If you pay attention to major news publications and financial media, you might have heard that MoneyOwl came up with this new income product called Fullerton MoneyOwl WiseIncome.

This is a multi-asset unit trust that is currently exclusive to MoneyOwl.

As the baby-boomers get older, many retirees are looking for a sensible income product that provides recurring income for their retirement.

In this article, I will explain more about the WiseIncome fund.

Why Do We Need the WiseIncome?

Many wealth builders struggle to properly distinguish the product from financial planning.

So when they sought out a solution for their financial problem, they would usually go with a product that includes the financial planning element.

MoneyOwl WiseIncome is a solution that marries financial element with investment management.

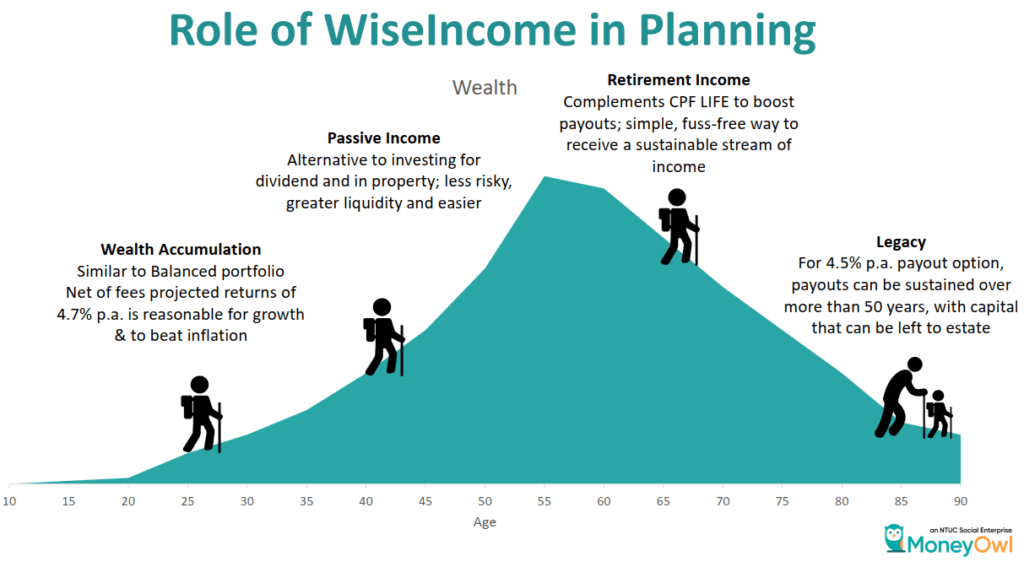

The fund

- Can help you accumulate towards your financial independence.

- Can provide you with passive income during the retirement phase of your life.

- Can provide you some alternate income in case you need the income for short term needs.

WiseIncome is a unit trust that you can use for both accumulation and deaccumulation.

1. Alternate Stream of Income from Work For Financial Security.

If you are in your 20s to 40s, you are still accumulating towards financial independence. However, you may prefer an alternative stream of income that is different from rental income or work income.

If you are retrenched from work, the income from your investment in WiseIncome may be able to pay for some of your expenses.

2. Growing towards Your Financial Goal if Nothing Goes Wrong.

If you do not need the income, WiseIncome can still grow at a growth rate that allows you to reach financial independence.

One of the common fear is that a focus on income may push the fund manager to concentrate the portfolio on income-specific financial securities. The opportunity cost would be to forgo growth for income.

WiseIncome sought to address that by balancing the need to generate income while still deliver a reasonable returns expectation.

3. Additional Stream of Income During Retirement.

If you are in your 50s to 60s and intend to spend down your wealth, the income from WiseIncome can augment your other streams of income such as rental income, CPF life annuity payout.

4. Preserve Your Capital While Giving Adequate Flexibility.

Some of you might have a lot more money than you need and wish to preserve the money as a legacy for your heirs.

Yet at the same time, you wish to tap upon it for contingency or to spend but not reduce the capital.

Certain share class of WiseIncome would allow you to have that flexibility.

The Nature of WiseIncome’s Income Stream

There are three different unit trust classes for WiseIncome. Each of these class have a unique income stream mode:

- No payout: Accumulation mode

- 4.5% per annum payout: The fund will pay out 4.5% of the net asset value of the fund. Since the net asset value will fluctuate, this means that from year to year, the value of your payout will fluctuate as well.

- 8% per annum payout: The fund will pay out 8% of the net asset value of the fund. This is a heavier payout and thus is meant more for a retiree intending to have more income and to spend down. If the fund provides more income, the net asset value will go down over time.

With regards to #2, while the fund manager intends to distribute 4.5% per annum, the fund manager has the discretion mandate to reduce the payout so that they can better sustain the fund in the interest of the unit holders. They could also choose to pay a higher rate of 4.8% per annum in some years.

If you invest in the WiseIncome, you need to get ready that if you select option 2 or 3, your income will be volatile.

But you know that for option 2 the manager has a job to balance paying you enough and making sure that your capital is intact.

This is what you want. Many of you might be managing your own portfolio, and wonder how do you gauge how much to distribute to yourself so that you do not impair your capital.

Even if there is a period where your portfolio grow very well, you would need to think about whether it is reasonable to give yourself a larger payout.

With WiseIncome this is handled by the Fullerton fund manager.

You can only invest in one of those three unit trust class. You cannot have three modes of payout.

However, you can sell from one unit trust class into another so that you can get a different kind of payout.

Since MoneyOwl charges the same advisory fee as a percentage of AUM, and the expense ratio is the same for all three, there are no-cost switching between funds.

Lifecycle Planning with WiseIncome

So knowing what we know about the unit class of the different WiseIncome, how can you incorporate this into your financial planning?

Let me bring you through 2 different human lifecycle.

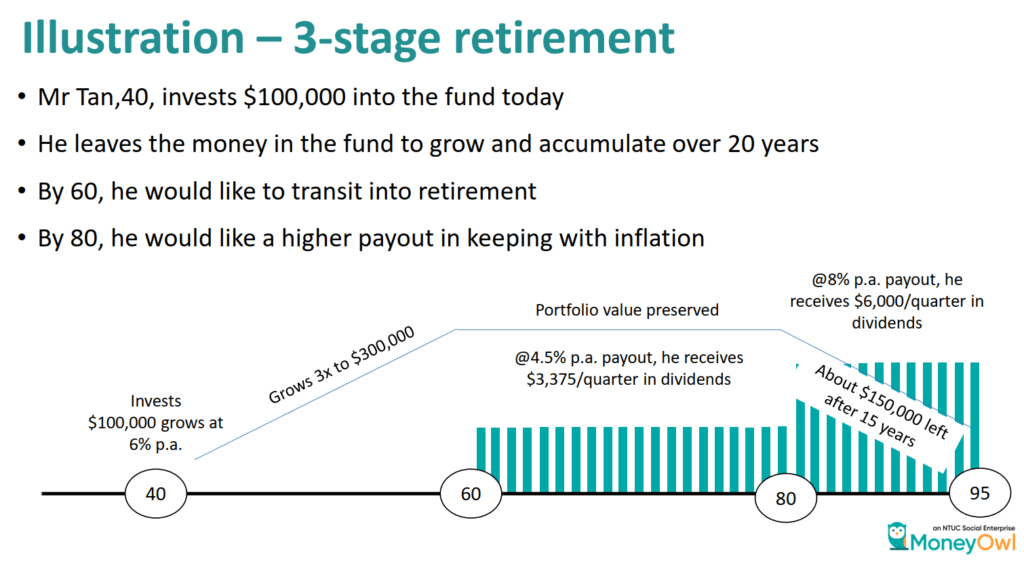

1. The Traditional Retirement

Mr Tan is probably the same age as me (sorry I am one year older than him) and he has the typical human lifecycle.

He wants to accumulate the money so that he can retire roughly at 60 years old. He thinks that he will live closer to 100 years old and while conservative, if he last till 80 years old, he prefers to spend down majority of his capital since he has no one to give to.

Mr Tan has two options. He can invest in the class that pays 4.5% a year in the payout or the class that does not pay any payout.

If he chooses the no payout class and has an immediate need that is short term (say 3-months), he can

- Sell units equivalent of an amount that is conservative and will not kill his portfolio (typically less than 4% of his capital)

- Switch to the class that pays 4.5% a year

If he chooses the class that pays out 4.5% a year, when he has no immediate needs, he can reinvest the payout, together with regular injections back to the fund.

At 60 years old, he will receive annual payouts equivalent to 4.5% of the NAV each year. If he needs more, he can in theory sell some more units to get additional cash flow (he would have to manage well)

At 80 years old, he can switch to the class that gives a higher payout.

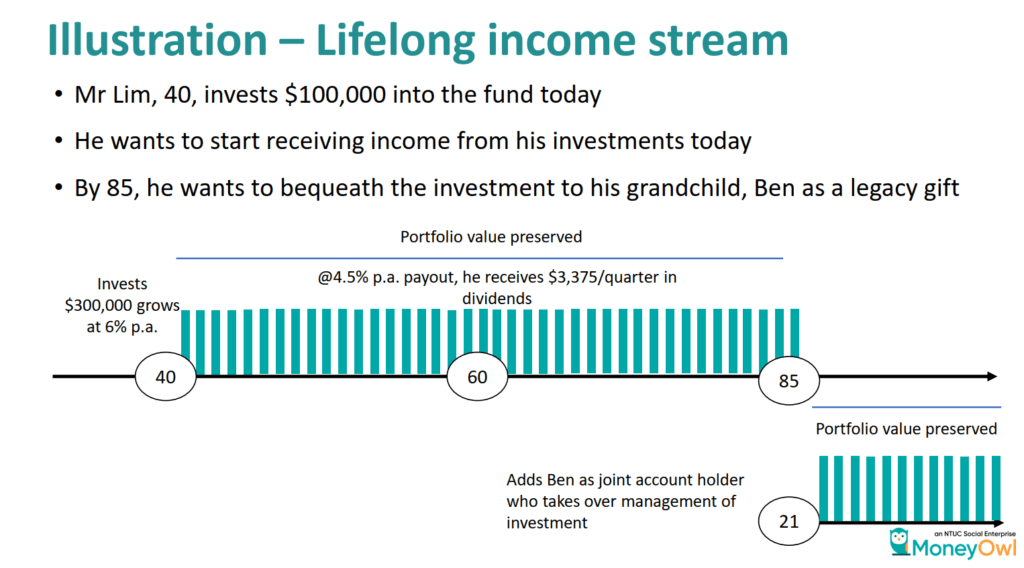

2. Legacy Planning

Mr Lim is a little different from Mr Tan in that he wishes to spend down his wealth immediately at 40 years old. He may be what we would term early retiree.

He would spend 4.5% per year of the NAV of the fund from 40 to 85 years old.

Since Mr Lim has open a joint MoneyOwl account with his son, upon his death, his son will immediately be able to receive his income stream.

If Mr Lim did not open a joint account with another family member, this portion of his wealth will be part of his estate and would have to go through proper probate process.

Under a joint account, the surviving account holder can withdraw all the monies in the MoneyOwl account and open a new account.

This seems to be coherent with how a lot of financial institution handle joint account with a deceased account holder.

But it does help the family speed up the probate process.

How WiseIncome is Constructed and Managed

The Fullerton MoneyOwl WiseIncome unit trust is managed by Fullerton Fund, which is a subsdiary of Temasek Holdings.

MoneyOwl conceptualize the idea behind WiseIncome and worked together with Fullerton and gave them the management mandate.

This is an actively-managed unit trust as compared to a passively managed one.

This is not a fund where the manager takes your money and invest in 4 different exchange-traded funds (ETF) or unit trust.

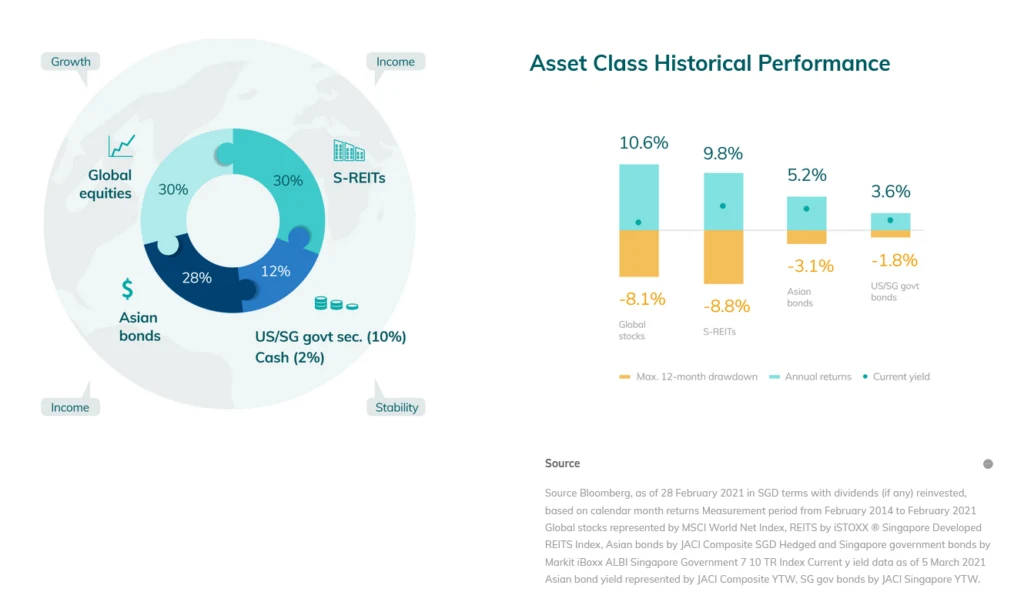

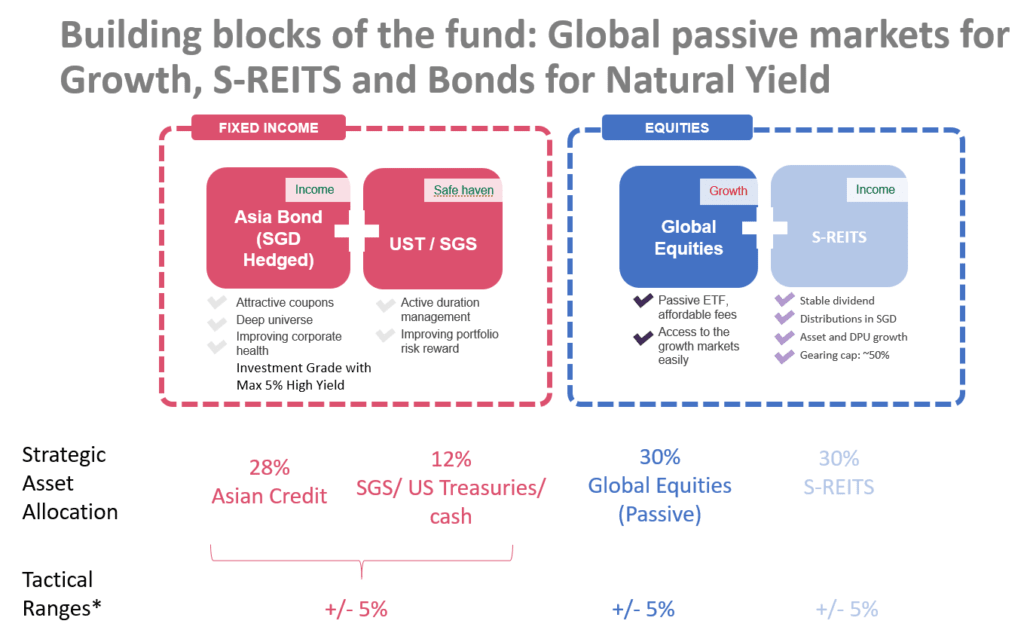

The fund currently invest in:

- 30% Global equities

- 30% Singapore REITs

- 28% Asian Bonds

- 12% US government bonds and Singapore government bonds and cash

Fullerton will tap upon a passive-index instrument to gain exposure to the global equities. However, for the rest, they will hold individual securities.

From what I understand, there will be no benchmark index to measure the performance of the Fullerton fund.

The fund is a 60% equity and 40% bond portfolio. So it will have the risk and return profile of a balanced fund.

The net asset value (NAV) of the fund is updated daily so the fund value will just fluctuate.

The fund is constructed with various characteristics:

- The US treasury and SGD bonds are the safe-haven assets. If another COVID-19 or GFC comes, this portion will reduce the volatility of the portfolio

- The Asian bond will also cushion the portfolio during bear markets.

- The Asian Bond and Singapore REITs are typically income-producing financial assets

- The Global Equities and Singapore REITs will provide capital appreciation.

- The short term government securities will do well in the short term if short term interest rates rise due to inflation. The properties in Singapore REITs is also a natural hedge for inflation (although they are also interest-rate sensitive assets so not sure how well they will do in that future scenario). Global equities should do reasonably well in a high inflation scenario (you can read my Providend article here about high inflation and equities)

The manager has the discretion to tactically shift the allocation between asian bonds and the government bonds, as well as between global equities and Singapore REITs.

The portfolio manager’s role is to review and identify the bonds and Singapore REITs that are high-quality, at a good value, yet provide a good income.

The securities are generally held to maturity but the manager has the discretion to sell if the risk/reward tradeoff benefits the shareholders.

The asian bonds are hedged

I will probably provide some additional data to give you some sensing at the tail end of this article.

What is the Minimum Investment?

The minimum starting investment is SG$1000 for lump sum investment and SG$100 for regular savings plan (RSP) investing.

What is the All-In Access Cost to You?

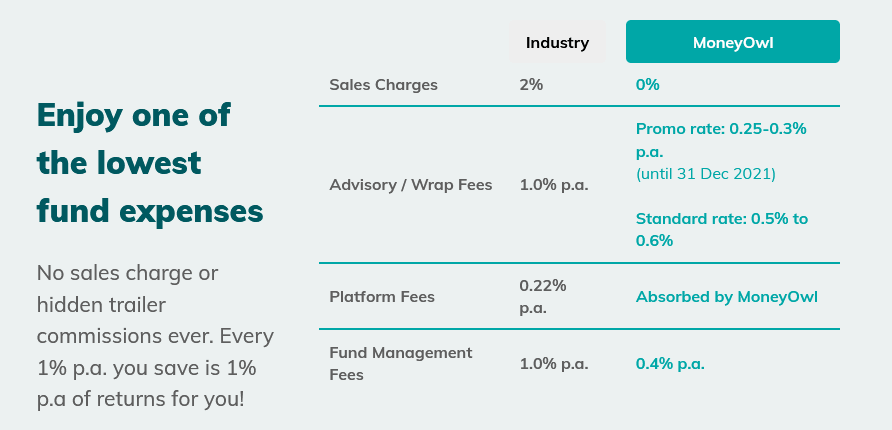

The Fullerton MoneyOwl WiseIncome fund has a management fee of 0.40% a year.

So for 0.40%, you will get active income portfolio management expertise. This has got to be one of the lowest around.

This is a management fee more associated with more passive, quantitative index strategies but MoneyOwl and Fullerton are able to keep the cost down.

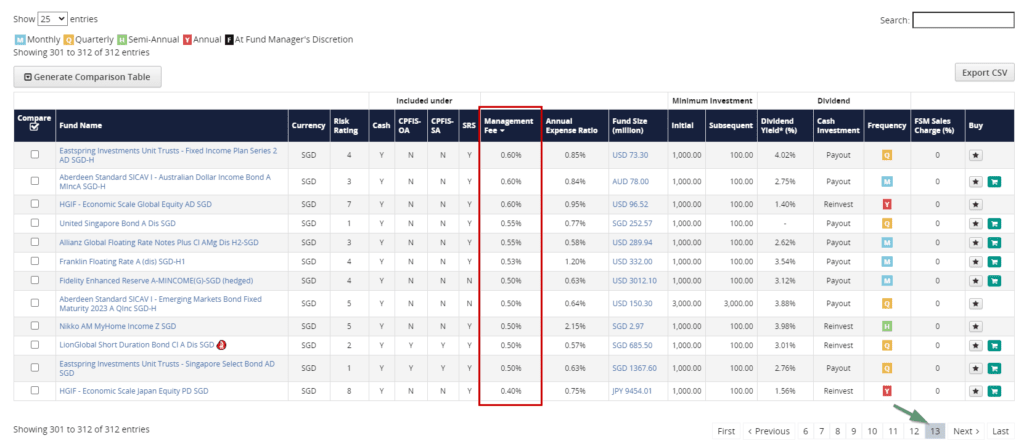

The table below shows a list of unit trust that have some frequency of dividend payout from Fundsupermart:

There are 312 such unit trust. This is the last page. Except for HGIF – Economic Scale Japan Equity PD SGD, most of the unit trust whether is equity or bonds or multi-asset have a higher management fee than the Fullerton MoneyOwl WiseIncome fund.

269 out of the 312 have higher than 1% management fee with the highest having an annual management fee of 2% (First Eagle Amundi International AHS-MD SGD-H)

There are no sales charges, switching fees.

MoneyOwl’s Advisory Fee is between 0.50% to 0.60% a year but during this promotional period (till end of 2021), they have lowered the advisory fee to 0.25% to 0.30% a year.

How Does Spending 4.5% of Your WiseIncome Net Asset Value Look Like?

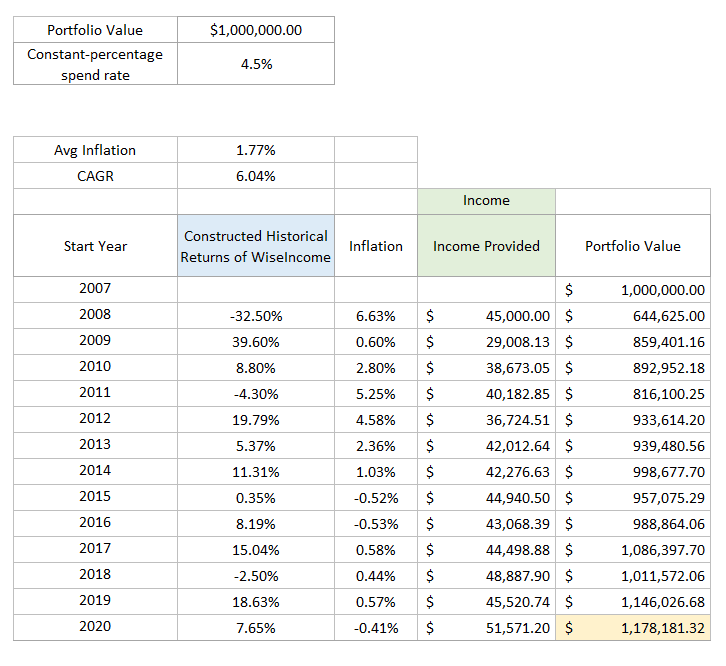

The folks at MoneyOwl was able to help me construct an index that represent the historical return of the WiseIncome fund.

Disclaimer: This is not the actual return, it is based on historical returns from reference indexes. The constructed returns and volatility should have close similarity with past results should WiseIncome exist since 2008. Past performance is not indicative of future returns.

In any case, some of you would like to see how volatile your income would be if you spend 4.5% of your portfolio’s net asset value.

We have about 13 years of annual returns so we can simulate if Kyith has a $1 million dollar portfolio and decide to dump all of it into the Fullerton MoneyOwl WiseIncome fund.

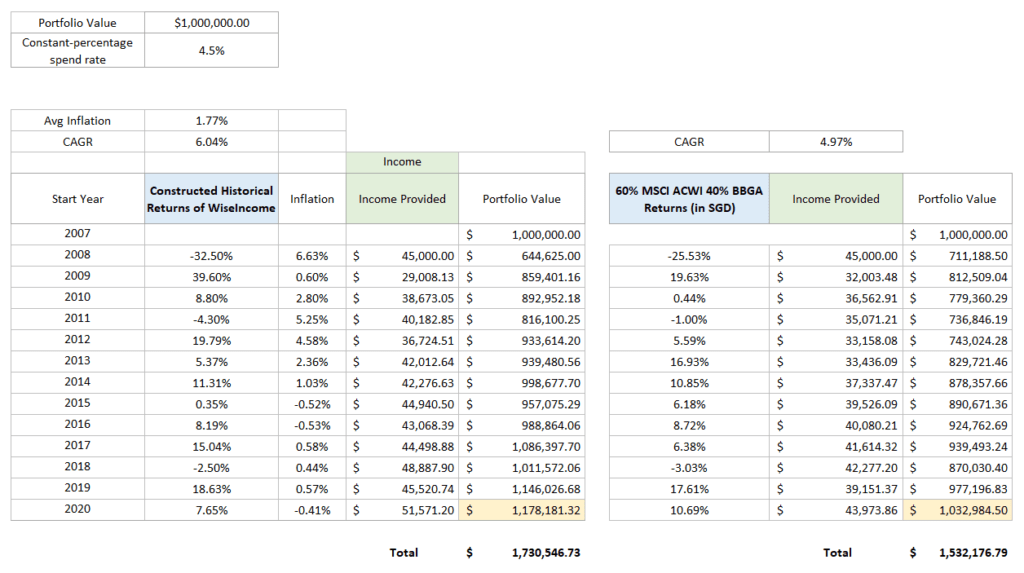

The table below shows the income provided and the change in portfolio value:

The portfolio has a compounded average rate of return (CAGR) of 6.04% a year over these 13 years.

There were 3 down years. Right off the bat, the portfolio got a negative sequence of 32.50%!

This is probably the much-feared negative sequence of return that I mentioned a lot, that has the ability to ruin your retirement, make your money run out earlier.

In year 2, the income provided is only $29,008 because the portfolio value fell to $644,625.

When portfolio value goes down, payout goes down.

The beauty of taking only 4.5% of NAV is that your portfolio in theory won’t run out of money.

If the portfolio is left with $100, 4.5% gives you an income of $4.50 a year. You cannot do anything with $4.50, but your portfolio don’t run out of money.

In Year 3, the income increase to $38,673 because the ending portfolio value in Year 2 is $859,401.

After 13 years, the portfolio value ends at $1,178,181. I would have taken out a total income of $552,365 during these 13 years.

Some of you might be wondering how does this constructed return do against a generic global equity and bond index portfolio.

In the following illustration, I compare the “retirement experience” against a 60% equity 40% bond portfolio made up of 60% MSCI All Country World Index and 40% Bloomberg Global Aggregate (BBGA) Bond Index:

The portfolio simulating WiseIncome’s historical returns gave more income and has a higher ending portfolio value than the 60/40 MSCI ACWI/BBGA portfolio.

Not too shabby.

The downside of spending a constant percentage (if you are interested you can read my article where I go through different types of spending strategies. Each of them has its pros and cons. Definitive guide to variable withdrawal strategies.) is that your income is volatile and may not keep up with inflation.

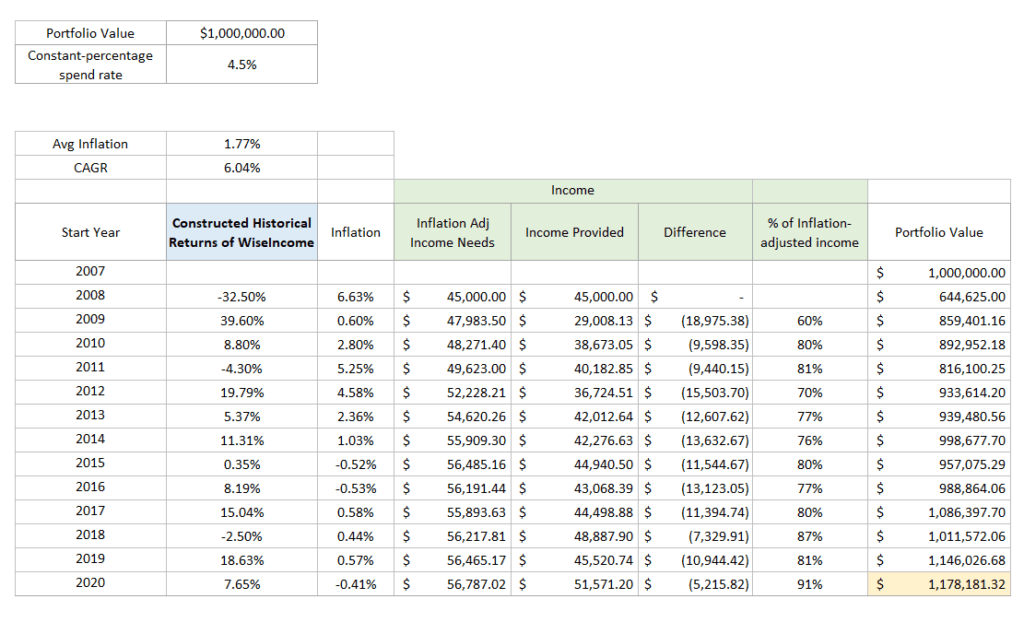

In the table below, I introduced a column to show the required inflation-adjusted income needs, and measure the difference between the need versus the income provided:

While the portfolio is able to retain its value, your income may not retain its purchasing power. This is the nature of the payout method.

To remedy this, you have the freedom to sell some of your units to extract cash flow, if you need more income.

This is the benefit of using a unit trust or ETF for your wealth building and retirement spending.

If you use a traditional insurance retirement plan, you will not have this flexibility.

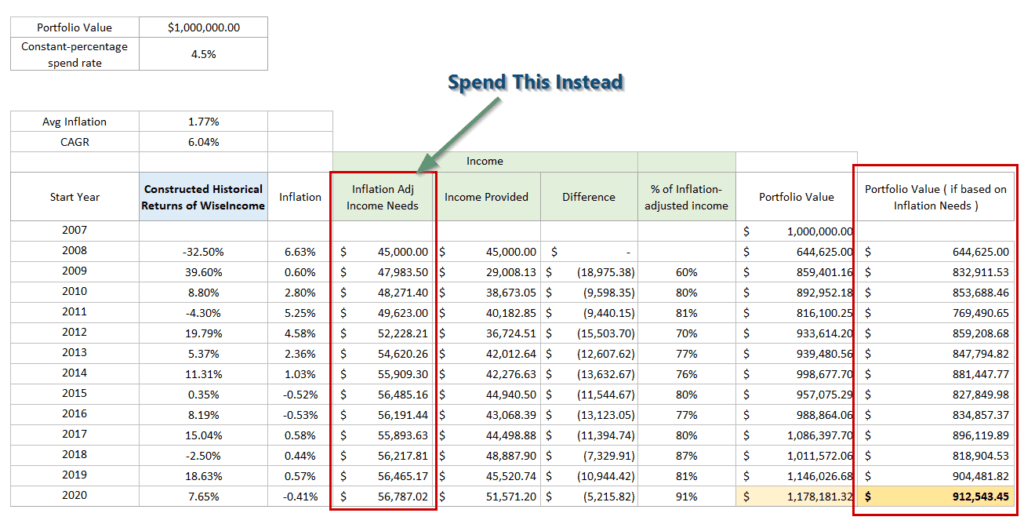

But would my capital deplete faster if I spend according to the inflation-adjusted income needs?

I did a simulation of the ending portfolio value if we spend an inflation adjusted amount:

The portfolio value would have been lower but not really a deal-breaker. Kyith would have spent more ($691,675 versus $552,365)

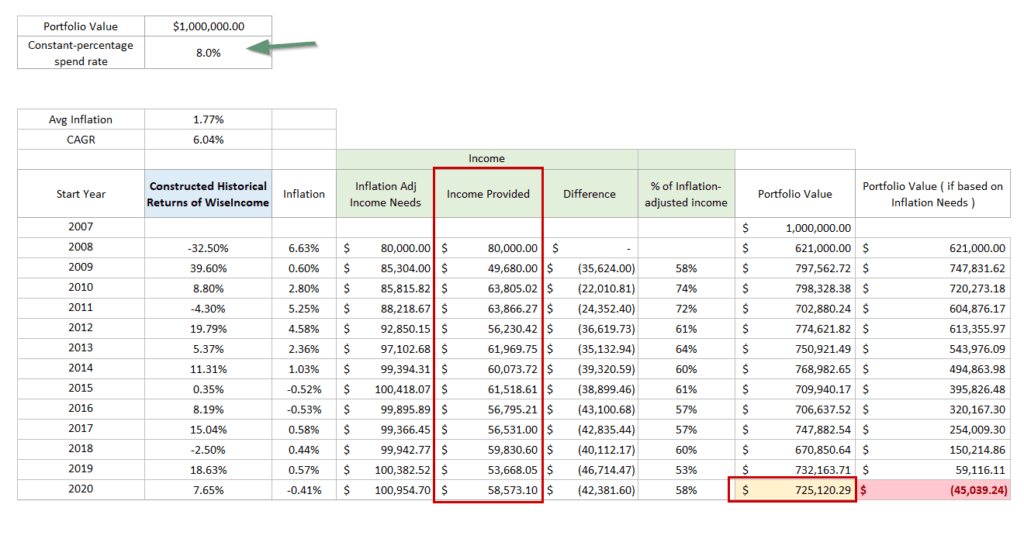

How Does Spending 8% of Your WiseIncome Net Asset Value Look Like?

This is the curious one.

If we take a greater chunk, the portfolio eventually will struggle to grow. But how would it look like?

Here is the simulation:

Firstly, you can see how the constant-percentage spending method keeps you in the game. After 13 years, Kyith would still be left with $725,120.

My annual spending gets bumped up more than 4.5%. However, the income never reached the initial $80,000 for the past 13 years.

I can also choose to sell units so that I can spend an inflation-adjusted amount. However, the money will run out after 12 years, compared to just spending 8% of the net asset value.

Conclusion

I hope that I gave a good overview about the WiseIncome fund.

There are many income products out there. The problem is that there are not a lot of products that you know roughly how it works.

Why is it important to know how it work?

So that you have conviction. We often recommend readers to stick with simple indexed unit trust or ETF because you can validate the performance. We can go back into history to review the performance of these indexes so that we can assess the level of volatility and the range of returns.

It is tough to do that with active funds. There are good active funds out there, but a lot of time, the managers expect us to trust how they manage and when there are poor performance (or unexpected good performance), we have a tough time finding out why they performed the way it did.

The financial planners do not have a direct line to the managers. So if you ask why your income fund give this income, you are left with generic answers.

I look at WiseIncome as a unit trust where the mandate is rather clear. The manager still has to deliver but at least if your money is managed by MoneyOwl, they have a direct line to find out about the performance attribution (what caused the outperformance or underperformance? is it the asian bonds, global equities or the REITs?)

I think it can also be more assuring with greater transparency. This is what we hope more unit trust to do. Unfortunately, the portfolio managers cannot always go out there and explain what they do in the fund (because they need to manage your money) and it may not be in your planner’s interest to find that out.

The fund is a nice balance of growth, income potential with a volatility profile close to a balanced fund, providing SGD income.

If you are interested, check out the Fullerton MoneyOwl WiseIncome here today.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

tg

Sunday 18th of April 2021

Hi Thanks for the article. How different is this MO WiseIncome different from Multi-Asset Premium Fund by NTUC Income/Fullerton Fund Management?

Can you also help to clarify Point no 2. in the article. Legacy Planning: Illustration-Lifelong income stream. It shows Mr Lim age 40 invested $100K today and the payout @4.5%pa= $3,375/quarter. At 85, leaves bequeath to grandson Ben. It also shows Ben as joint account holder. Q1: For 100K, possible to receive $3,375/quarter?, Q2: bequeath to a joint account holder?

tg

Sunday 18th of April 2021

@Kyith, Thanks for the explanation

Kyith

Sunday 18th of April 2021

Hi tg, i have no idea deep enough about the philosophy of the Mutlti-asset fund. It looks like an unconstrained fund that is geared for appreciation. There are no benchmarks similar to the WiseIncome. Regarding the illustration, it shows $300,000 distributing $3375 a quarter and not $100k. This legacy use case is basically explaining that if you create a joint account, you have this benefit where the joint account holder can get access to the investments and this money do not automatically fall under the deceased investor's estate.

Pete

Sunday 11th of April 2021

I read this article with a lot of interest. I am close to retirement and struggled to find a reliable way to generate income when I stop working. I have been looking at mostly padding my CPF (by returning money from property purchase) and be happy with guaranteed 2.5% annually.

I am curious, based on the table you have worked out for the 4.5% draw down model, are residual values inclusive of management fees from MoneyOwl (MO)?

What is the relationship between Fullerton, MO and me? In this arrangement, does it means I am a client of MO and Fullerton would have no idea I bought the fund? The fund would have been bought using MO as owner of those units? What if MO cease operation? These are relevant questions as we are talking about easily decades of drawing down the investment and being retired, we are rather vulnerable bunch if these are not legally protected.

Pete

Monday 12th of April 2021

@Kyith, Thanks!

Just to be nitpicking, the actual return from your table would be as much as 1% lower considering all fees.

Ref MO, the only robo I have a relationship with is Endowus and for that it is clear, I own the funds as it is clearly held in my UOB-Kay Hian account. It may not be amounting to much but for a "street" person it does give a bit of comfort seeing UOBKH sends me monthly statement of my holdings.

Again, thanks for writing this article, I have personally benefited from it.

Kyith

Sunday 11th of April 2021

HI Pete, the simulation do not include the advisory fees. The purpose is to show the nature of spending with the product. You will be a client of MO. You will own the fund through MO. Your funds are customized with IFAST. the manager of the fund is Fullerton. In the event that MO does not carry on with this business, you can still hold on to this investment as the custodian is iFAST. There might be an arrangement to sell your units managed by a new financial adviser. If the fund close down, they will liquidate your investment and return you the money. Numerous funds have closed down annually so it is pretty normal.

Retirewithfi is referring to the custodian of the units in Fullerton Wiseincome. the custodian of the units are with HSBC.

If you wish to understand the whole stack:

Adviser - MO Custodian of Wiseincome unit trust - IFAST Custodian of units in WiseIncome - HSBC Trust Custodian of actual securities in WiseIncome - I have no idea

So usually they are pretty independent. If MO goes away your stuff will be pretty ok. This is not unique to MO.

retirewithfi

Sunday 11th of April 2021

@Pete,

MoneyOwl's CMS license doesn't include custodian services so I believe they need to work with a bank providing custodian services for your holdings and I believe this is HSBC based on the product highlight sheet. But you raise valid questions - if you read the prospectus/product highlight sheet, there is one more entity involved - Lemanik Asset Management S.A and I'm not sure what's the relationships between all these entities. Also my understanding of the fees' structure, Moneyowl charges 0.5-0.6% advisory/wrap fee (Is this deducted from NAV too or taken from the payout) and Fullerton charges 0.4% management fee (which is deducted from NAV).