South China Morning Post (SCMP) wrote about a survey comparing how much it cost to achieve a set of financial freedom in different cities.

You can review how much financial freedom cost in this chart here:

Singapore ranks number 7 on the list. Our frequent rival Hong Kong is quite expensive in number 2 place. Kuala Lumpur is the place with the lowest threshold of financial freedom.

To be financial free, according to the standards of those surveyed by online property portal Juwai IQI, it would add up to US$3.23 million in Singapore (SG$4.33 mil)

That may look like a very big figure for some of you.

When I read this article, I tried adding up the cost of the desired lifestyle in my head and felt that the kind of the desired lifestyle they describe would cost much more than US$3.23 million in Singapore.

But I got a hunch that like a lot of survey, the respondents were lead in a certain way which results in the figures turning out this way.

Let me try to interpret the figures by wearing my financial independence and financial adviser hat.

What is Your Desired Financial Freedom Lifestyle?

Before you can find out how much financial freedom cost, you need to know the desired lifestyle.

Juwai IQI defines financial freedom as having the following parameters:

- Maintain a desirable lifestyle without having to work. In a second paragraph, they further define this as not driven by the need to earn a set of salary each year.

- Having enough savings and financial instruments to retire.

To attain this financial freedom status, you would need the following line-items:

- Home measuring 120 square meters (1291 sqft) in a decent urban area

- Two good cars

- Roughly US$1.2 million in financial investments

- US$90,000 in household income after tax

I find it challenging interpreting this desired financial freedom lifestyle purely from this set of description.

Let us break down the US$3.23 million by working out how much is roughly needed for each line-item.

How much does it cost so that you can have a desired lifestyle without having to work?

I think this set of description leans closer to what the financial independence community would term “FAT FIRE”.

This is a scheme of financial independence (you can review all the financial independence schemes of living here) where your residual income is so comfortable that you won’t feel constrained in your annual spending.

To achieve FAT Fire, your income needs are larger (because usually people who builds up towards FAT Fire builts in ample buffer)

The US$90,000 a year in household income is weird but after thinking through it, I think they refer to this as the income requirement during financial freedom.

This is one of the data point that makes me question if the journalist interpret things wrongly or Juwai IQI are very poor wealth planners.

If we take 90,000 divides by 1,200,000, we get a current withdrawal rate of 7.5%. The current withdrawal rate allows us to have some sense as to how long the money will last if the money is invested in financial investments that grow over time.

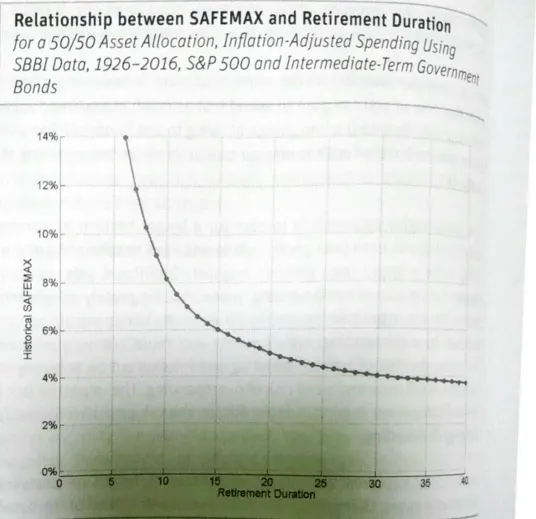

7.5% is a high withdrawal rate that I suspect won’t last the past 15 years.

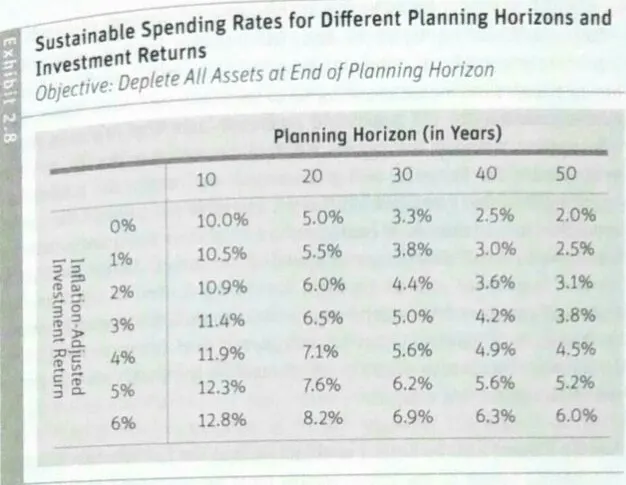

The following 2 tables were taken from Dr Wade Pfau’s book on retirement planning calculation:

Observe that from both tables, with a 7.5% first-year withdrawal, your money would last between 10 to 15 years. It could last 20 years if your rate of return is very high.

If their definition of financial freedom is to not work indefinitely, US$1.2 mil would not be enough.

Typical retirement planning will usually give us around a 4.5% withdrawal rate (don’t ask me why it is just an observation.). If you wish to be financially free in a very optimistic manner, you will need $90,000/0.045 = $2,000,000.

That is almost twice the amount Juwai IQI computed.

But using 4.5% is not entirely safe. If we assume $90,000 is really enough for FAT Fire, and you don’t wish to work since your early 50s, using a 3% withdrawal rate might be safer.

This would mean we need $90,000/0.03 = $3,000,000.

I think there should be some misinterpretation and it might be that their definition of financial freedom is “not driven by the need to earn a set of salary each year.”

This means they just want some safety protection and to have optionality in life. This means that they are still looking to work just not be so dependant on their job.

I think perhaps that is their definition of freedom overthere.

How Juwai asked the respondents in the survey greatly determines how the US$1.2 million comes about. The respondents could have been asked to select from a few numbers what is the desired sum of money they think is good to have.

If they were asked that way, then the respondents have set themselves up to be pigeon-holed to a limited set of financial independence figures.

So let us bear with it and just take on face-value people need US$1.2 million for their desired lifestyle.

How much does it cost to have two decent or luxurious cars?

What about the cost of two “good cars” in Singapore? Good cars give us a vague idea of what respondents were comfortable with. This could mean continental cars or it could mean two luxury cars.

Small luxury sedans such as Mercedes-Benz C-class, BMW 3 series and Audi A4 will set us back at $248k, $178k and $193k respectively (from ValueChampion research). The average price will be about $206,000.

If the desired lifestyle is two cars (do Singaporeans really desire two luxury sedans in Singapore?), that means they need $412,000 (US$307,400).

If good cars refer to two normal cars, then on average one normal car will set them back $110,000. They will need $220,000 (US$164,100). I think this is more likely.

How much does it cost to live in a 1291 square feet home in a decent urban area?

What about a 1291 sqft home in a “decent urban area”. I would think anywhere in Rest of Central in Singapore is rather decent.

If we select the condos of those areas that are closer to town, such as Farrer Road, Serangoon, Toa Payoh, Boon Keng, Marymount, Woodleigh, the new ones that are not too old range from $1,400 per sqft to $1,650 per sqft.

If we do not add any other cost, this would set a couple back $1.8 mil to $2.1 mil (US$1.34 to US$1.57 mil)

Adding up the 3 Line-Items

So if we were to consolidate the numbers:

- $1.2 mil for Savings and Investments

- $164,100 for two cars

- $1.34 mil for a decent condo

We get US$2.7 mil. This is below the US$3.23 mil provided by Juwai IQI.

If we were to use the higher grade option:

- $1.2 mil for Savings and Investments

- $307,100 for two cars

- $2.1 mil for a decent condo

We get US$3.6 mil. This is slightly higher than the US$3.23 mil provided by Juwai IQI.

I think the survey results are not too far off and we get sensing roughly the grade of the desired lifestyle the people are looking for.

Some Thoughts about this Financial Freedom Figure

My gripe with the survey is that it feels less practical for Singaporeans:

- I think in some cities, the mode of transportation is by car and thus having two sedans is desirable. Not so much in Singapore. Perhaps most desired to have one.

- A US$1.34 mil condo is about 15 times the annual salary of a couple looking for US$90,000 a year. If US$90,000 is their desired income to cover their expenses but in general they earn US$180,000 to US$220,000 a year, than that looks more realistic.

There are a couple of good questions you can ask yourself (or your friends and colleagues during lunch and dinner conversations) after reviewing this survey:

- Does your desired financial freedom lifestyle look similar to this?

- What is your desired, acceptable grade of housing, transportation need?

- How secured do you wish your residual income from investments to be?

I think for a lot of my friends:

- Living close to the central region and close to the main transportation line is desirable.

- Having one sedan is desirable.

- Having a certain level of residual income is desirable.

#3 would eventually need to cover all their expenses and last for at least 25 to 30 years.

Financial freedom, in my dictionary (see link below), is more associated with not having to worry about working and expenses so much. Thus, you really need a sum that is either closer to US$3 million, if your desired income is US$90,000 a year.

However, in the meantime, financial freedom aside, I think having 10 times their annual expenses is highly desirable because it gives the family a lot of options. (You can read what I wrote about how different levels of wealth can give you different utility here).

If your desired income is US$90,000, then that will be US$900,000. A single sedan can set you back US$82,000. A HDB that is in Rest of Central Region can set you back US$634,000.

This comes up to US$1.61 mil.

Looking at desired lifestyle this way is very simplistic but gives us an idea roughly how much it cost.

A couple would usually exchange their life so that they can get this desired lifestyle over time instead of needing a lump-sum to get this lifestyle.

You should shift the internal conversation to how you can achieve this desired lifestyle progressively over time instead of saying “I want this lifestyle right here, right now today.”

How realistic do you find this set of numbers? Let me know your thoughts.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

samuel

Sunday 11th of April 2021

Hi there i just would like to ask you about if its realistic to achieve 4-6% annual inflation adjusted targeted returns? as in if you were to look at all the financial products and offerings islandwide, what are the chances you would find 4-6% returns rate?

And i was asking stashaway who only manages a annual rate of return of 3.75% low risk income portfolio. is this good in your opinion? so if we round off to 4% and plug in those table you showed us above, it would be like if your investment horizon is 4% a year, for 50 years, does it thus mean that technically you could withdraw a max 4.5% of your portfolio amount every year for 50 years before the whole portfolio gets depleted?

for instance one has a 10million sgd portfolio for investment for passive income purposes, and at 4% rate, one could withdraw 450k sgd a year for 50 years am i right to assume that? thanks.

samuel

Monday 12th of April 2021

@Kyith, haha thanks a lot for your very long and comprehensive answer here, i guess most people who saw the figure at 4.3million being what is the benchmark for financial freedom, there would be some doubts as to whether this sum implies an individuals net worth or does it mean a family net worth lets presume family of 4.

actually before i though about the annual inflation adjusted interest rate, i was questioning myself if the report was actually being realistically truthful about having a 90k usd income (lets just presume its a family income) per annum , rounded and converted to sgd its about 120k sgd or 10k sgd a month. in your opinion is this sufficient to own a bmw 3 series, a mercedes c class and a farrer park condo thats 2.13million sgd? and afford 2 restaurant meals a day every single day and 1 hawker centre meal for a family of 4?

maybe lets take a look back, if someone has a usd$1.2million investment portfolio suggested by juwai iqi survey findings, and use exhibit 2.8 table above, the safe withdrawal rates for investment planning horizon and investment annual returns, now lets plug in the figure 5% as a going concern moving average inflation adjusted annual return based on what you mentioned above, does it actually translate into the following figures: just to make sure i got the table definition correct:

lets use 5% inflation adjusted investment returns , from the table, and $1.2m usd for illustration and clarification purposes,

so plaaning horizon 10 years , 5% means i can withdraw 12.3% of 1.2million usd, for 10 years in a row, same amount every year? then at the end of 10 years the whole sum is depleted, so in theory, $147.6k usd x 10 years is the "so called financially free family's" income stream for the whole 10 years

, at then end of 10 years, the financially free singaporean family would have used 1.2m usd to churn and generate $1.476m usd (ie a profit of 276k usd. is it right to imply this is what is exactly happening here with the table 2.8 above?

the same thing is happening for if we want to stretch usd1.2m for 50 years at 5% every year. we get 5.2% withdrawal rate x 1.2m usd which is 62.4k usd or about 84k sgd annually for the next 50 years, on average returns, it could be less than or more than 84k right? so thats how the table works generally?

Kyith

Sunday 11th of April 2021

Hi Samuel, let me see what I can answer. I think a lot of people expect that the returns to be a real return of 6%,6%,6%,6%,6%,6%,6% for 50 years. It does not work like that. Returns go up and down. If you review some of my articles that show the 10-year rolling return of the MSCI World ETF vs the MSCI All Country World ETF, you will observe that a lucky you could hit 12% a year for 10 years. But an unlucky you could get 2% a year for 10 years.

Stashaway cannot tell you the future because if you asked around, we cannot tell you the future. If the historical returns are any indication, you can get 5% a year inflation adjusted. But even then, inflation is unpredictable.

In the article, I computed the amount needed based on the Safe Withdrawal rate methodology. A lot of people don't understand this very well. The withdrawal rate methodology is like a lot of Samuel going back in time and each Samuel living through different 30-year, 40-year, 50-year period. Some Samuel will experience a deflationary cycle (where inflation is only 1.2% a year). Some Samuel will experience hyperinflation (where inflation averages 5.5% a year). Some Samuel will experience boom ties some Samuel will experience mediocre returns.

The study concludes withdrawing an initial 4% to be safe as that is the highest percentage a retiree can spend initially so that he won't run out of money. It is like the worst case scenario. The most challenging period in the past 80-90 years is the 30 years starting in 1968 to 1998. The poorest portfolio performance was maybe a negative 15%. The stock market was not the problem. the problem was inflation running at 5.5% and the retiree having to keep up with that spending.

The 3%,3.5%, 4% withdrawal rate is good as a Rule-of-thumb planning guide. If you are planning for your retirement, you will need more than this.

If you are interested to understand this withdrawal methodology you can read Bill Bengen's original article on his 4% Safe Withdrawal rate study here.

I use these withdrawal rate study heavily to let me know I am financially independent. Hope this helps.

lim

Sunday 11th of April 2021

I'm wondering whether this Juwai IQI is throwing random numbers knowing they are going to get a lot of publicity as the internet reposts their charts.

i also don't understand the '2 good cars' criteria unless that $4m figure refers to you and spouse, so in that sense you have freedom because you and your spouse don't share a car. But $4m for you and spouse and maintaining 2 cars in retirement... I don't think its 'financial freedom'

if $4m is per person, then it implies your spouse will own 2 cars and you will own 2 cars for a total of 4 cars in order to be considered financially free. sounds bizarre to me.

In retirement, I would probably want something with more cargo space rather than a sedan. also SUV have higher so its easier for older person to enter/exit. Looking forward to ix3 and EQC release in 2021, though probably better to buy in 2022 to get max rebate.

singvestor

Saturday 10th of April 2021

Juwai's public relations department did quite well, as their data was covered by quite a few news outlets. Their assumptions and data are quite strange. It is not clear if the USD 90k household income should come from some other passive sources, or should be generated from the USD 1.2 million, is quite unrealistic.

Adding the 120 square meter apartment to the list of "requirements" is also somewhat unrealistic / lofty in most of the cities. 120 square meters (sqm) is 1,292 square feet. Average price 2019 per square foot (source CBRE) and resulting price of 120 sqm apartment would therefore be: Hong Kong: USD 2,091 / USD 2.7 million, Singapore: 1,063 / USD 1.4 million, London: 776 / USD 1 million... That does not take into account that it is probably hard to find such large in apartments in Hong Kong to begin with.

Assuming that the early retiree would have the money for the apartment in cash, investing and renting might yield a better result in many cases. In the Singapore case, the USD 1.4 million invested would yield a cool SGD 6,250 a month at a 4% withdrawal rate. A nice, large condo can be rented much cheaper than that (SGD 4-5k easily, SGD 3.5k with some shopping around and compromises). This is also a good mitigation strategy against political risks (Hong Kong) and demographic risk (all cities, but especially Tokyo).

The idea that not only one, but two good cars are required is downright bizarre. The two expensive cars will eat up a large chunk of the USD 90,000 budget if they have to replaced every 10 years, as well as insured, parked, fueled and maintained. In Singapore a car is already inconvenient in my personal opinion, but even more so in Hong Kong and in Tokyo. Renting two garage spaces in a nice neighborhood in Tokyo is very expensive and driving anywhere in town is slower than public transport. Compared to the cost of car ownership that taking the Helicopter Shuttle from Mori Tower to Narita is a steal (starting from USD 280 one way). If public transport is not an option, budgeting SGD 2k a month for uber / taxis and the occasional helicopter transfer to Narita is much cheaper, less hassle and probably more fun.

A financially free life should be much cheaper than Juwai suggests, especially when making some smart choices...

Kyith

Saturday 10th of April 2021

Hi Singvestor! Thanks for the comment. Likely this is aspirational of the people. Likely, they might need to be better inform that if they expect lesser, it is much more reachable.