Happy National Day, Everyone.

In the previous two videos, I shared why I think having a simple, low-cost, diversified, scalable portfolio as the basis for your wealth accumulation and spending down strategy is possible.

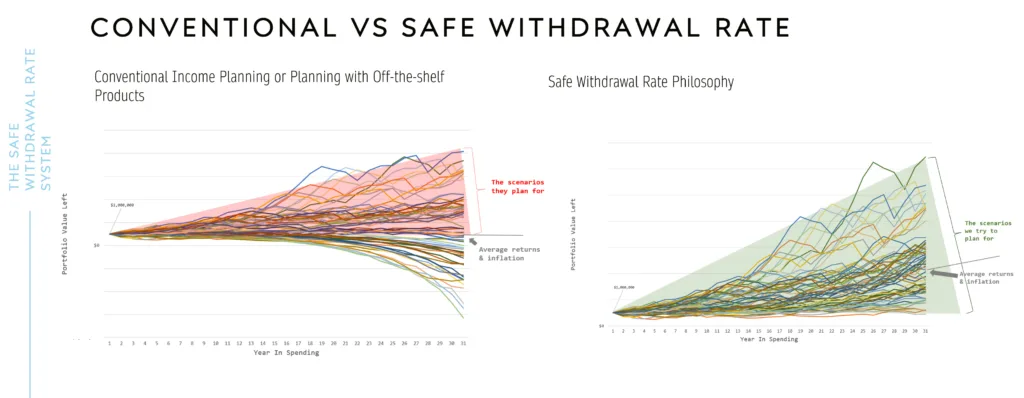

I also fleshed out the safe withdrawal rate system, which is a conservative, academic, empirical-based system of determining how much capital you need to have an inflation-adjusted income, for various duration you need.

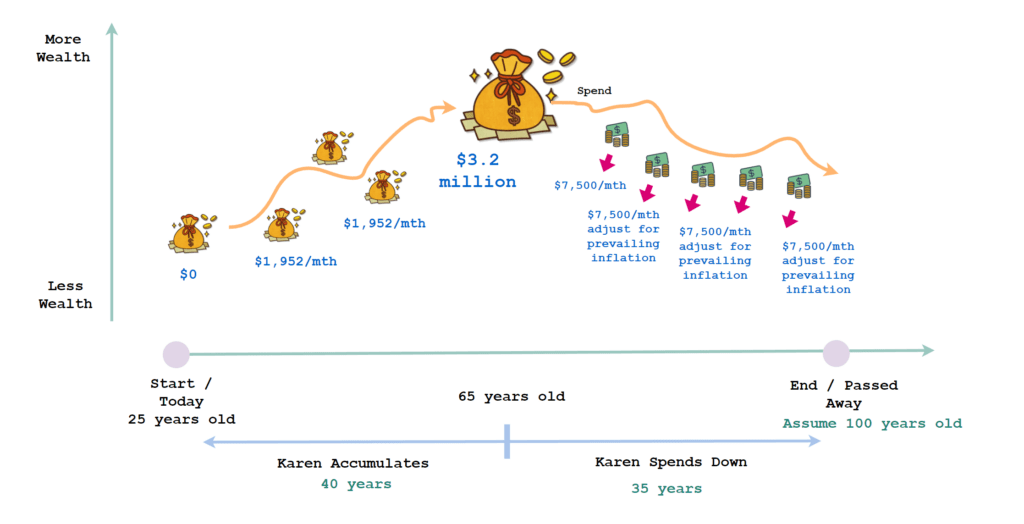

If we have a simple way to create a passive, low-cost diversified portfolio, and a conservative, empirical spending strategy, how do we create a financial independence plan?

This video tries to add them up and craft a plan to figure out:

- How much income monthly from your paycheck to put in…

- To accumulate a portfolio…

- So that you can have a more passive, inflation-adjusted income that considers many challenging scenarios…

- For a specific duration…

- How to determine what kind of portfolio is suitable…

- How the implementation will be…

- Then what happens after you implemented the portfolio, what you should consider day to day…

- And what happens when your situation changes…

A Good Singapore Financial Independence Planning Blueprint

This should allow DIY investors to see how all these stuff add up, from a financial planning perspective.

Let me know if you have further questions.

Do like and subscribe if you like the video.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

TT

Sunday 13th of August 2023

Hi Kyith, nice to read your recent video. Very educational indeed.

In your example, a fresh working adult, working toward retirement at 65 years old.

I am trying to apply to my situation, trying to retire before 65 years old. After working out the capital required at retirement age, says 60. The next steps would be the annual contribution, which I encounter some challenges.

Challenges: 1. However, I have accumulated certain level of asset, 50% of which is in CPF, unfortunately. How would I account for the capital (equity + CPF) I have today to work out the yearly contribution?

2. Do you factor in CPF payout as part of the SWR?

Appreciate any advice.

Kyith

Sunday 13th of August 2023

Hi TT, you are almost at retirement age. My video was created to take out the CPF portion because, the CPF is a weird shit that if i factor it in my video might be 2 hours long at least. When we look at things like the Safe Withdrawal Rate, we are treating that portfolio as a unique retirement product/strategy. The CPF is another stream of income.

So to find out your retirement sufficiency, one way is to see at 65 , after your CPF LIFE, how much more you need to cover your income needs. Suppose out of $4k it is $1.5k more (at 65 year old income not 60) then you can use that safe withdrawal rate (should be about 2.8% to 3%) and work out that the additional income you need is $642857. If you are less conservative and use 3.5%, then its $514,285.

hope this helps.