Kitces.com usually is one of the vital resources for retirement income planning, among other financial advisory topics.

I want to highlight a good article that those planning for Financial Independence, and Financial Security will be interested in: How Sequence-Of-Inflation Risk Impacts Retirees Beyond Just Sequences Of Returns.

This article sought to highlight the danger of using a fixed inflation rate in your income planning.

What is a fixed inflation rate?

Oh like those financial planners who like to use… 3% a year inflation, 2% a year inflation or….. 0% a year inflation.

Readers of Investment Moats would not be too surprised by the points raised because in the past, when I talk about sequence of return risks, I shared that whether we do well during the early periods of our retirement is very important to whether the portfolio stands a good chance of lasting.

Many would only think about your portfolio going down during the initial retirement years.

But many failed to note that if you spend too much, relative to your portfolio value in the early years, then the same problem occurs.

This slide is taken from an internal experimental slide deck to help illustrate the negative sequence of return risks. There is two investor A and B living through two different historical time periods. If they are accumulating, the compounded average return for both is 14.8% p.a.. That is an astounding good return.

But if both of them choose to start spending $50,000 a year, then adjust the next year income by the prevailing inflation, Investor A will end up with $27 million in legacy at the end of 30 years while Investor B will run out of money after just 14 years.

The bottom chart shows the progression of annual spending. Investor B live through a period of higher inflation compare to Investor A (who lives through quite a high inflation period himself) and so the portfolio cannot take it, despite having such high compounded returns.

This illustration shows how important the sequence of inflation is.

There are some illustrations from the article that maybe I can talk through and explain.

I don’t understand their tables.

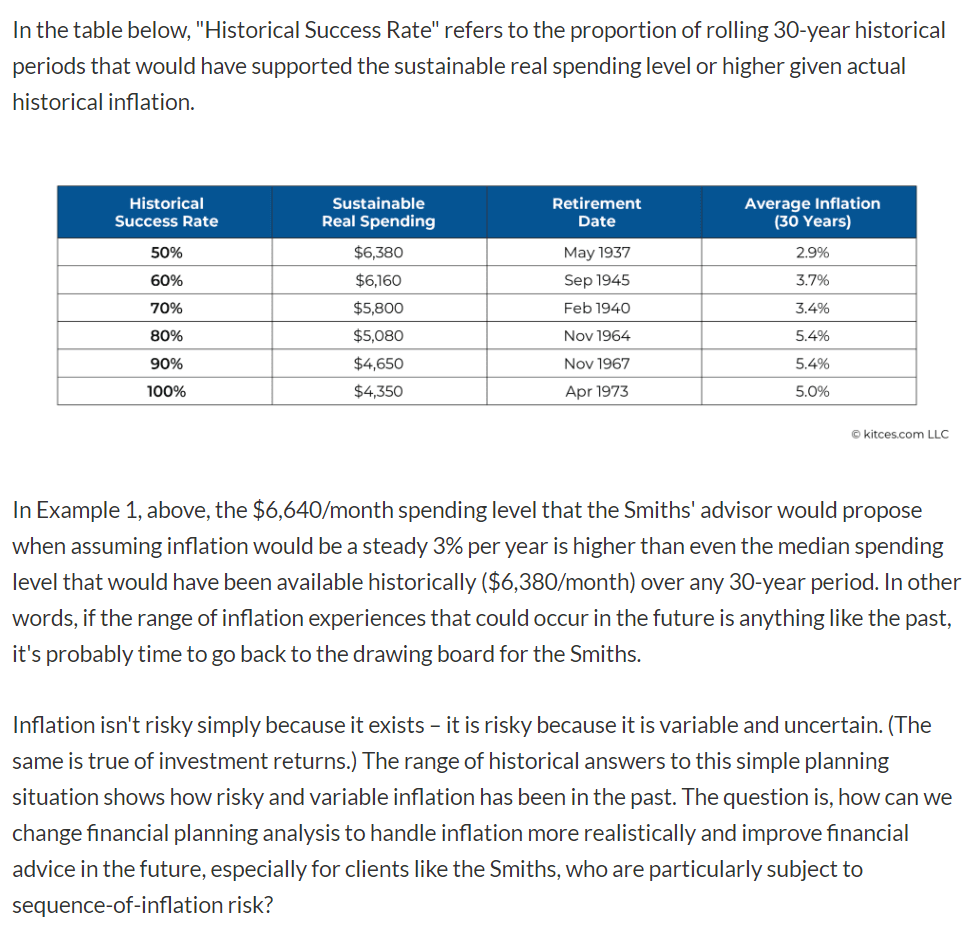

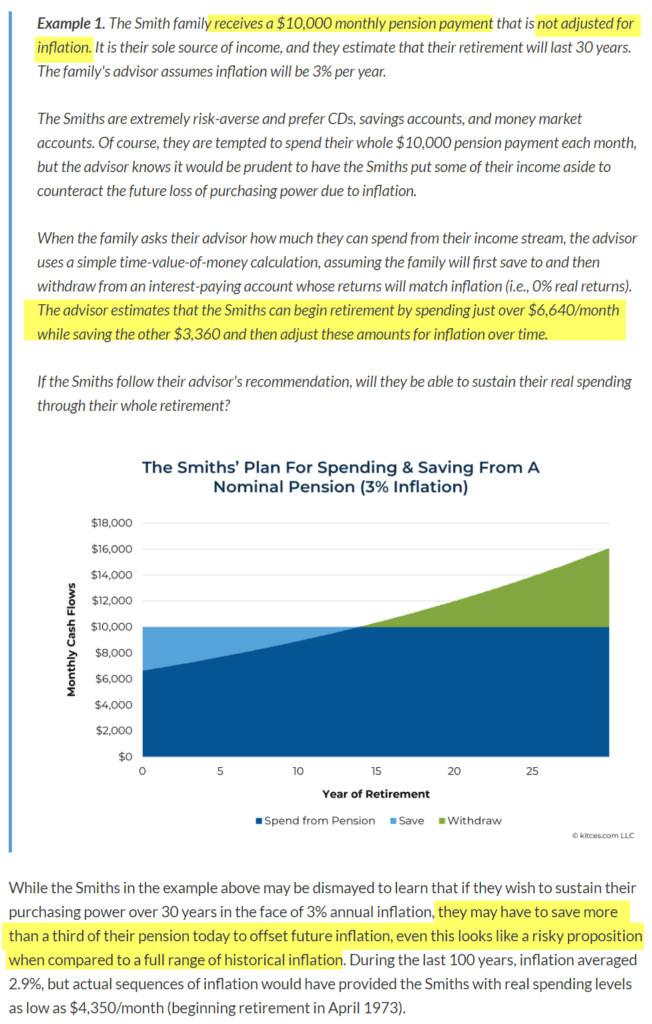

The author tried to illustrate that inflation is variable and uncertain through a fictional couple (the Smiths) who has a spending level of $6,640 a month:

But I don’t really understand the table. The historical success rate, if I am right, shows the amount of 30-year periods that would support the corresponding real spending rate (means inflation-adjusted).

The Smith’s $6,640 a month is higher than the 50% historical success rate of maximum income $6,380. If you go higher than that amount, the historical success rate drops. This means that less than 50% of historical 30-year sequence you end up having income for thirty years.

But I am not sure why they put a retirement date and average inflation rate next to it.

But they do list out the challenging thirty year periods of high inflation: 1964, 1967.

Those are the 30-year sequence that you can keep in mind. If your simulation beats those thirty year periods, they lean towards more robust.

What the author wants to say is:

If you use a constant 3% p.a. inflation, you end up being recommended a higher income than if you run through dynamic historical sequences.

It shows the weakness of constant inflation rate.

Your Fixed Inflation Assumptions or Projected Returns Need to Be VERY High to Factor In High Inflation Periods

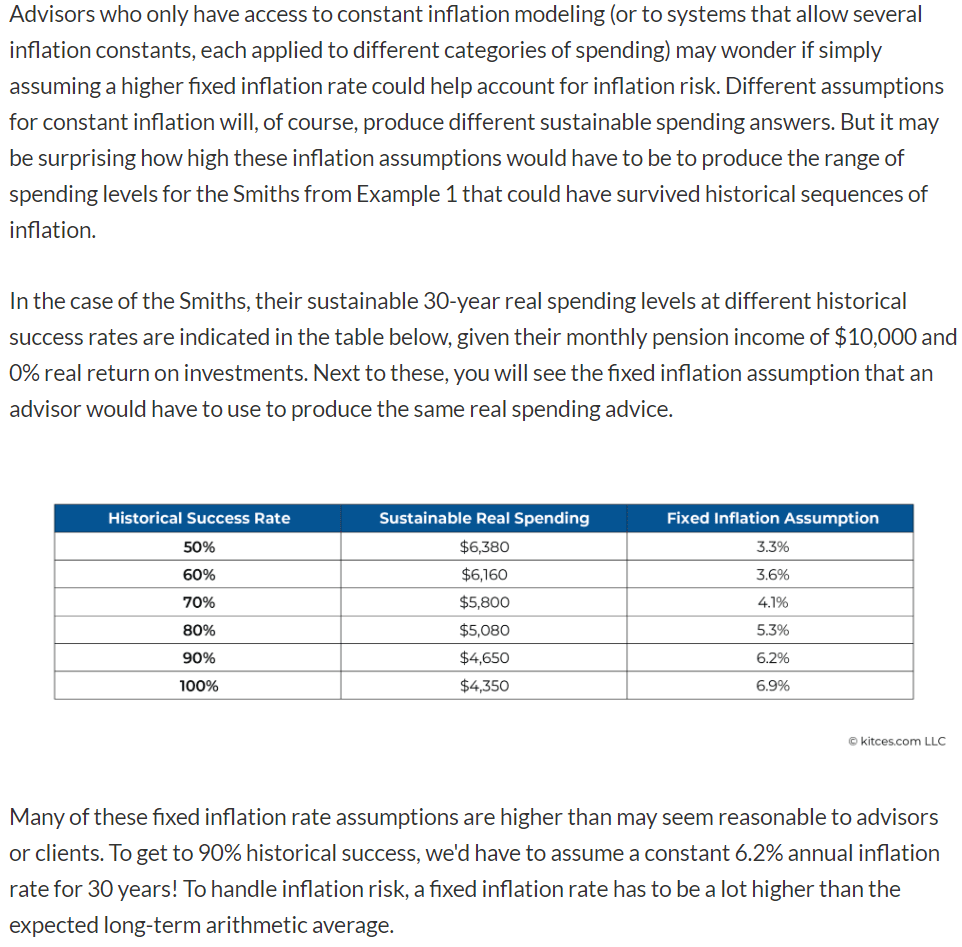

“Kyith, can we solve this uncertain or variable problem by using a higher fixed inflation or lower rate of return?”

In my experience, many just want a simplistic model of solving this problem so that it is easier to advise clients.

The author explored how high inflation needs to be to take into consideration the historical upper bound of inflation:

You probably need to raise inflation not just to 5% but above 6%!

This means you need more capital.

The author then talks something about rate of return:

This is analogous to how an advisor who wishes to find a sustainable withdrawal amount from an investment portfolio with varying returns but who uses a constant rate of return and time value of money calculations would have to use a rate of return (much) lower than the expected long-term arithmetic average.

For example, assuming a 5% arithmetic average annual real return and 10% standard deviation of returns (not far off from long-term statistics for a 60/40 stock/bond portfolio) in a basic Monte Carlo simulation, a $1,000,000 portfolio could produce roughly $46,700/year for 30 years with an 80% probability of success.

To produce this same withdrawal amount using straight-line appreciation, we would have to use a constant 2.3% real rate of return – well below the assumed 5% arithmetic average.

I notice in my data work, if you use a certain confidence level the long-term at the lower bound, or the worse return, is usually half of the average/median return used.

This means…. more capital is needed again!

Some wonder why I don’t use Monte Carlo simulation more and I don’t like it because it cannot easily simulate certain sequences (like an economic sequence of market overheating, then recession, then recovery) but also that if you want to prepare for the lower bound, the capital you need is likely larger than if I use the historical worse case.

Ultimately, the conclusion is you might need more capital.

Some Ideas That Relate to CPF LIFE Annuity

Unless you choose the Escalating scheme, the Basic and Standard does not adjust for inflation. This becomes a problem, even for planners who wish to model it realistically.

My thinking is:

Start spending a lower CPF LIFE income and save the rest for the future to buffer for inflation.

This is inefficient but it is one of the better methods after considering a bunch.

In the author’s example, they provided some hints as to how much lower your initial spending needs to be:

If our income stream does not have an inflation component, the data does show that we may need to start at 66% of the income you get.

Overall, a pretty good article. Nothing much that is unexpected.

- The Cheapest Way to Extend Your Laptop to TWODisplay that I Can Find. - April 29, 2024

- My Quick Thoughts on the Net Cash, 4% Yielding Boustead. - April 28, 2024

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

Sinkie

Monday 25th of September 2023

Those successful investors & retirees in Zimbabwe, Venezuela, Argentina will be the experts with their triple-digit inflation lol.

Things I can think of are: 1) work as long as health perfmits in order to save/invest more; 2) convert as much as possible into stronger currencies (not really applicable for us with strong SGD); 3) invest as much & as early as possible into real assets (productive real estate, bona fide stocks) to grow real wealth.

Kyith

Sunday 1st of October 2023

Hi Sinkie, thanks for the comments. I think the SGD really screw up this aspect of the rules.