In investing, things are most of the time not definite.

I make a very poor salesman because straight away, people can detect a lack of confidence. I would rather say, my face most of the time, show how uncomfortable I am with things.

That is why we have advisers because they don’t have this problem of mine. At work, I kept the deepest, darkest part of what I know about the markets and investing firewalled from them.

This is so that they can function. If you know too much, it affects your ability to push a good narrative.

My friends who teach investing courses, trading courses probably cannot share too many of these uncertainties. Placed enough uncertainties in a prospects head and they will not make a decision.

Outside of these two groups, I hear folks having high conviction in companies that will never die, strategies that will always work, REITs that will always be better.

Not sure if others feel the same way, but in the active investing world, seldom do you get a feeling an investment feels permanently safe.

In the past, I shared that you can build conviction in a stock, or a trend by digging deeper into the numbers and doing deeper qualitative analysis.

When I do more, I generally feel much more comfortable in putting money to work.

But I never had that “this will sure work” kind of feeling. The posture is always: “Think this is safe enough. Got enough margin of safety. Lets get invested. See how it goes.”

When prices starts to change, when events starts unfolding, it becomes: “Ok this is getting safe, let’s add more.”

Or “Shit man, this feels like a possible train wreck results coming up.”

I never felt things are definite. This is why I admire people who could have high conviction that

- Certain sect-oral trends would ALWAYS work

- This company will WILL survive

- This investing system WILL work

I dunno. Maybe I am a low confidence, risk adverse character by default.

I feel a lot of confidence people have is based on past history.

And today’s sharing might give a different perspective. We cover things passive investors, active investors and retirement planners can relate to.

The Limitations of Relying just on Numbers

The protagonist of this article (What I Learned From Losing $200 Million) eventually got a promotion and a great bonus. In the eyes of most people in the firm, he did so well and should be held up as a successful case study for others to follow.

I learn to have enough vulnerability to fully based investing decisions on my fundamental analysis after reading this article. Well, I had enough vulnerability before this, but this article really hits home the fact that if you do some really thorough work, if your framework has weaknesses, your investments will sometimes suffer from serious capital impairment.

Bob Henderson worked for a major investment bank during the 2008 financial crisis. He had a serious unrealized loss position to the tuned of $200 million at one point. In this article, Bob takes us through how he sees this deal. His firm largely viewed this deal as successful.

This is not a story of a trader that took a lot of risk and finally made a really bad trade that cost the firm. Bob describes their firms system as a collective effort. Bob was a physics trained PHD. He was hired for his skill in modelling.

By 2008, he has spent the past 10 years developing derivative and trading strategies. By and large most of the trades was successful. Bob thinks that his edge was not in predicting the future but simply for being careful and logical and systematic.

That sounds like what a lot of us want to think ourselves to be.

His models have worked for 10 years. This means that it has prevented large eventual trading losses. But 2008 was the first time he encountered the extreme tail end events.

His modelling is suppose to give the team a sensing of how much shit the open positions are subjected to.

His team’s models is mainly based on historical data. You can read the details of the trade from the article (it gives you a glimpse of why it is likely we may not be able to put out such trades by ourselves)

Bob would like us to think that his team’s models are very comprehensive. But that did not prevent his team from losing $20 million, then $30 million in 2 days. His model will show him that he is destined to lose even more money.

Until this point I’d managed the deal almost entirely on my own, making the decisions that led to where I … we … were now. But after a black cab ride from Heathrow to our Canary Wharf office, I got the guys off the trading floor and into a windowless conference room and confessed: I’d tried everything, but the deal was still hemorrhaging cash. Even worse, it was sprouting new and thorny risks outside my area of expertise. In any case, the world was changing so quickly that my area of expertise was fast becoming obsolete. I pleaded for everyone to pitch in. I said I was open to any ideas.

As I spoke, I noticed that one of the guys had tears welling up in his eyes. I paused for a second, stunned. Then my own eyes started to fill from a sudden wash of gratitude and relief that came, I think, from no longer being alone.

Basically, the math models stopped working in real world.

Historical Data Gives Us an Illusion of Control

Bob explains to us some of the frailties of using historical data.

I am trying to risk managed future situations with historical data. If the result shows that the probability of a high impact event is very, very low, I feel safe. If the maximum loss that I could suffer is still a manageable sum, I feel safe.

By doing this, I am expecting the future to be very similar to the past. In Bob’s case, 2008 presented real world events that is not contained in past data.

So what was once thought to be low impact, or very very low probability, became a reality and the models could not handled it.

Our models based on historical data makes us feel safe.

It gives us an illusion of control.

Bob thought he had good control for 10 years, until this one event showed him that maybe it is an illusion.

I understood immediately, having spent countless hours over many years struggling to extract probabilities and other forward-looking metrics from historical data.

The biggest challenge was always that the answers depended so much on which timeframe you focused on. The past month? Year? Five years? And if you want to use data to estimate the probability of a very rare event, then you need a lot of data—the more rare, the more data—which means taking data from further back in the past, and the further back you go, the less relevant it probably is.

But what’s the alternative to estimating probabilities? If we can’t say anything about what the probabilities are, then we really are forced to worry about the absolute worst possible scenario. A trader would never sell options or short stocks, since his losses could be infinite. People would avoid cars, planes, marriages … everything really, for fear of the worst possible result. We’d all be paralyzed.

This Explains why Most Money is in Fixed Deposits and Properties

For many of us, we want to ensure things are very very safe (to ourselves) before we can take the plunge.

One of the lesson I learn from this is that the future may rhyme like the past, but it is never the same.

And therefore you can never feel comfortable.

As investors, we try to search for the holy grail:

- A very decent positive expected return

- Low volatility in value of the portfolio

- Not too much effort to tend to this investment

- This investment do not cost us a lot

- Very safe. There is no blow up or not a scam

What if, it does not exist?

For a lot of people they just became paralyzed. They do not invest. They leave their money in what they considered as “very very safe and decent return places”.

These are the fixed deposits, and property. By what they know from the long history.

Guessing in a Forward Looking Uncertain World

Bob realized his models were not working. It is just telling him things will only get worse.

He needs to find another way to save himself (and the firm)

He gives us a hint that the answer lies in Bayesian Networks. Bayesian Networks tries to gain inference by looking at the probability of events depending on other events.

It feels to me like its a systematic guesswork.

At this point, I agree with that thesis.

I realized, what saved my wealth from numerous occasion of potential blow-ups was not just the fundamental analysis but making the kind of dependence guessing.

For example, competitors results are not looking so good (or looking very good). Given they are in the same industry, and what we know about the company’s potential, there is every chance this company will not do so well (or do better).

It is guessing after doing a lot of fundamental work.

Guessing has a Cost to It

The cost of guessing is that unless we are very sophisticated, we cannot always get it right.

To guess well, you got to be very in tuned with the company to make that guess. A lot of investors make guesses and say it doesn’t work. That is because they don’t really know that company (despite they claiming they “done the homework”. Basically not in depth enough)

If you know the health of a company, its earnings potential in the past, and learn about the industry, you could increase your probability of success in making a good guess.

For those who preached passive investing in a portfolio of low cost funds, they believe that even folks like myself cannot outguess the market well over time.

I generally think that way.

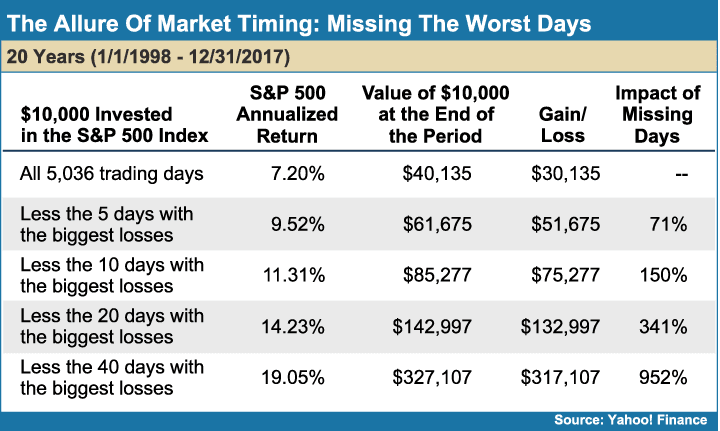

The cost is that if you missed the best 50 days in the market, your average compounded returns might go from 7-8% a year returns to negative a year.

The opposite is also true. If you missed the worst 50 days, your returns will look much better.

However, the key thing is… if you are truly risk adverse, missing out on the worst days increases the chances of you staying in investing for the long haul.

Passive investing in a way is betting that future looks pretty much like in the past.

Dealing with the Weakness of Using Historical Data in Retirement Planning

If you ask me what I will recommend for your wealth building or retirement, I would say a broadly diversified, low cost portfolio.

You can get cash flow from it for retirement or financial independence.

Then you will ask me how safe is this strategy?

Well, this post probably show you the weakness.

Many also asked me whether spending an initial 4% of your initial capital in retirement, then subsequently adjust that initial first year spending by inflation is a safe spending method.

Well, this post probably show you the weakness.

You will move on and try to find the next holy grail in investing or retirement.

You will probably not find it. And would find an active boutique fund, or a dividend income strategy that gives you that illusion they have more control over these uncertainty than my suggestion.

The reality is that… the future is uncertain:

- The banks where your fixed deposit are in, have every chance of blowing up

- Your property’s future growth rate might be very different from in the past, on a secular basis

- Your unit trust dividend income is based on the earnings and capital appreciation of the fund. If the performances lags, dividend income goes down. If you need $1000 a month in dividend income and the fund gives you exactly $1000 a month, and you cannot live on less, you are screwed

My counter to your question whether these are safe is… what is your alternative?

There are some safer alternative:

- Build a bond ladder of high quality bonds or a bond fund with high quality

- Use Inflation Protected Bonds

- Use a less than 2% initial withdrawal rate

All 3 have similarities. They are very safe, likely takes care of inflation, but also need a lot more money.

So the solution to a lot of problems is having more money.

Summary

The value of Bob’s sharing for me is to lay out some of the uncomfortable things I feel in active investing.

The future is uncertain. But a lot of the time, the future rhymes with the past.

Whether it is investing, or retirement there are no ultimate investment, super safe stock or safest retirement strategy.

You just need to get better at understand and living with these things. Understand very well how things work, mitigate, transfer or accept the risks that come with it.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- Should I Take Less Risk in My Fixed Income Allocation by Moving Away from a Global Aggregate Bond ETF? - May 5, 2024

- Singapore Savings Bonds SSB June 2024 Yield Climbs to 3.33% (SBJUN24 GX24060A) - May 3, 2024

- New 6-Month Singapore T-Bill Yield in Early-May 2024 to Stay at 3.75% (for the Singaporean Savers) - May 2, 2024

Khinwai

Monday 16th of September 2019

Interesting Kyith. Same here, I admire those who can say that a particular investment is never gonna fail or are certain that their thesis is gonna work for sure..

Sinkie

Sunday 15th of September 2019

Oh ..... Regarding the best & worst days urban legend, some research shows that most tend to both occur in close proximities & in clusters (< 3 mths).

The fallacy of the best / worst days is thinking they occur in isolation, with the other days giving a constant average mediocre returns. In reality if you missed the best days, chances are you'd miss the worst days too, and vice versa.

Kyith

Monday 16th of September 2019

Sometimes we should try to eliminate both, and see how the return is like.

Sinkie

Sunday 15th of September 2019

Most retail don't use beyond the past 5-10 years data. Even for professionals, 20-30 yrs is the max for most of them. Especially if they want or need very fine granular data that may not be available before 1980s, but which is required for their modern mathematical modelling.

If his models had included the wipeouts of US investments in the 1800s or Great Depression or even the 1987 mother-of-flash-crash ....... or the big wipeouts of non-US equities/bonds/properties in the 20th century due to wars/political changes/revolutions/national failures etc ..... Would he have been surprised by 2008??

In using analysis & backtesting & statistical modelling, it's useful to have both detailed shorter-term ones that incorporate maybe the past 20 years data, as well as broad overview ones that include 100+ years of broad data from around the world. Coz human emotions & desires are basically the same ... that's why history tends to repeat, with nuances due to culture & recency bias (e.g. 1 generation or 30 years). But I bet most people will yawn & say it's irrelevant.

Up to individuals to assess or go thru baptism of fire to experience their level of risk tolerance and adjust risk assets accordingly. The problem is always time & when & where you were born --- an adult in the US in the 1970s will have very different mindset to stocks & risk assets as compared to an adult in Singapore in the 1970s. Anchoring bias can be as far back as what happened during GFC or when you were growing up as a kid.

A simple prescription will be the old Talmudic portfolio of roughly 30% global stocks, 30% global properties/reits, 40% IG govt bonds & cash. And aim to grow the portfolio to survive on 3% withdrawal rate.