I have a friend who asked the following question:

If we do the math for a young person in 20s, just started working, how much does the person need to put aside per month starting from now to achieve the target of $5,000 per month in a traditional retirement?

Actually, I did a video to explain this:

I think my friend may want an answer more specific so here is the more specific math.

We can assume some guy that graduated as a 25-year-old is asking this question. Let’s call him Mike. If it is a Jane, Jane should graduate when she is 23 years old. A traditional retirement will take place from 65-years-old onwards.

To find out how much we need to accumulate to (the magic $$$ number), we need to find out how much Mike needs to spend at 65-years-old.

My friend wishes to fix the spending income need to $5,000 monthly in today’s money.

We use a 3% p.a. inflation rate.

Mike will need: (1.03)^40 x $5,000 x 12 = $195,722 annually or $16,310 monthly.

If you don’t like 3% inflation, you can change the numbers accordingly.

Next, how much capital you need depends very much on:

- How long you need the income stream? 30 years or 60 years?

- Do you need the income to be adjusted for inflation?

- Do you need the income to be consistent and are rather inflexible with how much you need?

If you are answer is yes to all, the safe withdrawal rate (SWR) model may be suitable to calculate roughly how much you need. (You can read up on the safe withdrawal rate here)

Different people have different degree of conservatives when they think about their income characteristics, how flexible they can be. But if the goal is so far away, and a graduate have not too much life experiences, we can start with a reasonable SWR to estimate the capital needed.

As we progress in life, we can adjust this “how much we need to accumulate to” figure.

Starting with a SWR of 3.5% is reasonable. For those, who want to be more conservative, you can use 3.0%.

With the SWR, the capital Mike need to accumulate to is: $195,722 / 0.035 = $5,592,057. If we use 3%, then it is $6,524,066. If you set aside more capital, your income stream is more resilient against challenging economic regimes.

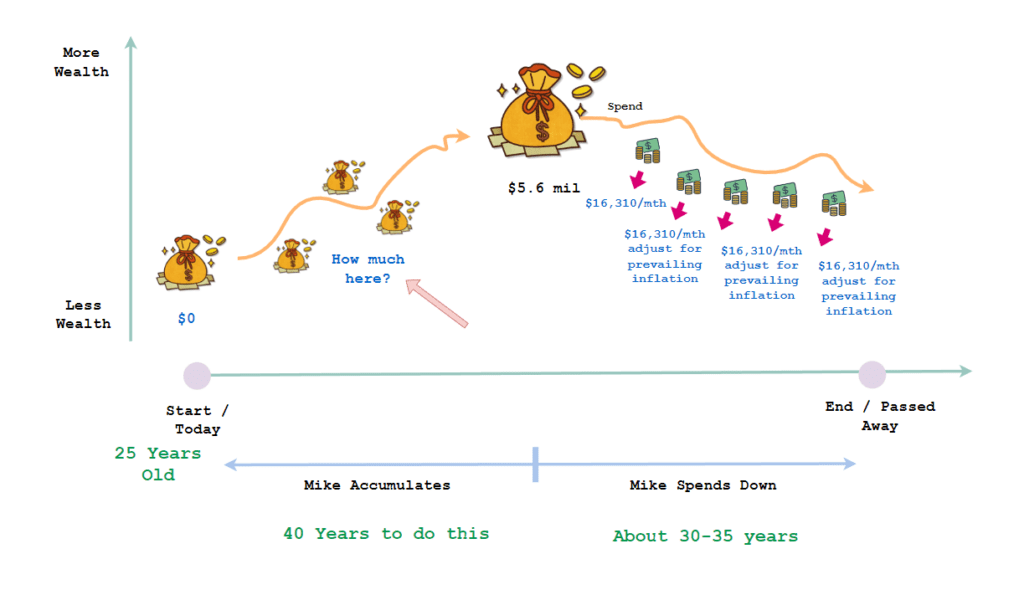

So we are here now:

Mike starts off with $0. We will need to figure out how much Mike needs to put aside to achieve $5.6 million.

How much will depend on the rate of return Mike is able to harvest during this 40 years.

Note that I say “is able to harvest” and not what is the rate of return that he can get from investments.

The investment return can do 10% p.a. but if Mike made all the common investment mistakes, then he won’t be able to get that 10% p.a. return.

We won’t know what is Mike’s eventual rate of return. If its high, Mike need less capital but if it is low, Mike needs more capital.

A conservative game plan is to try your best to set aside “enough” so that the rate of return you need is lower than the median.

We can work out a table with a financial calculator how much Mike needs to set aside monthly at 25 to achieve $5.6 million:

| Rate of Return Mike Can Achieve | Monthly Capital from Work Income He Needs to Set Aside |

| 2% | $7,726 monthly |

| 4% | $4,911 monthly |

| 6% | $3,015 monthly |

| 8% | $1,801 monthly |

| 10% | $1,054 monthly |

Mike might need to learn how to invest early, so that he can understand and start getting adjusted to invest in equities which has a higher probability of achieving a higher return. There is luck involve as well. We hope that Mike lives through a period where what he invest in is in a good regime.

We only live once, and cannot turn back the clock.

Also, this might not be a single person accumulation. I suppose my friend is looking at a $5,000 monthly spending needs for a couple.

Thus, the right orientation is to plan with a more conservative rate of return. I do think that if most can move towards a 4% rate of return, it means a higher monthly capital injection.

You may not have $4,911 to put away, and you can start with a lower amount, but strive to do better in employment to get to $4,911 monthly.

What if we factor in CPF LIFE Standard Annuity Income at 65 years old?

If we have CPF LIFE income at 65, then we need less income, which means less capital.

But how do we work out the math?

In How to Inflation-Adjust Your CPF LIFE Basic or Standard Plans, I wrote that if you are able to achieve CPF Full Retirement Sum (FRS) at some point in your life, you would have secured a 3% yearly inflation-adjusted income stream till you die that is equivalent to $764 monthly today.

This means that instead of $5,000 monthly, you need $5000 – ($764 x 2) = $3,472 monthly.

So, instead of putting $5k into all the calculations above, replace it with $3,472 monthly.

Note that this is for a couple. The numbers for a single will look different.

You will need $3.9 mil instead of $5.6 mil at 65-years-old.

The monthly capital will change to this:

| Rate of Return Mike Can Achieve | Monthly Capital from Work Income He Needs to Set Aside |

| 2% | $5,380 monthly |

| 4% | $3,420 monthly |

| 6% | $2,099 monthly |

| 8% | $1,254 monthly |

| 10% | $734 monthly |

The amount to save for a couple became much more manageable.

For a couple, putting away $3,420 x 12 = $41,040 annually from their take-home pay, without any increments, looks manageable if their combined take-home salary eventually scales up to $164,160. This will be 25% of their combined pay, leaving enough room to live a decent life.

However, if the couple is able to put away 50% of their take home, together with a better earning career, they might reached a certain Coast FI state earlier.

I hope this is helpful not just for my friend but also you.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

Klkk3

Saturday 16th of March 2024

“(FRS) at some point in your life, you would have secured a 3% yearly inflation-adjusted income stream till you die that is equivalent to $764 monthly today.”

Are you sure $205.8k (FRS) at age 55 today is the equivalent of $764/month today (3% annual inflation) at age 65?

If so, then to maintain a basic/dignified standard of living, one needs to set aside about 400k for CPF Life at age 55 today to receive about $1.5k/month in today dollars by age 65 (assuming don’t sell current residence and no other investments or cash savings).

I’m not sure how many people can afford to set aside 400k for CPF Life. Likely 80% cannot.

Klkk3

Monday 18th of March 2024

@Kyith,

I meant if FRS (~205k) today (55yo) provides $764/month in today dollars from 65 yo onwards.

To meet the 1.3-1.5k/month (dignified standard of living) suggested by lkyss, one needs to park ~400k in CPF Life to make it work (assuming no cash savings no more investments hdb paid off) … plus cannot fall sick if no H&S cover.

Kyith

Monday 18th of March 2024

Hi klkk3, the FRS sum is closer to $200,000 today for our cohort or those who have yet to reach 55 years old. It is not 400k.

Klkk3

Saturday 16th of March 2024

Some study a few years ago suggested one needs 1.3k/month for basic needs hence the reference to 1.5k/month… just basic nothing extravagant… cannot fall sick without H&S insurance.

Amit

Saturday 16th of March 2024

“A conservative game plan is to try your best to set aside “enough” so that the rate of return you need is lower than the median.”

Above is the foundation of sensible financial planning.

The return assumption below is eminently sensible. This article is a must read for all financial planners

“ I do think that if most can move towards a 4% rate of return, it means a higher monthly capital injection.”

Kyith

Saturday 16th of March 2024

Thank you Amit.

Sinkie

Friday 15th of March 2024

Haha I whacked Excel upon seeing your article title in TheFinance.sg before coming in to read it.

About $1,150/mth based on working 25-65yo, 8% cagr, 2.5% inflation, 4% swr --- you may treat this as optimistic scenario lol.

But very achievable for the average Uni grad these days, and can easily up the monthly amt as salary goes up & further anti-fragile the plan (as long no big retirement lifestyle creep lol).

The toughest part why 80% (ok, majority) won't achieve this is ..... loss aversion & most will stop/give up in the first -30+% bear market.

Sinkie

Sunday 17th of March 2024

Oh single person basis.

Kyith

Saturday 16th of March 2024

Hey Sinkie, when you say achievable do you mean by one person or two. Just wanna get it right.