Here is the update for my Daedalus portfolio for the month of May 2024.

You would likely not understand much of what I talked about if you don’t read this post.

I will try to provide as much of the update where possible if work is not too busy.

All my personal planning notes such as income planning, insurance planning, investment & portfolio construction will be under my personal notes section of this blog.

Portfolio Change Since Last Update

The portfolio was valued at $1.376 million at the end of May and is currently at $1.390 million.

We reported a portfolio change of $12,000 for the month of May 2024. The portfolio gained 1.2% which equates to 80% of the Vanguard FTSE All-World ETF, given the portfolio is 80% exposed to equities and 20% to fixed income. The portfolio lost 0.85% to the strengthening of the SGD against the USD.

Role of Portfolio

The goal of the portfolio is to provide consistent, inflation-adjusted income for my essential and basic spending. The portfolio is sized based on a conservative 2-2.5% Initial Safe Withdrawal Rate (SWR) so that the income can last even considering challenging historical sequences such as Great Depression, external war and 30-years of high inflation averaging 5.5-6% p.a.

Timeframe that the income stream to be planned for: 60-years to Perpetual

I am currently not drawing down the portfolio.

For further reading on:

- My notes regarding my essential spending.

- My notes regarding my basic spending.

- My elaboration of the Safe Withdrawal Rate: Article | YouTube Video

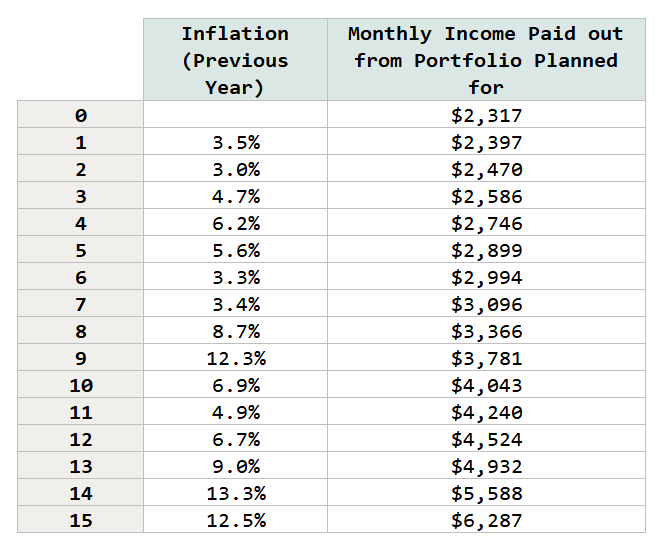

Based on the current portfolio of $1.39 million, the projected starting income is:

The lower the SWR, the more capital needed, but the more resilient is the income.

Nature of the Income I Planned for

Suppose when I start drawing the income, the previous year inflation goes in this sequence and here is the corresponding income to be drawn out:

The income strategy is constructed to withstand this high inflation

Investment Strategy & Philosophy

After trying my best to learn how to invest for a while, the portfolio expresses my thoughts about investing at this point.

The portfolio is run in a

- Strategic: allocation doesn’t change by short-term events.

- Systematic: rules/decision-tree-based implemented either myself or an external manager.

- Low-cost: investment implementation cost is kept reasonably low both on the fund level but also custodian level.

- Passive: I spend relatively little effort mentally considering investments and also action-wise.

You can read more in this note article: Deconstructing Daedalus My Passive Income Investment Portfolio for My Essential & Basic Spending.

Portfolio Change Since Last Update (Usually Last Month)

Decided to take my SRS fund to invest in:

- Dimensional World Equity Fund SGD Accumulating.

- Dimensional Global Targeted Value SGD Accumulating.

With this, I probably have $1,000 more to invest this year.

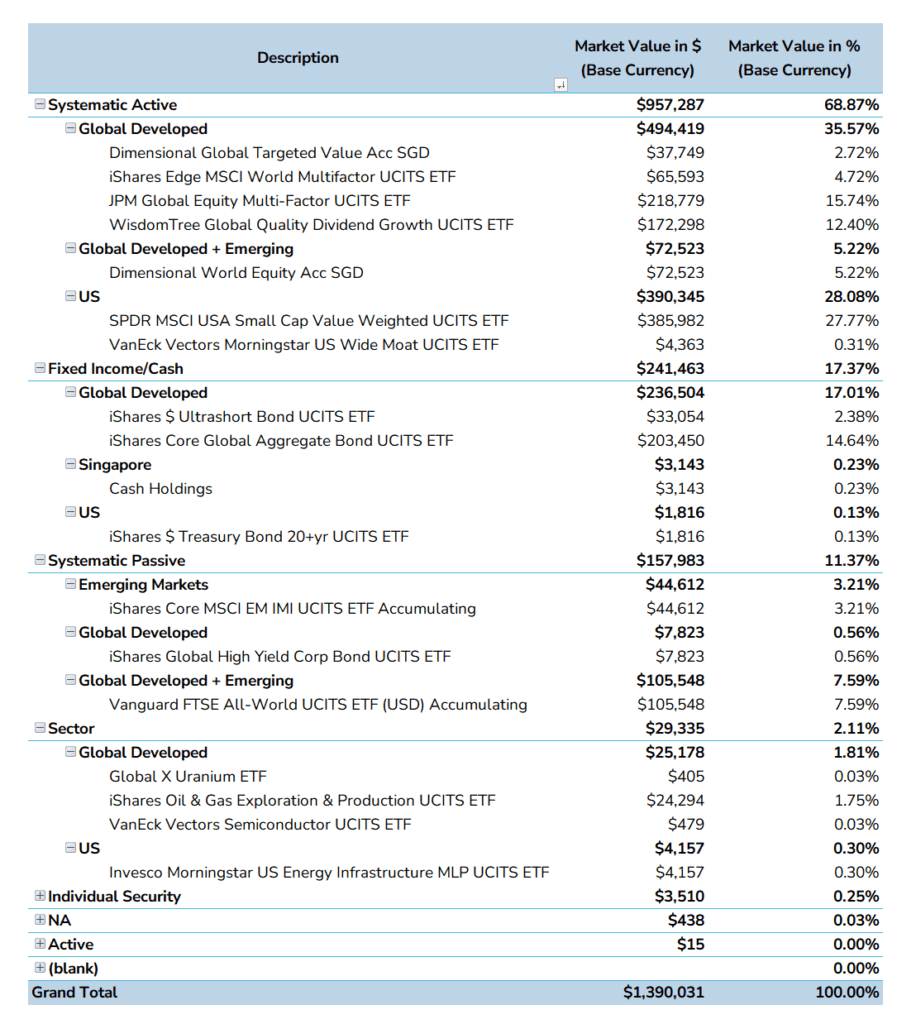

Current Holdings

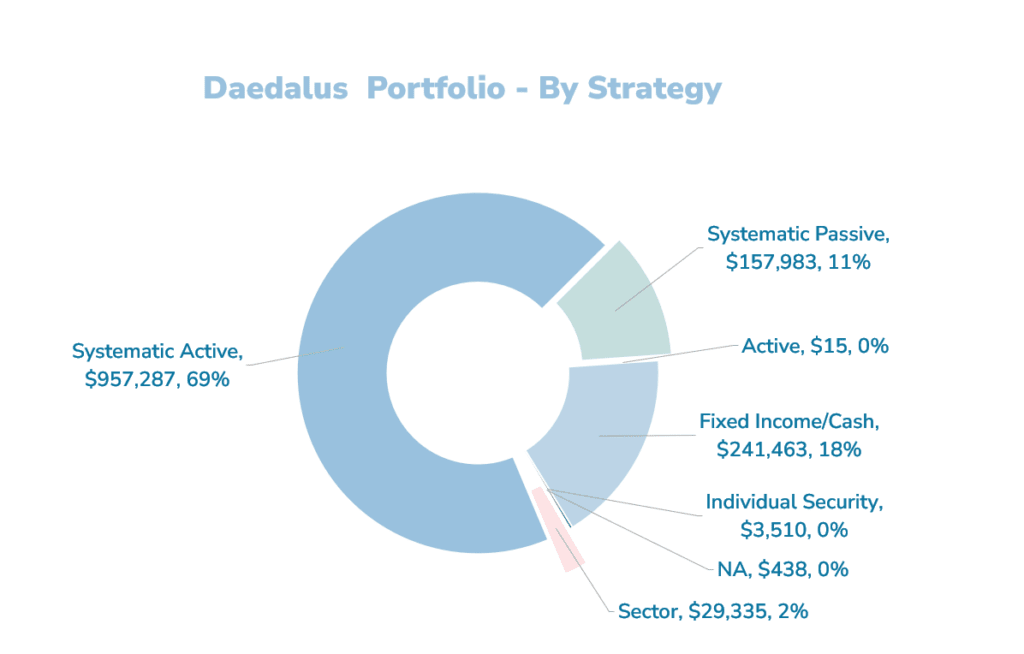

The following table is grouped based on general strategy, whether they are:

- Fixed Income / Cash to reduce volatility.

- Systematic Passive, which tries to capture the market risk in a systematic manner.

- Systematic Active, which tries to capture various, proven risk premiums such as value, momentum, quality, high profitability, size in a systematic manner.

- Long-term sectorial positions.

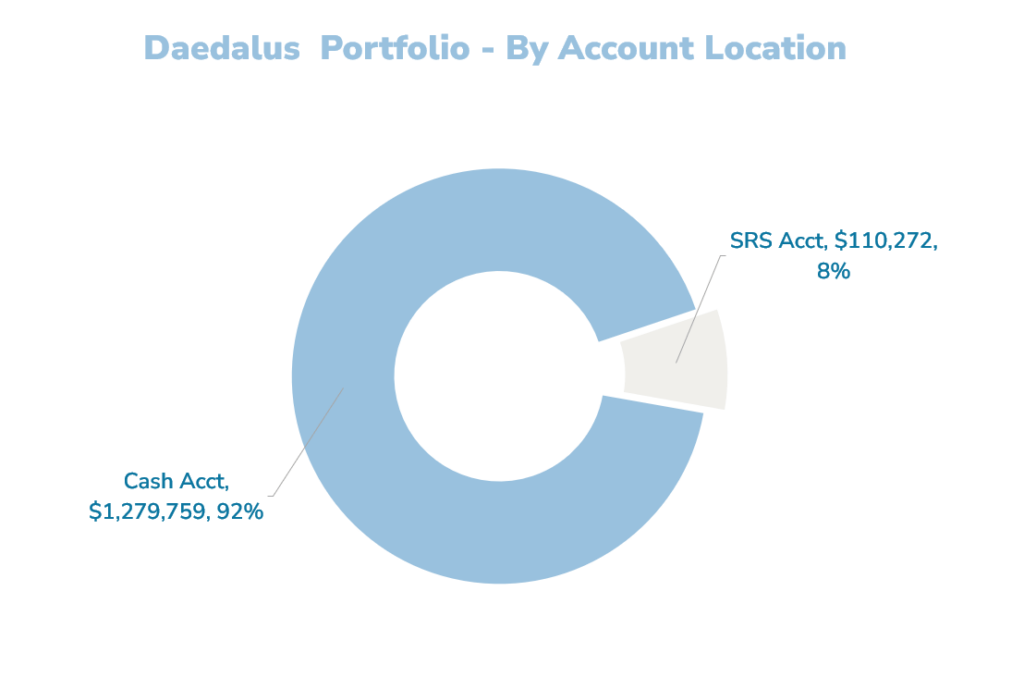

Portfolio by Account Location

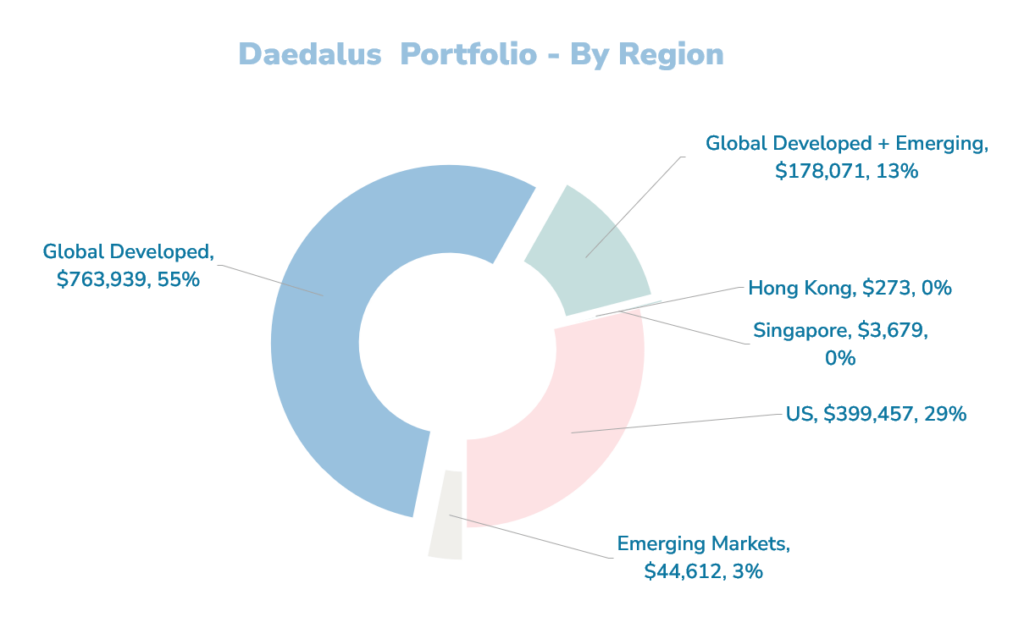

Portfolio by Region of Securities

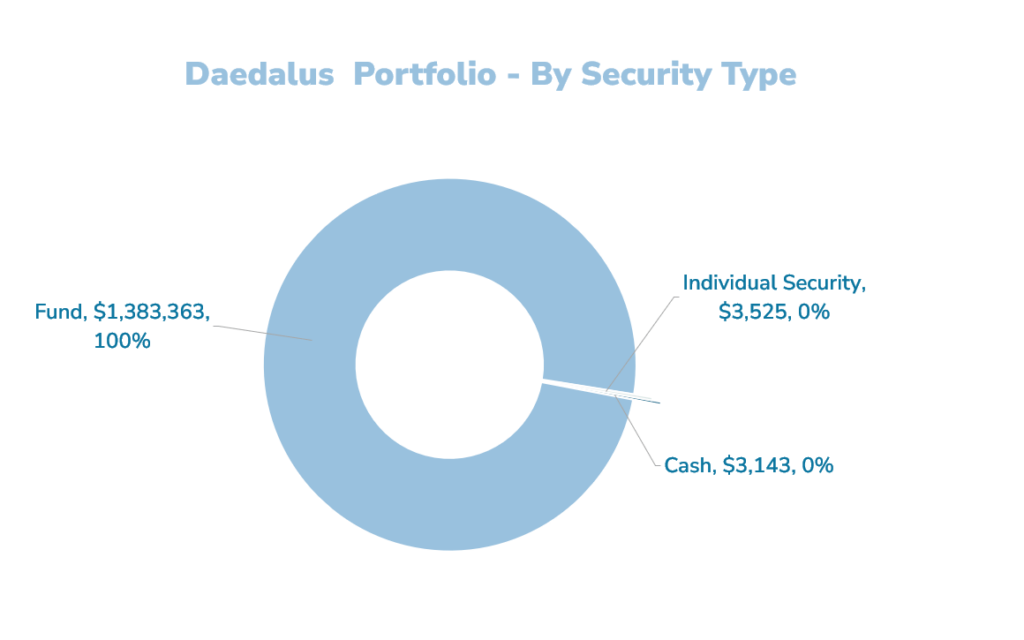

Portfolio by Fund, Cash or Individual Security

Portfolio by Strategy.

Main Custodians

The current custodians are:

- Cash: Interactive Brokers LLC (not SG)

- SRS: iFAST Financial

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- Knowing the Average Returns of Your Investments Does Not Help You (Part 3) - June 30, 2024

- New 6-Month Singapore T-Bill Yield in Early-July 2024 to Rise to 3.78% (for the Singaporean Savers) - June 27, 2024

- Why the S&P 500 Should Do Better Than the Other Segments of the Market Fundamentally. - June 23, 2024

MaxDOL

Monday 10th of June 2024

With Avantis coming with their own UCITS's ETFs, I wonder if you will use them or not. There will be 3 ETFs; Global Equity should be similar to US's listed AVGE Global Small Cap Value - AVUV + AVDV Emerging Market - AVEM https://www.etfstream.com/articles/american-century-to-enter-europe-with-three-active-etfs

Kyith

Wednesday 12th of June 2024

I think if there is a small cap value offering, i would switch to that. Probably the emerging market one as well.

Kyith

Wednesday 12th of June 2024

Wow thanks for pointing me to this. I am not sure where you all keep up with these news. We will have to wait and see what is the offering. Not sure when it will happen as well.

Sinkie

Monday 10th of June 2024

The only comment I would make is that if you're basing your retirement expenses at a basic essential level, the inflation rate will probably be higher than the median.

i.e. inflation at the 20th percentile household vs 50th or 80th percentiles.

This is no problem for you as you're starting with a very low SWR (essentially over buffering or over budgeting), however will be something the lower income needs to be aware of as they try to accumulate a sufficient retirement portfolio.

Kyith

Wednesday 12th of June 2024

Hi Sinkie, yup that is the idea!