There is this report in the Straits Times talking about half of the affluent in Singapore may not be hitting their retirement goals.

This sounds very short of details, but the actual report is quite interesting.

The news article talks about a Standard Chartered Wealth Expectancy survey done on 10,000 individuals around a few countries. Let us just say that we are not the only one falling short. So it is less of a Singapore problem.

The report sort of concludes that we may have too much in savings and equivalents. We may not be diversified enough and are not able to reap a higher return expectation due to our high cash and high property asset allocation.

Standard Chartered’s methodology is rather interesting.

How Wealth Expectancy is Derived

The report is made up of both opinion and economic modeling. This means that qualitative answers were asked but also they were able to tap their client database to form a better picture of the various segments they are reporting on.

They target 1000 wealth creators each in 10 different countries to form this survey.

The report assesses a few metrics that we have seldom heard of. They are based on Standard Chartered’s proprietary model.

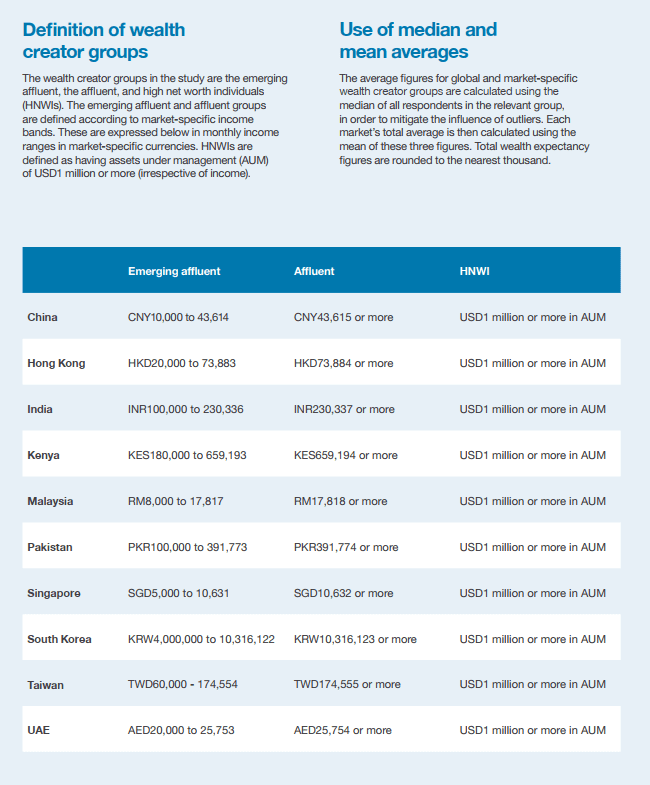

The 3 groups are:

- Emerging Affluent. These should be similar to the HENRYs, who have good income and are banking with Standard Chartered but net worth wise, they are not there yet

- Affluent. Amongst the top decile of their earned income in their countries and with USD1 million under management

- High Net Worth Individuals (HNWIs). Similar to the Affluent, these group of people have AUM of USD$1 million and above. The difference is that this group may not have the income

If you look at the salary gauge of Singapore, this report seems to be talking about individuals. The emerging affluent are the people that have an income that ranges from SGD5000 to 10631. These should be above the 50 decile to 80 decile of Singapore individual income.

Their definition of affluent are those that earn in the top decile of Singapore.

Next, what is Wealth Expectancy?

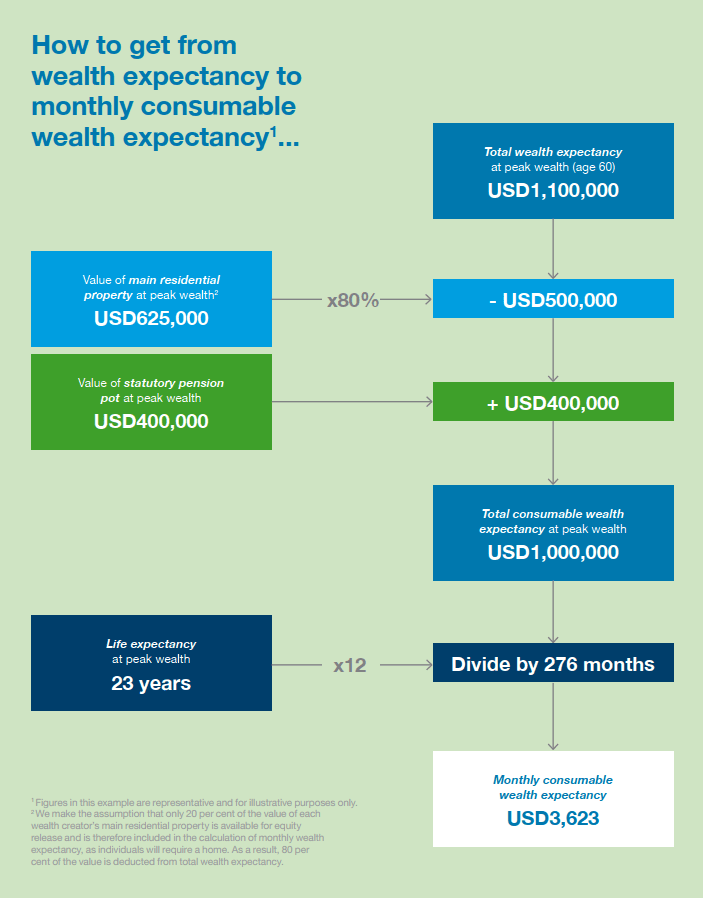

In the previous slide, they define wealth expectancy to be the highest total wealth you will reach in your lifetime. This is likely to be based on your income, growth of your income, your savings rate, the rate of return you will get, what is the total wealth you could achieve.

The peak that they used universally is 60 years old. This is the average start of retirement age for all countries.

Standard Chartered separates consumable wealth from normal wealth. Not all of your wealth can be consumed. They then divide this consumable wealth by 12 to get the monthly consumable wealth.

This is then measured against their wealth aspiration, which is the amount of wealth they need to live comfortably in retirement. They derive the wealth gap from there.

The rough formula to derive the monthly consumable wealth expectancy is shown above.

They probably derive what you earned from your human capital up to 60 years, deduct away 80% of your residential property value, add in your CPF pension amount.

It is pretty good that they show that not all your residential or investment property can be turned into cash flow.

Then they divide this sum by the number of months based on your life expectancy. If your life expectancy is longer, the monthly amount is smaller.

Based on what I see, this methodology does not overcomplicate things too much and the consumable wealth that you can spend is likely not inflation-adjusted.

How did the Richer Singaporeans Do?

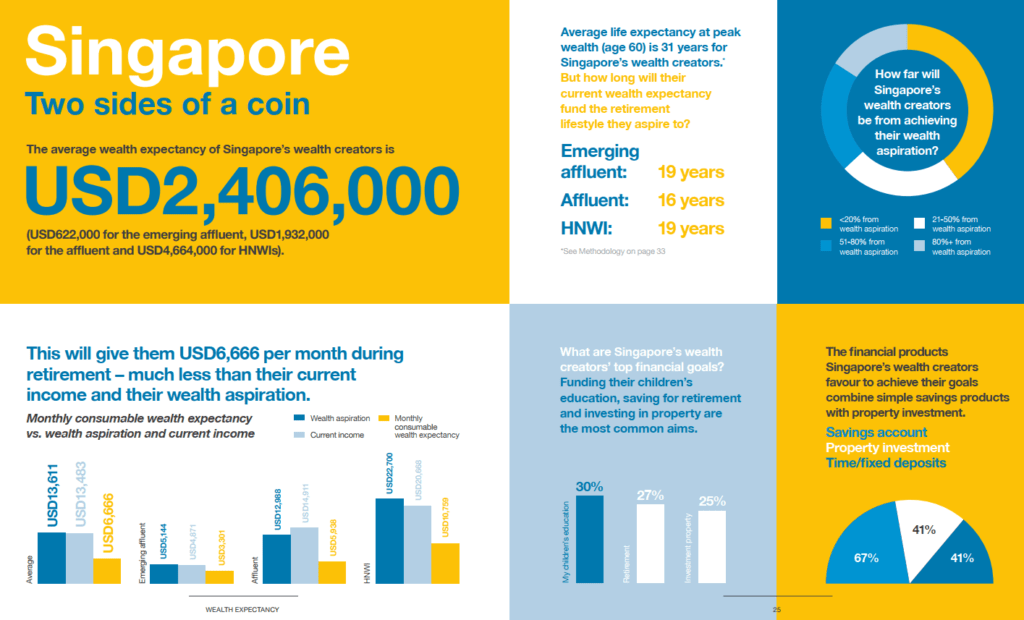

Singapore and Hong Kong have the highest average wealth expectancy. This means that by 60, you have the potential to build up a lot of wealth.

US$2.4 million is the average and here is the break down:

- Emerging Affluent: US$622,000

- Affluent: US$1.9 million

- HNWIs: US$4.6 million

We have a long life expectancy at 31 years, but our wealth-income would only provide us for between 16 to 19 years.

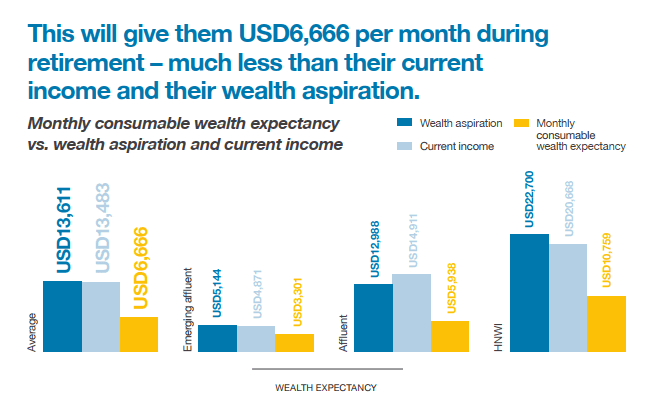

One problem is that our aspiration wealth is pretty close to our current income.

For example, the emerging affluent think they need US$5.1k, which is slightly higher than their current income of US$4.8k.

However, based on Standard Chartered’s projection, they might only be able to have US$3.3k in monthly consumable wealth.

I take note that the affluent want US$13k but likely will have US$6k and the HNWIs need US$22.7k but they only have US$10.7k.

Almost all these numbers are very high to Kyith.

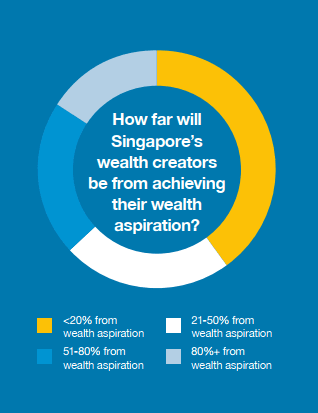

I think richer Singaporeans are doing better than their peers in other countries in that they are quite close to their aspiration. But the majority are far from where they want to be.

For the rich, their children’s education is of the utmost importance. This is followed by retirement and investment property.

It is so very strange that we have a separate category for Investment Property. The first 2 are life goals, investment property feels like an aspirational goal.

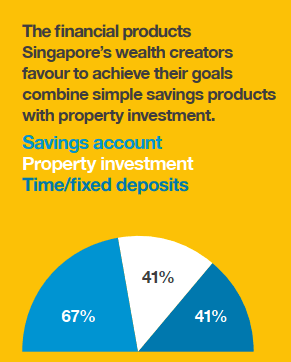

The problem is that the favored wealth-building financial asset happens to be overwhelmingly savings account. This is followed by property investment and time/fixed deposit. Fixed deposits are pretty close to savings and if we look at this as a whole, overwhelmingly it seems a lot of people’s money in Standard Chartered is not investments but their savings account!

They do not know the Best Wealth Transfer Approach

There were some interesting data points brought up as well.

Wealth transfer is a big thing and will become a bigger thing in the future. About 63% of wealth creators have a wealth transfer strategy in place.

This is higher than the 45-50% average for Asia that I came across previously.

However, nearly 47% do not feel the best approach to take.

55% of them want their bank to do more to help them.

Emerging Affluent of Singapore is More Concerned About Retirement but Really likes Savings Products

Saving for retirement is a top financial goal for 2/5 of the emerging affluent (42%).

This is more than any other markets. This is double that of the HNWIs and Affluent.

Perhaps they are surveyed at a different stage of their lives. The HNWI might already have more assets and thus they have higher priorities than retirement.

The divergence here is that the emerging affluent tends to focus on savings products while the HNWIs and affluent are more open to advanced products.

Compared to other markets, they prefer savings accounts and less of real estate investment trusts (REITs). This is a strange result, considering we have such a big REIT market here.

They use fewer digital wealth management tools than the affluent and HNWI.

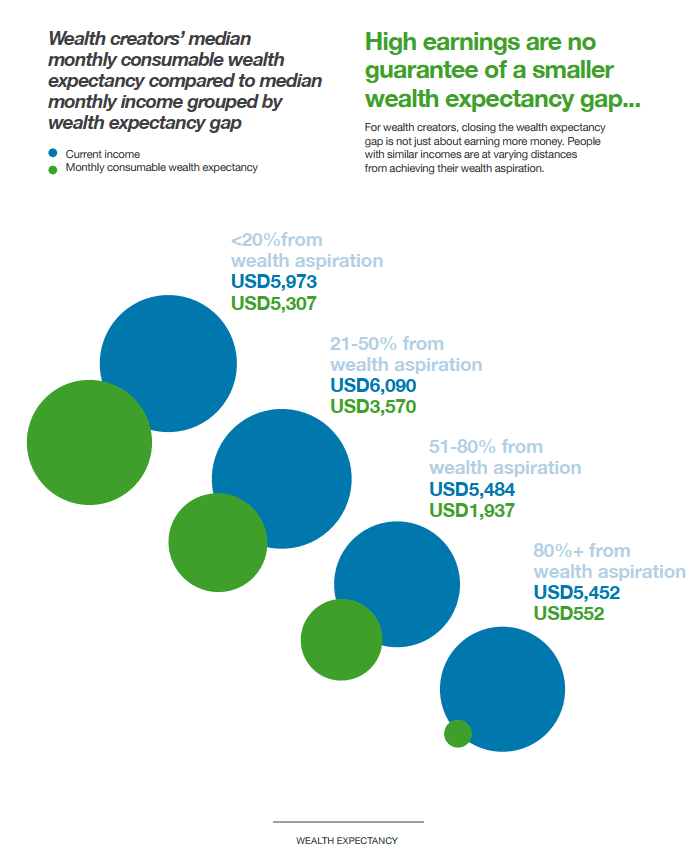

In the slide above, you will notice that the wealth aspiration becomes smaller if they are very far from where they want to be. Reality set in when we realize we are so far from where we wish.

In terms of adequacy, China affluent is the most power. Their consumable monthly wealth is so close to their aspirations.

For the HNWI, they have so much more than their life expectancy! Interesting is that instead of investment property, a large part of their wealth building is from fixed income investments.

My Own Takeaways

Here are some conclusions that are relevant to me.

- Consider the top decile to be the affluent. The 50 to 80 decile may get there but most will likely stagnate in their income after a while

- These are people with at least 1 million in AUM. Not investible assets. Likely their net wealth is much higher than this.

- We should note the current income and the income aspiration they are looking for.

- What people think they need is close to what they have now. The “End of History” Illusion is very strong it seems. Probably only the affluent show some deviation from this trend.

- The emerging affluent have a US$622,000 or SG$840,000 wealth potential. That is probably as close to what local university degree graduates can get. What would you do if you have this amount today?

- Almost all groups have a high preference for safe assets. This means that most likely, either they do well in their career or their business. If not they will not meet their retirement aspirations.

- If their database show so much cash, it means even the banks have a problem converting their clients to higher risk instruments.

To build wealth towards your retirement aspirations, you need a certain rate of return. Your rate of return depends on your overall asset allocation. If your overall allocation is at a low rate of return financial asset, then that is all you gonna get.

Very far from your goals.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

HNWI Uncle

Sunday 22nd of December 2019

Flawed survey. Sample size too small. Uncle stay in HDB and no investment property. I beg to differ, HDB and CPF are both not in my calculation of HNWI. The former will become zero one day. The latter is a bonus if I can withdraw @ 55 and 65, but I would not include it like some.

Kyith

Monday 23rd of December 2019

Hi HNWI Uncle, you need to try your hands and do some of these survey and maybe you understand how hard it is. They have to assume CPF and housing. lets just say that... in your lifetime, your home is not zero.

Fred

Sunday 22nd of December 2019

Honestly, I think this Stanchart survey is seriously flawed; both it’s survey methodology and findings. Each surveyed nation’s sampling of only 1000 account holders is not representative of any national attributes. For only 1000 samples to represent China’s 1.4b population is ludicrous and using the same numbers for Spore to say that its’ wealth creators prioritise children’s education over saving for retirement and property investment, fail to take cognizance of life’s different stages, thereby different aspirations and goals. An example would be most people would have completed their children educational goals by earlier fifties, giving them till 60 to accumulate or investing in other areas. Many people I know, adopt the CPF methods of managing monetary resources to aid one’s goals. It allocates a certain percentages to OA, SA and MA in different stages of life. Or using Providends’ method of using buckets systems in different stages. However, the future is fraught with uncertainties, unknowns and changes and the more flexibility for contingencies the better.

Kyith

Monday 23rd of December 2019

Hi Fred, they didnt say they didnt factor in CPF. they are taking into consideration.

Sinkie

Sunday 22nd of December 2019

Seems like an expensive & long-winded survey to highlight that their most favoured financial asset is actually their active income / profession LOL.

Most of them already experience lots of volatility, uncertainties & challenges in their professions & business world ... hence it's not surprising they want safety & assurance for their savings.

In terms of wealth transfer actually the best will be thru good upbringing, quality education and mentoring & maybe connections for good positions in good companies. That's been my observation of some HNW families' kids anyway.

Kyith

Sunday 22nd of December 2019

hi Sinkie, thanks for sharing. The wealth transfer part, is there any money aspect that will be something we watch out for?

I understand that in their daily lives, there is enough uncertainties. but the data does show that they need a lot of income, but not enough assets. in contrast those in China have less of these problems

lim

Saturday 21st of December 2019

I'm with SCB priority banking but I've never been interviewed for one of these surveys. They seem to be interviewing customers people that only hide money in savings account and fixed deposits.. (by the way the SCB graphic 67% + 41% + 41% doesn't add up and implies that respondents could choose more than 1 option... i.e. 67% that chose savings account, some of them may also have indicated stocks and shares...)

Do they deliberately interview customers that have low savings in proportion to income (i.e. what Millionaire Next Door calls persistent under-accumulator of wealth).

Kyith

Sunday 22nd of December 2019

hi Lim, I am a SCB priority banking customer as well and I have not been interview. They have an agenda la. But you are right that it would be a multiple option MCQ where they rank the priority.