I went on one of my leave days to meet up with my friend.

I used to have the chance to meet my friends more as we worked in the same workplace, but since I left and started working in Tanjong Pagar, it is quite nice we still keep in contact.

Our conversation eventually led to progress on the path of financial independence. The subject of money is not always easy and often personal enough that it is difficult for people to have a deep and meaningful conversation around it.

I am more appreciative if I can sense that this is a deep enough topic where people feel that there is something on the line, where the weight of the financial decision is important.

I gave him my thoughts about his financial situation, but unlike others (I think…), I tried my best to explain why I believe he is in a good position, with the desired lifestyle that he wishes, even though he thinks it is a short few years away. This is because I know we won’t feel mentally convinced that we are in a good position with our milestone if what we fear is left unresolved mentally.

Which brings us to the topic for today.

All of us frame comfort and security in F.I. very differently.

I strongly believe that comfort and safety can be achieved eventually with enough capital relative to the income a person or family needs.

Most people hold different beliefs and are very investment-focused and believe that investment returns are a critical part of making the plan work. But if appropriately guided, they too will understand that there is no choice to this. The amount of capital equals comfort and safety.

If you have less capital, either you hope that you are lucky in life or that when you are eventually unlucky, you are not too unlucky.

What we see below is a very common framing of their F.I. plan so that some can derive comfort:

They have a portfolio that provides them with income. But I think what gave them comfort is a few other fallback plans, including the ability to go back to work.

There are a few questions that I can put forth for people with this framing to think about:

Is there some double-counting? In some situations, I think we can have a sum of money earmarked for different things. But suppose you REALLY go through that very challenging, unlucky period, would your plan be okay since this amount of money is meant for two or even three different things?

At what point would you feel that the number of fallbacks is enough? I wonder if people are able to figure out the cut-off amount of money or “reserve buckets” they require to feel safe enough. People continue to work because mentally, they don’t feel safe enough, and they don’t have a cut-off figure.

But realistically, people are either basing the fallback on hope (because the plan is less mathematical), or they find comfort in collecting more and more of these fallbacks which lead them to the thought that “things cannot be this bad.”

The last point is that if we need so much fallback to feel safe, then wouldn’t the money set aside for these fallback should be part of the portfolio? In my opinion it should.

And if that case, what gives you comfort is often…. more capital than you think that you need.

Comfort in Conservative Returns or Dividend Yields

A different way to express comfort is through the returns that you use to plan for:

People can base their planning on returns or dividend yields.

The obvious flaw is the dangers of straight-line return and inflation assumptions. Historically there are periods where returns are 12% a year, and inflation is 5.5% a year and you still run out of money prematurely. This is what we call the negative sequence of return, or that the sequence of when the returns, inflation growth comes matter.

Most are realistic that returns or dividends do not stay constant and so to be conservative they will use a mental lower bound of returns or dividends in their planning.

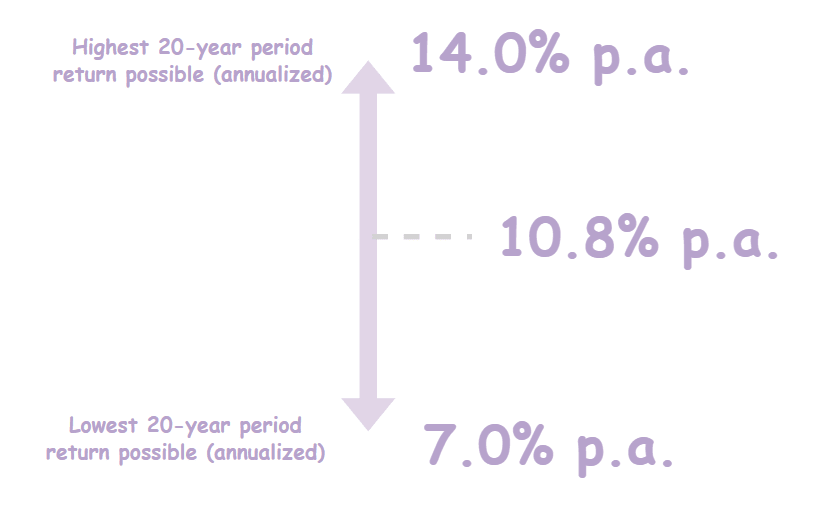

So in the range above, you would use 7% or around 7% in your planning (this is the 20-Year S&P 500 annualized return over a certain period)

If the returns are above this lower bound, their plan will be okay, so the safety lies in the range of the bounds.

This may not be the best, but there is a degree of conservatism.

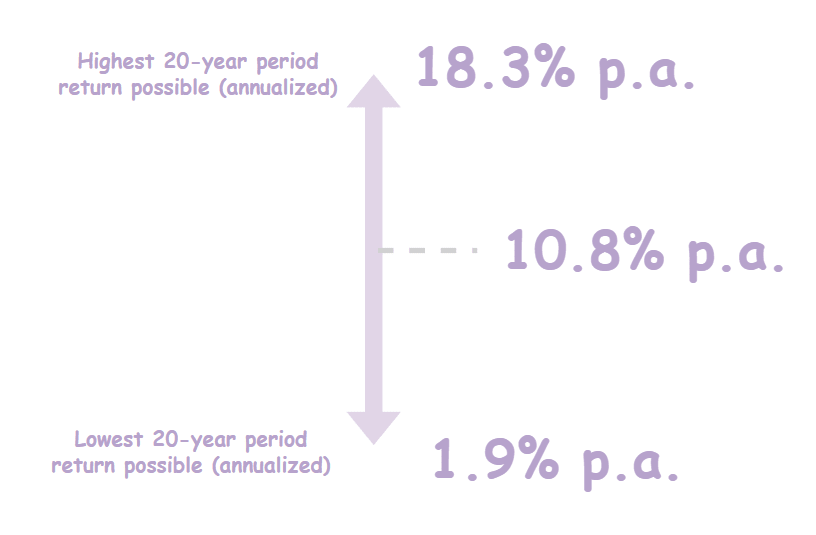

The problem is… people may be too optimistic in the range of returns they think they would get. If we really scale out the time period to 1926 to 2023, here is the range of 20-year annualized return:

The best 20-year returns are higher, the worst 20-year return is lower.

Now, if you are working on limited information that is crucial to your decision-making, you would have grossly miscalculated the amount of capital that you set aside.

So suppose you need $24,000 and your model plans for a pessimistic 7% return; your capital would roughly be $343,000, but now we know the pessimistic return can be 2%, your capital should be $1.2 million.

Big misjudgement there.

It doesn’t help that the weakness is that based on historical returns, there may be a worse off 20-year period that we may not have encountered.

I don’t always think we should plan for the worse-case scenario but with better data we can be more roughly right than precisely wrong.

Planning without any data visibility is precisely dangerous.

Comfort in the Safe Withdrawal Rate

Many would feel that I hyped up the safe withdrawal rate (SWR) but beat down on other stuff too much, but I do think that if you look upon the SWR as the result of a method of research, the method answers a lot of the things you actually wanted, and provide a blueprint how you can adapt to what is your preferred.

Eric Kong of Aggregate Asset Management once used that methodology to come up with why an initial 5% would work for a value-focused strategy. Those with other asset allocation, or retirement tenor use the methodology accordingly.

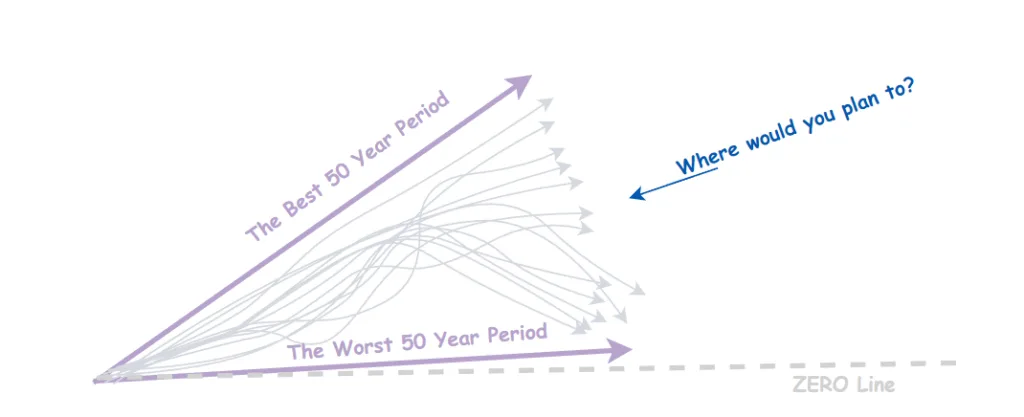

SWR to put it simply, is that for different tenor where you need the income (in this illustration say 50 years), the data allow us to see many different outcomes if we spend according to a certain strategy.

There are challenging and very easy 50-year periods.

Usually, if we wish to be conservative, to feel comforted and secure, we will make sure our plan takes care of even the worse 50-year period.

With enough capital, you can make sure the money last for 50-years in that worse case scenario.

The SWR weakness is if there is a uniquely worse 50-year period that we have not encountered despite the past 150 years, then we may not have factored in and have enough.

If we do not have enough historical data, SWR can also be weak.

SWR weakness is the strength of mathematical models like Monte Carlo simulation.

SWR’s strength is that it answers a lot of your “mental what-ifs” such as:

- What if I happen to retire at the start of a depression?

- Or a high inflation period?

- Or when inflation comes later?

- Or depression comes later?

- What if I am flexible by spending it this way?

The methodology, done and presented in a certain way, helps answers your mental questions.

Another strength of SWR is that it is more relatable in a way that you can explain better what have been factored in to clients.

Imagine if you point a gun to my head and ask me how safe is the plan. I can give you a very clear description. I may be less vague with other methods.

Comfort in Simple Monte Carlo Simulations

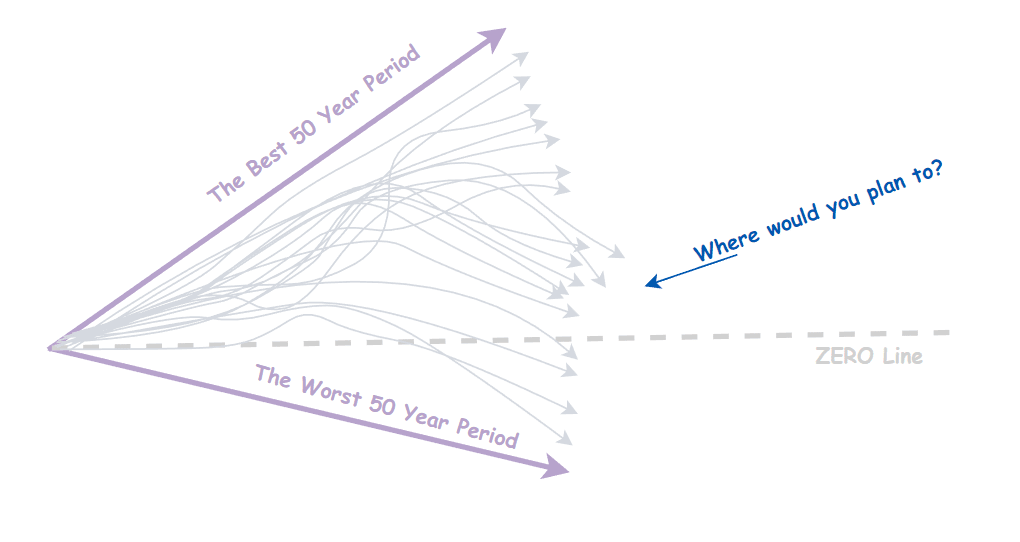

If we just use some historical returns, and volatility parameters of our portfolio and put it through Monte Carlo simulation, we are able to simulate what would happen if we split ourselves up into 10,000 or 100,000 Kyith living so many 50-year periods:

We would be able to figure out roughly if the capital can last or cannot last.

The challenge with simple Monte Carlo simulations is that you get a very wide range of mathematical outcomes, and you wonder if you ever hit the worse or best-case scenario.

For example, the worst-case scenario to happen, you probably have to pick a very pessimistic return one year, then the next, then the next then the next.

Is that possible? There is always a possibility?

The less realistic part is that it does not take into consideration the presence of minor or major market cycles. Cycles restore things just that each of them are different.

And since sequence of returns matter, a simple Monte Carlo simulation may not factor in so well.

Monte Carlo’s strength is that it doesn’t need a long historical returns but you may critique that if we don’t have long historical returns, wouldn’t the average returns and volatility be wrong?

Yes but if I were to be adventurous, we can borrow a different volatility profile from a different region or portfolio.

The most challenging part of the Monte Carlo is… how do you explain to people what is conservative enough?

You cannot factor in the worse-case scenario like the SWR because it will likely mean you can NEVER retire. Usually, we communicate based on percentage of success or failure.

But what does 86% success mean versus 80% and 90%?

Mentally, it is difficult to connect.

Summary

Almost all methods presented are trying to be conservative so that we can feel comforted and secure.

But the model and the lens we view through is different.

But you will realize to be conservative is usually through having more capital.

Different model may tell you how much more differently.

If you have less capital, or your income needs is high, how can it work out for you?

- Make sure your returns are confirm-plus-chop not too volatile and high enough

- Make sure your personal inflation rate is forever low enough.

Basically, make sure you are lucky enough.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

singvestor

Sunday 24th of December 2023

The biggest benefit of the fallback option is to trick the mind into some sort of post-scarcity mindset in my experience. When I started the semi-retirement / exit from corporate life in Sep 2022 I had built quite a cash buffer. I ended up not using the buffer and have been investing it slowly.

Having a fallback frees capacity in the mind that would otherwise be always active in the background - worrying whether the cash flow would be enough to pay for the lifestyle.

I find this book highly relevant in this context: https://en.wikipedia.org/wiki/Scarcity:_Why_Having_Too_Little_Means_So_Much

When it comes to the Monte Carlo simulation of the many different Kyiths, I feel that many people ignore the upsides and try to find further downsides to stress-test the scenario / their plans. With freed mental capacity after stopping to work, it is quite easy to unlock other income or options. In my personal case, I just tabulated the total side income for 2023, it was about SGD 22.5k. I did not really look for this extra income, the opportunities sort of came by and thanks to freed up mental bandwith from not being in a corporate setting, they could be realized

There needs to be a balance of fallbacks and realizing that life is short. It may sound like a cliché, but above 40 the realization sets in that we might not be healthy forever and that our attractiveness in the job market is going down. Spending the best years to build some sort of buffer / fallback system might backfire. At some stage, one needs to take the plunge.

Kyith

Monday 25th of December 2023

Hey Singvestor, hope you are doing well there.

I wouldn't consider side income to be an expansion of the monte Carlo. If we look at our wealth as based on equity, cash, property and bond returns, the market dictates to a certain degree whether we will have an easy time or not. While I expect more people to have free time and what you say is possible, those are work income in a way and less driven by market outcome.

I do agree with the part of how we look at things above 40 years old.

Ultimately, we all frame safety differently but often refer to the same thing.

Kissing

Monday 25th of December 2023

@singvestor, At what age did you decide to quit work? What made you think (financial models like 4% SWR etc) you had enough of work to commence your second act of life?

Katie

Sunday 24th of December 2023

I once read from somewhere that "If you are risks averse and wanted a more secure retirement income, then you must accept lower return".

I am one of those people. So I rely a lot on our CPF system, left a chunk of money in SA and even bigger chunk in OA. I won't use these 2 buckets until I am almost 80. The assumed return is 2.5% in OA and 4% in SA. With the recent quarters of good T-bill returns, most of the OA money has been earning more than 2.5%.

I also set aside personal sinking fund to cover many of life unpredictable expenses; the most unpredictable of which is medical emergency. I reckon the worst case scenario would be if either me or my spouse (or both) is diagnosed with critical/terminal illness, we will be in for an unpredictable expenses that might affect our retirement. While we do have some CI coverage, being a typical ks Singaporeans, we fear for the worst. While my medical emergency fund is not large, I hope to grow that further year by year and that it will be large enough to withstand at least one episode of those emergency.

I often review my own approach and wondered if I should take more risks, the fear of losing my future spending buckets always stop me from trying.

Katie

Tuesday 26th of December 2023

Hi @Kyith, the reason why I am only using my CPF funds at around 80 is because my other cash buckets are able to provide for my expenses until that age. Based on family history, I should be the one going first so the leftover money in CPF will also be a good pile for my partner.

I get what you mean about medical fund that I am keeping as emergency, thanks for your input. I read about the entire journey that you went through with your dad's passing and paid particular attention to the monetary part, I do not want to burden my children with money stress when I am sick hence trying to build on my medical emergency fund as I chucked along my retirement.

Kyith

Monday 25th of December 2023

Hi Katie, thanks for sharing your plan. I shared this with a few acquaintance and wonder why you would only spend so much of your CPF SA and OA at 80 years old only. Depending on different people, there may not have much time left.

I think those situations that you cited (the medical part), is not unpredictable. If you can say it, it is a risk and should be addressed. Having a sinking fund, for specific healthcare needs do help. That is not an emergency but planning for something that will come soon.

Just some thoughts.