4 years into my working career, I knew very well that I would stay in that line for a long time.

Not just that, I could see myself staying in the company for a long time. There were also other aspects of life that I believed in strongly.

I believe it is ridiculous my pull-up count will fall below 25 and my 2.4 KM run timing would be below 11.

15 years on, only 1 of them is true. I shall leave the guessing of which one is true to you.

The experiences that I have learned in the past 15 years have tainted that original perspective. What I learn does strengthen some philosophies but you learn that at 39, you didn’t know a lot of things in life at 24.

One of the massive ones was how the body could deteriorate and affect your capacity for work and life. You think that whatever you are weak at, you can outwork your competition every time. You cannot out OT a 25-year-old competitor now if you have to take care of 2 children, in a reduced cognitive state, weakened by insomnia.

The scary thing is that this is the same 18 to 20-year old that is supposed to have everything sorted out early. You need to choose a field of study and that could determine your future employment trajectory.

And make sure you do not fxxk up in life.

I would not trust that 24-year-old Kyith with everything.

Now I wonder can 60-year-old Kyith trust 39-year-old Kyith’s financial planning?

The End of History Illusion

The end of history illusion assumes that a person has come to the end of his or her history. In this state, they would change very little.

Daniel Gilbert, a professor at Harvard, comments that we will usually look back at our past and chuckle at how different we were back then.

Yet, we will believe that we will not change much from this point forward.

This is not restricted to one aspect of our life. They looked into our personality traits, preferences (what they like and dislike). For example, our favorite foods, hobbies, bands, vacations. They also look at their core values (their philosophy and what they believe in).

Researchers like Mr. Gilbert asks groups of people about these traits in the past. They were then asked to make their predictions of these 3 groups of traits in the future.

They recruited 7519 volunteers to a French science show. The experiment breaks them up into age groups. For each age group, they break them up into 2 groups. One group will report on their personality, preference and core values change in the past 10 years. Another group will predict their change in the next 10 years.

In this way, the researchers can match the predictions to what is reported. To be fair, this is not the same person, but here are the results:

There are a few things that you will notice:

- The change that they reported is always greater than the change predicted. While this is done by different people, we see consistency in the whole cohort underestimating their change in preferences, values, and personality.

- When you are younger, there is a greater gap between what is reported and what is predicted. This is particularly so for core values. You have greatly underestimated your philosophies and what you believe in to stick for a long time

- Older folks tend to stay the same more. It is not because we get better at predicting ourselves, but because… we really changed less

What is not observed in the charts is that an 18-year-old anticipate their rate of change in these 3 groups of traits to be similar to a 50+-year-old.

In another survey, a group of people were asked how much they would pay to see their favorite band from 10 years ago, and how much they would pay their favorite band now, 10 years from now.

The average result is that people are willing to pay US$121 for their current favorite band 10 years from now, and US$80 for their favorite band 10 years ago.

By right, if your taste does not change, you will pay equal equivalent amounts for the current band and the band 10 years ago.

This survey emphasizes how much we can trust our taste.

Your Future Self May Not Like What You Plan for Him/Her

Here are some conclusions from these behavioral studies:

- People have a fundamental misconception about their future selves

- They expect they will not change much in the future, despite seeing large changes in themselves in the past

- We might make decisions because we like something in the past. Our future self will chide us for making such an absurd decision

- We overpay for what we think we will like in the future because we think we will continue to like them

- We have no idea how we will change in the future. But that does not mean we will not change.

In other words, we cannot trust ourselves today to plan for our future self.

There is something more absurd than this:

We delegate to our financial adviser to help us plan. If you think about it, after this research, you don’t know yourself in the future that well, would your financial adviser be able to know better?

I think the chances are slim.

Unexpected Changes in Life Compounds to the Problem

Your personality, values, and preferences may change due to the environment.

Or they could change resulting in you needing to change your environment.

This compounds the financial planning problem.

My friend told me his friend migrated to Australia. A child was never on the cards. In their 40s, a child suddenly pops out.

Now they have to come back to Singapore.

I have a friend whose wife took some time off (no pay leave) to stay at home to take care of the kids. The plan is to rejoin the company when the children are older. The workplace is known to be relatively more accommodating to these things.

When she wanted to go back, they gave her a position that she felt vastly underutilized her capability.

That was totally not expected.

Finally, for some their careers have been going on very well. The salary is good, they have managed to achieve certain work-life balance.

But it took one moment of pure stupidity (or perhaps a constant amount of stupidity) for you to be doxxed by Hardwarezone folks, get on social media.

You lose your job as a result of that. To make it worse, your profile is all over, and it will be challenging for you to find another job that pays as well (unless the industry is in demand)

The Financial Planning Implications

Some financial implications:

1. Your Goals are at best Guesses. These are not my words but Carl Richards. It means if this is planned by your past self, they might not be very accurate.

You might not even like your current lifestyle in the future.

2. Asset and Liability matching is tough. You have goals such as children education, financial independence in the future. You have a mortgage as well. Asset-liability matching means funding the goals and liabilities today with your income from work.

If your goals are at best guesses, then you are matching something that you may not need in the future.

This is especially tough when you have specific likes and you plan for them. For example, a lot likes to go for vacations. They envision that when they got out of the rat race, they will replace that working time with very frequent vacations.

When you really live that life, you realize you like to do it at the start. But soon, other projects seemed more meaningful and overtaken your life. Thus, you spend less time on it.

Why did we assign so much of our asset to vacations then?

3. Your Future Expenses is Going to be Volatile. The lifestyle we envision in the past might not be accurate. We think we won’t change and plan accordingly, but eventually, we will change.

Even after 65, wellness might bring about changes to your expenses.

20 years ago, would you imagine you have a device that costs just $200 that can take a photo, plan your calendar, take notes, make calls, and entertain you all at the same time?

4. Standard Retirement Projection will be Out of Wack. If #1 to #3 is true, then how do we work out the retirement sum? Traditionally if you need $60,000 a year, your financial planner will work out that you need $3 million in 20 years time.

The consequence is that you may be over saving or under-saving.

Add to the fact that returns are also uncertain, and you have an uncertain retirement. Past return performance is a good gauge but our future results could vary wildly from 2% to 10%. And that would impact our goals.

Over-saving at least means that you are not running out of money. You have a fair bit of buffers, but it also means you exchanged more of your life energy for something that you eventually do not want.

How We Can Plan Things Better

With all that said it does make planning rather challenging. So here are some help planning perspectives:

1. Aim to Accumulate Based on Broader Goals instead of Being Very Specific

This will go against all the S.M.A.R.T goals that we were told to set. SMART stands for specific, measurable, actionable, realistic and timely.

If you can articulate them easily, you connect with them better and thus will act on them. If we are unsure whether what we want in the future, then a lot of the times we are just “broadly saving”.

So for example, this could be: Your adviser and yourself work together to work out how much you need next year, in order that you could stop work.

For example, if you spend $48,000 next year, based on a reasonable rule of 4% safe withdrawal rate, you will need $48,000/0.04 = $1.2 million.

To an extent, you may be over-saving but the idea is… what you do not need, set aside for tomorrow’s dreams and aspirations.

2. Critical Evaluate What to Spend Today and Accumulate the Rest

If you abide by #1, you may fall into the trap of funneling so much of your income for tomorrow.

And you leave little for yourself today.

That may not be the most balanced form of living. At the same time, people self rationalize a lot of their spending, explaining that they deserve to spend on these things, they need to spend on these things.

You need to spend enough on your life today.

For the rest, aggressively save for tomorrow through investing.

But what is “spend enough on your life today”? To know what is enough, and not too much, you need a good critical brain, adequate personal finance competency to make good decisions here.

If not, you need to surround yourself with people that you can depend upon to make these decisions.

3. Treat Things as a Journey

We fixed a very broad goal at the start, and we do our best to invest towards it.

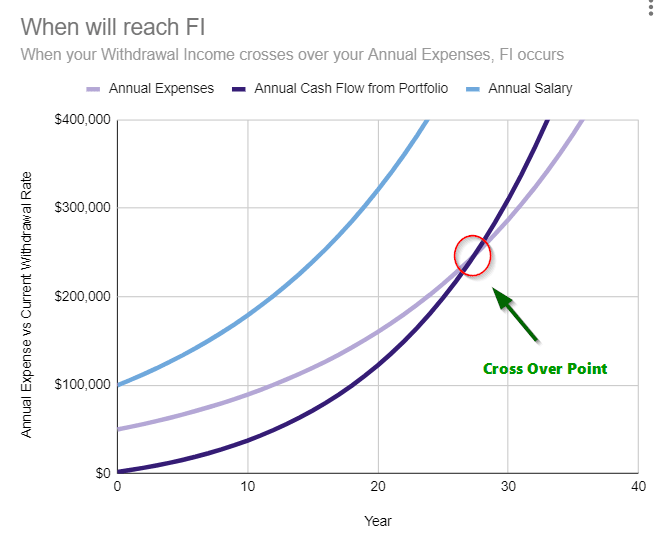

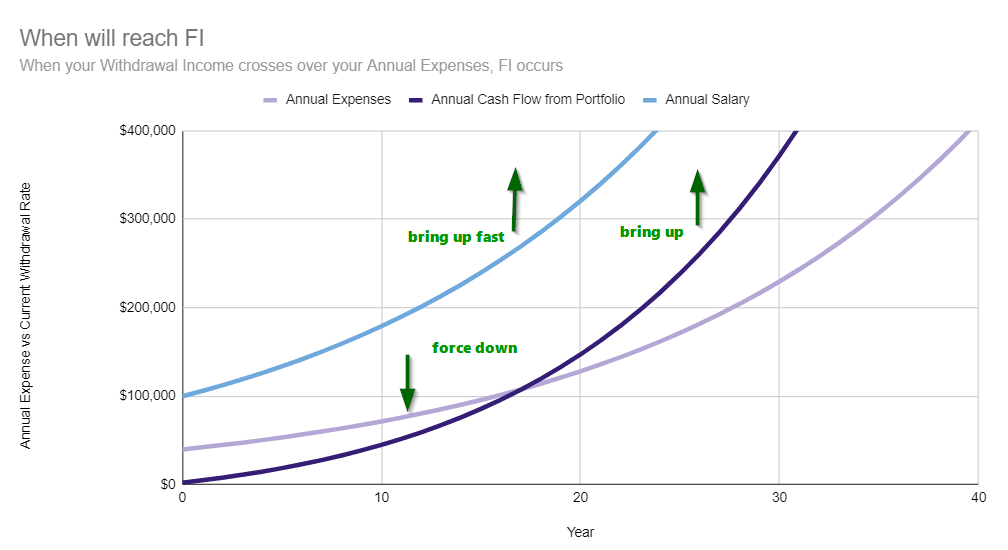

The cross over point brought up in the book Your Money or Your Life illustrates how we should go about this.

If you do #1 and #2 well, at some point your annual cash flow from your portfolio will be more than your current annual expenses.

Your life may change but if your cash flow from portfolio crosses over, it at least means that your wealth might have become functional.

This whole wealth building is a journey. There are days when expenses go out of wack and months where you may save very well. But if you do the three stuff in the image (build up your income, invest well, and force down your expenses), you might realize it crosses over in less than 20 years.

4. As Your Wealth Grows, Re-evaluate the Opportunities In Life That Your Wealth Can Buy

At some point, you have to narrow down and think about the specifics.

What do you want in life at that point? Do you still wish to do this kind of work or you wish to explore another domain. Do you stay in this company or go.

What are the aspects of life that you think was necessary but now it is not so?

Do you wish for one spouse to stay at home while one work? Would you take the risk and start your own software-as-a-service company?

How much would they cost? How many risks are we taking on? If they don’t work out, what are the opportunity cost?

Like last week’s post, if you know what you want, someone can help you assign how much it costs. And you can accumulate for it.

We often dream about what we want to do but in reality that might not what we truly wish for, and not something we eventually want.

Here are some things that you could do early in life to see if you feel strongly about it:

- Take a 1-year break from work and do the retirement life. If you feel strongly about traveling do it

- Experiencing as a couple of both not working so much and being around each other and the kids

- See if you can volunteer as you wish for

Basically, you need to test out your life goals.

This gives you a reality check. The study says our preferences do change over time, but I don’t think you will fall out of love with rock music or certain interest.

The frequency and magnitude of how you engage in your interest will change.

5. Re-calibrate the Financial Numbers and See if You Have Enough

By doing more of #4, you hope that you have tried to question what you preferred more so that you connect with what the future self wants more.

These asset-liability matching can then be re-calculated such that you see if you needed more money or you actually need less.

This might bring some good news and all.

6. Build-in More Flexibility Into Your Life and Plan

Ultimately, expect the unexpected. Read extensively to know what are some of the surprises along the way.

When you know them you could cost them. Then you can plan adequate buffers in and give your financial independence enough wriggle room.

However, there is a limit to what we can do with these kinds of planning.

Change is the only constant in life.

Planning for a fixed future is ridiculous. And for people that have been living a corporate life where they get a fixed salary, this is one aspect that they find it difficult to accept.

Build up a flexibility and adjusting mindset before financial independence. Or have so much money that whatever life throws at you, it is not a problem.

The money is only part of the solution. You can be money independent for a while but permanently imprisoned mentally by not feeling secure. Thus, in my post about financial security, I shared that a key to feeling secure is adjusting to volatility.

Summary

With the end of history illusion, it is rather challenging not just on planning your money but also other things.

The posture is to treat enough distrust of your family and your perspective. They will change over time. The idea is just to live a life based on mostly sound financial decision.

Whatever is leftover, invest aggressively.

Over time, learn to understand the future you want better. You cannot guess what you will feel, think like 30 years later, but you can try doing it 5 to 10 years later.

You will know what may come along your way. If you do not know, find an adviser that is competent and you trust enough to help you with those “I am thinking of sending my son to Australia to study in 11 years. How should I think about it?”

When you consistently evaluate, you will one day find out if you are ready for what you want in life.

I can see how we are addicted to our work income. It is like an insurance policy against uncertainty.

But know this: The alternative to my plan or even the general retirement planning is… your life will still change.

If you do not plan, you are left in an even worse position.

You can read the rest of my financial independence and retirement planning stuff below.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

Michelle

Monday 1st of February 2021

Hi, Does buying a retirement plan cover the basic needs of future self ? We dont really know how much is enough until we went thru that stage.

Kyith

Wednesday 3rd of February 2021

Hi Michelle, it is true that we may not know how much we need at that stage. What you can do is to work with someone to estimate to the best of your ability the kind of lifestyle that you think you will live then. Explore with the person what are the kind of line items that you will do. He or she would suggest to consider certain blindspots. With this you can estimate how much you need. We can how much you will need today or from your yearly savings from now till your retirement.

A retirement plan is a product. I shall reserve the judgement whether that is adequate or not. Even if you have the best product or financial assets, you would need to figure out your plan first. hope this helps.