By now, many of you would have heard that UOB has reduced the bonus interest rates that you can earn if you bank with them.

The revised rates are below:

Changes such as this sometimes positively affect us but also could negatively affect us, as in this case. On first inspection, the interest rate that we can earn is reduced.

We also observe that if you spend a minimum of $500 on your credit card and credit salary into your UOB account, there may be more interest to earn on an additional $50,000 of your savings. If you spend $500 minimum on your credit card and successfully carried out 3 GIRO transactions, you can earn more interest on an additional $25,000 of your savings.

Currently, I do not credit my salary to my UOB One account, so I would only fulfil the credit card spend and 3 GIRO transactions.

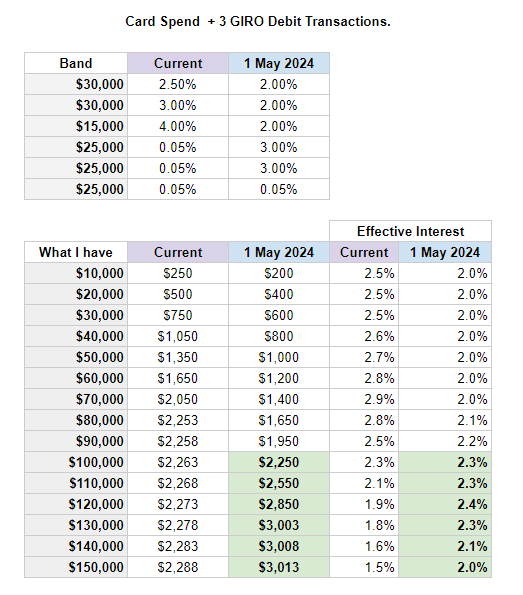

I decided to compile the impact in the table below:

The top table shows for each band of money in your UOB One Account, how much interest you will earn currently and when the interest rate changes in first of May.

The second table shows base on how much money you have in your UOB One Account, how much interest in absolute terms you will earn and what is the effective interest rate.

If you have less than $100,000 in your UOB One account, you will be worse off by the new changes. Your effective interest rate dropped from 2.5%-2.9% to about 2.0%-2.2%.

If you have more than $100,00 0 in your UOB One account, your effective interest will be higher than before.

If I have excess funds that came up to more than $100,000, this change would be better for me if I can only do these two banking options with UOB.

Some of you would find this effective interest rate unappealing and it is fair to say that. If I were to look at how much I lost due to the change in bonus interest, the sum doesn’t look too significant and I think I should focus on the fact that I could still get 2.0% for some of the money that I would like to be more liquid.

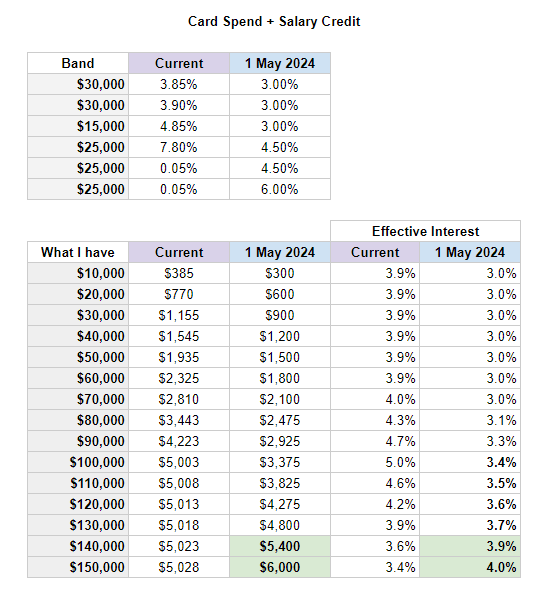

I compiled a similar table if your focus is on credit card spend and salary credit:

I think the loss in interest is more significant.

The average loss is about 1.0%.

With the increase in amount of money that can earn bonus interest, we see that only those who can put in $140,000 at least will be able to benefit from the changes in bonus interest.

The interest rate now is more aligned to the interest rate of shorter term, no volatility investments such as very short term bonds, or money market funds.

Some alternatives to the UOB One account are:

- Singapore 6-month Treasury Bills: 3.8% p.a.

- Fullerton Cash Fund SGD Current Gross Indicative Yields: 3.87% p.a.

- Fullerton Cash Fund USD Current Gross Indicative Yields:: 5.50% p.a.

- OCBC 360 Account Salary Credit and Incremental Save: 4.0% p.a.

- Singapore savings bonds: 2.99% p.a.

Making My Decisions Around the Interest Rate Changes

One of the things that we need to realise is that there is no permanence to the short term interest rate that we can earn. If there is permanence, it is that there will be returns volatility.

We must first understand the characteristic of these accounts. We are not going to lose money on them, but the interest rates will change from time to time. Then, we can ponder about the best use of these accounts as part of our wealth management plan.

The UOB Account, like the alternatives that I brought up, are good to allocate the money we need to be liquid such as our emergency fund goal, money to quickly call for our investments, or financial goals that is up and coming for the next 1 to 2 years.

If we require a higher rate of return to build our wealth towards some later, and more significant financial goals, we would need to deploy them into risk assets such as equities, longer term fixed income or property.

I look at different forms of investment securities like the way I just explained.

Even though the UOB One rate looks lower than the OCBC 360, and that other accounts such as DBS Multiplier might provide better rates, I know that if I switch to another one of the alternatives, the rates of these might change in the future.

I am at a stage that I would not wish to make so much changes.

The wealth will be build through longer duration assets such as equities, fixed income through ETFs and unit trust and that is where I will actively deploy the money to.

I should maintain less funds in accounts such as these, 6-month Treasury bills and the alternatives.

UOB One looks less attractive to OCBC now due to the extra hurdles and lower interest so the first $100,000 will be allocated to the OCBC and if there are excess, I would deploy them into SSB and 6-month Treasury bills.

I have to make GIRO transactions and use a credit card so the UOB One account is a good account to have if I have that much short term financial goals that require greater liquidity than SSB and 6-month Treasury Bills.

That is where I am with the UOB One account.

At the end of the day, I felt that the more wealth is created not in thinking about where best to deploy among these capital secured investment options but where best to deploy among those risky investment options.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

- The Cheapest Way to Extend Your Laptop to TWODisplay that I Can Find. - April 29, 2024

- My Quick Thoughts on the Net Cash, 4% Yielding Boustead. - April 28, 2024

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

Keith Tan

Wednesday 3rd of April 2024

You can transfer $1600 from DBS to UOB using Internet Banking and choose SALARY. Then transfer back the money back to DBS. In that way, it will be considered as you having credited your salary.

Kyith

Thursday 4th of April 2024

HI Keith, thank you for the suggestion!

GWR

Wednesday 3rd of April 2024

Thanks for sharing.

FYI, for UOB One, to achieve the monthly salary crediting criteria, you simply have to transfer $1600 from your DBS account with the purpose of “Salary” to your UOB One account. Since you already know there is a difference in % interest earned, enough said.

Can I check why you wouldn’t consider parking your liquid funds in MMF that yields 5.5% without having to do anything (spend/giro/sal credit)? Looking at how UOB’s new EIR is actually coming down (5% -> 4%).

Thanks.

Kyith

Thursday 4th of April 2024

Hi GWR, thank you for the tip on the salary credit.

As to the Money Market Fund that is a consideration. It woudl depend on how I want to segregate the accuonts. for my investment money that is shorter duration, I keep them in a USD ETF ERNA. There are some funds in money market funds. The money market funds are more responsive to changes whereas perhaps these hurdle accounts like uob one sometiems are less responsive. hope that helps to explain things.

lim

Tuesday 2nd of April 2024

One characteristic of a portfolio that pays dividends regularly is that you need to manage large amounts of cash. Whether that is a good or bad thing, it depends. To me, having cash in bank account gives me options :)

I am one of those who never manages to maximise my interest in my bank account because I don't try to satisfy all the requirements. I view a bank account, like you do, as a source of liquidity, ready to fund the next investment. On the other hand there seem to be some that play the 'fresh funds' merry-go-round game where they spend time moving funds between accounts to max out their interest.

My preference for cash management is monthly T-bill ladder. I have T-bills maturing each month which I then roll over into another T-bill.

Apart from that FSMOne cash management account at 3%+ is a decent place to park funds which can be used to fund my RSP of various ETFs. (FSMOne has 0% commission RSP for VWRA and IWDA finally...)

Kyith

Thursday 4th of April 2024

Hey Lim good day to you. I guess it depends on the constrains. We might find some of these things limited like you want to invest but don't wish to keep shifting about. So I understand the FSMOne move. Thanks for letting me know about that one.