I was doing some personal financial planning, and part of the planning required me to sense how well a flat in Sengkang rents for.

So I decided to crunch some data and since I did it, I might as well show you here.

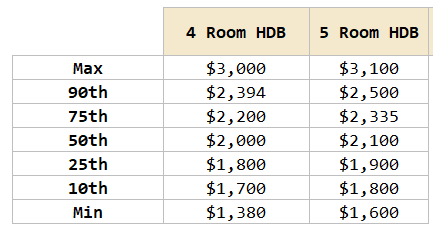

The table below shows the average rent declared to HDB from 3rd quarter 2007 to 4th quarter 2022:

This means we have about 15 years of historical Sengkang rental data. During this period, we went through a lot.

I won’t make much comment. Just take a look at the rental data.

In the table above, I have listed out the rent from the highest (max) to median (50th percentile) to the lowest (min).

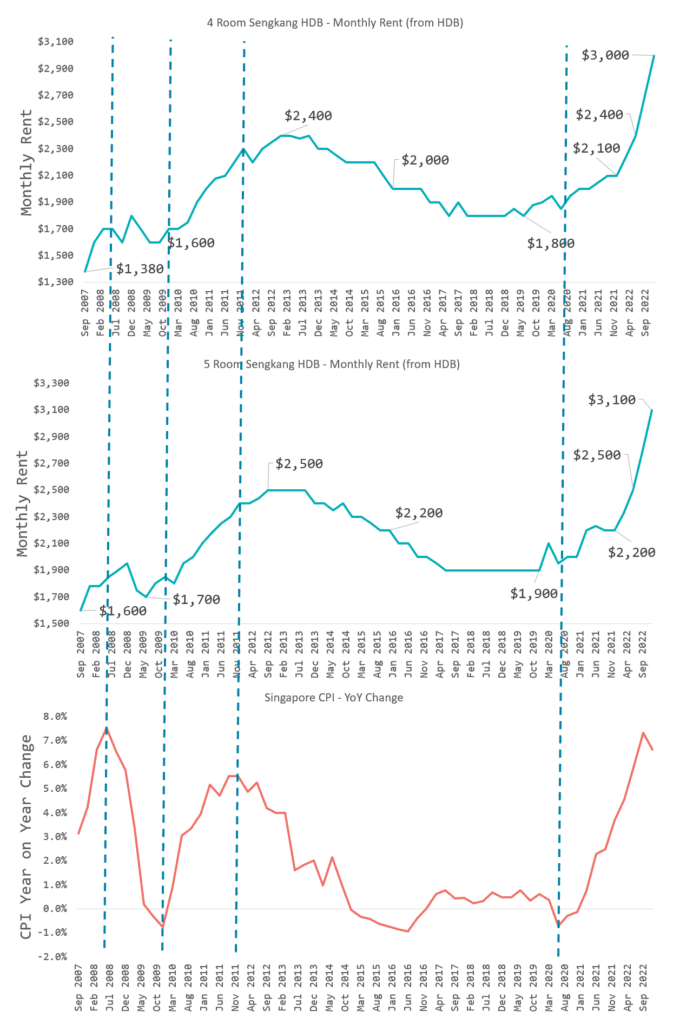

In the chart below, I plotted the rent over time, with the top chart for 4-room HDB, middle chart is the 5-room HDB and the last chart is the year-on-year change in CPI:

Not sure what your thoughts are.

The CPI includes housing as an input, so I don’t think it is a CPI is high, which is why rent is high. Most likely it is the other way around.

If there is a takeaway, it is that inconsistent is the constant:

- A person banking on his $1,600 a month 5-room rental income in Sep 2007 to pay for what he needs will be very happy that the income eventually climbs to $2,500 a month. The income will eventually go down to $1,900 a month for a number of years before his rent doubling to $3,000 a month.

- A person planning to retire with $2,500 a month in Sep 2012 will face cash flow constrain when the income eventually fell to $1,900 a month, or 24% less.

- If you are putting in some margin of safety in your planning for your retirement, how much buffer should you put in so that in the “unlucky” situation, you can still pay for what you need? Would 10% buffer be enough? or 20%, or 30%?

- The retiree who plans around the rental income in Oct 2019 will get a pleasant surprise when income rose 50% to $3,000 a month.

- The $2,500 a month high for a 5-room flat will only be revisited 10 years later!

- Despite all these income fluctuations… inflation consistently goes up, except for some mild deflations. The Sep 2012 retiree planning around $2,500 a month will see his income drop to $1,900 monthly. Despite the income drop, the prices of what he needs continue to go up.

You can replace the Sengkang HDB data with other data, but I am quite sure the constant is inconsistent income.

So right now… the market rent for a 5-room HDB is $3,000 a month.

If I am planning to quit my job and solely depend on the HDB rental for income, how much can I spend so that my income plan is sustainable? Do I spend just $2,000 a month which gives me a 30% margin of safety?

Do I assume that “this time is different”, that the Singapore rental landscape has changed, and income will just keep going up?

The lazy answer would be: “This is why you cannot depend on one income stream, you will need your spending income to come from various sources!”

Your income is from different sources, but if all the sources are going to be inconsistent, you will still get the same problem isn’t it? Perhaps it is more nuance such as “If my rental income falls 30%, my dividend income can make up that 30% easily!”

This is something for you to ponder about.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

Revhappy

Monday 29th of May 2023

3000 is actually outdated. 5 room flat now gets 4000 rental. One of the problems in Singapore housing is, locals are all on one side(owners) and foreigners on the other side(renters). So govt doesn't have much incentive to controls rents, they can just let it run so that Singaporeans can get the feel of prosperity. This kind of dynamic doesn't exist is most parts of the world. HDB on top of that is subsidized housing, so it kind of no brainer that HDB renting out is the best investment out there.

Kyith

Saturday 3rd of June 2023

not sure. it is not in the data yet.