Bob French over at Retirement Researcher has an article trying to make their readers focus upon the trinity relationship between savings, the investment return and how much is needed for retirement.

I think this is not new to my readers here.

In how to get rich (realistically) and stay wealthy, I explained that almost all the gurus will share a similarly high-level formula:

- Strive to earn more, optimize your expenses. If you do this well, you have a higher surplus.

- Invest your surplus at a good rate of return to leverage the power of compounding.

But I think Bob’s illustration take away the numbers so we can see the relationship better.

Bob assumes that suppose you plan to retire in 30 years and would accumulate by investing in a mixture of bonds and equities in a low-cost manner.

The stock returns 6% a year and the bond returns 3% a year.

Some of you are more risk-seeking. Others do not dare to take too many risks.

Some of you are privileged to have a higher income and after optimising your expenses, you have a big surplus (savings). Others are just starting out or struggle to earn more and the surplus tends to be smaller.

Okay, this matrix looks a bit intimidating so let me try to explain. The horizontal axis shows different equity/bond portfolio mixes. If you select a portfolio higher in equities and lower in bonds, you are more risk-seeking or more open to taking risks to earn a higher return and vice versa.

The vertical axis shows a different level of savings rate. Start reading from the centre row (base savings). The rows above and below pivot from this base savings.

In each cell, you get the amount of wealth built up, which is a variation from the base amount. The base amount is the middle which is using your base savings in a 60% equity and 40% bonds portfolio.

So if your savings rate is 30%, then you can view the vertical axis as +5%, +10%, +15%, +20% of 30%.

In this way, this table applies to most of you.

The wealth builder that is able to take advantage the most is the one with a higher savings rate and is able to invest in an 80% equity 20% bond portfolio. The amount accumulated is 34% higher.

But you would realize that you do not need to go so extreme. If you are able to take your savings rate up 20% and shift to a 70% equity and 30% bond portfolio, the amount is 27% more, which is not too shabby.

If you struggle to earn more in your day job, you have no choice but to take greater investment risks so that you end up at the base case.

If you are more afraid to take risks, then you have no choice but to have a higher savings rate.

But if you are struggling to earn more and are risk-averse, then it will be a struggle. I do think that part of the reason many are not afraid to take risks is due to your perception of risk.

You have some preconceived notions about investing as gambling or dangerous. That might not be the truth. And we can work through that with financial education.

But that is to a certain degree.

Ultimately, if you strive to be more educated and try to earn more and optimize your expenses better, you reach the base case.

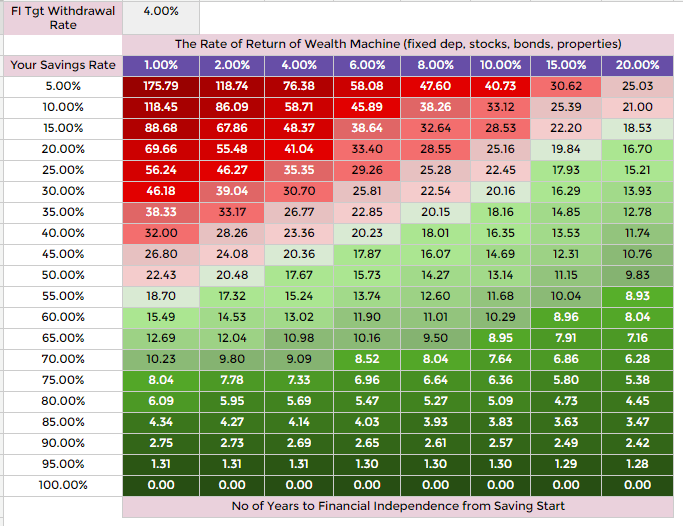

In my article, I have rather similar horizontal and vertical axis:

Instead of portfolio mix, I replaced that with absolute returns and in the vertical axis, it’s a different level of savings rate.

In each cell, it gives you a rule of thumb how many years to financial independence.

So the main difference between Bob and mine is he is the amount, mine is a number of years.

But you can take the baseline as a 30% savings rate and 4% rate of return. That will take you 30 years to save for the amount you need roughly.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- Should I Take Less Risk in My Fixed Income Allocation by Moving Away from a Global Aggregate Bond ETF? - May 5, 2024

- Singapore Savings Bonds SSB June 2024 Yield Climbs to 3.33% (SBJUN24 GX24060A) - May 3, 2024

- New 6-Month Singapore T-Bill Yield in Early-May 2024 to Stay at 3.75% (for the Singaporean Savers) - May 2, 2024

steveark

Sunday 5th of December 2021

It reminds me of the old engineering maxim that you can have any two of the following: fast, good, cheap. But the two you pick will determine the third. Not so different than savings rate, portfolio composition and time to financial independence. You can pick two of those and the third becomes fixed by those choices. Great post Kyith!

Kyith

Monday 6th of December 2021

I think the difference here is shorter time and larger wealth is not a bad thing. perhaps you are right. you have to sacrifice by taking more risk, and saving more, and in exchange you have an easier time accumulating or shorter financial independence.