I will share two articles with you today.

My friend RetireBy35 found his love after reaching financial independence and eventually married.

In his recent article about F.I/[R.E] and relationships, he correctly pointed out that whether we can:

- Achieve F.I. /[R.E]

- The speed you get there.

- Remain in that phase.

All of this will depend more upon 3 major factors:

- Your partner in life.

- Your accommodation.

- Your transportation.

I do agree. I would usually advise that it is better to have a fully paid-up property before you retire because you eliminate the breadth of rental income possibility or the need for a big chunk of income certainty from your most essential income. If you require a personal vehicle transport, think about how much your cost would vary if you retire in 2003 till today (20 years later).

Both of these move a significant part of the equation.

But none more so than your partner in life.

RetireBy35 realized his girlfriend back then exhibit more qualities than flaws in the following four areas:

- Compatibility of aspirations and values

- Conflict resolution style

- Openness to experiences

- Ability to learn and adapt

I thought his list is an important one in this F.I.[R.E] realm because the usual advise is not given from a position of F.I pursuit but general finance.

RetireBy35 just had a deeper understanding of both relationships, F.I. and R.E.

I gotten feedback from some that while they recognize the virtues to pursue F.I., their spouse is less keen.

They either don’t pursue it, most likely because their spouse is so unaligned in most of the four areas above or for some like my friend, choose to pursue F.I. himself, for his portion of the household contribution, despite his wife not understanding and believing in it.

Only some dynamic thinkers are able to identify that we can pursue F.I for ourselves even if we are less aligned. Think about it, if you like fishing but your wife does not share what you like, you would do it as well right? The only problem is money is a bigger part of the equation than fishing.

Being Open to Experiences Before Reaching F.I

Some look at F.I.[R.E.] as a hard transition.

Your wealth needs to reach a certain milestone before you officially recognize that you have attained F.I. status.

Singvestor manages to look past that and make use of the benefits of financial independence before attaining the status. Even if you and I are not officially financially independent, having wealth to a degree gives us enough optionality to experience other modes of living and working.

Singvestor decided to head to Europe to work for a startup. He took a pay cut or a compensation package with more potential upside instead of the safe route.

In his most recent updates, he feels like working in a start-up in Europe feels like he is experiencing a form of semi-retirement.

And we can have a glimpse of how much it cost and what he spent on:

Some readers cannot resolve their mind thinking that the goal is to cover all their existing spending. Singvestor recognizes that a lot of his spending may be more flexible and okay to cut down sometimes:

From a Singaporean perspective, European countries like Germany, France, Spain… are rather cheap. Despite this, I spent too much money, most of it on wants vs. needs.

In 2023, close to SGD 12k was spent on traveling around the continent, around SGD 7k was used for subscribing to a car, as I lived in some mountains for a while. I could not resist the restaurants in Spain and France and eating out cost close to SGD 5k a year.

As RetireBy35 have explained in his post, your life would change constantly, and if you cannot craft a framework to handle mental and monetary adjustment in F.I., well, things will not work out.

Having money is one side of the equation but it will be a struggle for people who have less openness or unable to critically think in a dynamic fashion.

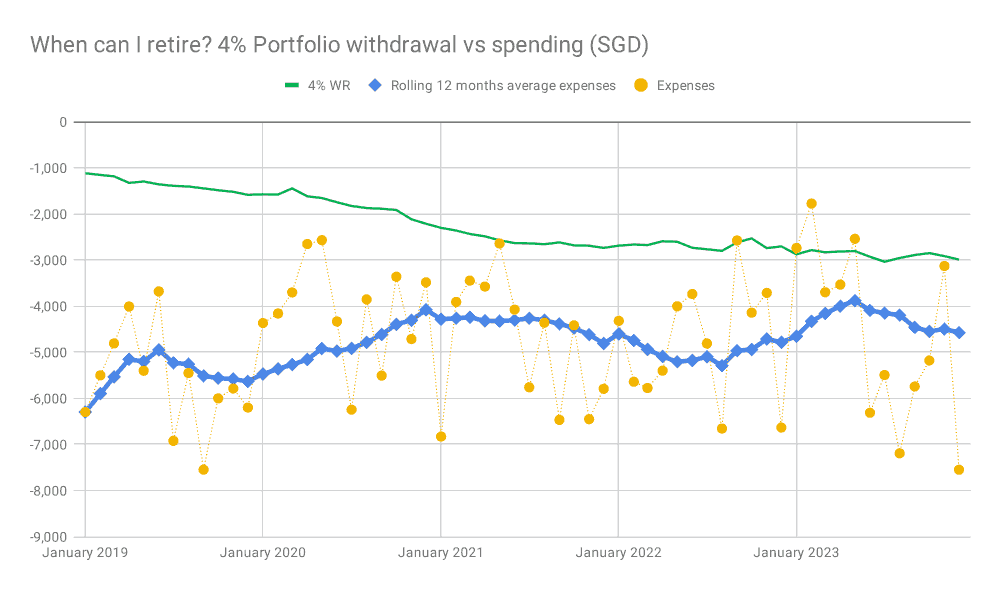

Some may find it challenging to interpret Singvestor’s F.I. chart. I find that this is the best way to track things and personally track it in this fashion myself.

We can express what we have in a lump sum, or as a stream of income. Many struggle to express their wealth as a stream of income because they can only see income coming from plans, or securities that distributes. But if you understand the safe withdrawal rate, you can use different percentages such as 4%, 3% or 2.5% to give you a sense that, if you retire today, how much income would you have and for how long.

This is Singvestor’s green line. when he started tracking this in 2019, he had closer to a $1,000 monthly income and is currently closer to $3,000. The yellow line shows how his income fluctuates monthly with the blue line showing a smoother average monthly income.

I like this chart because it relates what you have with what you can buy or wish to achieve. By showing the volatility in spending versus the income projection, it also lets you see the gap, which represents the work income you may need if you semi-retire.

You might find it a bit OCD to track spending so religiously but I find that you cannot have a peace of mind if you don’t understand the nature of your spending.

Some less dynamic thinkers might look at that same chart and conclude they need at least 20% or 30% higher than the highest spending to be safe to retire. Or for some 100% more.

Singvestor probably understands that the reality is spending is going to be dynamic and he would rather have higher mastery over understanding over the lifestyle he can be comfortable with and the associated costs instead of just buffering.

2023 Portfolio Review – “Retirement light in Europe”?

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- The Cheapest Way to Extend Your Laptop to TWODisplay that I Can Find. - April 29, 2024

- My Quick Thoughts on the Net Cash, 4% Yielding Boustead. - April 28, 2024

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

singvestor

Monday 5th of February 2024

Quite the honor seeing my humble little blog being featured on this page! Retireby35's post is spot on, interesting read!

Kyith

Tuesday 6th of February 2024

Thanks for making such a good post singvestor.