I have a friend who knows that I collect the returns of these matured insurance savings plans.

I wish to satisfy my thirst to find out how close or far they are off the projections that their insurance adviser showed them in the past.

You can review all the past insurance endowment returns my friends and readers have provided me in Does your Insurance Saving Plans (Endowment) give you 3 to 5% returns?

I known my friend for some time first as a customer in my old company and then as a colleague when he joined us sometime later.

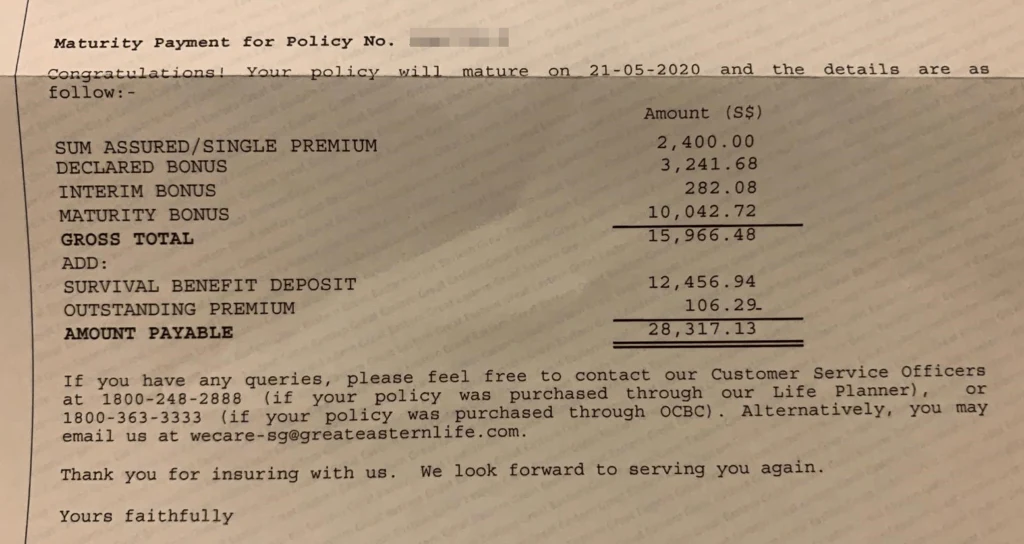

After servicing his Great Eastern MaxSave Plus for 18 years, it has finally matured and will get back his principal and returns.

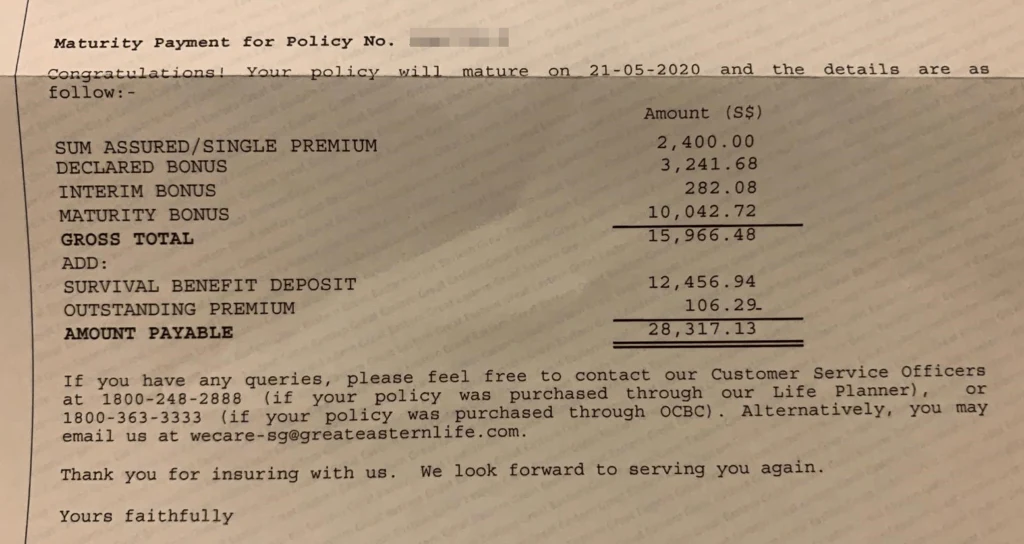

My friend put in $102.40 as a forced saving every month for 18 years. The total premiums paid amount to $22,118.

The sum payable to my friend recently is $28,317. During this period, he has not taken any cash benefit and has put it back into the policy, earning a 3% return.

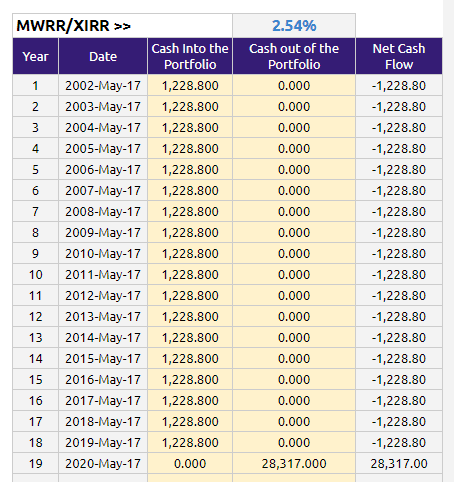

Many people would have computed his returns as (($28317 – $22118)/ $22118+1)^(1/18)-1 = 1.38% a year.

This is not an accurate way of computing his compounded returns since his contribution happens throughout the 18 years and not a lump sum upfront.

We often try to find out the internal rate of return of this stream of cash inflow and cash outflow of my friend as an accurate measure. For the layman, think of this as the “interest rate a year” you earned for this uneven stream of cash inflow and cash outflow.

If you have any doubts whether this is the right way to compute a policy’s return, in recent years, the insurance companies are publishing the projected policy yield that you earned based on internal rate of return.

The internal rate of return is closer to 2.54%.

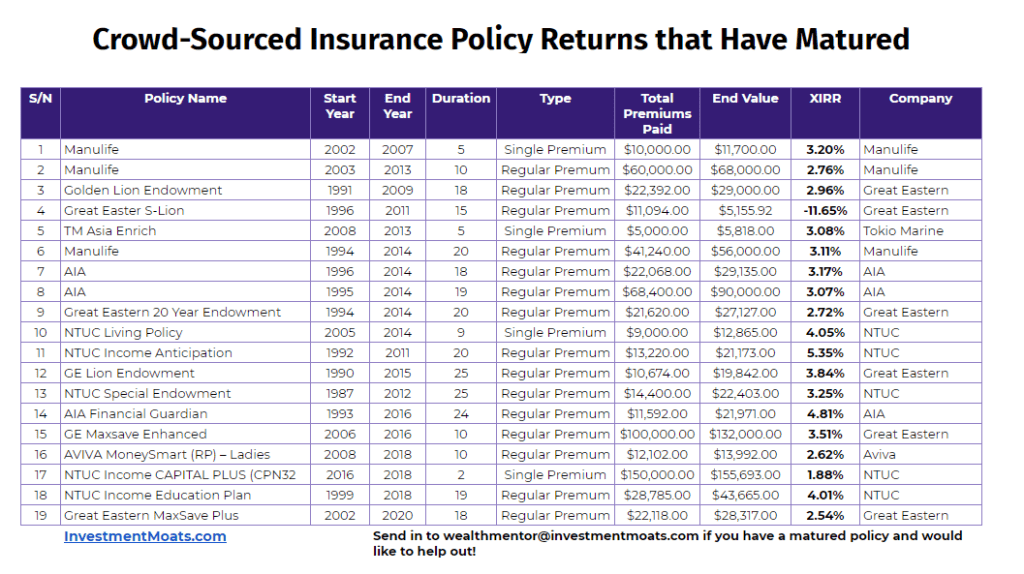

In the spectrum of returns that I have reviewed in the past this one is closer to the low side.

You can then compare this 2.54% a year against the returns and risk of investments you made during this period, be it stocks, unit trust, bonds, government bonds, properties.

For reference here are a summary of the rest of the policies that I have reviewed in the past:

If you have a matured policies and are pretty OK for me to share it with readers do contact me at [email protected]

I started this crowdsource because I am not sure if the returns from endowment plans are atrocious or respectable.

No one shares their returns around.

If you are interested in the details of the MaxSave Plus, you can continue to browse the rest of this post.

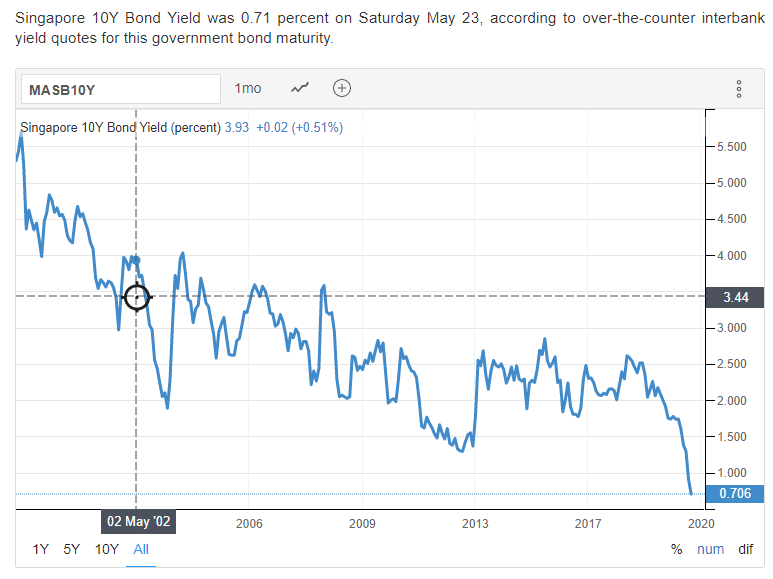

How should we compare the 2.54% return to?

I think the returns of the 10-Year Singapore Government Bond Securities is a good comparison because the duration is long, and the asset class is closer to what makes up the participating fund of the investments behind the endowment funds.

It will be easy to say that my friend should just purchase the less risk 10-year SGS bonds.

However, that would not be an apples to apples comparison because my friend was putting in money every year instead of a lump sum at the start.

Just use this as a reference.

What is the Great Eastern MaxSave Plus?

If I were to share my honest opinion, I would expect the yield on this policy to be higher than the 2.54% we see.

The reason is that

- The duration of this policy is longer, and thus the insurer can assign the money into longer duration bonds and equities that potentially have higher returns expectations

- Whether the reinvested interest rate is 3% or 4%, it is higher than this 2.54%

Back then my friend might be 3 to 4 years into his young career and looking for something as a form of forced saving.

Great Eastern MaxSave Plus is an endowment policy. The primary aim is to help you save money at a reasonable rate.

My friend had to commit to a fixed monthly premium payment of $102.40 a month for 18 years.

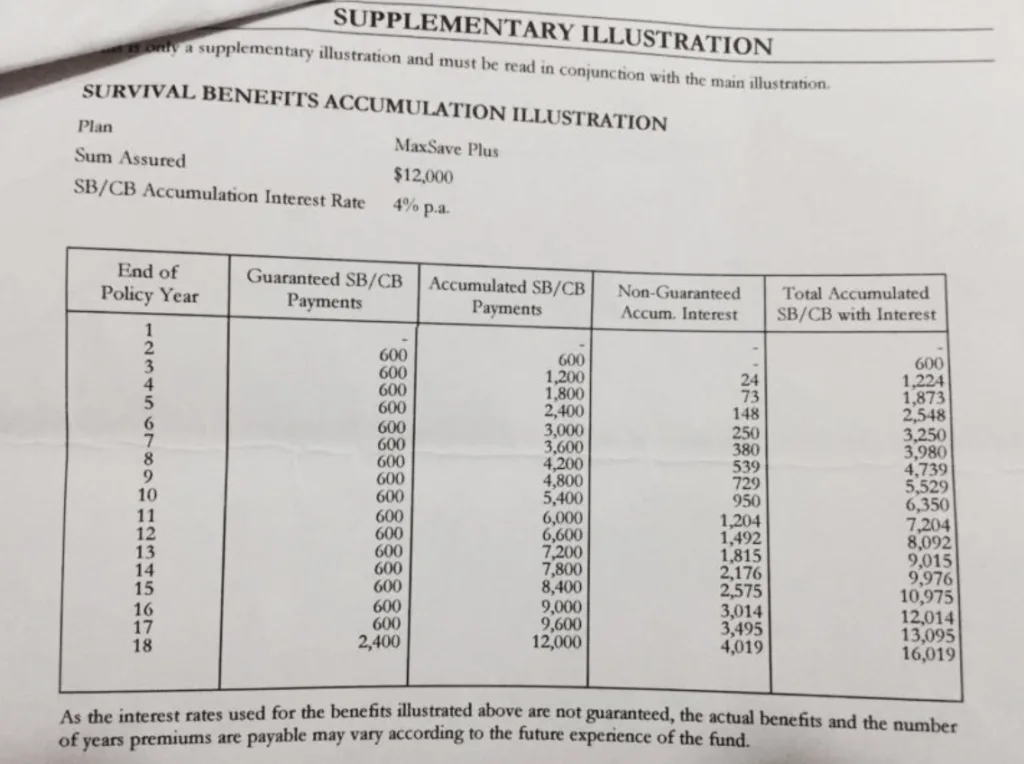

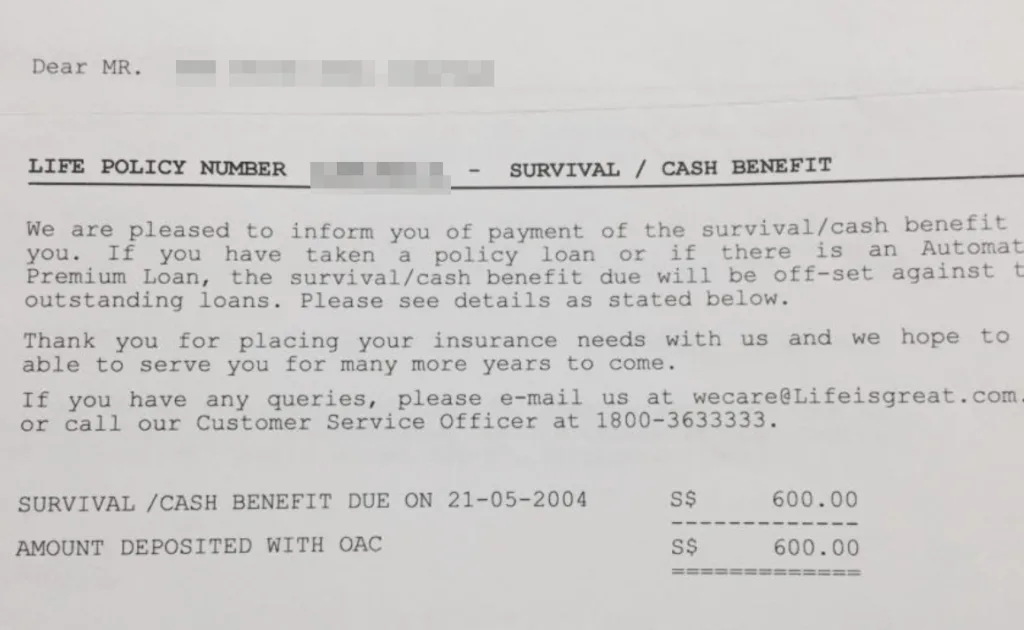

A feature about the MaxSave Plus is that from year 2 onwards, the plan pays out an annual cash benefit to you. The cash benefit of $600 a year looks to be guaranteed.

On the last year, the cash benefit payout is $2,400 instead.

I reckon this plan sells very well at that time since it is a very nice feeling to have a plan that pays out cash flow to you.

You can choose not to take the cash benefit and reinvest back into the endowment plan. The reinvested amounts grow at a non-guaranteed rate of 4% a year.

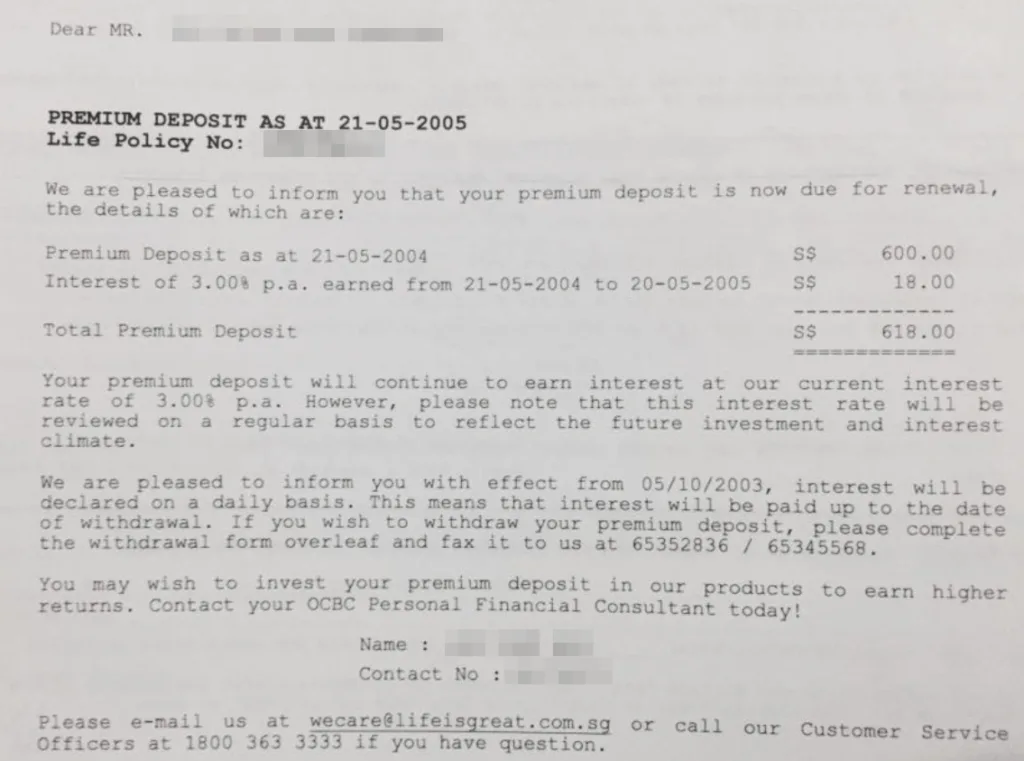

My friend choose to deposit his cash benefit instead of spending it.

I would have thought the interest rate earned on the deposited cash benefit is 4% but it seems to indicate that the interest rate on cash benefit has fallen to 3%.

This interest is after all non-guaranteed.

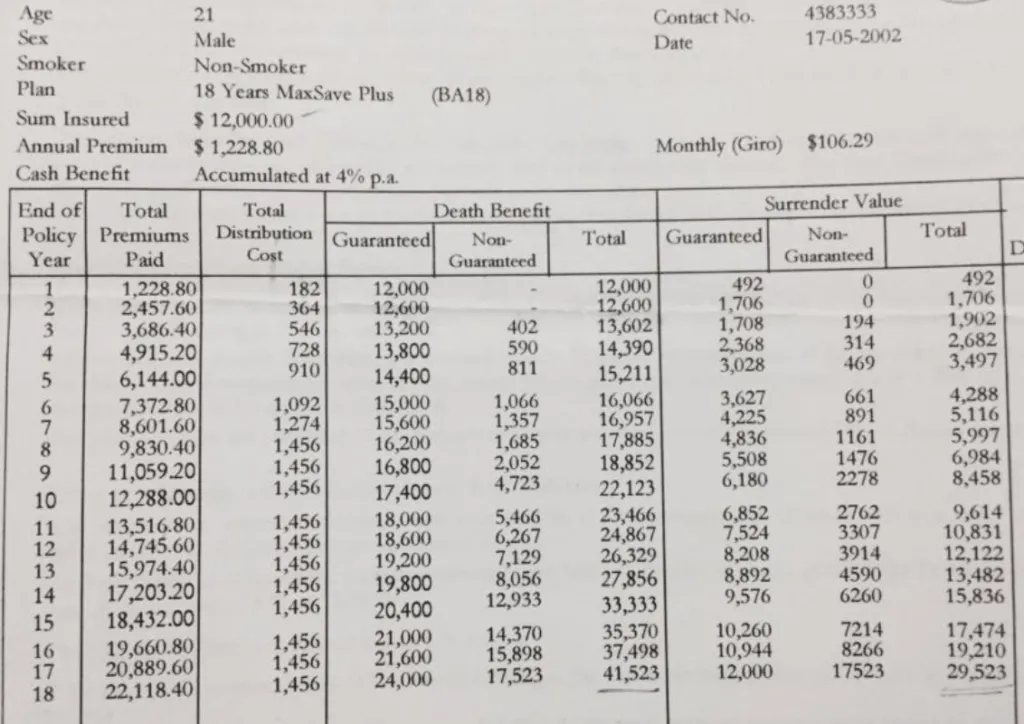

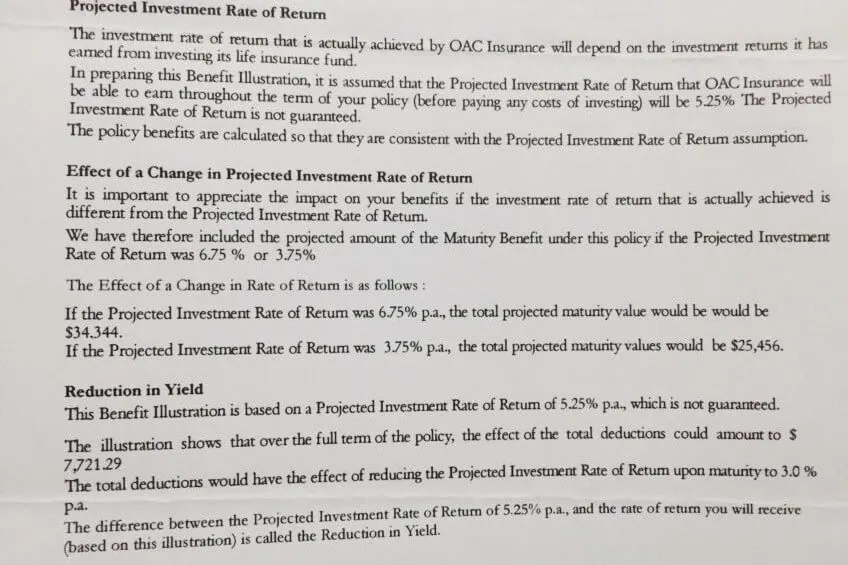

Projected Surrender Value back in 2002

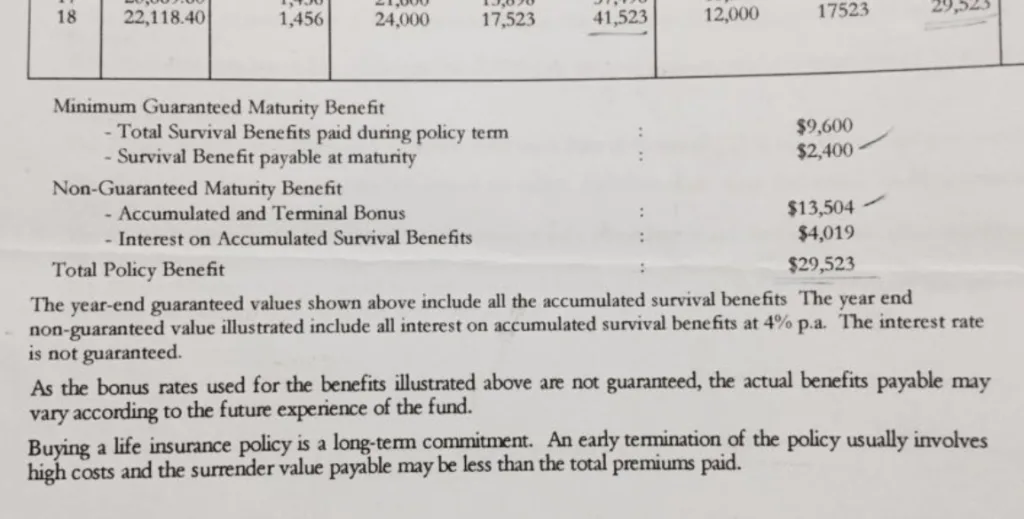

My friend showed me the total policy benefit that was illustrated to him back in 2002:

Based on the projections, my friend would only break even on his premiums almost at maturity of his plan.

We can also see that the projected investment rate of return is much higher at 6.75% and 3.75% versus the 4.75% and 3.25% we use nowadays.

The strange thing is that based on the surrender value, it already projected that the MaxSave Plus plan would yield my friend just 2.5% a year.

That does not look very attractive to a lot of people. I guess the appeal of a policy will depend on how the policy was explained to my friend.

The idea of getting an annual cash benefit of $600 a year do sound good. What would be hard for most of us to get around is that to get that 2.5% a year return, you cannot take out the $600 a year cash benefit, which defeats the cash benefit feature.

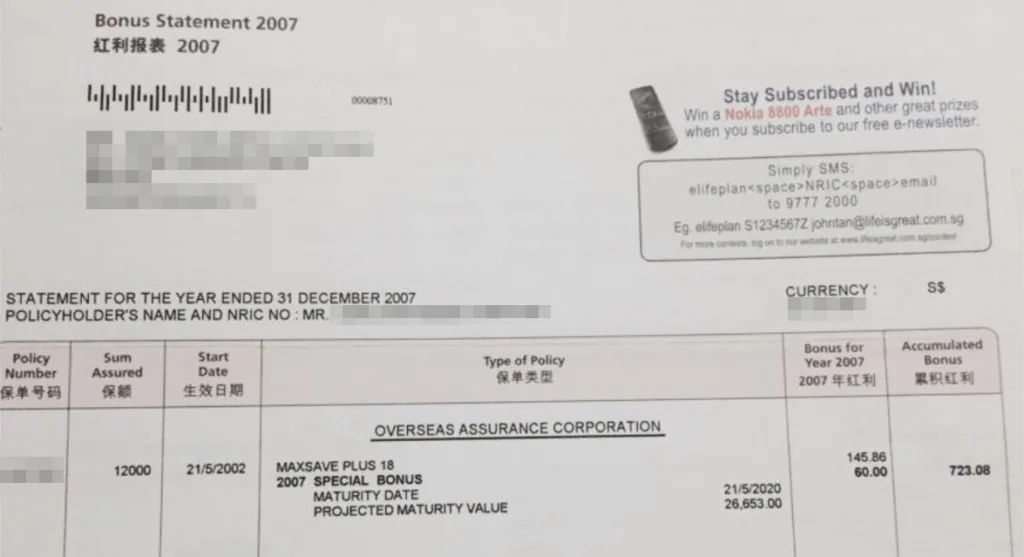

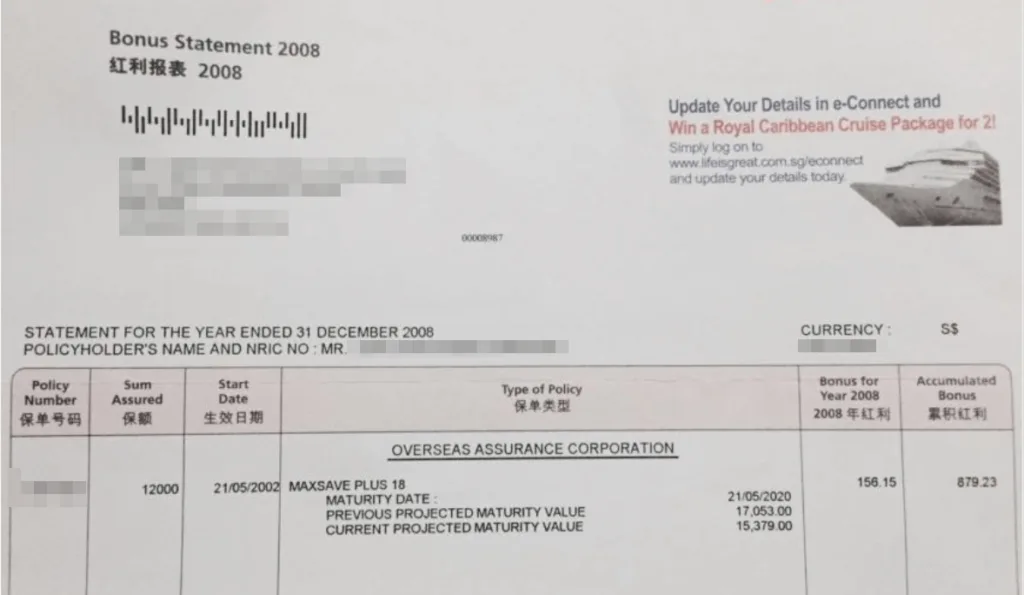

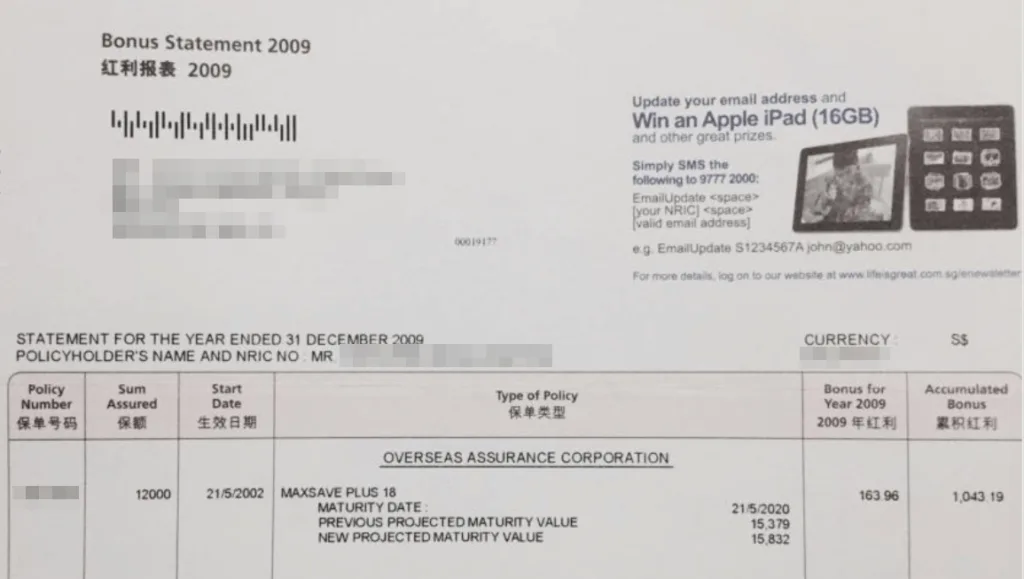

Projected Maturity Value Reduces as Time Passes

The total maturity value at maturity was supposed to be $29,523. However, if we review the bonus statements my friend receive from 2007 to 2009, we would notice that the projected maturity value indicates the maturity value will be much lower:

From $29k to $26k.

Then to $15.3k.

Then back up to $15.8 k.

Eventually, at maturity, my friend received $28,317 in total.

The return that my friend get does not look too far from the original returns projected in 2002.

I wonder if the insurance firm revised the projected maturity value lower, would they eventually bumped it up if the investment return does better?

My hunch is that in reality it is very unlikely that the insurance firm will revised the maturity value higher for two reasons:

- The insurance firms are rather careful in projecting the returns. Majority of the portfolio are lower in volatility and more predictable and as such a large percentage of the returns should not surprise

- Markets seldom surprised on the upside so suddenly that will make the most recent revised projected maturity look too wrong

I suspect that if my friend does not take all his cash benefits, the eventual maturity value based on the original projection in 2002 should be closer to $29,523 + $12,000 = $41,523.

However, based on the actual performance, the insurer can only pay out $28,317.

The Lessons That You Can Learn from this Review

Some of my blogging friends will say if there is one lesson to learn about reviewing the actual returns, it is that you should only trust guarantee returns in the projection.

I find that to be hard to accept because, if you look at the guarantee returns of recent policies, the guaranteed returns projection is very, very low.

Like 0.9% low.

If you are locking in your money for 20 years, you should expect some premium to having your money locked up.

If you are only expected guaranteed returns, and the returns barely break even, then why do you lock up your money at all?

The only reason you will invest is that you are alright with the returns of a conservative investment return projection.

That tends to be 3.25% instead of the 4.75% that the insurer would like to anchor your brain into.

If there is one lesson to be learn, it is that

- Projections are projections. Expect the Reality to be different.

- You do not like the unpredictability and volatility of other financial assets. The underlying instruments of the endowment plans are the same volatile instruments, so the projected values are going to be volatile whether you like it or not

- The biggest volatility you will face is the volatility between the projection and the expectations in your own head. You will only know whether your decision is right or not 20 years from now.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- Should I Take Less Risk in My Fixed Income Allocation by Moving Away from a Global Aggregate Bond ETF? - May 5, 2024

- Singapore Savings Bonds SSB June 2024 Yield Climbs to 3.33% (SBJUN24 GX24060A) - May 3, 2024

- New 6-Month Singapore T-Bill Yield in Early-May 2024 to Stay at 3.75% (for the Singaporean Savers) - May 2, 2024

theFI35

Thursday 28th of May 2020

Thanks for doing this research Kyith. No one else is doing this and I think it really helps to educate the public. Hopefully this helps them to make better insurance and saving decisions.

Kyith

Saturday 30th of May 2020

No problem.

David Yang

Monday 25th of May 2020

1. This plan is written by OAC. I guess this plan was probably bought from OCBC. OAC par fund and Great Eastern par fund are different.

2. " I suspect that if my friend does not take all his cash benefits, the eventual maturity value based on the original projection in 2002 should be closer to $29,523 + $12,000 = $41,523." $29523 has already taken account guaranteed survival benefit, $12000. Maturity value is supposed to be 17523. (=29523-12000). Finally your friend receives less maturity value, which should be caused by reduced one-time terminal bonus. By the way, from the illustration, there is no reversionary bonus in this plan.

3. The insurer reduced non-guaranteed SB(guaranteed survival benefit) interest rate from 4% down to 3%.

4. Cashback plan provide liquidity but at the same time lose return. If endowment plan without cashback features, the return rate is close to 3% considering 18-yr duration.

4. if using monthly mode to calculate XIRR, the rate should be higher a little bit.

Kyith

Monday 25th of May 2020

Hi David, thanks for explaining this to us. The reduced terminal bonus explains a fair bit.