I first got to know Samuel when he reached out to me because he needed some help figuring out his plan for financial independence.

He explained to me why his wife and himself are focus on accumulating for financial independence. That conversation also gave me a glimpse of the world of professional photography.

I have this insecurity after I wrote about how freelancers should manage their money. I wasn’t sure if what I wrote was realistic at all.

So I reached out and asked Samuel whether he is willing to share his story with my readers. He was very gracious to share with us some of his life and money stories, lessons learned that enable him to feel financially stable and secure.

You can check out his guide to the BEST wedding venues and planning a (kick-ass) wedding celebration as well as his creative works.

If you think you have a unique life & money story that you would like to share with us, do contact me.

I had big dreams when I first set foot on the land down under back in 2006.

I would ace my classes as a physiotherapy student. I had my sights on having my name upon the dean’s list. I planned to run my own physiotherapy practice. Perhaps even a chain of them.

I was going to buy a house, settle down with kids, and go fishing on the weekend. Life was going to be great.

It sounded like a perfect plan, until it all came crashing down.

My name is Samuel, and I take pictures for a living.

Most of my weekends are spent hanging out with couples making the biggest commitment of their lives, and then partying the night away in all sorts of manner possible.

I know, it’s a far cry from what I initially envisioned my life to be, right?

But let’s backtrack a little and start from the beginning.

My family left for Australia when I was midway through my national service, and I packed my bags and joined them soon after.

Life in Australia wasn’t what I dreamed it would be.

I’ll sum it up by saying that a combination of unrealistic expectations, a sudden change in culture, and a two-year-long bout of severe eczema led to a long drawn battle with depression and an eating disorder.

My interactions with my younger classmates also helped me realize that my sheltered upbringing in Singapore in a middle-class household resulted in many shortcomings. Whilst proficient academically and perfectly skilled at memorizing and regurgitating, my critical thinking skills and emotional intelligence were severely lacking. I couldn’t even hold a decent conversation, for crying out loud.

Although I was able to ace most of the exams, my poor communication and practical skills led to misunderstandings with patients and supervisors and poor execution of procedures that ultimately secured the demise of my hospital attachments. I had to repeat the year and the university removed me from my honors program. My appeals were rejected and no one, except for my honors supervisor, lifted a finger to help.

As simple as that, I lost everything I worked for over a period of three years and I lost all interest for physiotherapy.

I came back to Singapore and over the next six months, contemplated what to do with my life.

Coming back to Singapore was tough, because, besides despair, I also felt shame – I felt like I had let down everyone who had believed in me. I took those two months to think… a lot. I thought about life, the meaning of life, the shortness of it. I would also think about my dreams if I had any and what they were. At the end of my trip, I couldn’t figure out what I wanted, but I knew one thing, that life was far too short to be stuck doing something not worth my time.

So I made up my mind then, to pursue my passion and to become a photographer.

Prior to this, I had never held a part-time job for more than three months other than a short stint as a sports trainer at the soccer club. This meant that my work experience solely consisted of massaging grown men’s calf muscles and carrying them off the field when they got injured.

So I had to hustle and do photography work at all sorts of events. These jobs earn me a measly $10,000 after a grueling two years.

I was ready to give up, but I hung on and went into photographing weddings. The lack of work then meant I tried to survive by taking on jobs both in Singapore and Australia just to make ends meet, and business began to gradually take off.

My wife (who is also a photographer) and I have two independent brands. My wife serves mainly events in Singapore. I was able to have opportunities to work with clients in Perth, Australia. It was not always easy being away from her and those trips can be rather intense that I was not able to find time to visit my family in Australia.

Our ability to deliver value to our clients has enabled us to gradually scale up our fees. Life became less of a struggle but it also opens up to some adult problems that we have to come to terms with.

I Needed to Manage My Money Better

I was rather ecstatic when I finally saw my savings account reach six figures for the first time.

You have no idea how much I cherish having enough financial buffers such that I do not have to worry if I have enough money for my expenses.

The nature of my projects-based work means that cash inflow tends to be uncertain. Our strategy, on a high level, is always to put a distance between our expenses and how many months of expenses our savings can last us.

At least this is for my wife and me. Throughout my life, I have been rather frugal.

When I started seeing my savings go up, I thought I better learn to manage my family’s money in the right way so that I will not lose what I have painstakingly built up.

Being more introverted, I would try to see if I can find out what I don’t know online. I came across A Singapore Stock Investor. Ak71’s blog was a wealth of information.

I greedily absorbed his sharing on

- The right insurance policies to purchase

- The impact of saving rates

- Investing for passive income to supplement our lifestyles

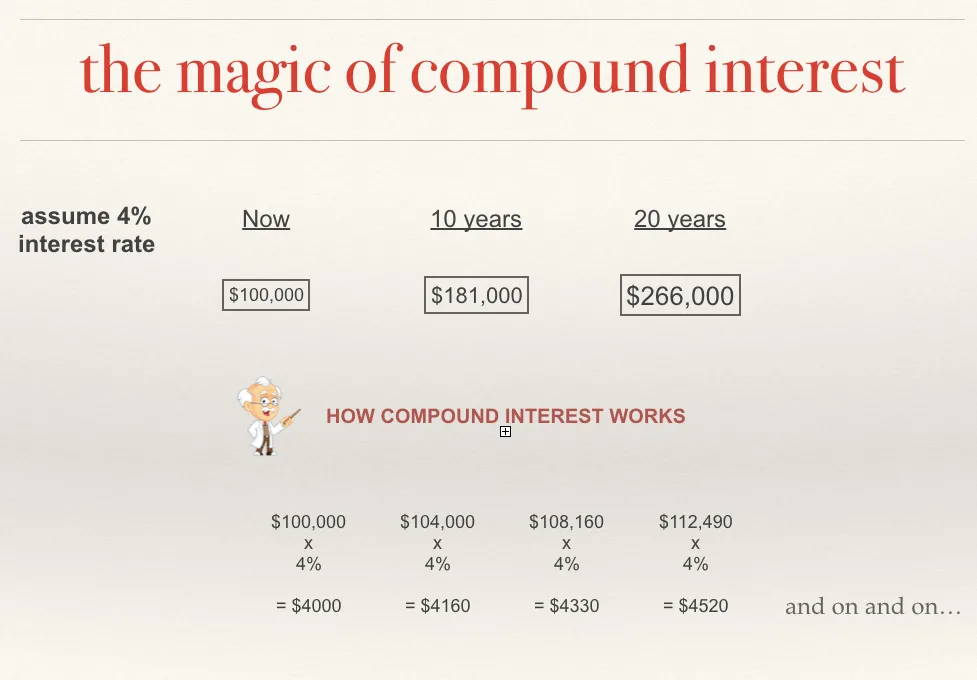

- The power of compound interest using CPF

I devoured more articles and came across Mr. Money Mustache. Mr. Money Mustache gave me a path to focus upon to escape the challenges of the photography business.

I have experienced the volatile industry dynamics and came to the conclusion that we might not be able to figure out the outlook of my niche in the next 5 years. Due to the physical nature of our work, I felt that it was impossible to keep up with the same level of dedication well into our 40s.

By pursuing the path to financial independence, there was something in there that may give me a sense of security and not always be subject to the whims of this creative industry.

Creatives and Money

Kyith reached out to me to see if I could share my experience in managing both my money and the money aspects of my small business.

I hope that by sharing my experience, some of my peers would recognize that they have to manage the money side of their life and business well.

The creative industry is an extremely competitive industry. There are consistently new players and the rules are always changing. The consistency is that you cannot rest on your laurels.

Yet many creatives failed to join the dots between the dynamics of our industry with the money aspect.

It is not uncommon to hear of stories of someone you think was doing very well suddenly fade away. It is only later that you hear that their business hit a snag they could not recover from. Cash flow problems ensued.

I would be the first to admit I have not got the money formula sorted to perfection but I hope that some of what works for me would work for you as well.

So here is the first lesson.

Lesson #1 – Calculate Your Earnings Based on Net Profit

In our industry, the money comes in a lumpy fashion. It is not uncommon to be paid a sum that you can spend for 1 or 2 months (or even more). February and August tend to be months which are relatively quiet as well.

My observation is that some of my peers cannot match the cash inflow with their cash outflow.

Our cash outflow tends to be more recurring. Resolving between lumpy and recurring can be a nightmare for creatives.

They will think that they could consistently bring in projects that pays them a lumpy cash flow. When there is a late payment, or a seasonal period where they did not get jobs, they had to dig deeper into their savings.

I find that if we account based on net profit, it allows me to see how much we are making, net of expenses much better. When customers pay me a big lumpy payout, I do not get overly ecstatic about it as I know part of it will need to pay for some business expenses in the following months.

Lesson #2 – Plan Ahead if You are Thinking of Applying for a Housing loan as a Freelancer.

When we came back to Singapore, we stayed in rented HDB flats.

Renting was not always a great experience. The last place we rented had such a weird layout that we just could not get a good night’s sleep. That experience was the ultimate and we decided to get a place of our own.

However, when we wanted to get a place of our own, every bank rejected our application for a housing loan, even an independent financial advisor shook his head. Apparently, it seems that as a self-employed, your credit scores are much lower than if you were an employee.

In order to obtain a housing loan, you need to provide a level of certainty of being able to service the loan. That includes two years’ worth of IRAS Notice of Assessments and CPF contributions.

Financial institutions also generally assume that as a freelancer, your income is unstable, hence they will reduce your stated monthly income by 30% when calculating your Total Debt Servicing Ratio.

Therefore, ensure that the price of the house you are looking at fits within your budget based on your level of income before applying for a loan.

Lesson #3 – Separate Your Business and Personal accounts and Set up Rain Buckets

Despite the amount of time and effort we put into our business, as a wedding photographer, there are multiple factors that can impact the amount of work we end up booking.

As a result, the income we earn can drastically fluctuate every year.

We felt that it is absolutely essential to creating separate business accounts and personal accounts.

The business accounts then pay a recurring income into our personal accounts. Then we further divide our personal accounts into sub-accounts for different goals.

Our plan can be illustrated in the diagram above.

Our business account records all invoices and expenses. From this business account, we pay ourselves a consistent salary of $5000 (as an example).

We were fortunate that our business account can pay a consistent salary. This income gives us stability. We can then accurately funnel this $5,000 into 5 different “rain buckets”, each with a particular life goal.

The rain buckets create boundaries between the money meant for different purposes so that we know if we are overspending in some areas and whether our wealth machine is getting stronger.

We use apps to create virtual rain buckets. You can check out applications such as You-Need-a-Budget (YNAB) and Wally to help you do this.

Lesson #4 – Know Where You are and Where You Want to be

As I went deeper down the financial education rabbit hole, Mr Money Mustache taught me one of the most important concepts. This was the FIRE concept or financial independence, retire early.

Reading on financial independence where the passive income I earned could potentially cover my lifestyle expenses was a great revelation for me, and I saw a practical solution to my problems.

However, we need to know where we stand (financially), before we can plan our destination and how we can get there.

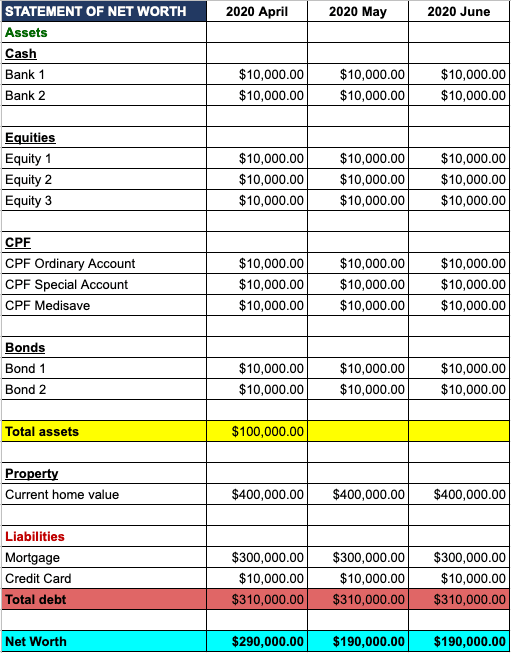

I will recommend that you tally up all your assets and liabilities and creating a statement of net worth that you can update on a monthly basis.

Here is an example that worked well for us:

We use a simple tracking where we laid out all our assets (cash, equities, CPF, bonds, property), our liabilities, and net worth.

We felt more relaxed when we saw our numbers getting better. When I learn about the shockingly simple math behind early retirement, you get more motivated when you realize the math might work out in reality.

Despite earning well, our lifestyle expenditure was keeping up with our earnings and we couldn’t save much. When we start tracking these numbers, we begin noticing where the problems are. We discussed and found that some of our spendings were unnecessary and so we reduced them…

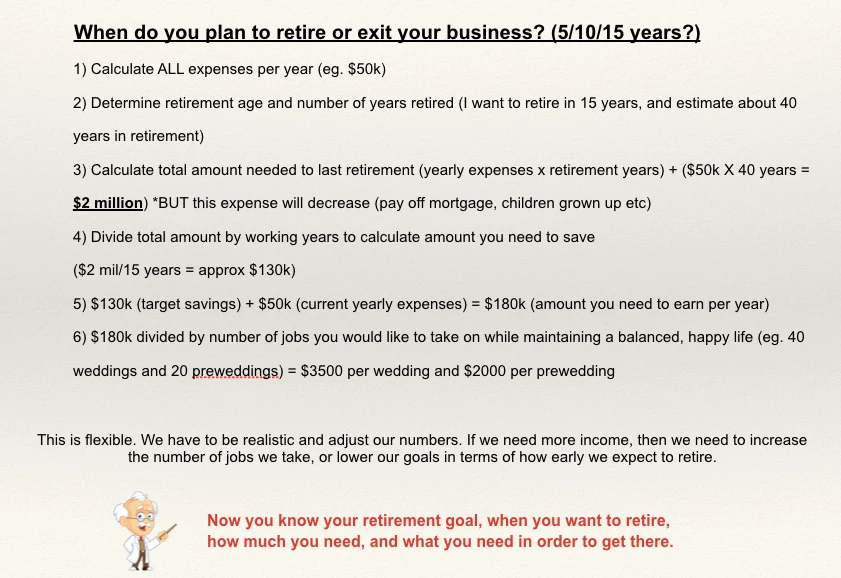

Where I learn from Kyith is to also create a separate column of essential expenses.

This allows us to have an idea if we need to really cut back (like during this Covid-19 period), we know how much we can live on, what is the quality of life, and roughly how much to cut back.

By doing this, we get a clearer picture about where we are.

We can then consider where we want to get to.

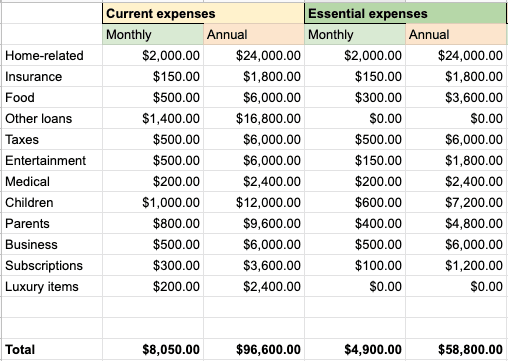

How Many Projects for Me to Reach Financial Independence?

After evaluating the formula to financial independence by Mr Money Mustache, I began to see how I can link how much we need to accumulate with our photography work.

Recently, I shared with some of my peers how I link where I want to be with my daily work:

Going through this exercise allows me to see whether my goal is realistic or not. For example, based on my past experience, can I do 40 weddings and 20 pre-weddings in a year. Can I raise my rate?

It also gives me an indicator whether I am working too hard.

Instead of always focusing on a dreamy goal, I can get to business to focus on getting X number of weddings and Y number of events.

Lesson #4 – Building a Solid Emergency fund

Most financial gurus advocate for six months of emergency fund.

However, I understood early on how financially rocky it can be as a freelancer, and I felt that I needed at least 12 – 24 months of essential expenses because when shit hits the fan, it hits hard.

I didn’t predict this pandemic, but I guess I prepared for it all along.

Building up your emergency fund is so important in providing lifestyle stability during times like this when the entire industry is halted and there is no foreseeable work for the next 1-2 years, or if we encounter any crippling injury that stops us from being able to work.

In case of a recession, it also acts as a buffer to prevent us from selling our equities or bonds at a loss for liquidity.

Lesson #5 – High Savings Rate Matters for My Goal

The spectrum of profit that creatives can earn in the industry vary widely. There are some who despite their best efforts, could not put a distance between their expenses and what they earn. Then there are some who get huge revenue bumps once once in a while.

As we steadied each of our individual businesses, we were getting our work calendar filled and we were earning good money.

Yet I noticed we weren’t feeling like we were saving well. We realized that was because our lifestyle expenses crept up as our earnings increased.

Reading both Mr Money Moustache and ASSI on savings rate helped me understand how important it was to keep expenses low, whilst increasing earnings so that we have a high savings rate.

I realize if I want to reach my financial goal, we have got to something.

Your savings rate is the percentage of your salary that you do not spend. According to conventional theory, a 20% savings rate will not cut it, and here’s why.

Assuming that you spend the remainder of your salary:

- Saving 50% of your salary means that for every one year that you work, you can take one year off.

- Saving 20% of your salary means that every five years that you work, you can take one year off.

Hence, if you want to retire for 30 years at the age of 50 and without additional wealth building tools, you will need to save for 150 years – This does not make sense to me at all, and it’s virtually impossible to retire.

However, saving 80% of your salary means that every ten years that you work, you can take forty years off.

That is why a high savings rate is so crucial for early retirement.

It’s important that we live comfortably, but at the same time minimising our expenses ensured a higher savings rate.

Early on, we made the decision to not own a car, purchase a smaller flat to reduce our mortgage payments, and to cook at home more often to build up our savings.

This worked to our advantage as we increased our wealth gap, thereby channeling the extra savings to instruments that generate more passive income.

Lesson #6 – Buy Term and Invest the Rest

Early in my career, I had an accident and broke both my wrists. I still went on to photograph a wedding the next day for twelve grueling hours with both my arms in casts – that incident solidified the importance of insurance.

Insurance doesn’t have to be expensive.

From the meager returns of my parent’s investment-linked insurance policies after ten years, I learned at a young age that those are pretty mediocre instruments for building wealth.

The purpose of insurance is to, well.. insure!

Or rather, to provide a source of income for our dependables in the unfortunate event of our passing or loss of function.

A solid term insurance plan that pays out in the event of death, critical illness or total permanent disability will solve that, and they are fairly inexpensive, especially if you start young.

A hospital shield plan is also absolutely essential in the event that we need to be hospitalised for whatever reasons. A hefty medical bill is a surefire way to diminish our savings, and it’s far better to budget a set amount to negate that unknown scary possibility.

For the above, I’ll recommend a fee-only financial planner. This ensures that they will recommend the right products for you without any reward bias in the form of commissions and kickbacks.

MoneyOwl will be a great place to start for most (this post is non-sponsored nor am I affiliated to MoneyOwl in any way).

Lesson #7 – Understanding the Benefits of CPF in an Objective Manner

As self-employed people, it is mandatory to contribute to their CPF Medisave account. However, self-employed can choose to voluntary contributions to their CPF via the voluntary top-up scheme, and retirement sum top-up scheme (RSTU).

I understand that we all have mixed sentiments regarding the CPF. Amongst the self-employed, the sentiments are even more mixed!

I do think that it is important to remain objective and educate ourselves to determine whether it can work to our benefit or not.

CPF is essentially a social security savings scheme to meet our housing, healthcare, and retirement needs.

To completely explain about CPF would take a few pages, so I wouldn’t dive into that.

However, as a freelancer who had zero knowledge about investing then, I saw CPF as a stable instrument with capital guaranteed and moderate returns. I also learned about the power of compound interest and calculated the possibility of having a lifelong annuity at 65 while being able to withdraw most of my contributions at 55, if I managed to reach the Full Retirement Sum in my Special account at a younger age.

I therefore worked on building up my CPF Special account with money that I don’t need for the next 12-24 months.

We also made the decision to pay our mortgage in cash if our situation allows us to. This allows our CPF OA and SA accounts to accumulate interest, and avoid the situation of having to pay back accrued interest if and when we sell our house.

Lesson #8 – Create Multiple Passive Income Streams

As creatives, I felt that we understand the concept of multiple streams of income better than my salaried friends.

Each of our clients, especially those on a retainer, are one stream of income. If my salaried friends lose their job, 100% of their income gets impacted. However, if some of our clients decide not to go with our services, it is not a 100% impact.

When people talked about multiple streams of passive income, I see that this is a progression from what we understand.

Instead of needing to physically work with clients, we do the work upfront to build up our investments and our investments provide a diversified stream of income without us needing to be there.

I’m not an investment guru, nor do I claim to know a lot.

However, I started by making sure that every dollar I had was working.

I parked our emergency cash fund in fixed deposits, and other multiple income streams are interest payments from Singapore Savings Bonds, CPF, and dividends from equities.

Kyith has a fantastic article on building a wealth machine HERE.

Lesson #9 – Invest based on your Personality and goals

Investing can be one method of achieving our financial goals faster than what we can earn through our jobs. It could also negate the detrimental effects of inflation on our spending power.

There is a wealth of information on investments out there, and it’s so easy to be confused – (Investment Moats is one website I consistently utilised to educate myself; the breadth and depth of information it encompasses is astounding.)

It’s therefore crucial to understand our personalities and risk appetite before diving headlong into the investing world.

As I am extremely risk averse, I preferred instruments that could guarantee my initial capital, such as Singapore Savings Bond, CPF and fixed deposits. However, I also understood that in order to build wealth at a faster rate, I will need a higher return on my investments.

I learned from my early experiences of dabbling in active stock picking that there’s a lot of work involved in understanding the internal and external factors that could impact a company’s value and share price. Although the returns can be high, it’s also easy to get burned if I didn’t know what I was doing.

I’m therefore more inclined towards a diversified index fund with a dollar cost averaging approach based on this book by Joshua Giersch – it explains investment concepts based on a Singapore context in an easy-to-digest format. My portfolio currently consists of the Singapore index, an international index and Singapore bonds.

There are also many formulas out there calculating how many percent of your portfolio should be dedicated to equities. One such example will be 110 – your age = your percentage in equities.

However, like they say, everyone has a plan until a pandemic smacks them in the face.

Experiencing a market crash where my portfolio went from +20% to -35% in a matter of days really helped me understand the type of investor I am and the portfolio allocation I am comfortable with. As important as building our wealth is, we should never ever underestimate the power of our emotions versus rationality and the importance of a peaceful night’s sleep during times of extreme market turmoil.

In the event of a global recession, my primary source of income could stop and I will be more comfortable with a larger cash reserve to tide my family through a long period of uncertainty. Therefore, a portfolio allocation of higher bonds and cash component and a lower equities component will suit my investment personality better.

Final Lesson #10 – Adapt to the Current Situation and Prepare for the Next Crisis.

This lesson would be my last financial lesson.

If you’ve made it this far, thank you for taking the time to read what I have shared! I hope that it has at least started a conversation in your mind about the importance of managing your finances well, especially for a freelancer.

Covid-19 have really disrupted the business of many creatives including myself. The gig economy is the first to go and may be the last to open up. All the jobs from April to August have stopped and clients are cancelling their events up till the end of this year

Almost 95% inquiries have stopped.

Everything is a standstill.

I take solace that what I learn over the course of these few years have set me up well. However, I do not know when normalcy will be restored to my photography business. And how will things look like when it is restored?

As it stands, this has definitely affected the trajectory of my financial independence plan.

I try to search for the positives.

As challenging as it is, we have to adapt as best as we can by changing our mindset and utilising our skills to build side hustles and bring in other forms of income.

At the same time, there will be other crises in the future, and we could prepare for it mentally, emotionally and financially by learning the lessons from this current one.

We should always balance our drive to be financially independent with the health of our relationships. No marriage or family is worth sacrificing to be financially independent.

Buy that cake for your daughter, take one less job so that you get to spend Christmas with your wife, these are the intangible valuable moments that mean the most.

Take care and stay woke,

From your photographer and friend.

Samuel

www.samuelgoh.com

owlcents

Sunday 31st of May 2020

Hi Kyith and Samuel, @Samuel, I am glad you have some savings to tide you over this tumultuous period. Thank you for the courage in sharing this post and I wish both you and your wife the best. Hang on there! @Kyith, thank you for what you do. These difficult times have proved that financial knowledge is so important, yet most of us are lacking in this area. Your blog have been a great resource for me throughout these years. Thank you.

Kyith

Monday 1st of June 2020

Hey Mao Tou Ying, thanks! I try my best to do what I can.

Sharon

Sunday 31st of May 2020

Glad to read about Samuel's story.

Being a freelancer is tough. I was there once for 2 years before I called it a day. Although I was great at what I did (even till this day after 5 years, I received a call from one of my customers, asking my opinion), it was grueling work for 12 hours per day.

I agree with him on the meagre returns of ILP. I have one too and am planning to surrender it soon because finally, I'm seeing it breakeven. Yay!

I'm definitely checking that book he recommends. Thanks for sharing!

Kyith

Monday 1st of June 2020

Hi Sharon, I am glad you like what Samuel shared. How were the returns for the ILP if you only considered the unit trust returns (not the wrapper costs)?