If you have read some finance books, you would be acquainted with the traditional asset allocation.

The traditional asset allocation model typically explains the different kind of assets. They are typically stocks, bonds, cash. The finance books will explain how you should allocate between these three asset classes, when you should allocate them and in what way.

We continue with some excerpts from an outstanding personal finance book Family Inc.

You can read my introduction to this book in this article.

This article is enlightening if you have started investing for a while, perhaps a few years, and are wondering more deeper about how your portfolio should be like if your situation is…. different.

Specifically, how do you factor in your assets and liabilities out of your investment portfolio?

In this article, Doug McCommick, the author of Family Inc tries to provide a different perspective

Doug first explains that what is an optimal strategic asset allocation for investors depends on 4 things:

- What they can reasonably expect to earn from their investments (i.e. their “targeted return”)

- Their present and predicted earnings

- Their present and predictable future financial obligations

- Their time horizon or duration in which they need to start selling these assets

Out of all these, the time horizon is the most influential in determining how best to allocate your resources.

In addition, some sound investment strategies will attempt to minimize the gyrations in the value of your portfolio (in investment speak, this is volatility).

This is usually achieved through diversification in different asset classes, industries, geographical locations that do not rise and fall together.

The financial assets that you put your money into has 3 kinds of risk:

- volatility (fluctuation of value)

- liquidity (how easy or hard to sell for cash)

- impairment (loss of capital)

We are familiar with #1 but most might not be aware of #2 and #3.

If you have a higher risk, you need the investment to have a higher return to compensate for it. If not, the investment is not correctly priced, or in my term, overvalued as it does not provide a margin of safety, you are assuming more risk that you may not be compensated.

If you chase high risk, you wish for higher reward, but you might not realize that it comes with higher volatility. You will find those seemingly high reward, low volatility investments, which often turned out to be scams (because in reality, there is not many of them out there!)

Doug thinks that each of our time horizon and our ability to take risk is different.

There is no right asset allocation.

Typically, the asset allocation that financial advisers provide is based on a formula of 100 – age to determine your allocation to stocks versus bonds. Some use 120 – age.

You will have an allocation of

- 60% equities

- 35% US Equities

- 20% International developed country equities

- 5% Emerging market equities

- 35% bonds

- 5% cash and near cash equivalents

Some will replace 10% of equities with property like instruments like REITs. The higher net worth individuals will deploy up to 15% in alternative assets like private equity, absolute return or hedge strategies.

The conventional asset allocation advice probably frustrate Doug because he sees some part of it that does not make a lot of sense. He explains more in this chapter.

With this, here are 8 main weakness he identified regarding the conventional allocation.

1. Utilizing your Net Worth as a Wealth Machine

The conventional allocation model focuses on the smoothing effect cash and fixed income has on portfolio volatility but fails to acknowledge that your asset management business also serves an important liquidity function: supplying cash to finance significant business or personal assets, and cash to support your consumption until you are paid for work that you have already provided or while you wait to liquidate other assets.

In this weakness, Doug points out that we do not look at the net worth for other functionality other than the traditional ones such as:

- Retirement

- Children’s education

We can use the net worth as an overdraft account whenever we need to manage daily cash flow needs. If you are a freelancer, you might be able to identify with this.

In that case, an absolute amount (not in percentages) should be part of the allocation.

I do agree with this somewhat. I think that the net wealth you built up, can be more useful earlier, than just putting it away for retirement. This is as long as what you are using it for is fundamentally sound.

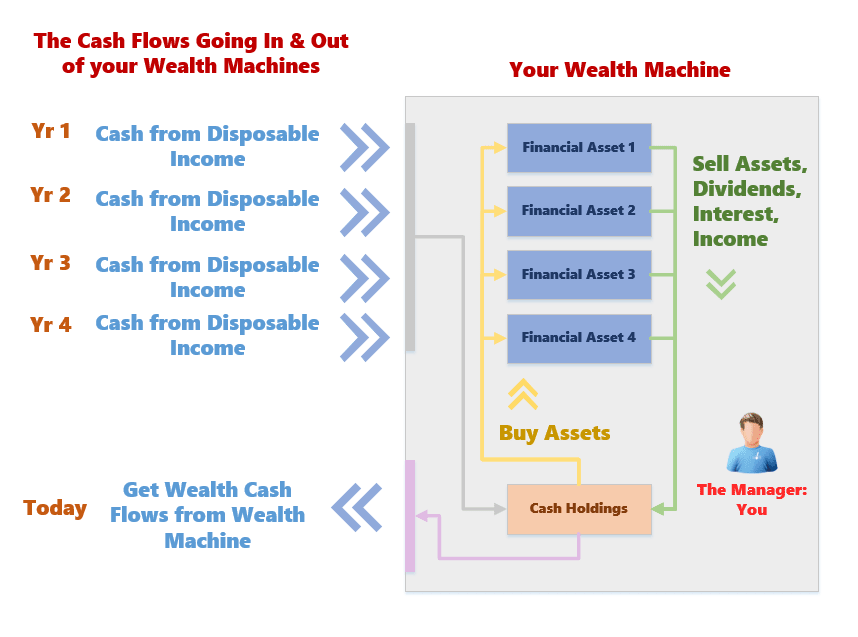

In my article on wealth machines, I tried to explain how we can view your investments, and the cash you set aside to be invested as a machine. You consistently fund it from your work income, and as the investment manager, you deploy the cash into investments that would grow over time.

The wealth machine is a way to frame how you can look at your portfolio.

While your wealth machine might not be useful when you start off, over time, the accumulated value is useful for many things.

If you “sell” some of the assets in your wealth machine, you provide a cash flow that might tied over some short term spending crisis, or career transitions, sabbatical.

Doug emphasize on have adequate cash allocation, but in reality there are some things you would be able to anticipate there are some that you will not.

I do feel you can have an absolute amount of cash allocation. The way he is explaining, it is as if he is saying your emergency fund should be in your portfolio.

And I think there is some truth to that.

Once you are investing, you may consider the cash as an allocation in an overall portfolio.

2. The Low Correlations of your After-Tax Labor in Your Net Worth

The conventional model fails to acknowledge the holistic nature of net worth, as defined by our Family Inc. Net Worth concept, which includes the expected after-tax value of labor as the largest asset for most people.

As with the first Family Inc article on career, the conventional model didn’t recognize that your income, bonus, stock options, as well as your CPF contributions are annuity like.

So you have an annuity that decays over time.

The significance Doug feels is that this is a major assets and it is less correlated with the equity markets.

The volatility of your income will depend on whether you are in a bond/ annuity like job like the one I used to be at, or one with a lot of call option like investment banking.

Whichever way, Doug wants us to see our entire net wealth together. And in that picture, maybe you can have a higher equity allocation when you are working.

For example, when Kyith is working now, if the market goes through a 30% draw down, it is very different from when Kyith is NOT working and the market goes through the same draw down.

In the latter case, Kyith will need to spend down the net wealth systematically. When I spend the net wealth, there are less wealth to return to the level before the 30% draw down. This is essentially the negative sequence of return risk.

However, if I am working, I do not have to touch the equity that has gone down in value. I am still spending the cash flow from work income.

Thus, this might be what Doug is talking about.

3. Framing Your Live-in Residence in your Net Wealth

This allocation fails to acknowledge in addition to labor and investment securities, many families own their primary residence, which generally represent their single largest asset other than labor.

It is not just Singaporeans who have a love affair with properties. In US, they do love it enough, more so in the early 2000s and many got burnt by it.

Doug explains that if you look at the live-in residence as part of your portfolio, then if you get a few more, essentially you are concentrating in a single country, single asset class, single sector.

And your net wealth will face tremendous volatility, liquidity risks that some may not have considered.

4. You need to Consider the Leverage Factor in Your Investments with your Other Debts

The allocation model fails to acknowledge the debt that exists in most family balance sheets related to real estate, education and consumption items such as vehicles and credit cards.

As an investments person, Doug does not shy away from using leverage in his investments in a controlled and sound manner.

Here, he points out not to forget understanding how levered you are in your other assets.

Based on the latest survey, Singaporeans do have a fair amount of

- Mortgage loan

- Unsecured personal loan

- Credit card debt

- Student loans

Before you use leverage as a tool, do view your net wealth holistically.

5. Conventional Planners takes less into consideration CPF

The allocation model does not account for assets a family may have at the time of retirement from Social Security or a defined benefit pension plan, both of which act like bonds.

Doug makes a short comment here in that many planning was done by not considering the social security. In Singapore’s case this will be the CPF.

He does not elaborate much, but I am thinking that a lot of pension system will eventually convert these to an annuity like instruments (CPF Life is an annuity)

Due to the way the annuity is backed, this class of financial asset tends to be bond like, which affects the amount you allocate to equity before you received your pension and when you start drawing down the annuity.

6. Over-allocation to Lower Risk Assets

Asset-allocation models frequently under-estimate how long you will hold the investments before you cash them in, if ever.

Doug thinks that there is an over-emphasis of mechanically de-risking to safer instruments such as bonds.

Again, we are going back to the 100/120 – Age Stock allocation formula.

I think planners use that rule of thumb too much, but that rule of thumb in general have serve the majority of the people well. There is however, an idea that you should increase your stock allocation in retirement to ensure your money last longer.

We came to this conclusion because of more research. This also shows that we cannot just be static and take what we know in the past as forever true.

7. Risk Tolerance need not go down as Our Age Increases

In most traditional asset-allocation models, age is the primary variable that influences risk tolerance – as age increases, risk tolerance decreases.

Doug questions whether our ability to take risk really needs to decrease over time.

He explains his 79 year old dad and his situation.

Doug’s dad is a 79 year old retired educator. He is on a defined benefit pension plan that he paid into for over 50 years, and he funds substantially all his consumption from his pension and Social security.

In addition, he owns multiple homes and real estate holdings, with minimal debt on these property.

His dad accumulates less than 20 percent of his Family Inc Net Worth in stocks, bonds and mutual funds.

Doug’s situation is different.

He has more financial risks in his life:

- 46 years old so younger

- Business owner without regular paycheck

- Income heavily influenced by performance of the business investments. The earnings can fluctuate over 500% between a good year and bad year, with negative cash flow expected in bad years

- Owns two homes, with mortgages

- Two kids that will be college eligible in 5 years

Given the normal age profile, Doug should be heavy in stocks, his dad should be heavy in bonds.

However, given this explanation, it would not be wrong to recommend more equity exposure for Doug’s dad and since Doug’s income is so tied to the stock market, his allocation should be more tilted towards lower volatile instrument.

8. The Wealth Effect and How it Disrupts Conventional Asset Allocation

Doug gave a few more examples when the conventional asset allocation breaks down.

A lot of the frailties are seen when the wealth increases.

Doug commented that most family businesses are overallocated toward labor assets.

We cannot often diversify away the labor assets except to deplete them.

The above allocation is when someone holding a conventional bond and stock portfolio considers the non-conventional assets. We observe how little the equity allocation is.

If you are afraid of having too much equity, if we frame things this way, you will realize you have too low of an allocation.

Doug then gives the example of a 67 year old woman who retires with the following profile:

- No debt

- $500,000 in cash and short term securities

- $500,000 in bonds

- $500,000 in real estate

- $ 3 million in equities

- Requires an annual after tax consumption of $150,000 a year

The conventional advice will be to re-allocate a significantly over allocation of equities to bonds.

Doug says this conclusion is wrong because

- if she keeps this consumption pattern, this woman will never deplete her net worth

- given her rate of consumption relative to her anticipated asset growth, the expected duration on her investments is actually very long in spite of her age. Re-balancing a significant proportion of equities to bonds robs her of compounding ability

- the re-balancing is tax inefficient. Bond interest is taxable and capital gains of the equities sold is taxable

I am for one befuddled whether I would agree that this amount will not deplete. In my opinion, Doug is factoring in some really high equity rate they are able to achieve.

Conclusion

I think what Doug talked about is not rocket science.

If you have invested for a while, developed some critical thinking, you will start asking yourself these questions.

Something….. does not feel right about these kind of conventional advice.

There is a reason they are given.

As rule of thumb in investment planning or financial planning they work well for a large mass of people.

However, in order for them to work for you, you need to fully understand portfolio allocation, what is the objective of it, and what you are trying to achieve in financial planning.

With this knowledge, then you can push the boundaries and tailor a plan for yourself.

Financial planning and investment planning are both very personal.

For someone like myself, the situation is very different from conventional. I should have a good plan for myself that is different than you.

For most of you, you would own real estate. You might be 28 years old and your human capital asset annuity present value might be much higher than mine. Your allocation will look very different from me.

Family Inc is a Good Book. You can pick them up in your book store or the library.

My Family Inc Series of Articles are:

- Viewing Your Career as Investments

- 8 Weaknesses of Conventional Family Asset Allocation

- Measures of Family Wealth

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- The Cheapest Way to Extend Your Laptop to TWODisplay that I Can Find. - April 29, 2024

- My Quick Thoughts on the Net Cash, 4% Yielding Boustead. - April 28, 2024

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024