we take out his mortgage, his spending today would be $4,000 a month instead.

Let us re-run the numbers:

If his income requirement is lowered to $4,000 a month in today’s dollars, he has attained Coast FI today!

His 880k will grow to $3.57 mil at age 65, providing him with an initial income of $116k a year.

The difference when income requirement is reduced from $145,000 a year to $116,000 a year is huge.

I have always been a stickler for understanding your spending and it has shown here again that when you know your spending needs to a fine degree, it might mean you can make big life changes earlier.

How to Factor in his Future CPF LIFE Annuity Income into the Estimation

A lot of people were asking how they can factor CPF LIFE Annuity Income into the Coast FI computation.

The shxt thing about CPF LIFE is that the estimation is very convoluted:

- You specify your age.

- Money in your CPF RA

Then it spits out an income you get at 65 years old based on Basic, Standard or Escalating scheme.

For those younger than 1981, they cannot make use of the calculator.

In most calculations, I prefer to keep things simplistic. As such, my preference is to use a conservative rule of thumb to estimate how much future income my reader’s CPF can give him.

Here is the way I think about it. His income requirement is $4,000 today. Out of this $4,000:

- One part today will be provided by CPF Life Annuity at 65. This is not inflation-adjusting.

- One part today will be solely provided by the portfolio at 65. This is inflation adjusting.

But how much of the $4,000 today will be provided by CPF LIFE?

I adopt a simple rule of thumb: The retiree retiring today gets $1,200 a month in annuity income if he or she hits CPF Full Retirement Sum (about $181,000 currently).

CPF interest grows on average between 2.5% to 4%, we can say on average 3% a year. That is almost the same as our 3% inflation estimation.

So I would assume that my reader:

- Between 35 to 65 years old needs to hit his Full Retirement Sum at 55 years old

- His CPF LIFE will provide an income equivalent of $1,200 a month today

So we can assume that out of $4,000, $1,200 will come from CPF LIFE (we assume his wife cannot reach FRS by 55). His portfolio will need to take care of the other $2,800.

Let us put $2,800 into the calculator:

My reader was able to reach Coast FI with his current net wealth.

But this computation shows that with CPF LIFE, he has an additional layer of margin of safety to his plan.

Out of the $880,000 today he would just need $583,000 if he factors in his CPF LIFE.

There is a surplus of $300,000 for him to deploy to other financial goals if he so chooses.

What if You Wish to Completely Stop Work Earlier than 65-Years-Old?

One of the reasons I can have an easier time factoring in his CPF is that he is pursuing a standard retirement age of 65. It coincides with when he can get his CPF Life Income.

For those who wish to stop work earlier, then you really need to do some acrobatics.

You will need to break your income requirement into two tracks:

- First track: first half serviced by cash portfolio, second half serviced by CPF LIFE

- Second track: service by cash portfolio all the way.

In this example, suppose the income requirement is $5k today. It is realistic for a couple retiring today, with Full Retirement Sum to get at least $2k a month.

So $2k will come from the first track, $3k will come from the second track.

In the illustration above, I have provided an initial safe withdrawal rate for money that needs to last for 20 years and 55 years.

At 45:

- First track: will need ($2,000 x 12)/0.05 = $480,000

- Second track: will need ($3,000 x 12)/0.028 = $1,285,714

- Total: $1.77 mil.

You will then need to present value this $1.77 mil to today’s value based on your investment rate of return.

But I think you roughly get the idea (if you are not sure, leave in the comment below)

In Summary

I think whether my reader needs $4,000 or $5,000 today, he should be Coast FI with the help of CPF Life.

It would be immensely free to know that he has taken care of this financial liability that many have struggled to address at the age of 35 years old.

With what he earns today, he can choose to allocate all he earns productively into areas that align with his values.

And his wife might not need to return to work.

Of course, there are still milestones to be cleared:

- Pay off his mortgage.

- Hit his CPF FRS (should be about 61,000 more).

If he has greater surpluses, he can channel to pay down more of his mortgage.

If you have unique financial independence or lifestyle planning questions that you would love to hear what I think, you can write to me at [email protected].

Here are some of the through-provoking, financial planning questions or case studies readers have asked me and I have done a deeper dive on. They may trigger some reflections about your own financial situations and help you live a better life:

- The best strategy to save up $80,000 in 4 years to pay for the downpayment on a home

- A mid-35-year-old couple planning to have $2 million for retirement and getting one of them to stay-at-home

- Having a $550,000 portfolio, reaching Coast FI and thinking about making a risky career switch

- 3 years later, we relook the case of that $550,000 Coast FI situation

- Early retire with a $2.5 million dividend-focused portfolio due to health and stress at work

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

June

Tuesday 8th of June 2021

Hi Kith,

Thank you for the trove of information. I'm looking to do some passive investment. Do you still recommend VWRA as a good ETF?

June

Monday 14th of June 2021

Thanks. And I have followed your tips and opened an online trading account with SCB. Looking forward to building my wealth machine. You have inspired me to take charge of my finances. Just a pity that I started so late.

Kyith

Thursday 10th of June 2021

Hi June, I think VWRA is still applicable. It is low-cost, liquid, broadly diversified across developed and emerging markets. So it can be a building blocks to an individual's financial planning needs.