A friend of mine asked in my Telegram group:

If we have an investable $4 million and our fixed expenses, which include our mortgage, are roughly $11,000 a month, and if we are retiring, would we place all the $4 million in long-term fixed income and bonds so that the bonds can generate around $150,000 a year or would you prefer to do a 60% equity 40% bond portfolio, subjecting your money to sequence of return risks?

I clarified a few things further with him and understand that:

- The mortgage loan is unique to him, such that while the tenor is 30 years, there are not so many interest rate risks.

- He is not looking for bonds which is too far out of the credit risk spectrum, preferring higher quality, direct individual bonds.

- His definition of long-term is closer to 5-6 years.

- If he needs $121,000 a year, effectively he is setting aside some buffer to the $150,000 a year annual income he is expecting from the fixed income/bonds.

- Within the $121,000 a year, there are buffers in place.

When I see a question like this, I am incline to put on the financial planning hat to clarify more things.

Many times, the nuances do matter in helping you come up with an ideal choice.

Usually, I would ask him to split out his mortgage as the expenses for the mortgage tend to be rather fix. He can be conservative and assume a 3.5% or 4.5% mortgage interest rate and set aside a fix sum of money.

But I reckon this is a question more about:

- Relying on a long term direct fixed income income strategy versus

- Relying on a balanced portfolio strategy

So we don’t have to go into the income but it is important to know that he has two layers of buffer.

The Concentrated, High-Quality Fixed Income Bond Strategy

The fixed income strategy involves curating an ideal set of direct individual bonds that meets the credit rating you are comfortable with. The coupon payment will be your income and when the bonds mature, you will have to roll them into a new set of bonds of the same credit rating.

If the coupon is not enough, you might be force to move out further in the credit risk curve to get a higher coupon at the expense of higher default risk.

The pros of this strategy:

- Unless default, your principal is protected.

- Income is consistent within the tenor of the bonds.

- There may be adequate bonds to diversify to.

The cons of this strategy:

- The income does not adjust for inflation. You have to get your income needs right. There is not much room for income upside surprise unless interest rate surprises on the upside.

- When the bond matures, you face reinvestment risk of a different prevailing interest rate.

- You need to think about reinvestment because it is going to happen.

- Unless you have a large amount of capital, it may be challenging to diversify into a few bonds so that a default will not kill your plan. Usually, it would result in an investor sticking with bonds of higher quality.

An investor would also need to have enough sophistication to assess that the bond is of good quality not just at the start but ongoing (this is because it is likely you are holding a small number of selected bonds.

A large amount of your capital hinges on the well being of a business ability to pay the payments.

While the income from this strategy is consistent, the reinvestment risk is real.

Zooming In on the Bond Reinvestment Risks

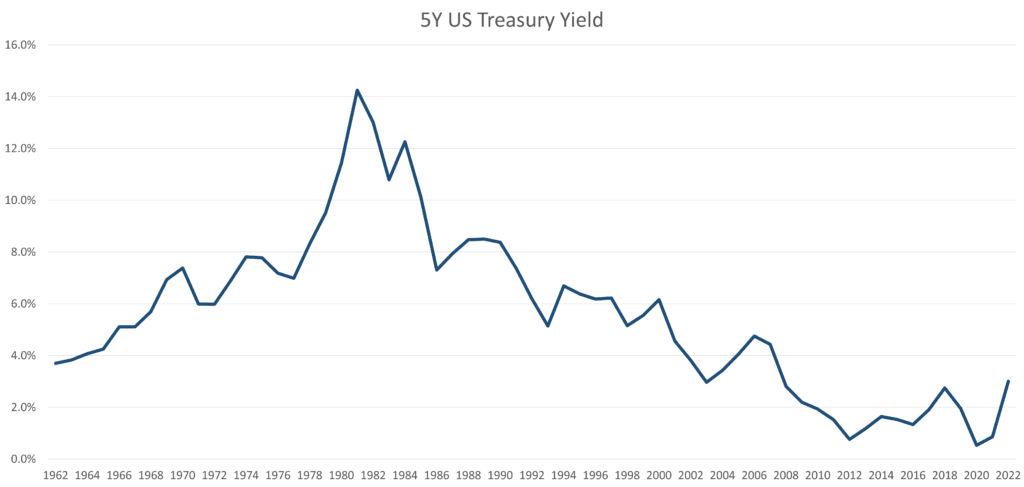

The chart above plots the prevailing yield of the US 5-year Treasury from 1962 to today.

Now Kyith, why do you use the yield of the five year US treasury when your reader is looking at Singapore direct bonds?

I think is a suitable proxy because:

- The tenor of the bonds is not too far away from the 5-6 years he is looking for.

- The Singapore bond yields is not going to veer far from the US yields.

- It shows that bond yields are volatile whether it is in Singapore or the United States.

- US bond yields tend to be around 1% higher than Singapore’s and since the reader is looking for bonds of higher quality, the credit yield spread should be pretty close to the Singapore government bonds which would be almost similar to that of the five-year US Treasury.

You will notice how volatile the bond yields were in the past, which means it does pose a reinvestment risk.

If you staggered your bonds, each matured bonds will also face reinvestment risks.

Now let us try to simulate my reader’s plan to give you an idea how it looks in practice. The starting yield in 1962 is around 3.7% which is pretty similar to the yield my reader is look at ($150k/$4 mil = 3.75%).

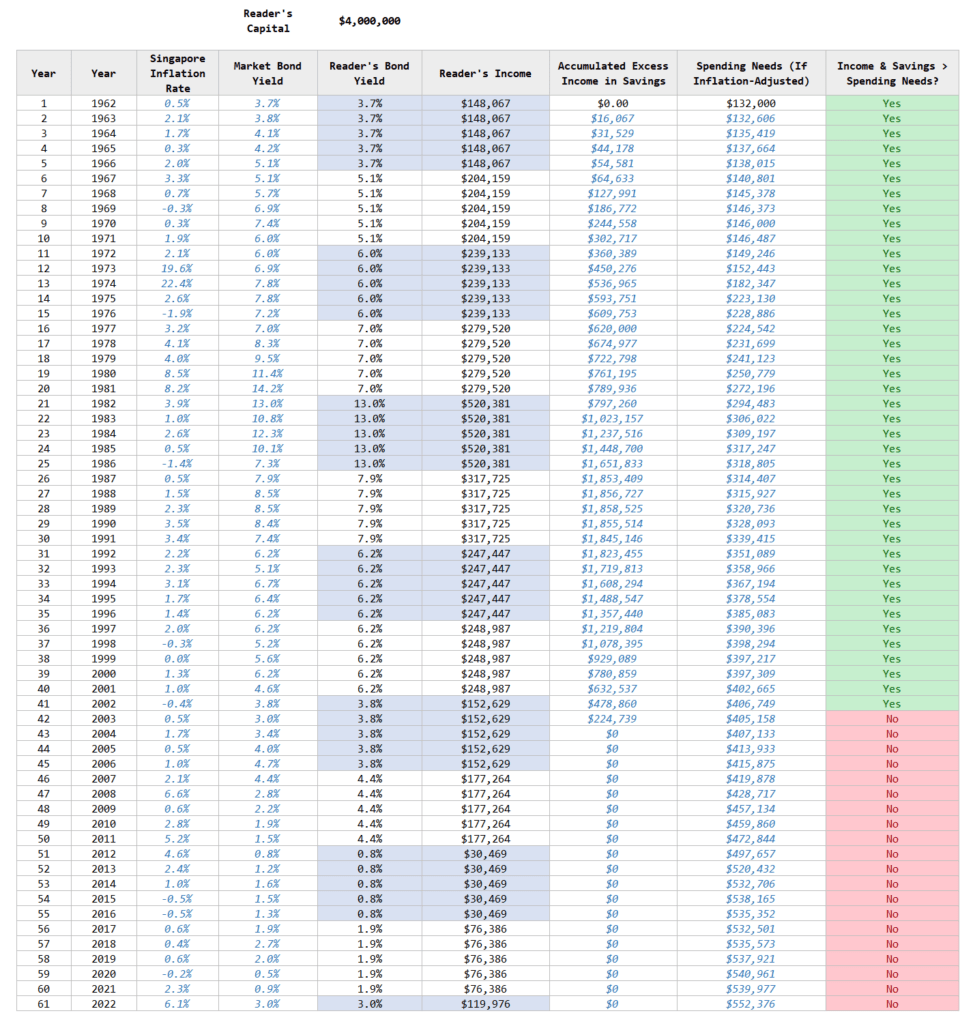

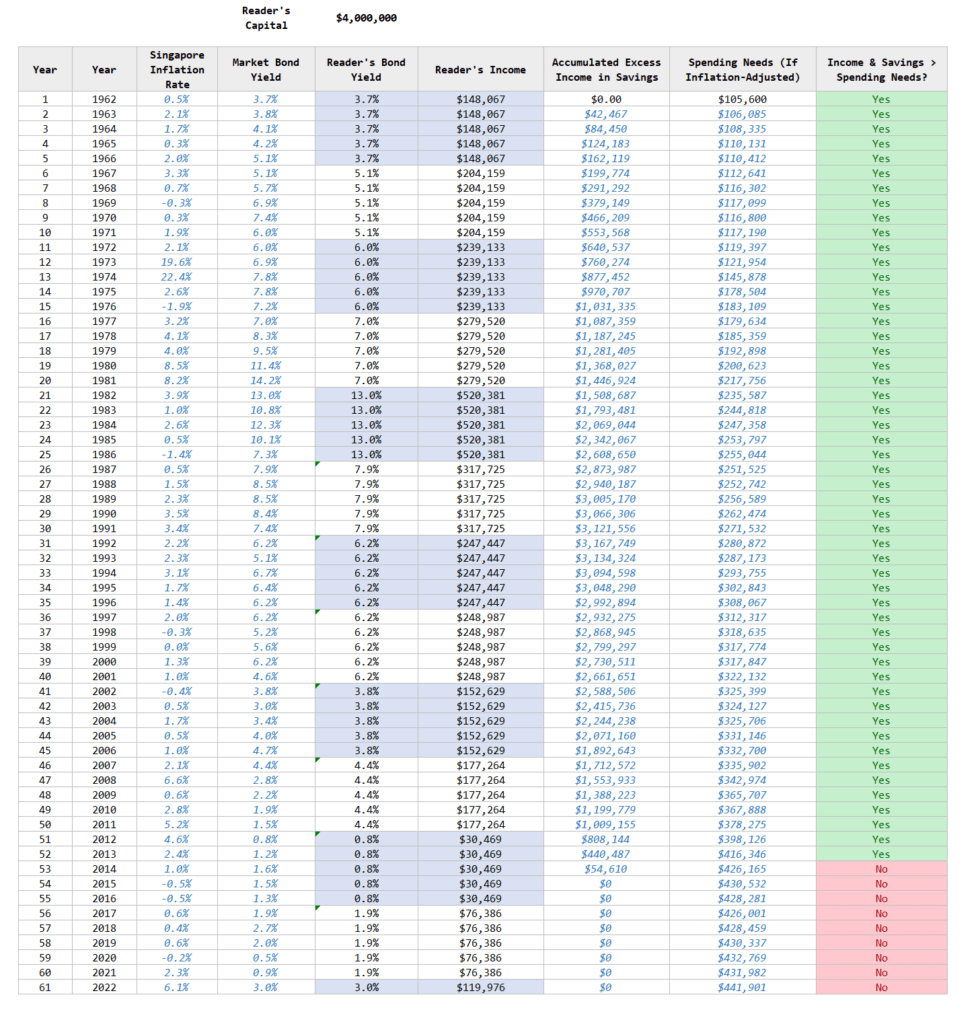

Now what if we imagine he puts his $4 million into a few bonds which yields 3.7% in coupon at the start to give him $150,000 a year in income. His income needs currently is $132,000 a year but lets assume that the needs go up with prevailing Singapore inflation (which coincidentally has inflation data since 1962).

For those bond income that is unspent, he will keep them as cash.

His plan will look like this:

This looks like a very busy table but it basically shows that if my reader starts his retirement in 1962, his income and any savings from unspent bond income will be lower than the inflation-adjusted spending needs after year 42 or 2003.

The principal of $4 million is intact, if the bonds do not default, but at year 46, my reader would really need to explore selling some of the bonds in the market to make up for income.

In year 42, the income needs is $405k and the income is only $152k!

Notice that the reader’s bond yield changes every five years.

I would say that… if my reader goes through this sequence, he is very lucky. His income actually went up then go down. Imagine if his income goes up and down, up and down.

I wonder if he will have saved up enough income. He might not have.

Now… we have to remember that in his income needs of $121,000 a year, he also has buffer.

So lets say he set aside 20% of the income needs as buffer, which means his actual needs is $96,800 a year.

Would his plan be intact if we adjust the spending needs from $132,000 to $105,600?

My reader’s simulated situation improves and he only hit the hiccup in year 53.

But I think you get the idea.

Interestingly, if you approach spending only 2% of your capital, your capital usually last much better, which is the same as my perpetual income idea.

Ultimately, I think the key is always to respect the income-to-portfolio-capital ratio.

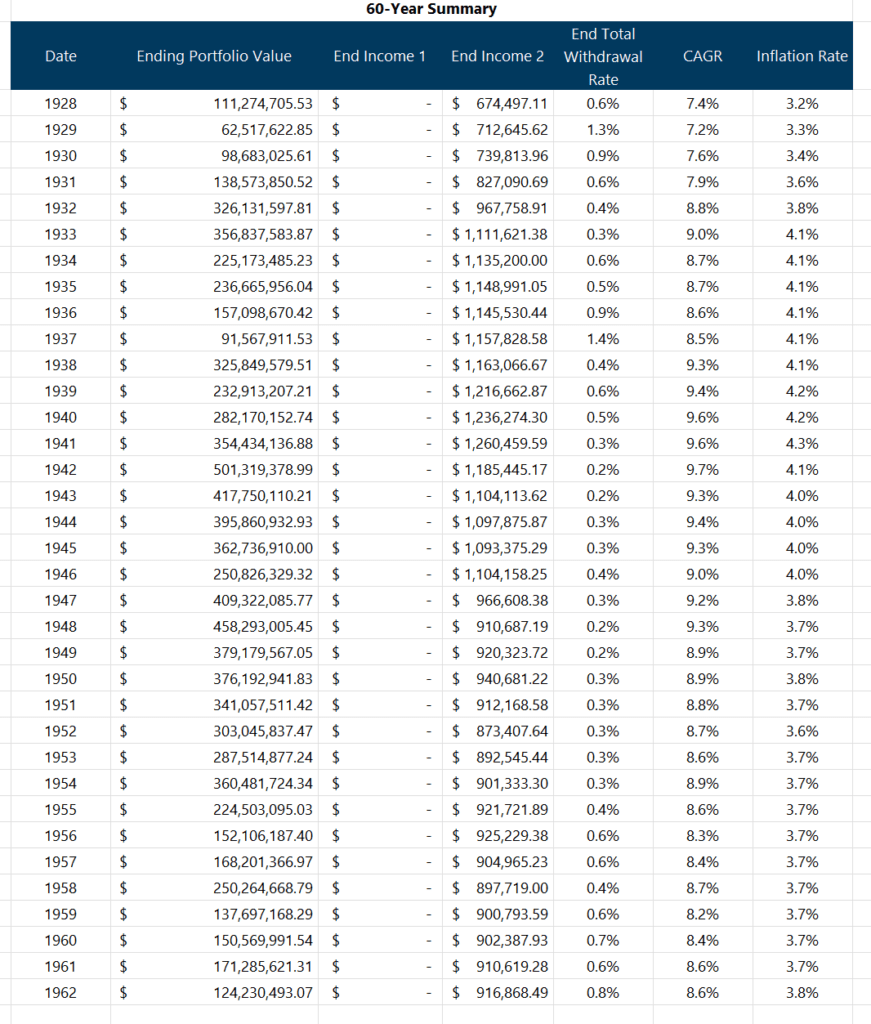

What if My Reader Goes with a 60/40 Portfolio Instead with a $105,600 a year income needs?

Since I have my trusty safe withdrawal rate calculator, I can simulated for all the 60-year periods in the US, with US inflation (not Singapore inflation. US inflation generally is 1% a year higher than Singapore’s inflation).

The table shows the result if we start with spending an inflation-adjusted $105,600 a year on a $4 million portfolio of 60% equity and 40% bonds (an all-in-cost of 0.50% p.a.). The lowest ending value at the end of 60-years is about $62 million. The ending withdrawal rates are all below 1.5%, which indicates the money should last perpetually.

Lessons to be Learnt

Aside from the pros and cons of investing in a concentrated portfolio of higher quality direct bonds, I want to bring your attention to some points:

- The sequence of yields that my reader reinvest his bonds do matter. If he is unlucky, it might be a problem.

- What made his plan partly work so well was the buffers. There is a buffer on his income needs versus the actual bond income and another buffer in his income needs. What many fail to see is that over a long period, there is going to be some uncertainty over the yields. You cannot assume a 3.7% yield will stay like that for 30-40 years. Interest rate will always be volatile!!

- There is seldom a 100% safe plan. There is going to be some form of uncertainty in one form into another.

- Why not do a direct bond allocation with a 30-40% equity allocation? The equity allocation can be sequenced for later years to help with income longevity.

Hopefully this is of some help to him.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- The Cheapest Way to Extend Your Laptop to TWODisplay that I Can Find. - April 29, 2024

- My Quick Thoughts on the Net Cash, 4% Yielding Boustead. - April 28, 2024

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

Thinknotleft

Wednesday 20th of September 2023

Certainty in finance is expensive. 100% fixed income ignores inflation and inflation is a killer if the retirement period is long.

Equities can counter inflation.

Like you said, "Why not do a direct bond allocation with a 30-40% equity allocation?"

Or to keep things simple, a 50-50 bond-equity allocation may also do.

Kyith

Sunday 24th of September 2023

Hi Thinknotleft, thanks for your perspective. I can understand where he is coming from because at some point, i always wanted to know why there cannot be one strategy or just one asset class so being very focus allows us to explore the pros and cons. the downside is we fail to see that we can perform a mixture!

Kelvin W

Wednesday 20th of September 2023

Also, the table used for your illustration of the 60/40 portfolio.

Kelvin W

Wednesday 20th of September 2023

Kyith,

If I read it correctly. I think your illustration in the above article using $121,000 is incorrect. If your friend needs $11,000/month in expenses, then it would come up to $132,000 a year.

Kyith

Wednesday 20th of September 2023

HI Kelvin, you are right, i got my math wrong! I have since corrected things and the conclusion is the same