One of my good friends eventually succeeded in his ballot for a flat and turned out to be Alexandra Peaks at Bukit Merah.

The Alexandra Peaks BTO projects fall under the Prime Location Public Housing or PLH flats for short.

My friend wanted a place to live with his future wife. Both of them are not big property people but they do have a certain lifestyle that they enjoy. I think the central location would work pretty well for my friend so he can take long walks from other places back to his current place.

My friend is an equity guy with an IRR of above 18% for the past 12 years. He knows how to build wealth without the capital gains of property.

I didn’t really pay attention to how restricted PLH flats are until he told me about it.

Then I was shocked and I thought I take this article to think through all the layers of rules that the government have put in place for PLH flats, relative to the other market segments.

You can take a look at the points below but here is my short summary.

Singapore property rules is made up of various layers. Some affect supply, and some affect demand of different segments of the population. By setting certain specific rules in each layers, they tweak the demand and supply in the way that they prefer.

The rules for PLH flats affect the future demand for PLH flats, take money back from you, so that you need to make serious consideration at the onset.

The following future demand are taken out:

Singles like Kyith(Edit: from 2H 2024 onwards singles can also buy PLH BTO 2 room flat)- Expat couples.

- Permanent resident couples.

- Couples with existing income higher than income ceiling.

- Couples who disposed of their interest in private property within 2.5 years.

You may hear some of our Indian or Malay friends say that while they live in a flat in good location, they cannot monetize that well due to the ethnic integration policy (EIP) or HDB quota. They are trying to create a similar effect for the PLH.

This reduce the view of PLH flats as a tangible investment asset but more like a home to live with a lot of intangible advantages to families.

If it works, it tries to realign the rule of HDB flats to make people consider the living aspects than to look at it as a stepping stone to your first pot of gold for future property purchases.

Based on population statistics, the PLH is still suitable for those who didn’t start off rich, but became wealthy through non-property means to eventually buy. They may want a place that is good to live in, well located that brings a lot of intangible benefits.

And I think the government is okay with that because it may mean that by all indications, that is the direction to go.

This may match the aspirations of younger Singapore adults who feels that they have no access to good living because property prices become more and more expensive. They will have to find other ways to build their wealth in the meantime, though.

Early Singapore retirees (or FIRE people) who made their wealth through careers and business may find PLH HDB flats to be a nice balance in ideal living and cost.

- They can quit their job, reduce their income below the income ceiling to be eligible to buy a PLH Resale Flat.

- Since the prices are capped, relative to other housing choices, FIRE people are a unique niche group that may benefit from this.

1. A PLH Household Must Comprise at Least a Singapore Citizen and one Singapore PR.

The minimum household for a typical resale flat is Singapore Permanent Residents (SPR).

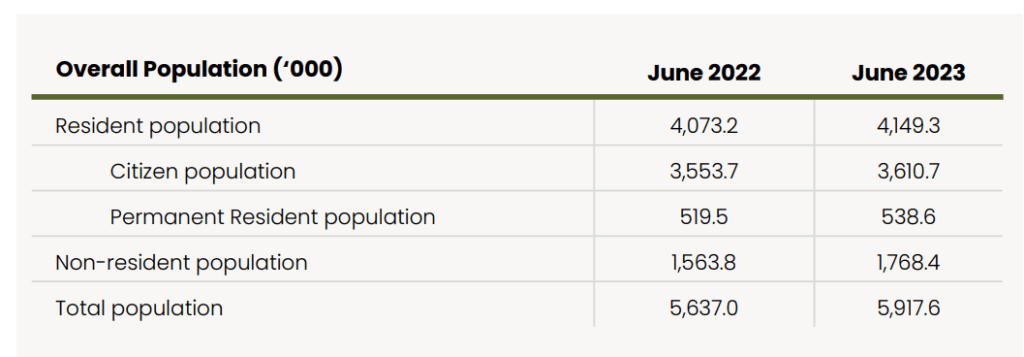

This constrains the demand to 70% of the overall population. I would like to think this has a small impact.

2. Singles Cannot Buy PLH Resale Flats

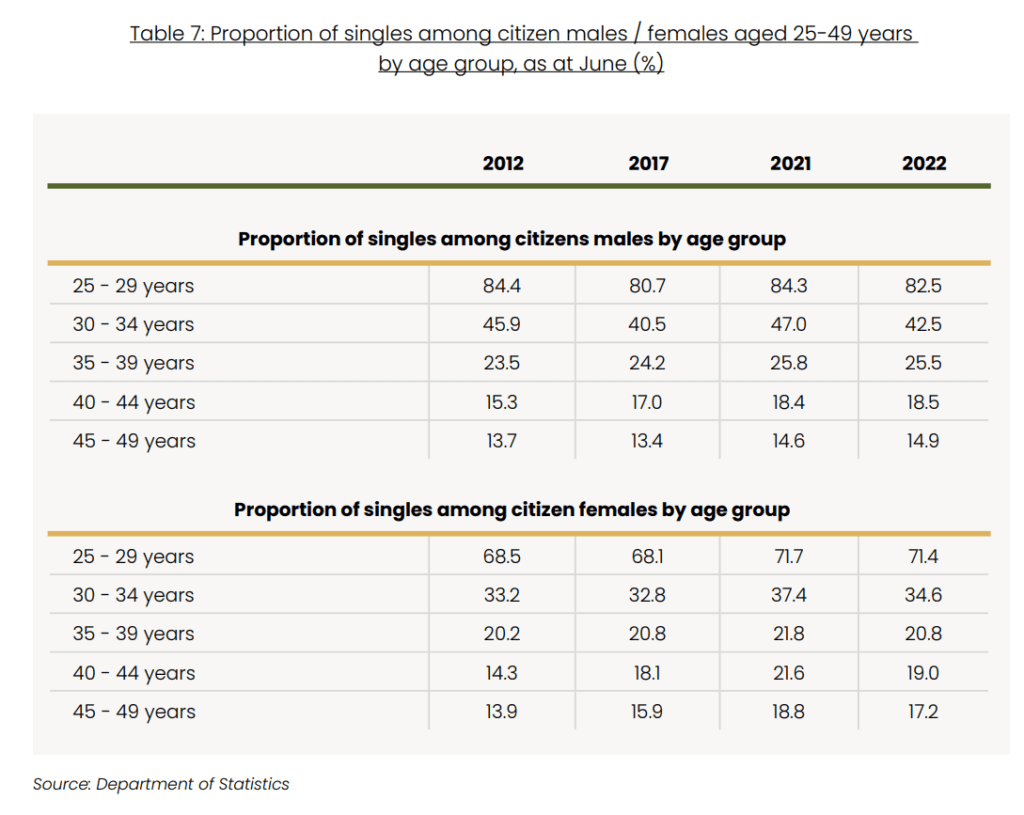

Unlike a typical resale flat, a PLH household cannot be bought by singles and the underlying message is this flat is for those who want to start a family. Typical resale flats can be bought by singles aged 35 and above.

So no matter how rich and willing is Kyith as a single, he cannot buy.

So from the previous table, we will cut the number down by another 20-25%.

The demand is half the population of Singapore roughly at this point.

3. There is an Income Ceiling (Currently $14,000) to Buy Resale PLH Flats.

There is no income ceiling for the typical resale flat but there is for PLH flats.

If you are a couple in the 30s, there is a likelihood your income will move past that.

Or as a couple, one of you can game the system by not work for a period of time so that the combine income will be lower than the income ceiling.

Retired couples with at least one Singapore would apply as well.

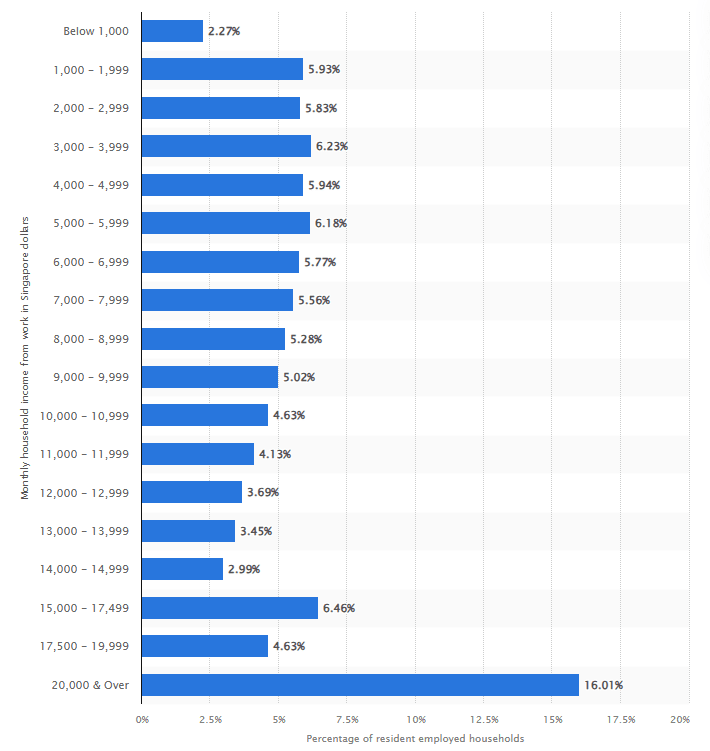

The table above shows the household monthly income in Singapore in 2020, by income level. With the current income ceiling, probably 70-75% of the current resident employed households will still apply.

4. Must Not Own or Have an Interest in a Private Property and Have Not Disposed of any Private Property in the last 30 Months (2.5 years)

Under the current resale flat rules, you can buy a resale flat after owning a private property but you got to dispose your private property within six months of buying the resale flat.

However, with PLH, the rules are much stricter.

You cannot have interest in a private property within 2.5 years. This means even 1% ownership also cannot.

If you are a rich person and want to help your kid buy a gosu PLH in good living condition by applying together with your kid, you got to make sure you sell all your private property for 2.5 years, then buy it back.

I think you may just go and buy a non-PLH near the place that they want to live.

The government probably have enough data to show what jacked up the price was the Singaporean households who sold off their condos for nice profit and would like a HDB in a nice location.

You can still buy a PLH by disposing your private condo, but you got to rent for 2.5 years at least. Might not be so hard to do.

5. Minimum Occupation Period (MOP) is 10 Years for PLH Flats

The government is encouraging younger Singaporeans to be able to own an HDB flat by reducing the income floor.

However, the minimum occupation period for PLH is 10 years instead of 5 for the typical HDB flat.

This means a couple will need to make serious consideration when they buy.

If they choose a PLH flat:

- They can only get a private property like 13-15 years later (3-5 years of build + 10 years MOP) and by then they may be 40-50 years old.

- 13-15 years is an investment opportunity cost to compound their wealth.

- They cannot own an interest in a private property so they cannot participate in some sort of co-ownership.

For those who look at the PLH as good living, and would wish to be able to sell to those who wish for good living, and don’t care so much about the price, this is still doable.

6. With Mortgage Servicing Ratio (MSR), Demand and Price of PLH Resale Flats is Further Capped.

Mortgage Servicing Ratio refers to the portion of a borrower’s gross monthly income that goes towards repaying all property loans, including the loan being applied for.

The MSR is capped at 30% of the borrower’s gross monthly income.

Together with the current $14,000 gross income ceiling, this means that the maximum financing is $14,000 x 30% = $4,200 monthly.

If we put these into a loan calculator, the maximum loan that you can get is $890,000.

And since the minimum downpayment is 20%, the price of the PLH flat currently cannot exceed $1.11 million.

Now building up to this point, if you are a Singaporean couple, with low employment income, that have been building your wealth via other means (maybe like Kyith through managed investments, equity and fixed income), living in BTO or resale HDB, you can still buy.

This is the group that can still push up the price.

But you look at the intersection, it is uncommon based on past history.

It takes a lot of people to push the prices up so you need this eligible cohort to level up financially.

The government would very much welcome the price to be pushed up if you are a couple, that build their wealth not through private property mainly, used to live in HDB flats, build up their wealth through other means and vote that “you want a nice place to retire at”.

If the prices does get push up, it is in the direction that they want.

7. Higher Subsidy Clawback will Cap Capital Gains.

Flats sold in an open market by first time owners are liable to a subsidy clawback that is based on the resale price or valuation price at the time of sale, whichever is higher.

Each project will have a different subsidy clawback.

Here are some examples:

- Rochor (2021 Nov): 6%

- Alexandra Peaks in Bukit Merah (2023 Dec): 8%

- Dover Forest at Dover MRT (2023 Feb): 6%

- Farrer Park Fields (2023 Feb): 6%

This will mute the investment appeal of the PLH flats relative to other options.

After capping the demand for the PLH flats not enough, they make sure they take back money from you.

8. You can rent out only spare rooms and not the whole home.

This is to prevent people from gaming the system by renting out the whole home.

However, folks can still rent out two of the three rooms if they want since the location is so good.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

Terrorblade

Saturday 25th of May 2024

Dear Kyith

One comment for Point #4: “Under the current resale flat rules, you can buy a resale flat after owning a private property but you got to dispose your private property within six months of buying the resale flat.”

Believe that the above is no longer applicable.

As of 30 Sep 2022, there is now a 15-month wait-out period for private home owners before they can buy a HDB resale flat. Only exceptions are those aged 55 and above who are moving from their private property to a four-room or smaller resale flat.

Can refer to: https://www.channelnewsasia.com/singapore/property-cooling-measures-condo-hdb-wait-out-period-2976136

Kyith

Sunday 26th of May 2024

Wah Terrorblade, don't sundar me. Thanks for pointing that out. Sorry missed out on this. I acknowledge the mistake.