LendLease Global Commercial REIT is going ahead with their IPO.

However, the number of properties that will be injected into the IPO will only be 2, contrary to what I have speculated in my first article.

The Australian based group LendLease will be looking to a placement and public offer of 387 million units.

The IPO price is set at S$0.88.

In total, there will be 1,167 million units outstanding. This will make the market capitalization of LendLease Global Commercial REIT to be close to S$1.56 billion.

This IPO is a strange for the following reasons:

- I struggled to find what is the indicative dividend yield of LendLease Global Commercial REIT

- It is a mixture of office and retail REIT

- LendLease Global Commercial REIT’s portfolio have a fair bit of concentration risk. You can liken it to IREIT Global’s portfolio concentration

- LendLease Global Commercial REIT’s 2021 dividend yield of 6.01% is not a screaming buy (2020 dividend yield forecast yield is 5.8%)

In most cases, if you look at this profile, you would have given this IPO a miss.

However, I think this IPO is going to be received well. For probably 2 reasons.

1. The Cornerstone Investors

Out of the 1167 million units:

- LendLease Global Commercial REIT’s manager will take up 8 million

- Cornerstone investors will take up 453 million

- LendLease Group, the sponsor will take up 28% of the units or 318 million units

- Public and Placement will take up 387 million units

If you compare the reception of this IPO to that of the last REIT IPO, Prime US REIT, you can see a big difference.

For one, they do not need to conduct cross placement and public offer.

Secondly, look at the cornerstone investors:

- AEW Asia Pte Ltd

- Asdew Acquisitions Pte Ltd: Wang Yu Huei’s investment company

- BlackRock, Inc

- DBS Bank (on behalf of their wealth management clients)

- DBS Vickers Securities (on behalf of their corporate clients)

- Fullerton Fund Management

- Lion Global Investors Limited

- Moon Capital Management

- Nikko Asset Management

- Principal Asset Management

- Soon Lee Land

- The Segantii Asia Pacific Equity Multi Strategy Fund

- TMB Asset Management

LendLease may have spent enough time building up their cornerstone. But I believe that if you have sometime that people in the industry find iffy, no matter how hard you tried, people would just avoid it.

It has been some time since I see a cornerstone list like this.

2. The Sponsor: LendLease Group, may be the Jewel

I felt that biggest appeal of this IPO is that this is a REIT from LendLease Group. LendLease Group was formed in 1958 and currently has a market capitalization of A$9.5 billion.

LendLease has development, construction and investment around the world. Their development pipeline is approaching A$100 billion, construction backlog of A$15.6 billion and funds under management of A$35.2 billion.

Lendlease has won major jobs this year, including a $21bn deal with Google in the US it struck to develop three mixed-use communities in the San Francisco Bay Area.

We may be betting that in the long term, investors want access to Lendlease Group’s $30 billion international commercial development pipeline.

A REIT may wish to change its name next time when it expenses its mandate. However, if LendLease Global Commercial REIT calls itself… a global REIT, the sponsor might have some big dumping ambitions.

In the section above, LendLease Group gives us an idea that they might wish to use this REIT as a platform.

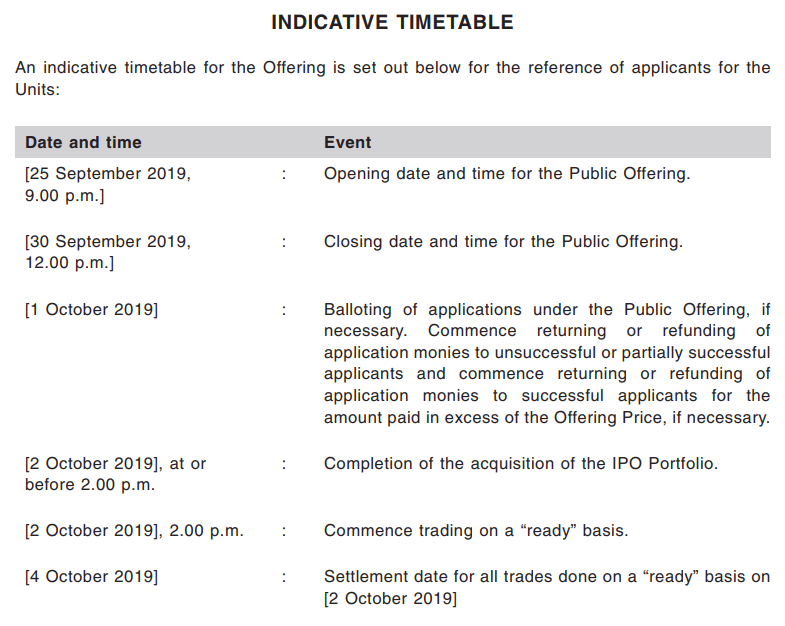

The IPO Timetable

Comparisons

LendLease Global Commercial REIT’s closest competitor could be the Starhill Global REIT and Suntec REIT. These are either a close by competitor, or a REIT will a retail + office REIT.

You may also consider Mapletree Commercial REIT as well.

In any case, its Price to Book and Dividend yield both look more attractive currently.

The Inverse Relationship Between Size and Value

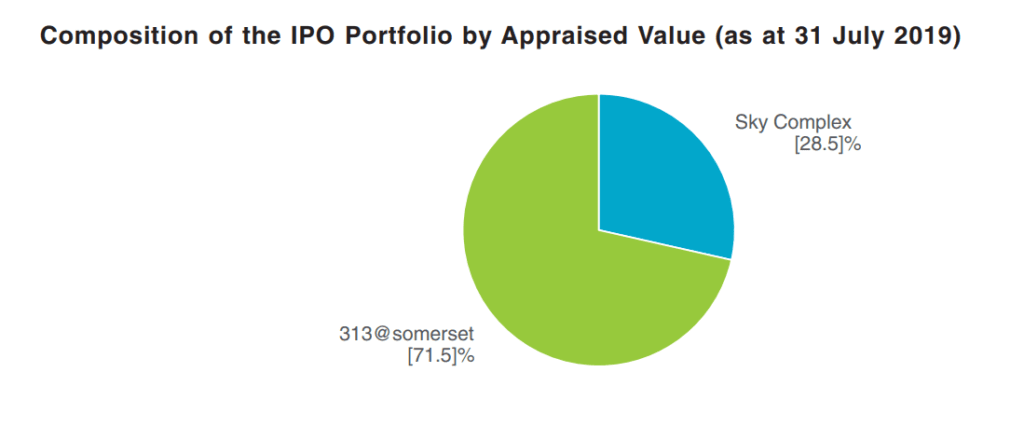

Majority of the asset value comes from the 99 year lease 313 Somerset. Less comes from the Freehold Sky Complex.

Yet when it comes to size of the properties, 313@Somerset is only 288,277 sq ft NLA while Sky Complex is 999,116 sq ft NLA.

The Location of Sky HQ Complex and 313@Somerset is Pretty Good

The Sky Italia is located in southeast area of the Milan Municipality, which is the main office, industrial and retail center of Milan.

LendLease as an engineering and construction company, engages in many of these rejuvenation or reinvention of large spaces around the world.

One of the project is in the district of Milano Santa Giulia. They are to build 2,500 residential apartments and a large park.

Most of us are familiar with 313@Somerset, which is a shopping center at the mouth of Somerset MRT station in Orchard.

LendLease Commercial REIT have a 99.9% Committed Occupancy with 4.9 Years WALE

The lease to tenants for LendLease Global Commercial REIT is pretty long compare to the average.

Sky HQ is fully leased to Sky Italia, an Italian satellite television platform own by Sky Limited (owned by Comcast). This master lease lasts for 12.9 years. This was a continuation of a 12 + 12 years lease starting in 2008. If we look at it, most likely Sky Italia is going to continue renting it to go into the second 12 year lease.

Note however, that Sky Italia have the option to break their lease in 2026 (7 years later)

The leases have a built in CPI-adjusting escalation. Given the low inflation environment in Europe, this is currently unexciting.

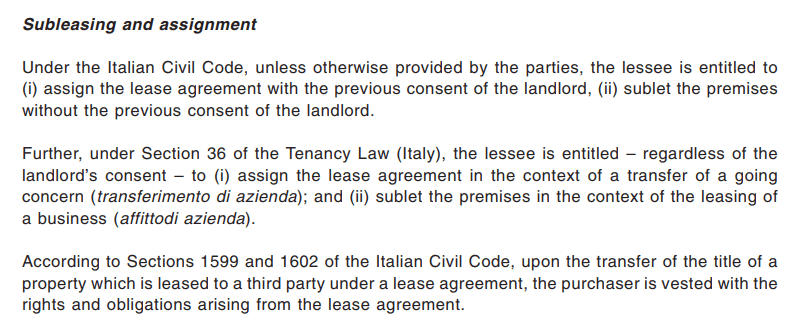

It would seem, tenants are able to sub-lease their units to others.

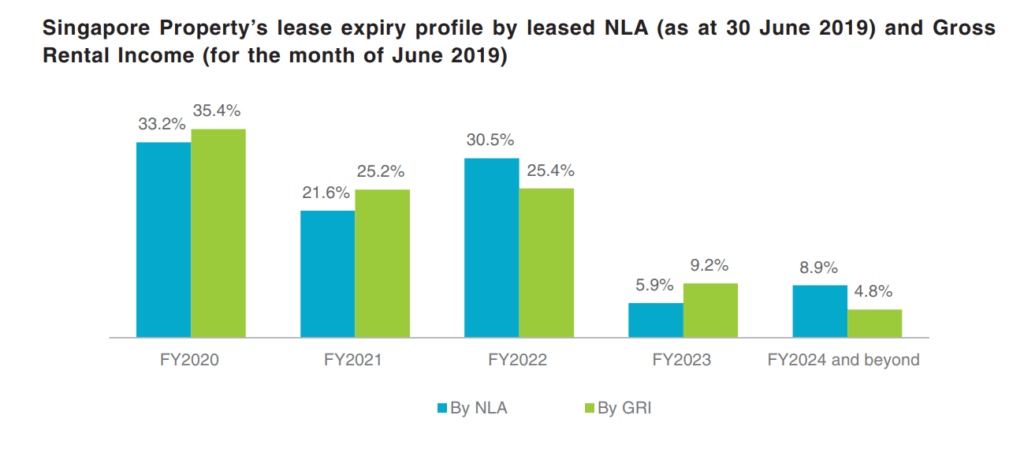

313@Somerset have an average lease of 1.6 years.

The lease agreements for Singapore 313 Somerset is 2 to 4 years typically. Major tenants can lease up to 5 years.

The freaking crazy thing is that 58% of LendLease Global Commercial REIT’s Singapore leases have built in 3% rental escalations.

This short lease is not something new. Local retail malls have similar lease structure. When you invest, you got to know what you are getting yourself into. If there is a tourism boom, better economy, you can capture a better rental. If the economy tanks, your portfolio will be subjected to greater fluctuations.

LendLease Commercial REIT has Relatively Long Land Lease

This portfolio have a rather long land lease.

313@Somerset was built in 2009 but its land lease starts in 2006 and will last till 2105.

Sky Italia is freehold.

Sky Italia have a first option to purchase the Milan Property

The tenant has a contractual clause to the right to purchase the Milan property should LendLease Global Commercial REIT wishes to sell.

If they choose to exercise the option, they would have to match the price LendLease wishes to sell to the buyer.

LendLease Global Commercial REIT’s Management

The CEO Kelvin Chow Chung Yip used to be the Chief Financial Officer of Keppel REIT. Prior to that, he was the Chief Financial Officer of Soilbuild Business Space.

The general manager Liaw Liang Huat is a banker who used to work LendLease and Standard Chartered Bank.

LendLease Global Commercial REIT’s Management Fee

I do find that this REIT have the most nostalgic fee structure.

- A base fee of 0.30% a year of LendLease Global Commercial REIT’s deposited property

- A Performance fee of 5.0% of a year of LendLease Global Commercial REIT’s NPI

For the first 2 years, LendLease’s management will choose to receive the fee in units.

Most of the newly listed REITs will base their base fee on 10% of distributable income and performance fee on DPU improvement. The way LendLease Global Commercial REIT structure their fee, they will almost always earn.

NPI is higher than distributable income, so it makes sense to charge 5% instead of 10%. But in this case, it is as a performance fee rather than base fee.

Whichever way, whether it is 10% of distributable income or as a percentage of asset, typically the base fee usually work out to 0.4% of the asset value for most REITs.

You can compare LendLease Global Commercial REIT’s fee against the others.

There should not be Withholding Tax Levied by Italy

LendLease Global Commercial REIT structure their Milan property with a common AIF structure in Italy.

This AIF will pay the dividends back to the Singapore company.

When we deal with overseas property, you have to contend with volatile taxation laws.

The prospectus list out the conditions in which the AIF will be exempted from withholding tax. LendLease Global Commercial REIT have updated that the AIF constitute as an undertaking for collective investments that is established in a state included in the white list.

Thus, the rental income send back to Singapore should not be taxed for withholding tax.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

JH

Saturday 28th of September 2019

Hi Kyith, I briefly browsed through the prospectus but haven't noticed any information on how units will be allocated if the IPO is oversubscribed (and it seems like it will be quite oversubscribed). Do you know where this information is typically found? Thanks

Kyith

Sunday 29th of September 2019

what do you mean? whether the stabilized units will be allocated in the event of oversubscribed? should be in the prospectus

Ani

Tuesday 24th of September 2019

Hi Kyth,

My quick research on Landlease sponsor showed that they have a few troubled projects.

Would it affect the future potential quality properties from the sponsor?

https://www.fool.com.au/2019/08/19/why-the-lendlease-share-price-has-rocketed-10-higher-today/

Thanks