Every year, I will review how much I spend for the year.

I will carry on the tradition for this year.

There is a difference between budgeting and tracking your expenses. Tracking your expenses tell a person or an entity what they spend in the past. If you do not review it and have no aim for it, then tracking your expenses does not do much.

Thus, tracking your expenses serves more to be conscious about the past so that you can set some goals, form some good habits to change your spending pattern along the way.

To effectively plan for your financial independence, you would need to know how much you spend.

Many find it a chore to track their expenses. It is an indication they probably value their time now more than having some money security. What is conscious gets managed.

It is also normal for your expenses to go up and down. And that is normal. As you track it through the years, you will have a better sensing of what expenses that your family definitely cannot lift without, cannot reduce and what are the expenses you are spending extravagantly.

Given the choice, you could cut them down. Or you have tried but you could not.

Here are My Past Expenses Reviews

It’s pretty surreal that I managed to have a 6-year record of this stuff.

Here are my past write-ups:

- 2014: $23,798/yr – A review of my past year’s expenses

- 2015: $22,150/yr – How our family’s $22,150 annual expenses means for our financial security and financial independence

- 2016: $26,238/yr – My Annual Expense Report – $26,238/yr and its link to Financial Security and Independence

- 2017: $21,723/yr – Annual Expense Report 2017 – $21,723

- 2018: $19,655/yr – Annual Expenses and Financial Security Musings

You can see a progressive trend where the expenses gets lower and lower. Would this year be any surprise? Let us see.

Expenses Rose Back to 2014 High

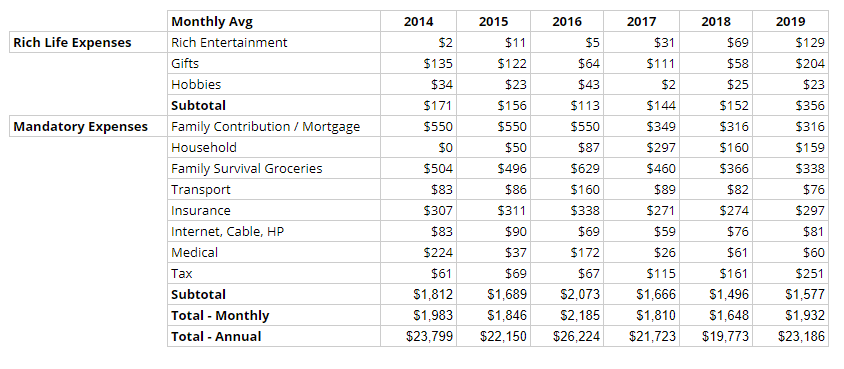

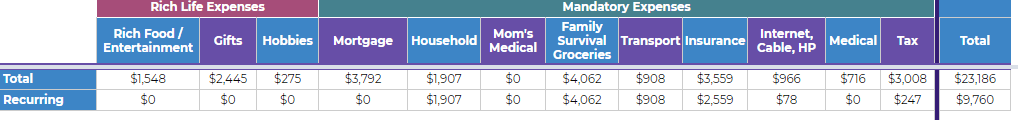

Like the past years, I have tabulated my expenses month by month, in various broad categories in the table above.

The expenses were separated either my Mandatory Expenses or Rich Life Expenses. Most of the time, I cannot reduce the mandatory expenses. They are needed for the household and myself to function well.

The Rich Life expenses are good to have. I could go crazy in certain years but by right, I should be able to cut them when I need to.

This year’s expenses come up to $23,186 a year.

This will rank as the third-highest annual expense in the past six years.

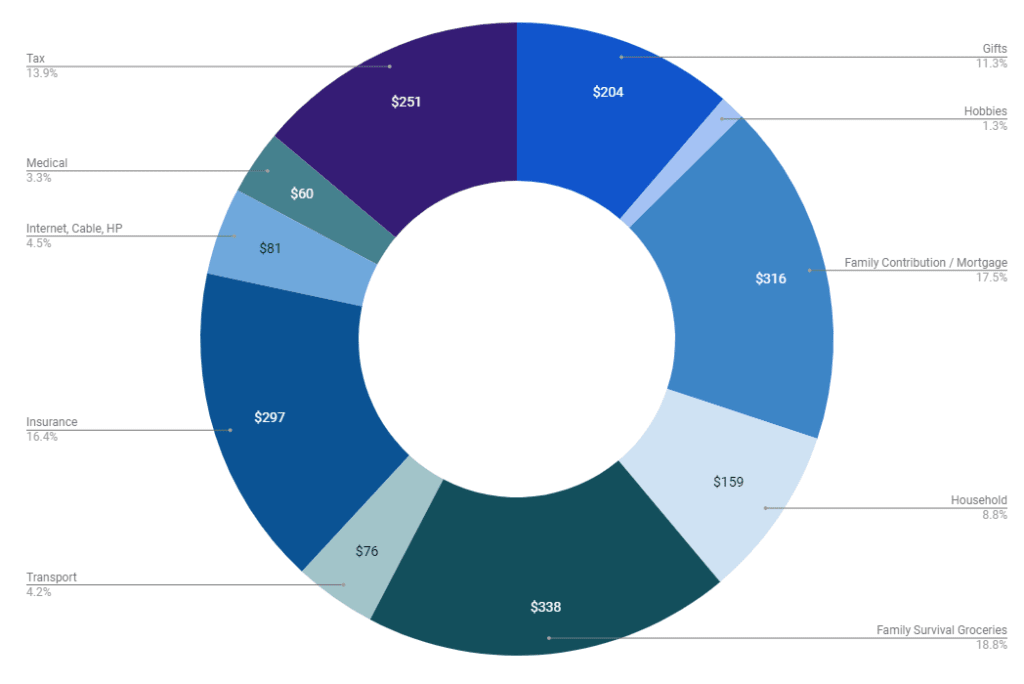

If we were to break down the average expenses to a monthly amount, it will look like this. The bigger categories are food for the family, mortgage, insurance, taxes.

This year gifting has become rather substantial.

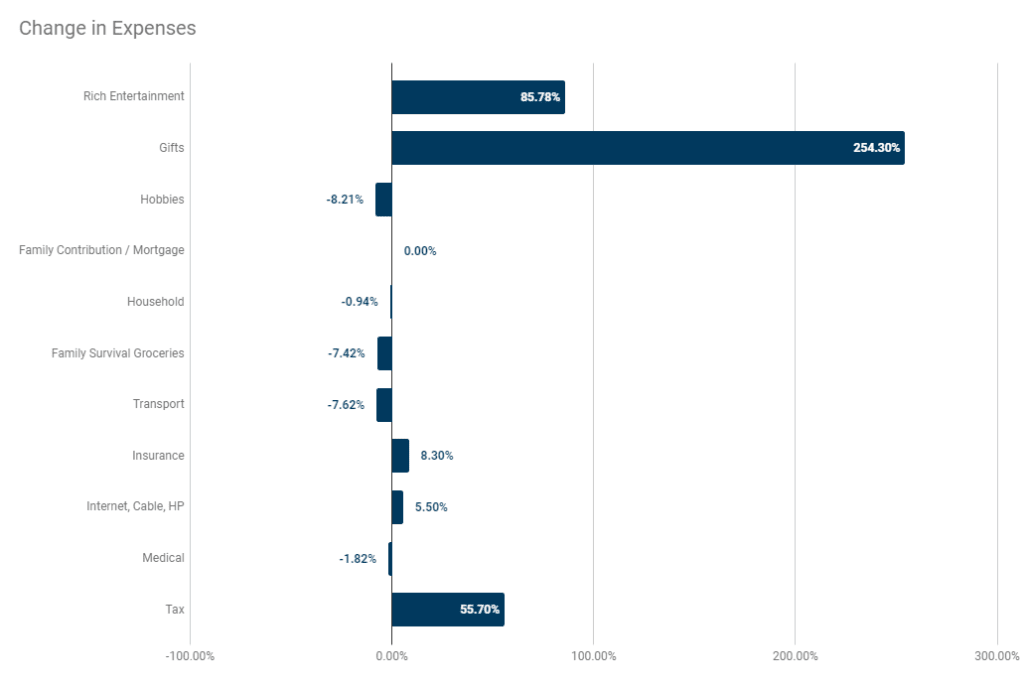

In the change in expenses chart above, we can observe better the change in each category versus the spending in the category last year.

I think I am not comfortable with higher gifting and entertainment expenses but it is something I would need to get used to. You cannot bring all the money to the grave. If you have the ability, learn how to spread the money around to bring more joy to the others. If not why they fx#k do you go through all the trouble accumulating so much?

I see taxes as a result of earning more. If I earn less then I pay less taxes. Taxes are a bigger issue if you work so much, suffer so much dread, and you get a much-reduced share of your salary. In that scenario, you actually paid out more to the government than yourself.

Transport went down because there were fewer emergencies that require me to take a taxi and that Providend’s office needs less bus transits.

I cannot believe I could reduce my grocery bill even lower. Perhaps, this is because my dad and I ate less this year.

The washing machine gave way this year. I change it to a 9KG Samsung WA90F5S5QWA washing machine for $480 to replace the old one. I heard the washing machine today do not last very long. Then again, I heard the same thing when we bought the old one a long time ago. I do expect that this machine last me 3 years. That will be an annual cost of $160.

Due to wear and tear, I do think that we need a sinking fund for our household furnishings. We need to contribute to it consistently annually.

Here is how each category of expenses transition over the years:

Inflation Trend During This Period

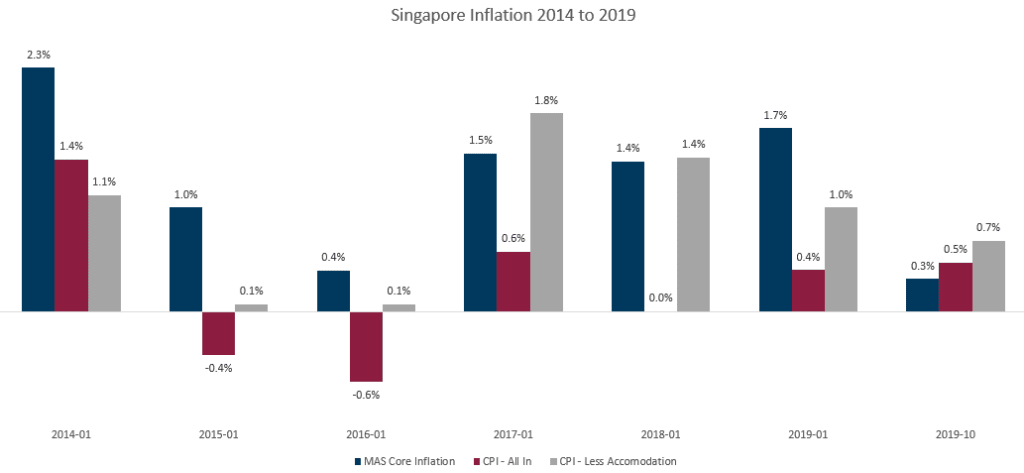

We always project a 2 to 3% inflation in our retirement planning. In the past few years, inflation and growth have been rather low. It seems like we might have buffer too much in our financial planning on first glance.

In Singapore, you can have 3 different kind of inflation measurement:

- Consumer Price Index – All In. We have data dating back to 1961

- Consumer Price Index – Less Accommodation. We have data going back to 1990

- MAS Core Inflation. This measurement-do not factor in private vehicle prices and residential housing prices

For a person that has less housing costs and private transport cost, The MAS Core Inflation is the most suitable measurement.

The chart above shows all three of these measurements between 2014 and 2019. Inflation is rather low during this period.

MAS Core Inflation is the highest at 1.21% a year, follow by CPI less Accommodation at 0.87% a year with the CPI-All In be at 0.25% a year.

I have always said that you have your own inflation rate which may be very different from the general public. In this case, taking out accommodation, perhaps it shows very well that daily food, services cost have gone up.

This year, my annual expenses are up 17% versus last year. You could say… my expenses are higher than inflation.

However, if we look at it from a higher level, what impacted my spending was more of conscious and unconscious spending through the years.

In most categories, my spending does not just go up by inflation. In various categories, it does go down and for some, it went up massively.

I think that maybe a challenge in retirement planning for retirees. Most would plan with a fixed set of expenses, thinking their expenses won’t change much through the years.

In reality, our expenses will just fluctuate. Could we keep to a fix $2000 a month schedule? I think that will be challenging.

How this Annual Expense Affects Financial Security and Financial Independence

If you have a sensing of your expenses, you can take the first steps to knowing what is your financial security or independence number.

In my past reports, I have always compute this.

Including Some Rich Life Expenses into Financial Security Expenses

For this year, I reviewed my spending and I decide to add more expenses in some categories to the annual expenses that I estimate I would need to be financially secure.

The main reason is that while I can survive on the bare minimum, that might not be something that I can do for a long time. It would not be psychologically in the modern-day not to have some rich life living that you are comfortable with.

You do not need everything or the highest grade of eating out, but even some form of eating out, some lower grade of entertainment can do your morale a world of good.

Reviewing How Much I need for Financial Independence and Financial Security

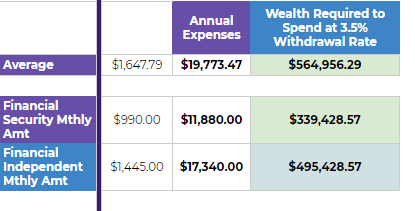

In the following table, it shows the amount of wealth in my portfolio if I were to generate a stream of cash flow to replace my expenses, or a stream of cash flow so that I can be financially independent or secure in 2018:

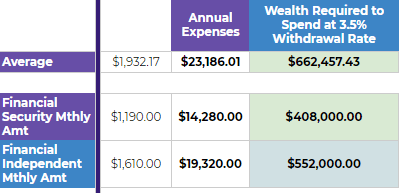

This is this year’s figures (2019):

Instead of $564,956, I need $662,457 this year, which is almost $100,000 more! The price to pay for my “indiscipline”!

The wealth required to spend at 3.5% initial withdrawal rate is higher to secure my financial security and independence as well. However, they are much in control at roughly $50,000 to $60,000 higher.

It is quite interesting that back in 2016 when I first start going down this rabbit hole to figure out the financial independence number, my net wealth was around $556,000. That figure still looks quite functional for financial security and independence today.

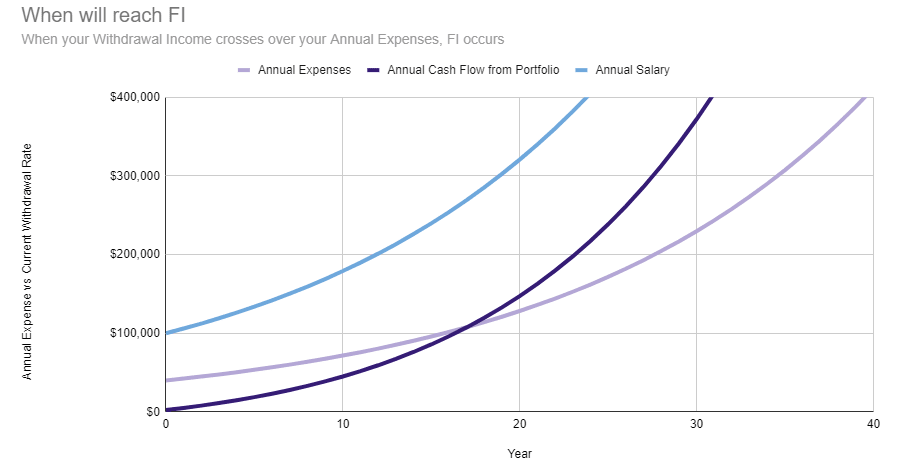

Your Expenses is Going to Fluctuate and then it Should Crossover

The journey to financial independence should be somewhat like this:

- You may not have reached it, and your expenses will fluctuate

- If you work on it, your expenses will maintain, or come down

- If you earn more, your accumulation will be better

- Your expenses and your net worth will be volatile but if you do everything correctly, they should trend upwards

- One day, the cash flow from your wealth will cross over to higher than your expenses.

Would Recurring Expenses Be a Significant Metric?

Being in the financial planning space, I am constantly interested if there are some metric that is important enough to add to what we will review with clients on a consistent basis.

One friend of ours over at my Financial Independence Telegram group shared with us financial tracking. And it is damn comprehensive.

But what stuck to my mind was the metrics that involve recurring expenses:

- Passive income / Recurring expenses: How many times

- Net wealth / Recurring expenses: How many years

- Cash and Equivalents / Recurring expenses: How many years

I am leaning towards how useful this metric is but I will not write much on this as it will make this post really long.

For some of you, you might be wondering what is considered recurring. I removed rich food/entertainment, gifts, and hobbies.

The way to determine this is to wargame in your head in what circumstances you will need to know your recurring expenses. That will be when things go to shit. For those with families, I believe you cannot cut all these to zero.

For the rest in Mandatory, you cannot really cut down. I could cut my mortgage and some insurance because there is a limited duration to them, and I could pay them off or set aside a lump sum for them.

This result in my recurring to me $9760 a year. I could then paste this next to my liquid net wealth and see how many years is that.

I think this is a hard and fast rule to determine how secure you are when things go to shit. This is pretty close to having financial security.

If you have 5 to 10 years of your recurring expenses, that is pretty good.

Helpful Articles on Tracking Expenses and Budgeting

In the past, I have written some pretty useful articles on budgeting and tracking expenses. It might prove useful to you.

Here they are:

- The Complete Personal Budgeting Guide

- Don’t Track Your Expenses or Budget First. Track Your Net Worth First Instead

- How to budget with envelope budgeting to save money easily

- Some More Advanced Personal Cash Flow Management

- How to Manage your Investment Portfolio with YNAB or Financier.io

- You don’t really need to budget but…..

Summary

My current tracking application is You Need a Budget 4 or YNAB4 for short. It looks like support for this older version of YNAB is going to end someday.

This means that I have to find a good alternative application that does almost the same thing to replace this.

I am still on the fence whether it is worth it to spend like $50 to $80 USD to keep track of my expenses. I will definitely need a way to track my expenses, but it is not a deal-breaker.

Right now, I have historical expenses spread between a Quicken file, a Financier.io file and YNAB file.

I stared at my monthly financial security expenses $1,190 a month for a while. This is up from $990 a month last year. It is still a very low sum in my opinion. This is after factoring in taking out some insurance premium payment, taxes, paying off mortgage.

The difference is almost $650 a month.

I tried to work out a friend’s financial security figure and for her, it is about $750 a month. When you discount housing and some meals, the minimum sum that you need to keep life going can be rather low.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Focus

Sunday 19th of July 2020

Hi Kyith, would you please share your excel expense sheet and other excel sheets you use for personal finance? Thanks! :)

Kyith

Sunday 19th of July 2020

Hi Focus, that one I think I will not share. But you can monkey see monkey do. It is not too much rocket science. I did a lot of trial and error myself.

Johnny lim

Saturday 28th of December 2019

Maybe rather than absolute amount of expenses, it is better to track % of after-tax income? As income rises, if one limits expense growth, this % should come down and is an indicator of financial prudence. My expenses are currently at 3% of after-tax income so I manage to save 97% of my salary every month after putting aside income tax. Think that is not too bad. Are you at a similar level?

Kyith

Saturday 28th of December 2019

Hi Johnny, that would mean that you need to track your income to expense. Otherwise, it will be tough to know what is your percentage in the first place. wow you save 97% of your salary. I have not come across anyone do that. do you make like $1 million a year?

curious_one

Monday 23rd of December 2019

Hi Kyith,

I have been tracking for my expense for the past 2 years now, and i am already finding it hard to cut down on my expense (~35k per year). I cant believe my expenses are this high till i actually tracked them, even when my car loan is fully paid and my mortgage is on HDB loan fully.

My broad categories are: term/medical insurance for myself, mom, son (4000/year), tax (150/mth), utilities bills (240/mth), mom allowance (450/mth), car/transport (380/mth), food (500/mth), groceries (300/mth), personal grooming (65/mth), festive (2000/year), travel (4000/year)...

All-in-all, its about 35k per year.

Kyith

Tuesday 24th of December 2019

Hi Curious one, kudos to you for being inquisitive and tracking it. not many could. not many would. your expenses is below the $4000 a month of a typical household so don't be too worried about it. Your food and groceries i am not sure is for how many people. It looks good. Some of the categories that i would consider rather fixed and necessary for survival would be your insurance, tax, utilities, half your mom allowance, one third of your transport, all your food and groceries and 1/3 your festive. this would come up to $1940 a month which is pretty good.

I do think your utilities is a bit high though. Did you include things like cable tv, broadband and such?

Ivan

Sunday 22nd of December 2019

Hi Kyith,

Thx for sharing.

Your post used to have a search box which can type in keyword and find the related post. May I know why now not able to find this search box ?

Kyith

Sunday 22nd of December 2019

Hi Ivan, I added it back in. It is at the top right now.