I got the announcement that Standard Chartered Bank is making its simple, financial planning solution available to all Standard Chartered Online banking customers.

I been a Standard Chartered Online Bank customer for the past 9 years. I use their platform for simple banking as well as trading needs.

Their trading platform allows you to trade in various markets such as Singapore, US, UK, Hong Kong.

Working in Providend, I played with my fair share of online financial planning applications. As a financial blogger, I also played with my fair share.

Standard Chartered’s online financial planner SC Goal Planner is robust. It has its limitations but for the everyday person, it is more than good enough to help them figure out if financially they are OK.

- Can you be financially independent? Does your wealth last till 100 years old?

- Are you well protected? Do you need more insurance coverage?

- What happens if I decide to buy a new home?

Standard Chartered collaborated with Better Trade Off (BTO), a Singapore headquartered fintech startup that created this very robust online financial planning software.

They enable financial planning firms and banks to give their planners the ability to chart client’s financial lives better.

So this is not a run-in-the-mill financial planning software coded inhouse.

And this is for FREE.

If you are a client, you can access this today.

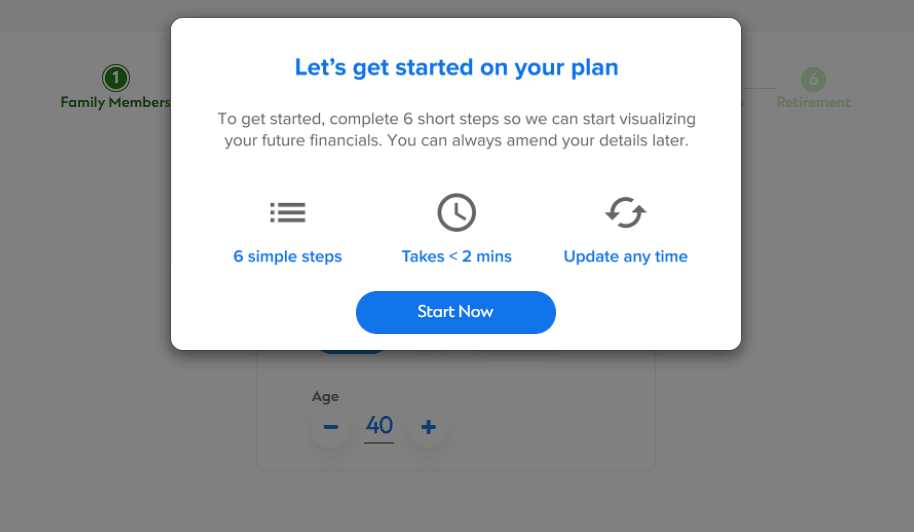

BTO have made the whole process more intuitive (you can let me know in the comments whether you have a hard time putting together a plan.)

Ok let me take you through what it can do.

You can access Goals Planner by going through your Menu and select SC Goals Planner under Goals & Planning.

Describing Your Financial Life

You will start your financial planning journey by letting the software know your current financial and non-financial life.

Creating a cash flow plan can be a daunting process for someone who have no idea what they don’t know.

SC Goal Planner tries to breach this understanding gap by coming out with a guided wizard to help you with that.

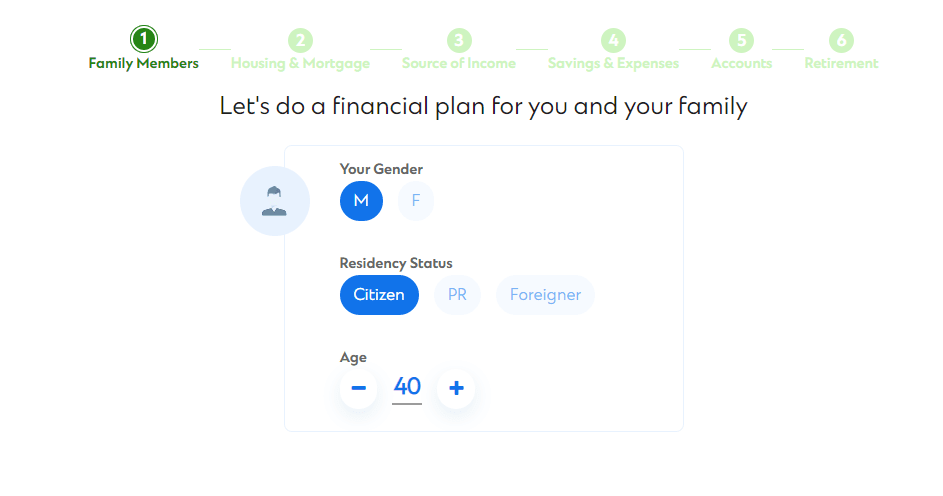

You can first define some basic information about yourself. Then you can define your family.

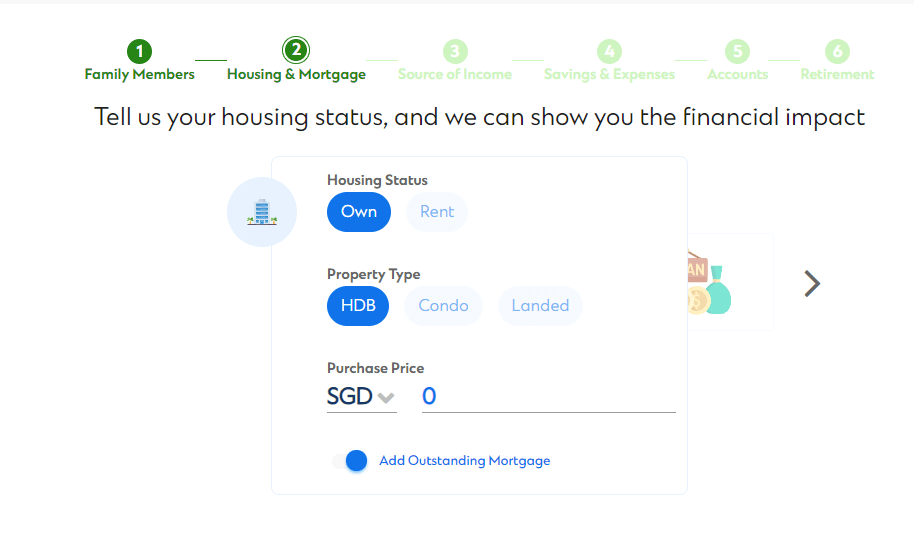

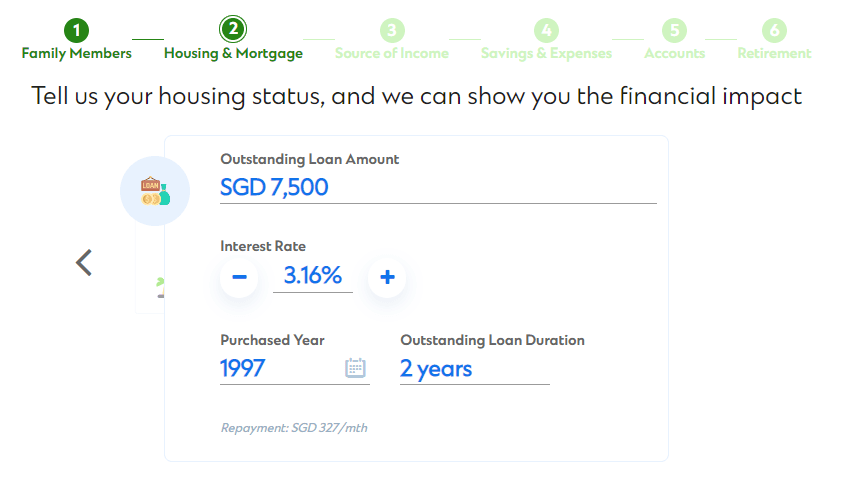

Under housing and mortgage, define whether you rent or own a property, what kind of property, what is the property type, what is the purchase price and what is the outstanding mortgage.

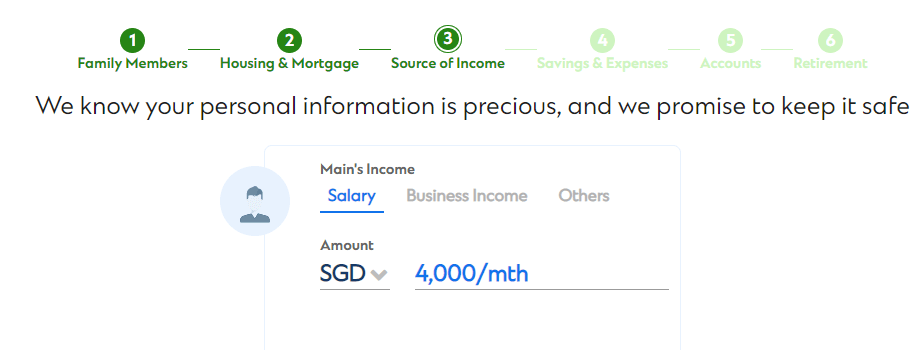

Next, you can define your income.

Your income is split into either your work income or income you can get from other sources.

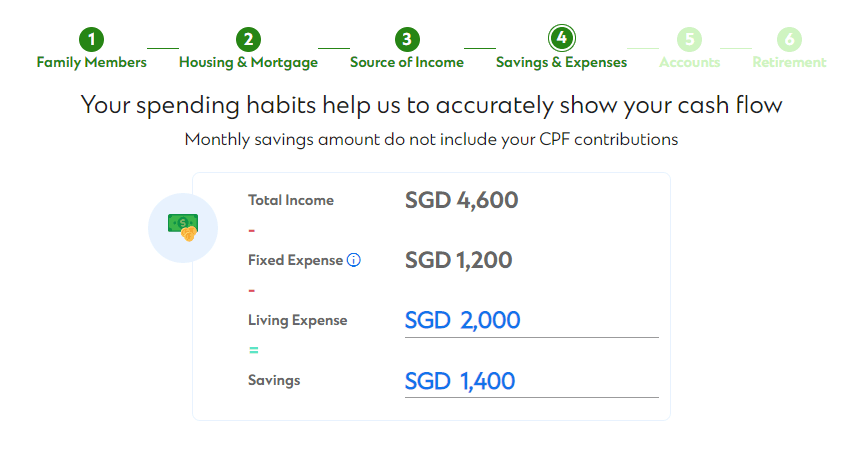

The wizare automatically calculates a fixed expense for you.

I have no idea how they go about doing this. You can specify your living expenses. It is quite refreshing to see some guiding comments such as the comment explaining this savings do not include the CPF contributions.

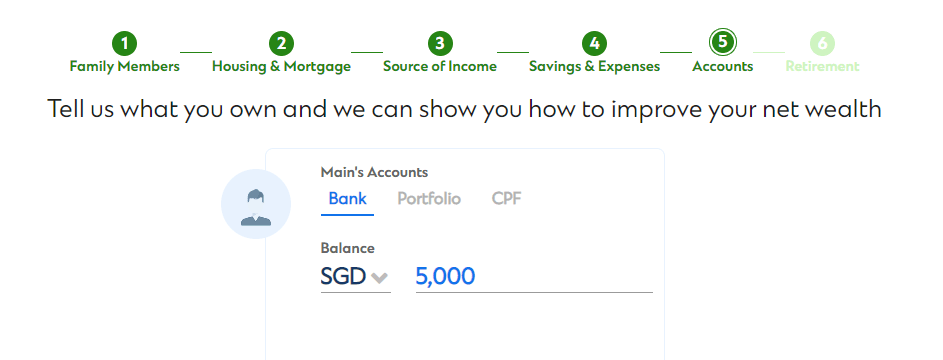

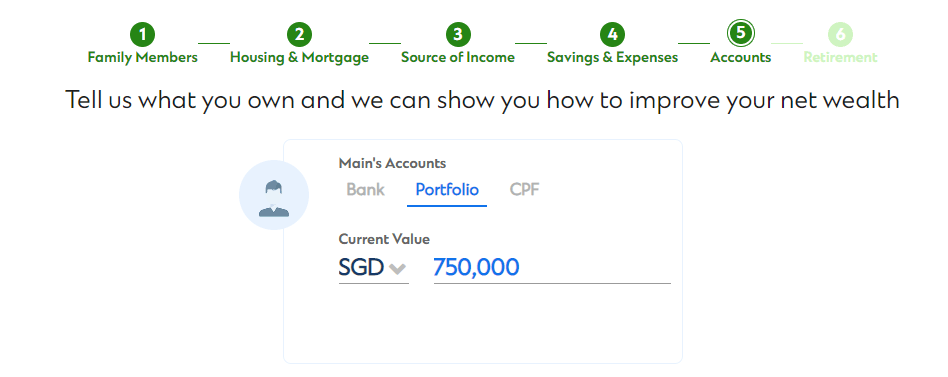

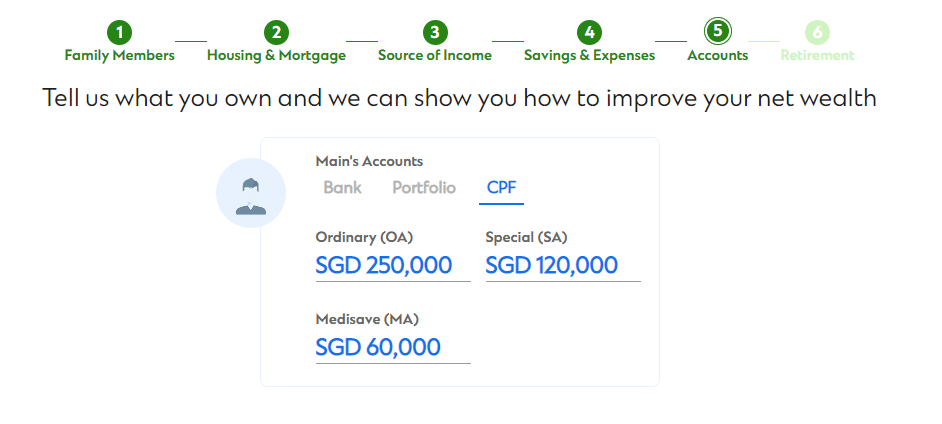

Under this section, you can specify your assets.

Here is your definition of your CPF. It is robust enough to factor in the three different accounts (unlike some other sophisticated financial planing softwares).

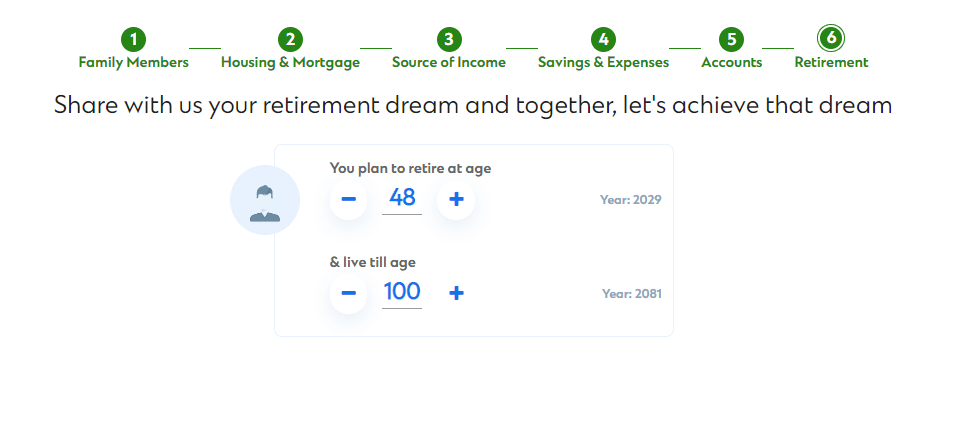

Finally , when do you wish to retire and how long do you estimate you will live until.

How Healthy Are Your Current Financial Health?

The greatest benefit of a cash flow financial planning software is to tell you how is your current situation.

A cash flow financial planning software normally gives you two views:

- Net worth

- Cash flow

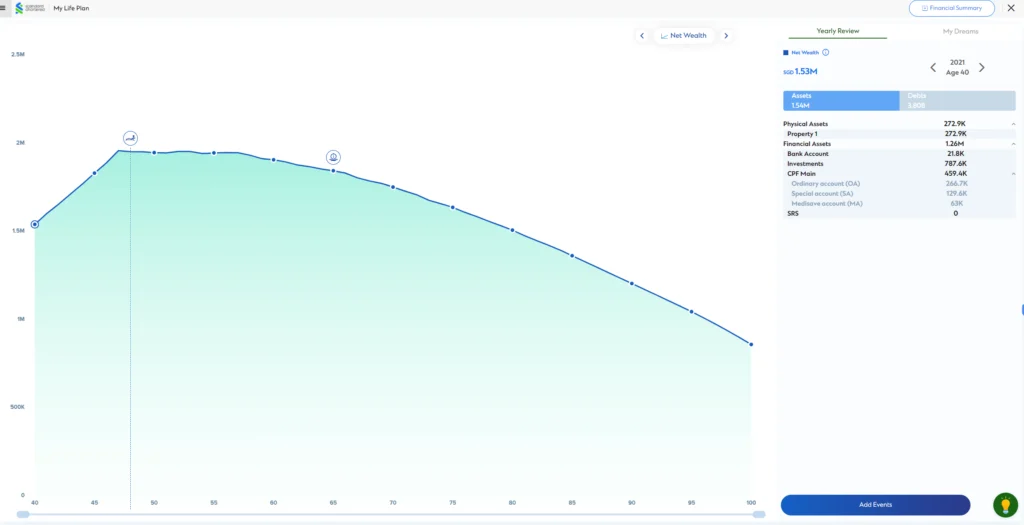

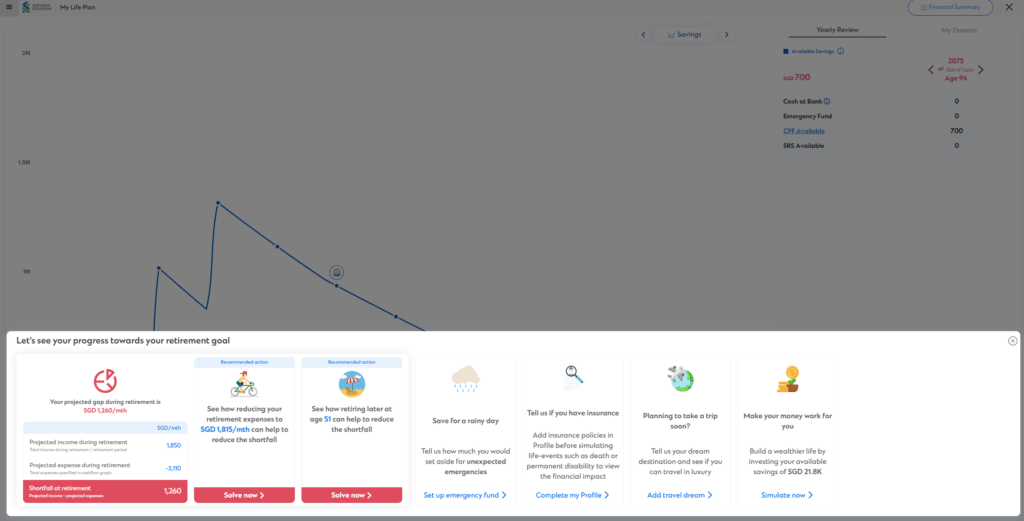

In the net worth view, SC Goals Planner shows the change in your net worth over time.

If you have entered everything truthfully and correctly, your net worth chart factors in all your life choices from 40 years old till 100 years old.

You can model all of that.

The planner helps answer the important question: If you go down this path, how is your financial health.

Usually, there are 3 conclusions:

- You run out of money at the end. This is not so good.

- You do not run out of money but your plan does not have much buffer. This is Ok.

- You do not run out of money and you have adequate buffers. This is the best situation.

On the right hand side, you can use the arrow keys to go year by year and you can see the forecasted value of your accounts change over time.

This is useful to tell me at age 57 how much exactly I will have.

Notice also on the chart there are some icons at certain part of the curve. These icons represent pivotal events in your lives.

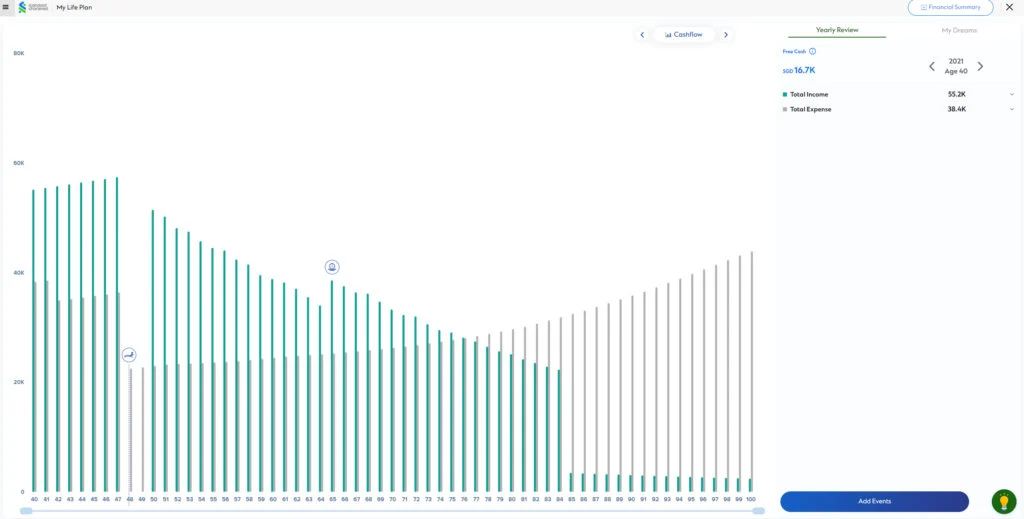

The cash flow view gives you an idea how your inflow and outflow will be like.

The grey lines show my expenses increasing over time. The green line shows that my income is losing to inflation!

The small green lines show my CPF income.

SC Goals Planner Can Factor in Various Life Events Into Your Plan

For those who do not nerd out these financial planning stuff, it might be daunting to think about what to consider.

SC Goals Planner has a wizard to advice you what you should consder to make your plans more complete.

This could include:

- Reducing your retirement expenses.

- Retiring later.

- Add a rainy day fund.

- Specify your insurance.

- Make money work harder for you.

Let me go through some of the planning features.

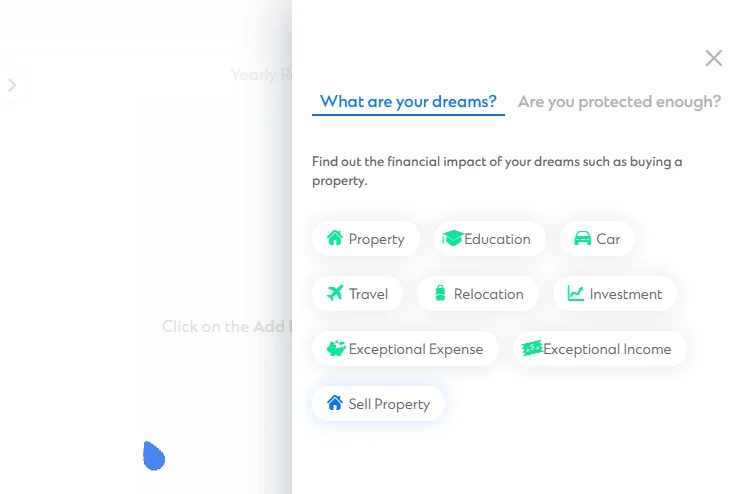

Add Different Life Events

You can add various kind of life events to your plan. This will add icons inside your net worth chart.

Make your plan more realistic, and you have greater confidence in the plan.

How Granular Can They Specify Your Investment Portfolio?

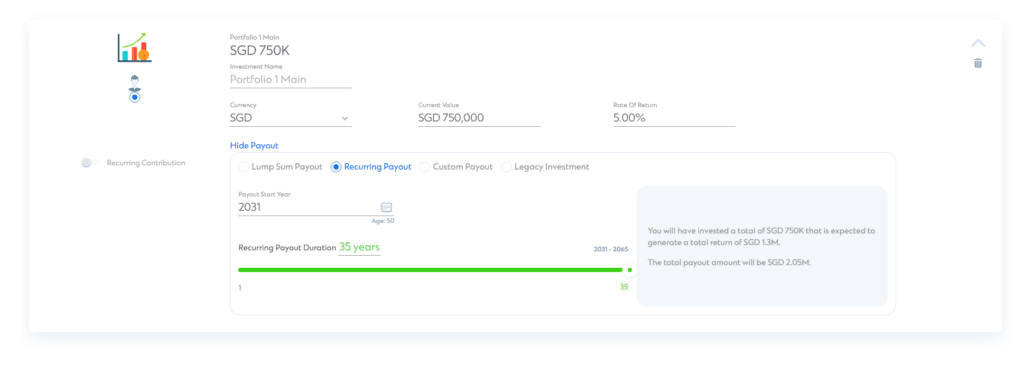

Charting the growth of your investment is always an important component so we are always curious how flexible the planner can do this.

We can specify the rate of return of our portfolio and we have the flexibility to choose between a few different spending down schemes.

The limitation is… for the recurring payout method, the maximum that you can select is 35 years of payout.

So if I were to early retire today, and I wish to plan for 47 years of payout, I cannot specify it this way.

This kind of payout specification is more equivalent to an insurance planning kind of methodology. In a way, Better Trade-Off caters more towards insurance planner to help them sell endowment plans to the clients.

This is a major limitation because if we payout to cash, the rate of return dramatically reduces. Yet we have no way of simulating a 47 year payout.

You cannot change the rate of return of cash

I realize that we do not have the flexibility to change our cash rate of return. Not a deal breaker.

However, if some of you can get 9% a year return on your cash, you may not have the flexibility to change.

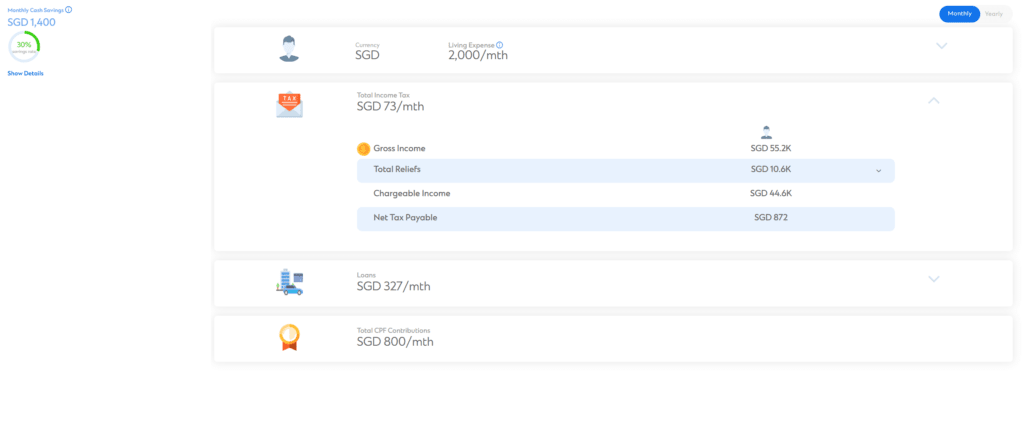

Income Tax Estimation

If we take a look under our monthly cash savings, we can see an estimation of our income tax. I thought this is pretty cool.

Not sure how accurate this is.

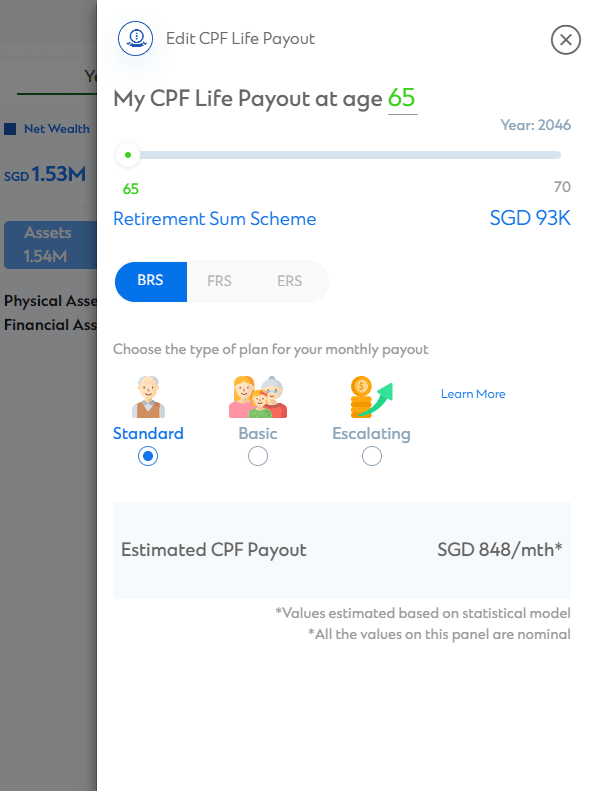

Good Enough CPF LIFE Integration

The planner gets our CPF system pretty well.

You can change your payout type and it gives your estimated CPF payout based on their own statistical model. I find that the payout to be pretty OK as an estimation versus some internal tools.

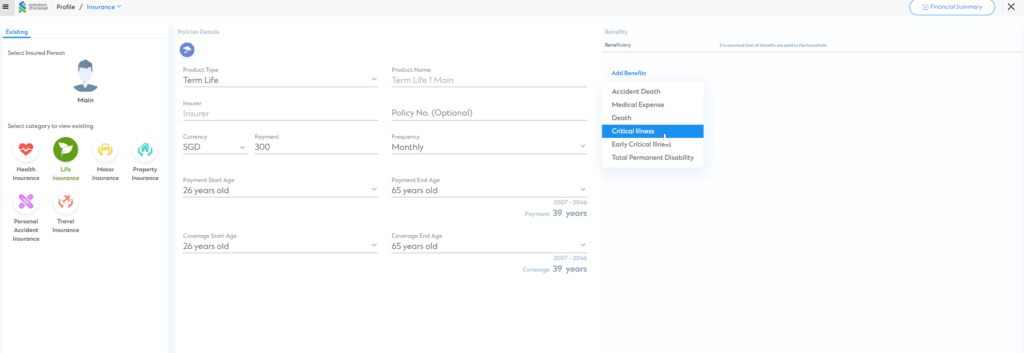

Simulated How Well Protected You Are

One of Better Trade Off’s main customers was a insurance firm, so in terms of what you can do with insurance protection, you can expect a lot of sophistication.

Basically, the level of detail of what you can specify is spectacular.

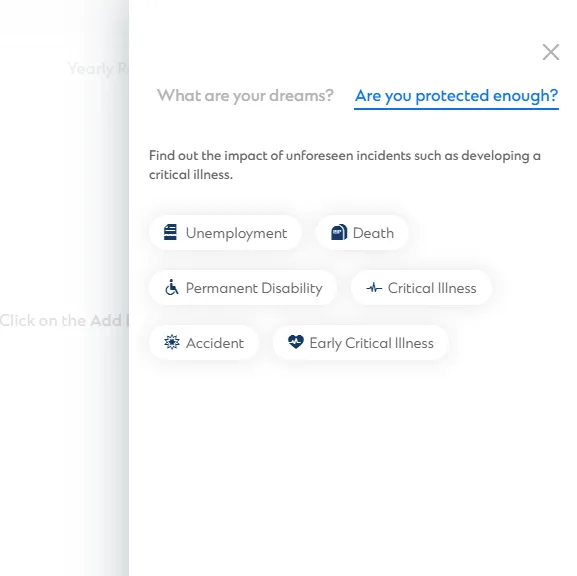

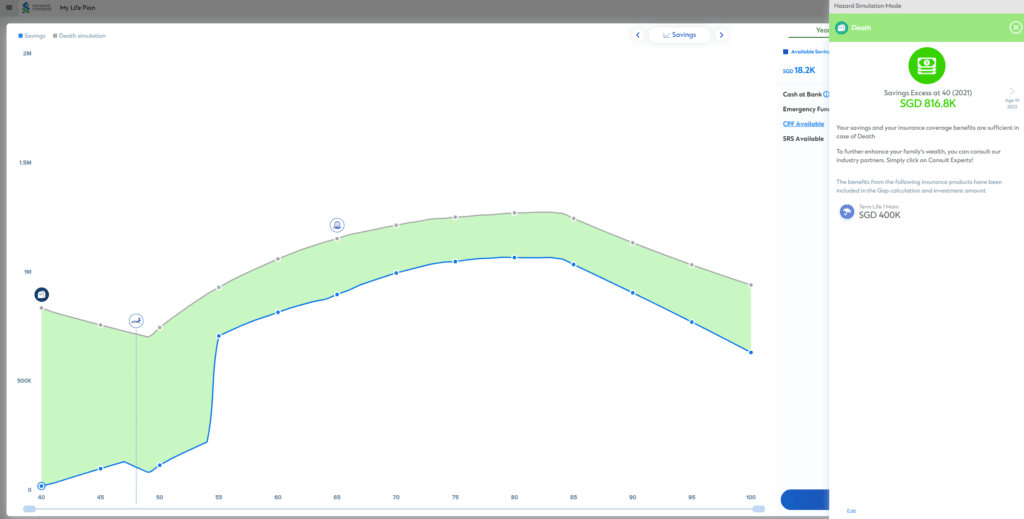

Under life plan, you can simulate various unfortunate events.

The planner can estimate whether you are well covered.

In this example, I trigger what if the person suffers from an untimely death.

This person is pretty well covered, with excesses.

This kind of simulation adequately helps you answer if you have adequate insurance coverage or you have spend a lot on insurance and still end up not so well covered.

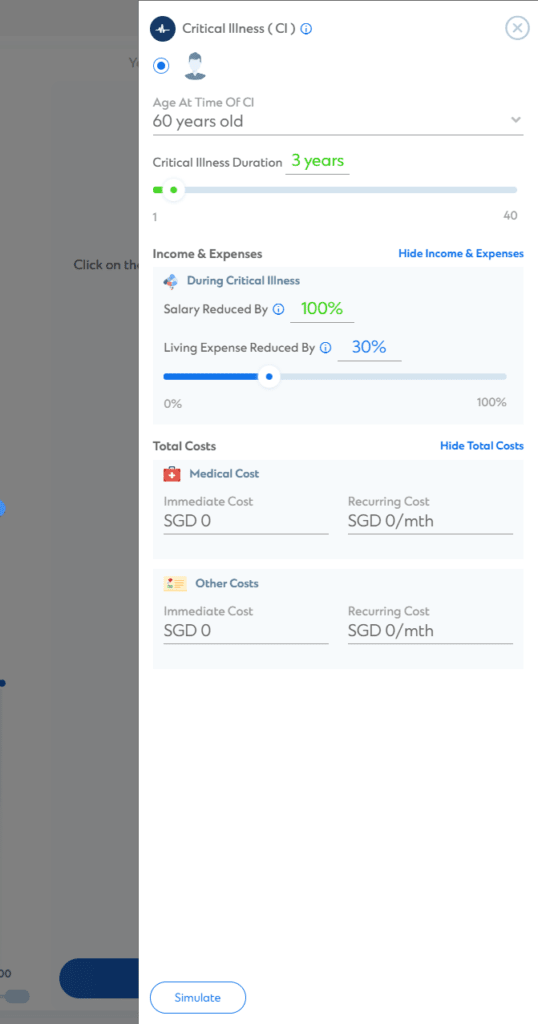

This is how granular you can specify the critical illness event.

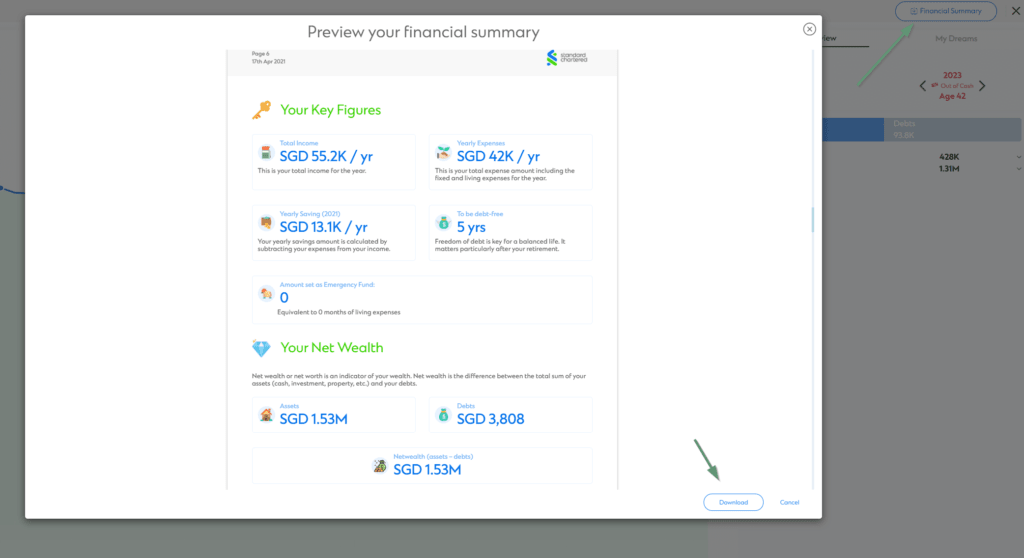

Download Your Financial Report

Standard Chartered customers can download a report after they have done up your financial plan.

Summary

I think this is a major value add to give clients this SC Goal Planner.

Kudos to Standard Chartered for investing in Better Trade Off’s product.

If you are an existing Standard Chartered client, I would urge you to go and play with it. You can maintain your financial plan frequently to see how well you are doing.

Or you could enter the data annually to see how well you are doing.

If you are not a Standard Chartered customer, I felt that while SC Goal Planner has its flaws (like the investments portion), it is good enough for me to sign up and maintain a banking relationship just to use this it on a frequent basis.

Lastly, the online financial planning software empowers you, but the quality of how you piece your financial life together, how you interpret the plan, how you take action to adjust your plan is what is most important.

Clients of SCB, let me know what you think after playing around with it.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024