One of our client advisers, Chin Yu, got interested in this Financial Times article about private equity.

I realize the article was written by Robin Wigglesworth, the author of the book Billions, and knew it will be a long read. I am 100 times a poorer writer than Robin but he is rather evidence-based often as well.

The article: Is private equity actually worth it?

The article is well researched and I decide to list down the main points as lists so that when I re-read in the future, I can focus better.

Why is there an urgency for many investors to add private equity into their portfolio? Investor’s motivation.

- Companies are staying private longer. They don’t want to list anymore. An investor is missing out on the returns of this smaller segment.

- Empirical data points to great private equity investment returns.

- CEM Benchmarking of $15 trillion worth of pension funds, endowments and other SWF. Private equity has 4% higher than what its clients have made on public markets in the past ten years.

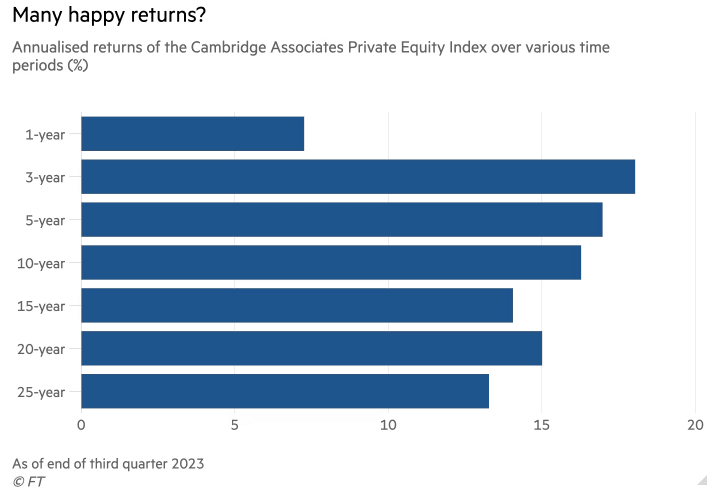

- Cambridge Associates have data showing the portfolios deliver strong returns.

- Private equity performance is measured in IRR but IRR can be rather misleading.

- Costs are opaque and complex and don’t just stop at the classic 2% management fee and 20% of profits.

- Institutions have a hard time figuring out how much they are paying.

- Kaplan, Antoinette Schoar Private Equity Performance – Returns, Persistence and Capital Flows – 2005 – Returns roughly similar to public equities after adjusting for the fees.

- Kaplan, Harris, Jenkinson – Private Equity Performance – What do we know? – Returns had exceeded public markets for a long period of time and by a healthy margin (more than 3% p.a.)

- Andrew Ang, Bingxu Chen, Goetzmann and Phalippou – An Inconvenient Fact – Private Equity Returns and the Billionaire Factory – Private Equity industry is unsustainable if it still allows some to present arguably window-dressed performance information and incomplete fee information.

Private Equity Returns Look Great Maybe Because How the Story is Sold

- What is the right benchmark to use?

- Most are measured against publicly listed equity with the MSCI All-Country World index.

- Probably 80% private equity monies are tilted towards the US so a more appropriate benchmark may be the MSCI USA index. If you use this instead, the benchmark is higher at 11.98% versus 8.48% and that reduces how great the private equity returns look.

- Private equity companies are small size companies so why are they frequently compared to the S&P 500 or large cap equivalents?

- Using average and annualized rate of returns hides the experience an investor will get.

- Studies show that private equity returns are better in the 80’s and 90’s when private equity was much smaller and less competitive. Current long term average return rates, includes those period and skew the returns to look much better.

- Smaller, more specialized funds that focus on niche area did better with average return of 38% in the past decade (dad from Mantra Investment Partners) but most of the money raise are to generic LBO mega funds.

- Returns in public markets are un-leveraged while buyout funds use a lot of leverage to generate those returns.

- The 1978 KKR Houdaille acquisition used $1 million equity for the $380 million purchase. Nowadays, we cannot like that anymore.

- Public companies now also borrow money but less so.

- Different funds will have different degree of transparency issues.

What More Balanced Research on Private Equity Tell Us

- Jean-Francois, Rossitsa Stoyanova, Kathryn Shaw, William Scott, Charissa Lai – A bottom-up approach to risk-adjusted performance of the buyout fund market.

- Using the right risk-adjusted benchmark, controlling levered size, and sectors, they find no significant outperformance of buyout fund investments versus the public market equivalent on a dollar-weighted basis.

- University of Southern California’s Arthur Korteweg – Risk and Return in Private Equity.

- After accounting for additional risk factors, the net-of-fee risk-adjusted performance of both venture capital and buyout funds is lower. Many cases, the outperformance is insignificant or negative in some cases.

- Richard Ennis – Have alternative investments helped or Hurt?

- There is no support for the proposition that private equity has added value to pension fund returns in the post-GFC era.

- Hedge funds and real estate “significantly” hurt returns.

- PE companies say they improve companies but Bain’s latest report on industry

- Nearly all value creation from 2012 to 2022 came from revenue growth and multiple expansions. Not much came from margin expansions.

Fundamental Reasons Why Private Equity Returns Will be Much Lower Going Forward.

- The competition is more intense because the industry is larger. More competition for deals. Every deal is looked at with more eyes.

- One dominant factor in the past is declining interest rates and going forward, that may be reversing.

- Bad deals can be rescued by refinancing at cheaper and cheaper rates.

- Mediocre deals turn into cash cows to be milked through dividend recaps.

- Federal Reserve paper in 2022 estimate that half of all growth in US corporate profits between 1989 and 2019 due to lower interest expenses and tax rates.

- Discount rates for valuation will also be higher.

It May be Hard to Find Good PE Funds with Persistent Performance.

- Normal active funds in public markets have a persistent performance problem already. This means that if a fund has a good run, the chances are greater that it is about to do badly. It is very difficult for investors to consistently pick winning fund.

- Kaplan and Schoar – Private Equity Performance: Returns, Persistence, and Capital Flows

- General partners (GP) whose funds outperform the industry in one fund are likely to outperform the industry in the next.

- There is persistence not only between two consecutive funds, but also between the current fund and the second previous fund.

- These are different findings from mutual funds, where persistence is difficult to detect.

- Harris, Jenkinson, Kaplan and Ruediger in a recent study found that this persistence have been weakening.

- Large investors need to use their size to negotiate discounts.

- Or they have to setup internal investment team to co-invest with these LBO funds.

- A few pension plans such as Canada, Australia and Europe are doing this.

- CEM Benchmarking shows that internally managed PE portfolios do better because the cost savings outweigh the better performance.

The Illiquidity Premium or Discount?

Private companies do not get re-valued often. They don’t seem to go up much during rally but they often stay steady during bear market.

Institutional investors welcome this cushion.

More and more investors justify their larger and larger allocations in private equity by quoting the mythical illiquidity premium.

- AQR Capital Cliff Asness – The illiquidity discount?

- Liquid, accurately priced investments let us know how volatile things are and smack you in the face with it. What if many investors actually realize that this accurate and timely information will make them worse investors as they will panic and redeem at the worse times? Perhaps illiquid, very infrequently and inaccurately priced investments will make them better investors because it allows them to ignore their investments.

- Would the extreme illiquidity and price opacity be a feature instead of a bug and you have to pay a price for that feature. Smoothing of returns do not come free.

- If illiquidity is more positive than negative to many investors, it could easily mean paying a higher price and accepting a somewhat lower return to obtain it.

- We should all look at our own needs and whether we need certain feature of certain strategy. While smoothing of returns is a feature (not killer feature) of private equity, some of our portfolios may be able to take on volatility.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024