If you would like to post some rather vulnerable rant about the CPF on your social media, you got to recognize a few things:

- The CPF team picks up these things rather fast. This may make people abuse the social media as a way to get their unreasonable request through

- CPF have a serious trail of where every $1 that goes into your CPF goes. This means

- Into which account whether it is RA, OA, SA or Medisave

- If it is paid out, when it is paid out

- Where every dollar comes in originates from, whether it is a voluntary top up, retirement sum top up, or from your employer or employee contribution

I am not sure if there is a need for this level of sophistication but in a way, in some situations it does help.

There is this little incident that got picked up in the media.

A certain Mr Toh Thiam Hock Michael was voicing his displeasure that he is only getting $15 back in his POSB account. While his HDB is fully paid up, there are much utilities that he has to pay.

Mr Toh probably is the generation that is still under the old Minimum Sum Scheme (MSS) instead of our FRS, BRS and ERS. Instead of CPF Life, once activated, CPF will pay out a certain fixed monthly sum depending on how much he has in his CPF.

CPF provides a Response

CPF picks up these kind of chatters damn fast.

And here is their response:

No truth to allegation that most of his CPF funds were transferred to MediSave without authorisation. His Retirement Account had already been depleted following monthly payouts to him since 2013.]

Mr Michael Toh Thiam Hock claims that most of his CPF savings had been transferred to MediSave without his authorisation. This is not true. If there were such transfers, it would appear on his CPF statements.

In February 2019, in response to Mr Michael Toh’s allegation that his CPF savings were locked up, we had informed him that although he does not have enough CPF savings to meet his cohort Basic Retirement Sum, he is eligible to make a withdrawal of about $10,000 from his Ordinary Account (OA) and Special Account savings. To date, he has not applied for his lump sum withdrawal.

Like all CPF members, Mr Michael Toh’s CPF contributions are allocated to the Ordinary, MediSave and Special accounts for his housing, healthcare and retirement needs. We note that he has used over $86,000 of his CPF savings to meet these needs. Over $54,000 was used for his flat which is now fully paid up. Mr Toh has also withdrawn over $9,000 from his Retirement Account (RA) since 2013. Although his RA is now depleted, he continues to receive $15 monthly due to the government paying extra interest on his OA savings.

Like all homeowners, Mr Toh may wish to enhance his retirement income through options such as (a) renting out a room, (b) right-sizing his flat, or (c) selling a portion of his flat’s lease back to HDB under the Lease Buyback Scheme. HDB officers are available to guide him through the process.

– CPF on Social Media

You can see their response is as dry as it can be.

What we are also able to observe is how clearly CPF knows where each of Mr Toh’s CPF dollar goes to. Mr Toh has an option to take out, which means he has money.

While he does not meet the minimum sum, he is still able to take them out over time.

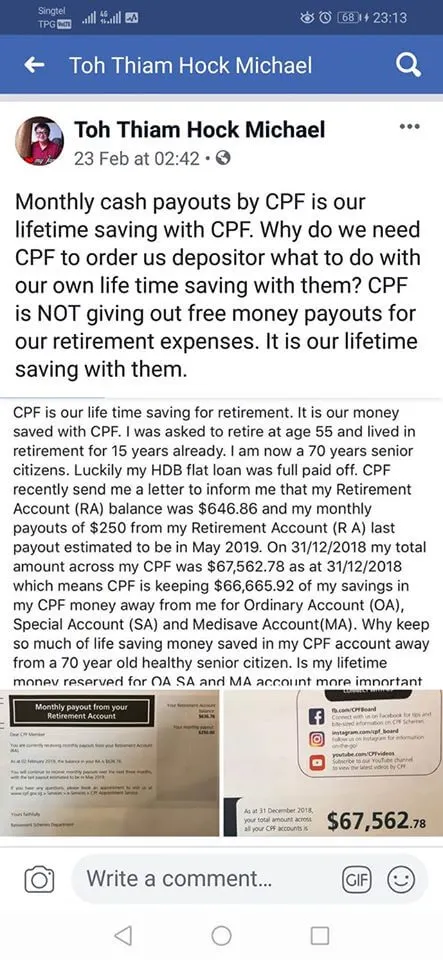

A Different Rant in February this Year

During the response in Feb this year, Mr Toh’s gripes is a little different:

From the CPF statements it can be seen that he has $66 to $67k in his CPF accounts last year. This is far higher than what is in the Medisave account.

The most important thing is that Mr Toh is getting $250 a month in payout from CPF Retirement Account. But the account is running out of money.

Mr Toh’s gripe then was: Why do you keep so much of my money locked away?

Further Checks on Social Media

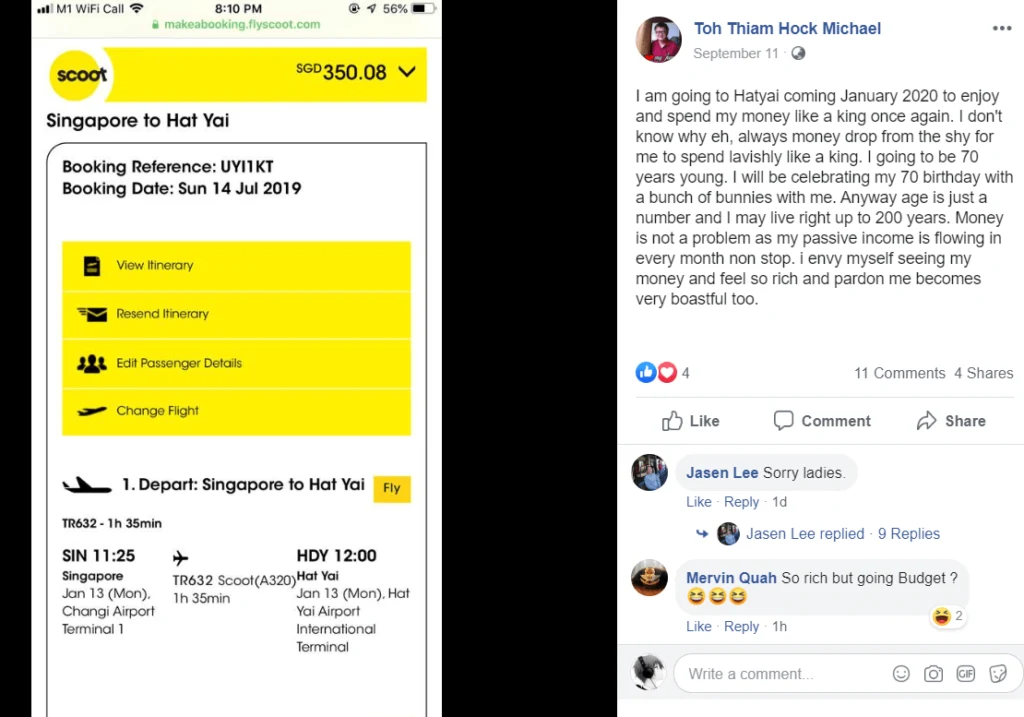

Mr Toh’s private life from what I can see…. is deeply concerning.

He has this political slant that seemed to be not too happy with the incumbent. If you are interested, you can do a search up his name and it should bring you to that page.

But my biggest take away is this post:

I am not sure this is a satire post, or him being sarcastic. Honestly, after this series of post, I lean towards not trusting what he says most of the time.

But if you wish to come up with a coherent narrative, why follow up a post of you not having much money to pay your utilities, with a post of not having passive income non-stop?

These Rants is Likely to Backfire Badly for Him

Mr Toh does not realize that it is these kind of rants that is going to eliminate rather than advanced what he leans towards.

They feel that the government is out of touch with society. But I do think they are the one that is out of touch with society. Especially the younger ones.

He has generated a whole narrative by posting some negative comments, and then see the whole social media tearing his argument apart.

People look at this whole story and think: “Wah liew, I better don’t turn into folks like this next time.”

And those who view him associate the behavior of the parties that he leans towards to be the same as him.

People wishes to be seen as able to make logical choices. The more we have these kind of episode is going to hurt them more.

And it seems, folks like Mr Toh is really out of touch with a key part of the society, not the government.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Ho wei wei

Friday 13th of September 2019

Where is my cpf life interest i already ask for the cpf board and they push to cpf life until now letter send come no prove for the interest the amount show 5 years the amount same but the letter written have 4percent why never add togegher to prove same as ra sa oa account than i call and ask if i pass away at age 64 or leave singapore tthey feed back only pay back the amount and where the interest go who which to keep money without interest i think only the goverment people like it

Sinkie

Saturday 14th of September 2019

Ho wei wei,

Interest for CPF Life accrues into the pooled fund & not into your individual account. This is the price to pay for lifetime payouts which are higher than other insurance companies on the market, and to ensure long term viability of the annuity scheme.

You can opt for CPF Life - Basic Plan, where only about 10% of your BRS/FRS/ERS goes into CPF Life, and the rest remains in RA. Interest in RA of course accrues to your own account, hence the larger bequeath amount if you die before reaching around 84. The catch is a smaller monthly payout.

You don't need to choose which CPF Life plan before 65. Hence before 65 all your retirement sum remains in RA & earning you 4+% interest that accrues into your RA account. Hence you don't need to worry about your nominees not getting those interests if you die before 65.

CPF staff would have explained the above to you. You should have asked them further if you didn't understand.

PS: For other readers too as many Sinkies are confused over CPF Life issue.

Huh...

Friday 13th of September 2019

Bro, let's raise a indiegogo for you to buy a keyboard with punctuation keys. Hard to understand your problem, my friend used hokkien to describe your problem - gong jiao wei.

I'm testing to see if it's a site problem, so if my post has no punctuation too, should feedback to the site.

Kyith

Friday 13th of September 2019

Hi Ho Wei Wei, i find it difficult to read as everything is in one sentence. Can you help me break it down with some fullstops?