I had one of those longer days at work and as I head towards Man Man Unagi in Keong Siak, I came up with an income strategy.

As I thought about it more, I realize that it is rather stupid.

Don’t worry, no one triggered me to think about this income strategy but I think my conversation with our Investment Analyst Choon Siong about how a Constant-Duration bond fund work did trigger this.

I decide to share this stupid idea of mine with you because trying to find out why it is stupid and discuss around the strategy might help all of us to learn something.

Who knows, may be at the end of this article, we might realize this idea is not so stupid after all.

So the idea around this income strategy is this:

Use a 100% Investment-grade Fixed Income Bond Fund Portfolio. If we spend lower than the prevailing market yield of the fixed income portfolio, we will get income and won’t run out of money!

This is stupid because most more well-learned investors will tell me to:

- Use direct, individual bonds instead of a bond fund.

- The income is going to be so volatile!

Perhaps they are not wrong, but what they may be wrong about is #1 is not gonna be easily solved by direct bonds.

To refresh ourselves, when we need income for a specific purpose, we have to make sure we are able to fulfill the following:

- The income needs to meet our spending needs.

- Income needs to be consistent enough (most of the time)

- Income needs to last as long as we need.

- As a consequence of #1, income usually needs to keep up with inflation.

We can debate if the income can be volatile and still be suitable and the short answer is yes, if you are ready for the degree of income volatility, then you can think less about income consistency.

I did cover the direct bonds portion in another article here.

A High Certainty Income Plan With Glaring Holes

Direct bonds have a few problems but the biggest one is unless you match the tenor to your goals exactly, you have some reinvestment risks. Even if you can secure a coupon of $70,000 on a $1 million portfolio, if ten years later the reinvestment rate is $40,000 then how you make up for the difference? (You may need to touch your capital).

Another big problem is aside for the income, we have not cover the inflation needs of the income.

But the topic of today is not on direct bonds but how this stream of income will look.

I am more interested to show weird income ideas and let you be the judge if this strategy will work for you.

I have this idea:

- Many of us like the security that a 100% fixed-income portfolio gives us, so that will be the basis of our income solution for today. I will us the Bloomberg Global Aggregate Bond Index (hedge to USD) as a proxy for this. The ETF is buyable at Interactive Brokers under the ticker AGGU (Hedged to USD) or Amundi Global Aggregate Bond Fund (Hedged to SGD) at Endowus.

- Most are only comfortable spending income and so to make sure that we are spending our income we should only spend below the average coupon yield. But because it is quite difficult to get the average coupon yield of a portfolio of government and investment grade bond, I will use the prevailing market yield of a 7-year government bond as a yardstick of how much income we spend annually.

- To build on #2, our investor will spend 90% of the prevailing market yield just to be conservative. So if the market yield is 4%, the investor will spend 3.6%.

- We start with a $1 million portfolio and see

- How long the portfolio last?

- What is the nature of the income?

The Calendar Year Returns for the Global Aggregate Bond Index in the Past

The chart above show the calendar year returns of the Global Aggregate Index since it’s existence. This is a 100% bond index with almost half in government bonds and the rest in riskier bonds that made up an average investment grade profile.

The maturity tenor averages 8 years but the duration is about 6.5 years (what is the difference between tenor and duration? Perhaps better to Google this)

The average calendar year return is 5.3% and the compounded return over these 34 years is 5.2% p.a. This is total returns (coupon, gains or losses).

I think if we can travel back in time, and can invest in this, many would be satisfied with the return and drawdown. The deepest drawdown was -11% during the bond great depression of the 2022. The second one is -3% in 1994.

How come the volatility is this low?

That is the nature of bonds.

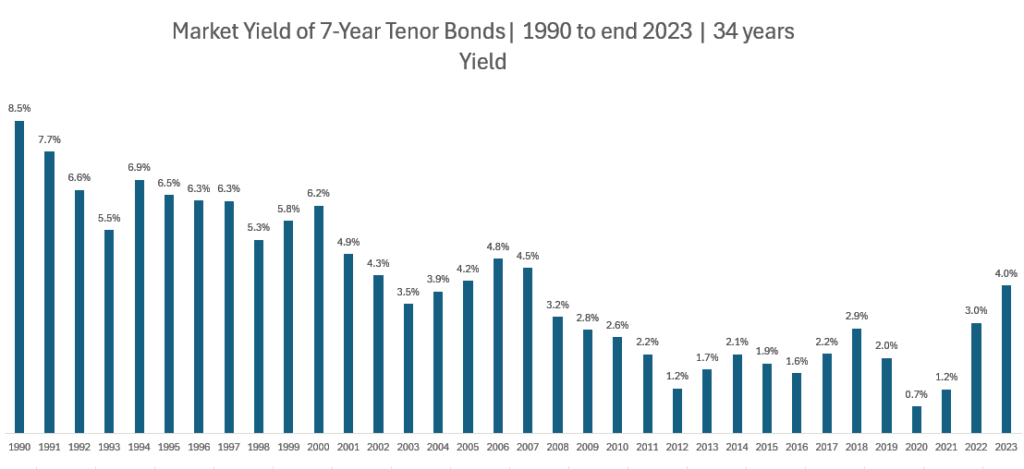

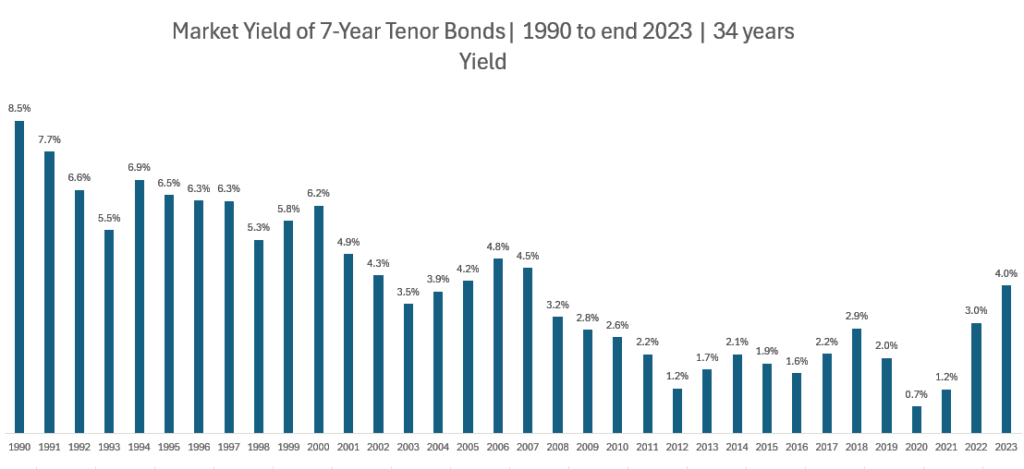

The Market Yield of 7-Year Tenor Bonds from FRED

I cannot get the investment-grade yield-to-maturity but I feel we don’t have to do that because usually, the investment grade bonds will trade at a premium around the government bond yield of similar tenor.

They might be higher or lower, but using the government bond yield in our simulation is good enough:

The yield was 8.6% at the start in 1990 and went down all the way to 0.7% in 2020.

Firstly, let us acknowledge how volatile the market yield can be and if we use this in some parts of our planning, something about our plan is going to be volatile.

So every year, we are going to spend 90% lesser than this.

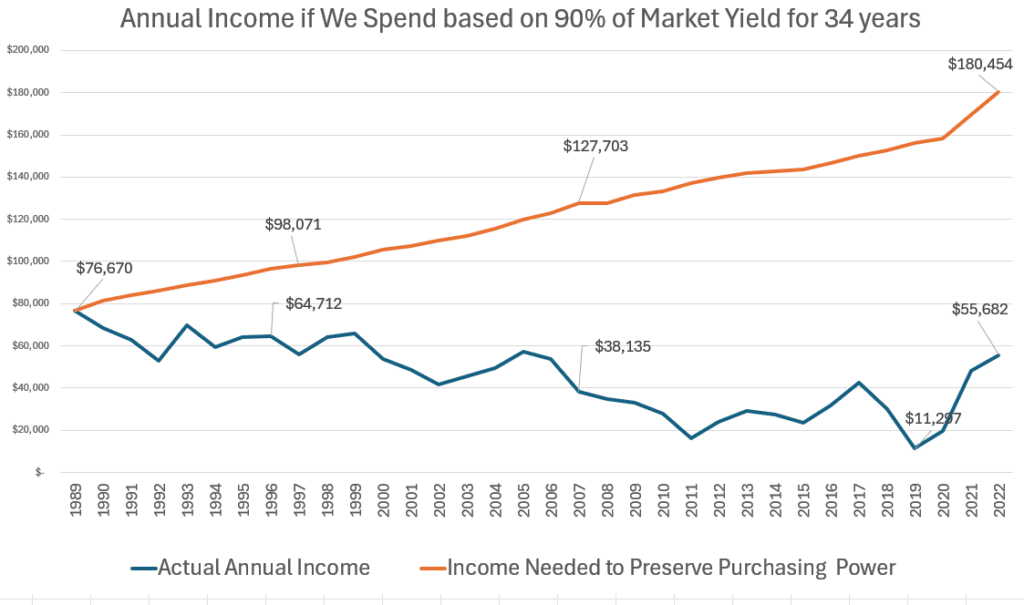

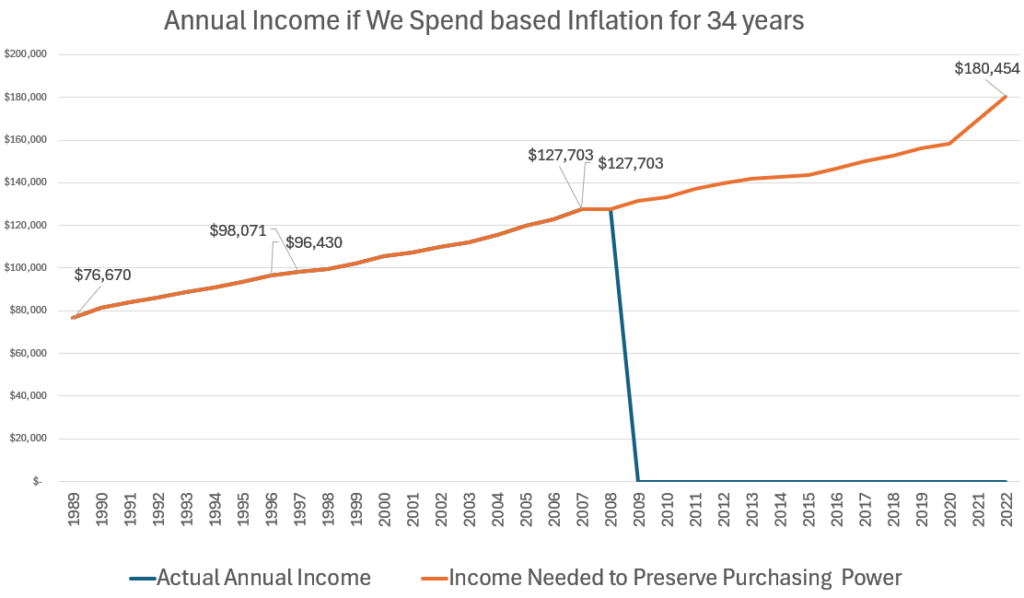

How does the Annual Income Look Like?

Here is how the income would look like if we extract 90% of the prevailing market yield:

The blue line is the annual income. The income starts off at $76k and gradually drops to as low as $11k a year in 2019.

I plotted the income required to retain your purchasing power, if we use the US CPI as an inflation reference (the orange line). You would notice that the income needed grows over time to $180k today.

This means that as time passes, the investor has an income but the income is further and further away from inflation.

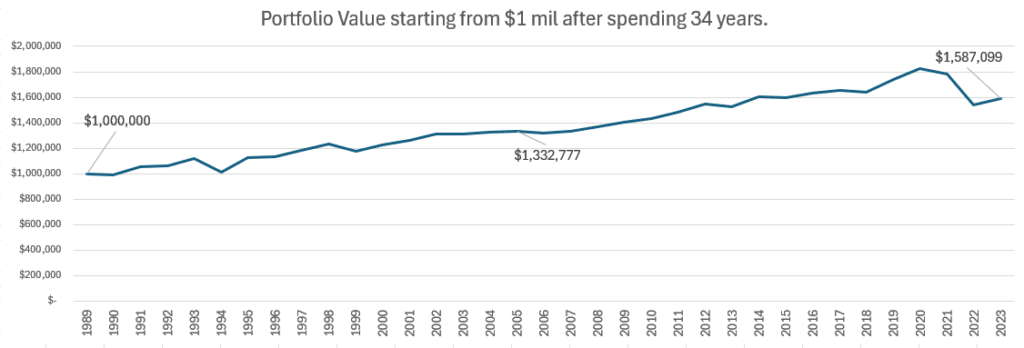

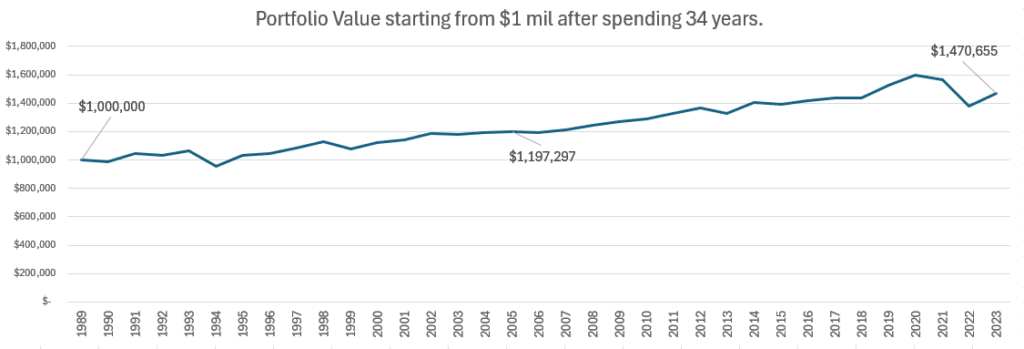

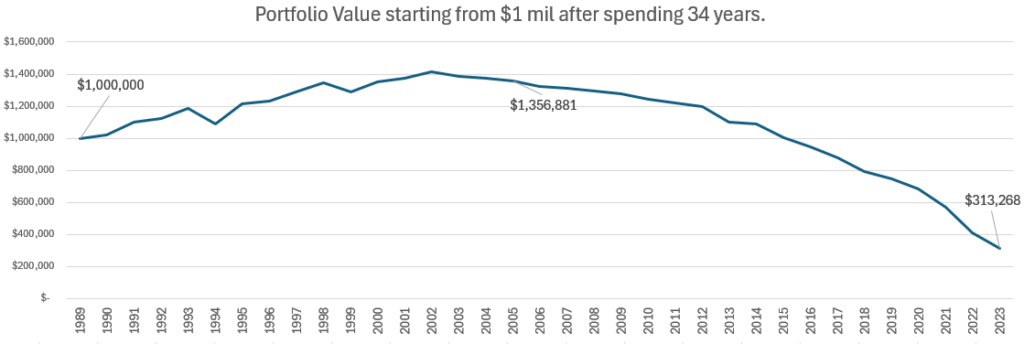

How does the Portfolio Value Look like?

The portfolio look pretty healthy.

After 34 years the portfolio grew to $1.58 mil despite spending $1.5 mil.

Questions and Answers

We learn the best by putting in a weird income plan and tackling the questions around it. So let us tackle some potential questions.

1. Wouldn’t the income be very volatile? What a stupid idea!

Well, I did say this is a weird income idea didn’t I?

More so, there are many income plans that end up with volatile income over time, at various degree.

In fact, I did say in the past that almost all off-the-shelf income solutions will have income that is not too consistent because the creator of the solution will take on too much obligations to ensure that the income is consistent.

Why Off-The-Shelf Income Products & Investment Ideas Will Not Solve Your Passive Income Needs

It will be easier if they:

- Don’t tell you the nature of the future distribution

- Base future distribution on other metric but the result will be volatile income

- Share a percentage of portfolio mandate

And that is what most do.

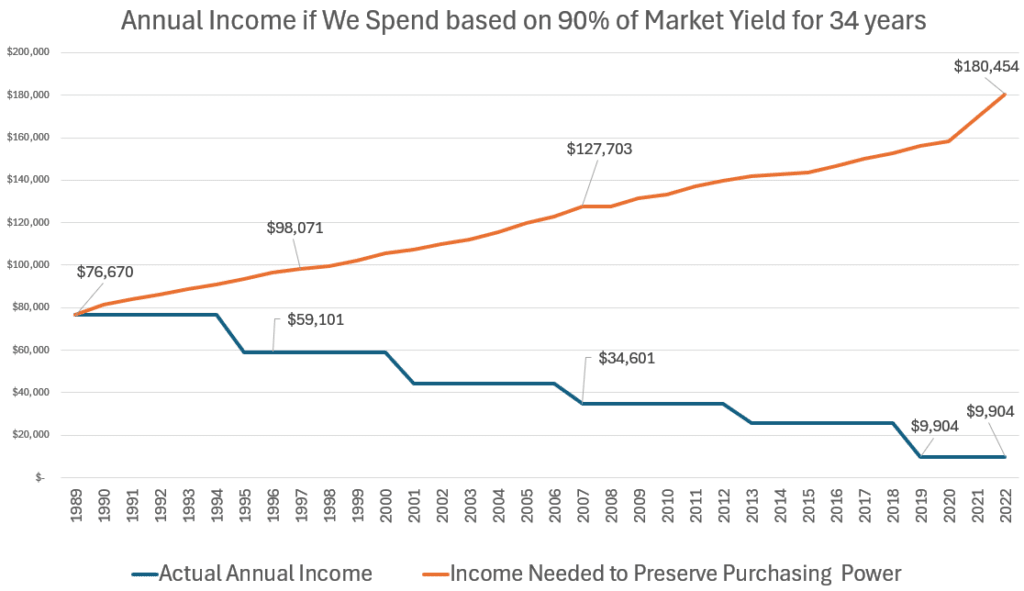

2. If Investor Withdraw the Same Income for a Tenor Equivalent to the Average Duration of the Portfolio, Will it be better?

What is better?

- Is the income more consistent?

- Does the income keep up with inflation better?

- Does the income last?

I think it is better if we can achieve all three.

We can simulate that by just keeping the income for 6 years before changing the income drawn based on 90% of the prevailing market yield.

Here is how the income look like:

The income is more consistent but eventually the income goes down over time. I notice that because we are spending based on a gauge and not coupons, the value of the portfolio grows over time:

This is not too different from the original plan in that the value of the portfolio grows over time.

This investor was the unlucky one who reinvest his last income when the market yield was 0.7%! But because the portfolio left was $1.5 million instead of $1 million, the income is higher.

The total income drawn out and the ending portfolio value is not better than the previous plan.

3. Kyith, Wouldn’t this mean that the Capital that I need to Save Up for My Income Needs is Very Uncertain? How to Plan Like that?

Yup.

It is obvious that if your strategy is based on the current yield, and current yield changes so much, your capital needs will keep changing.

If you need $50,000 a year in spending income, and today happen to be 1990, then your capital need is $50,000/(0.9*8.5%) = $653,594.

But if it is 2020, then your capital need is $50,000/(0.9*0.7%) = $7.9 million (!!!).

But… if we fast forward to 2023, then your capital need is $50,000/(0.9*4%) = $1.39 million.

You are at the mercy of what is the market yield 20-30 years in the future if you are accumulating your money.

4. What if we use coupon yield instead?

The coupon yield is more conservative… but… coupon yield tends to be lower than the yield-to-maturity of the portfolio.

So your income profile will still look the same, but you get a lower income!

5. Kyith, if Interest Rate Gradually Rises instead of Drop over Time, Isn’t my Income Experience Better?

Yup.

There is this bad fixed income influence, that when interest rate rise, it is bad for fixed income.

It depends on from what angle you are looking at it.

If the interest rate goes up overtime and you execute something similar to both the strategy mention up to this point, your income will go up over time.

And that is a good thing because you can get more spending income.

6. What if We Adjust Our Subsequent Year’s Income By Inflation Rate?

This will be similar using something similar to our Safe Withdrawal Rate methodology but our starting rate is closer to 7.6% instead of 4%, a very uncomfortable rate:

If you spend this way, you will preserve your purchasing power, but your money will run out in 2009.

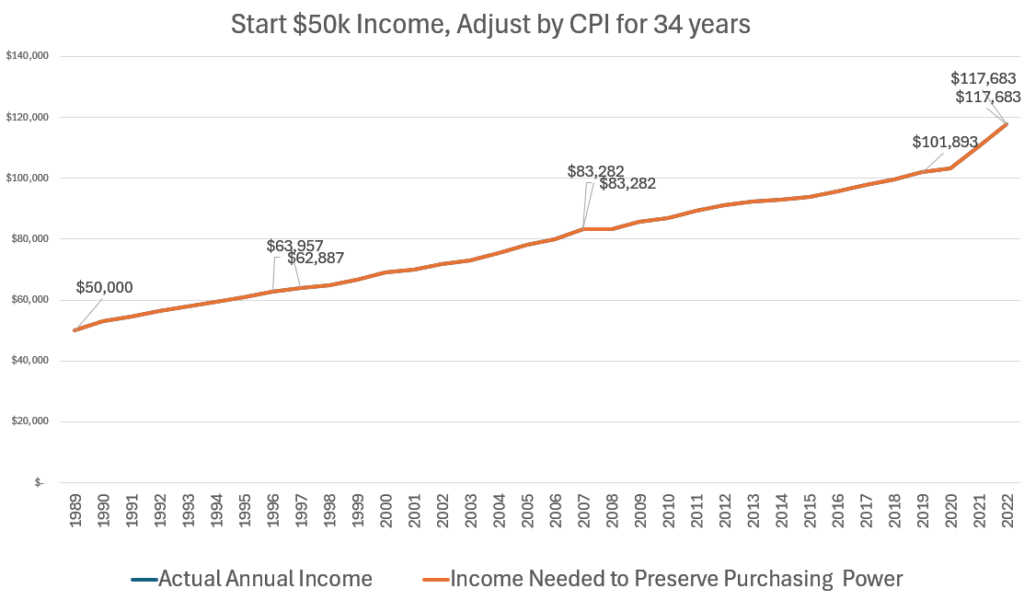

7. But what if we start at say $50,000 or 5% instead of 7.6% of the Starting $1 Million Portfolio?

We start with $50,000 in income, then adjust the subsequent year’s income based on inflation.

You can see that the portfolio last and you get inflation adjusted income.

Here is the portfolio value:

Not bad after 34 years.

5% is slightly below average return of 5.2% p.a. The average inflation is 2.7% p.a.

8. Kyith, I think I can be flexible with my spending, but not to this extent!

In our mind, whenever someone tells us that our spending tends to smoothed out over time, and that part of our spending is flexible, we need to see if our own situation is similar.

What is more important is also the DEGREE of volatility of the income.

In this case, the income went from $76,000 to sometimes $34,000 to sometimes $11,000.

Can your spending be that flexible?

Unless it is for a specific spending need if not I think is unlikely.

Conclusion

I hope you enjoy going through this stupid income idea with me and I hope that I didn’t insult you if you also came up with the same idea.

To be considered a viable income strategy, we have to take care of not just one aspect a few aspect.

Strangely, the best solution, in this historical sequence, happens to be not on yield, or coupon, but purely based on an arbitrary sensible yield and adjust the income based on inflation.

I think many planners are not ready to accept that despite us pulling $2.7 million in income over 34 years leaving $300k. If you look at the total amount at the end of 34 years, almost all the plan end up with the same money (income + portfolio left). But this strategy will exactly match your desired income so isn’t that great?

The question is what would be your goal? To have income, or to preserve our portfolio or both?

I think the questions may give you something to ponder about, if your ideal income strategy have similar aspect to this strategy.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.