There are probably 7 REITs that up to this point have announced their results or put out notes on their latest quarter of business development.

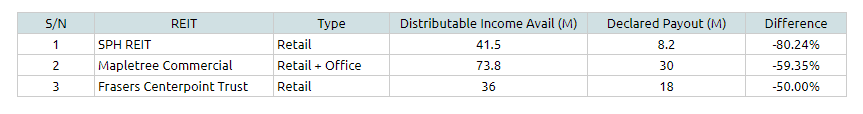

3 of the REITs have cut their latest quarter of dividend per unit that is distributed to shareholders.

If you look at the dividend per unit cut, they are very drastic. What it shows is that based on the net cash flow that the REIT earned in the last quarter, they decide to pay out 50% to 80% less.

The REITs that have announced but did not cut their dividends to this drastic extend are Keppel REIT, Keppel Pacific OAK, Parkway Life, Sabana, Keppel DC.

The reason this is done is to conserve cash flow.

The Singapore Government and Australian Government have announced that landlords cannot evict their tenants. They have provided landlords with property tax rebates and expect that these rebates are passed on to the tenants.

Contractually, the tenant are supposed to pay rent. But tenants are pushing back that if I am not operating my business, if I am not earning any revenue, why should you still continue to charge me rent?

So a few REITs have passed these rebates provided by the Government to their tenants, and some have extended their own cash to support their tenants.

Cash flow needs to be conserved because, for the next quarter, the properties are not going to get much revenue due to forced locked down. If this drags on, the next quarter is going to get effect.

Even with no revenue, you can minimize management fees paid to the manager through paying in units, but there are some ancillary costs of landlording that you cannot stop paying.

Most important, the landlords still have to pay the interest on loans.

If you look at the REITs who have cut their dividend per unit, they are mainly the retail-centric REITs. Together with the hospitality REITs, they are the most hard-hit because they are forced to close.

So almost zero revenue for the month, yet still have to pay costs. Of course, the natural thing to do is to conserve cash, even if it means losing certain tax transparency.

In order for Singapore REITs to enjoy certain tax transparency, they would have to pay out 90% of their distributable income to their shareholders.

When a REIT conserves it’s distributable income and not paid out, they do not enjoy that. What Monetary Authority of Singapore did was to give some flexbility there to allow the REITs to delay their dividend payout to no later than Dec 2021.

In this way, the Singapore REITs can still enjoy that tax transparency.

What This Means for You the REIT Investor

When distributable income is cut, this means that if you depend on the income for your upcoming needs, you do not have it.

This is more impactful if the majority of your portfolio are in specific sector of REITs.

Or majority in REITs for the matter.

If your REIT survives COVID-19 and go back to some semblance of normacy, then in 2021, your REIT would backpay the distributable income that they conserve.

So this means that you are not going to stop seeing this money.

Is This a Black Eye On the REIT Model?

I think there are enough people having an eye on the REIT ran up the last few years and say this is a bubble.

And you have REIT investors looking at these people and think they are laughing at them.

However, I do think it is not really a broken model. It is just that it is misunderstood.

What we have today is pretty unprecedented:

- Almost all your tenants, no matter how diversified, don’t have revenues or cannot work

- It is an uncertainty which of your tenant is going to survive, despite how “blue chip” their status is

- You still have expenses

- You still need to pay interest

I want you all to touch your heart, and think if you are corporate planning this, how would you risk managed a situation where you have zero revenue from a diversified tenant base, across geogrpahical regions, when all of them stop paying you.

I think you can put it out there, but to really execute on it is rather tough.

In a severe downturn, at least some of the businesses are still bringing in revenue for you. This time it is not.

The Single Property Experience is Not Perfect Either

If this is a poor model, then I wonder about the alternative, which is to purchase a single private property and rent it out.

One of the reasons people would gravitate to a portfolio of stocks and bonds is that they witness first hand that they go through periods of tenant vacancy and the maintenance cost of repairing your place for the next tenants.

If you own a single private residential property, you would face the same problem as the REITs, but you are better off because the government allows you to defer your mortgage payments. But you still need to cut the rent of your tenants as they negotiate with you.

The Ineffciency of “Lao Kok Kok” Property Companies

The biggest gripe, of a lot of people, is paying out almost all their cash flow.

They say it will be better if it is not a REIT model like Hotel Grand Central or those “Lao Kok Kok” (old) property companies.

To me, these Lao Kok Kok property companies are doing the same thing.

If you observe whether they can cover their dividends with their cash flow, a lot of them tries to cover their dividend payment almost equal if not pay out more than their recurring rental cash flow from their investment properties and operating business.

This is no different from what a REIT does.

Their payout ratio is lower… because not all their business is in buying and renting out properties. It is mixed with property development or other things.

There is also a reflexive effect.

The REITs are rated by the market better because they are cleaner. People see them as a portfolio of buy to let properties. There is a clear dividend payout policy. The management job is to grow AUM and get properties to rent.

They are build-to-suit for certain investment purpose.

If you contrast it to others, the narrative is not so clear cut. It is up to the discretion of the management who tends to hold their cards closed to their chest.

When you package everything clearer, the market gives them a better price. And we see them trading close to their price to book.

In contrast, many mixed-property companies, they tend to trade below their book value.

You make money from these mixed-property companies when development profits shows up, and during price dislocations where the price trades closer to book value.

Whichever way, you can go ask the owners of non-REIT properties whether they have or do not have the same problems as the REIT landlords.

The Frustrating Thing About Looking at Investors

If we go back to finance 101, we know that dividend payout is not mandatory. Interest payment on debts is an obligation.

Dividends are paid out only when times are comfortable.

REITs are essentially still stocks. So dividend payment is not mandatory.

It is just that, due to the specific nature of this property sector, the probability of a company not having comfortable cash flow is low.

Well, we have a period now.

I get frustrated when investors or prospective investors say “Cannot cut dividends. This shows poor management. They should have anticipated this”

Sometimes, I wonder if they talked to people in real business or been in business themselves.

It is not always plain-sailing.

These businesses are listed probably because they have stabilized in a certain way. But for those SME, we been like fighting tooth and nail over different business decisions and capital decisions.

I think these shareholders prefer the situation where the stock they own

- lays off 100,000 workers

- they can commit to paying out dividends

This is what is happening at Disney now.

I used to be someone who just looks at the black and white. The numbers just tell the management decisions.

The managers can get you in a meeting or seminar and talk all the flowery stuff but at the end of the day the numbers support it.

I would say this is still right at this point but I tend to think knowing certain qualitative aspect is important.

But if you look at the context of this COVID-19 situation, the shareholder perhaps are the more unreasonable ones. This is not a black swan but a real tail event.

Some of these employees or certain services got your dividends in the past, and now when the going gets tough you just want to cut them off.

I dunno. I think it just sounds plain selfish.

Think I still have something to say but going into a daily standup meeting soon. Perhaps that will be for tomorrow.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

BlackCat

Saturday 25th of April 2020

Hi, I think its obvious a REIT whose revenue will drop 30-80% in the next few quarters should not be paying dividends now. I am thinking a lot about retirement and how to have diversified assets/income - putting everything in one basket, like 'SG REITS', is asking for trouble.

Hope this crisis causes reits to change their behaviour and conserve money, instead paying 100% of distributable income. REITs actually only have to pay out 90% of taxable income (not distributable income) - the difference being depreciation. Any reit which has leasehold property and pays out 90-100% of *distributable* income is just returning your capital, and guaranteeing future capital raise on lease expiry.

Kyith

Saturday 2nd of May 2020

i think it is interesting that you talked about the 100% distributable income thing. there are many ways to slice things but i think depreciation in properties is a bit strange because technically they are not depreciating if it is perhaps closer to freehold. of course if we are talking about industrial properties then it is another matter altogether. it would be better if they are prudent, but that might not make them attractive.

i think you have a good handle that maybe in retirement things should be more diversified.

Vince

Thursday 23rd of April 2020

Good post, in the time like this, all should understand each other and embrace hand in hand. landlord and tenant, shareholder and employee. I too seen a lot of people in Investing Note commented bad management for cutting dividend, which I personally wouldn't agree.

Btw, I can't find any update on Sabana distribution in their recent business update presentation. They only mentioned they has changed to semi-annual distribution. So we would not know whether they will cut dividends to drastically until next result announcement.

Kyith

Friday 24th of April 2020

I only saw a note but did not announced a cut. What you say might be quite true as well.