In the latest Animal Spirits podcast, they brought on a US housing data analyst Logan Mohtashami to discuss the state of the United States housing market.

This article is probably going to impact Singaporeans less but I thought its an interesting epsiode to take a look at all the different factors why housing prices was driven up, stayed up, and probably going to stay up for a longer period of time.

Through this experience, we may be able to compare and contrast against what would move our local housing market, and why other housing markets moved as well.

We find out what drives the US housing price increase, the quality of the mortgage market, the economic incentives of homebuilders, are professional funds disrupting the housing market, and what makes this market rather unhealthy.

One of my big takewaway was how important slack in the housing market is to stable prices. I also find it unique that, if you take the investment element out of the analysis, the consideration is much simpler.

Unfortunately, I did not get a clear idea why around the world, suddenly everyone wants a shelter of their own instead of renting like in the past.

After listening to this, I think Singapore won’t turn out the same situation. However, we are seeing some possible transitory price increase similar to the other markets because it takes time for the homes to come online (construction takes time).

The Inventory is Very Low!

Logan explains that the main reason prices are skyrocketing is in the short term, the supply of homes is not meeting the demand.

We can see from the chart above that the number of unsold, finished new homes per community have come down. It is like there were no demand prior to COVID.

Then suddenly, people seem to think that they need a home!

“Hey guys, I am saving up to buy a house in the next 2 to 5 years, what should I put my money into, in the meantime?”

Ben Carlson asked Logan the most common question they get from listeners writing in.

Logan has a unique answer to this question:

“Housing is the cost of your shelter to your own capacity to own a debt.”

That sounded like a profound answer to me but I think what Logan means is that if you treat your home purely as a shelter, whether you would buy or not depends on how much you could afford, which is linked to how much debt mortgage you are willing to take up.

Logan believes that when home buyers are ready, they will buy.

There is mythical lore that there is a group of marginal people at scale on the sidelines waiting to buy a home. This money is waiting for the crash and then this money will come in and buy.

When COVID happen, what you see is that some people thought that it was a good idea to pull their sale listing off the market.

But what we see is people just rushing in and buy, despite the price not dropping.

More Americans have bought home in 2020 than in any period from 2008 to 2019.

Logan says that Homebuyers look at housing as shelter. Everyone else thinks housing is an investment.

Homebuyers are paying the mortgage and the mortgage is what they are buying.

In his opinion, you should never ask another adult such as a bank or advertisement on TV when you should buy a home. You are a grown-up now and should be able to assess your own situation.

If you are ready to buy the home you should go out there and make a bid.

The most that could occur is that your bid does not get accepted. But it is also interesting that the people that are outbidding you are your fellow Americans. This means that you did not make enough, relative to your American peers. This is one of the most frustrating feelings for the homebuyers because they want the house but they cannot get the house.

Are the Professional Buyers coming in and snapping up the supply?

The mortgage application data since 2012 have been rising year over year.

This shows that the main driver of this market has been the traditional homebuyers.

When these homebuyers on mortgage go down, the sales go down accordingly.

Those buyers who pay for home with 100% cash were dropping because there weren’t so many distress sales around.

To him, it is very simple, there are milions of people who want to buy a home to live in.

Who are the Cash Buyers?

These can be individual homeowners who buy the property with 100% cash, people looking for rental yield or investors.

Historically, these cash buyers make up 10% of the buyers but in the past few years, it has been trending around 20%.

You are getting nothing by putting your money in cash or certificates of deposit and rental income looks very lucrative in that perspective.

That is why in a low-rate environment, the big investors are not going to be sellers.

But people think these cash buyers are a bigger deal than it really is.

This is An Inventory Crunch

People hear the stories of 30 people going to one viewing home and they have this bubbly feeling about the housing market.

Existing-home sales in the US in 2020 comes up to 5.64 million. This number is just 130,000 more than the existing home sales figure in 2017.

This is not a credit boom like what created the housing bust in 2007.

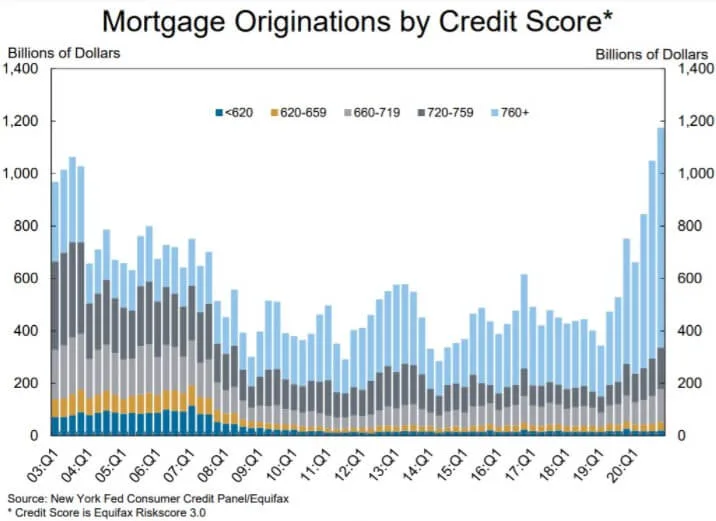

The chart above breaks down the mortgage originations based on credit score. We can observe that the people signing on to the loans have much better credit quality than during 2002 to 2007 (the blue and yellow bars)

However, in his opinion, this is a very unhealthy housing market because there is not enough supply.

There should not be 20 people competing for a single home.

Thankfully, this is not a credit crisis and inventory should rise over time.

Rents should pick up. If the money makes its way into the people’s hands, then the rent, which have been falling during COVID period, should turn up again, reversing the deflationary situtation.

Why are the Home Builders so Slow to Respond?

The home builders overbuild homes from 2002 to 2005. The housing demand crashed by 80%. The United States have the weakest housing recovery in history afterwards. New home sales figures have missed a lot during this economic recovery.

The home builders are in this to make money and not cure a housing problem.

Building new homes is expensive. Construction efficiency is terrible in the United States. The builders are building in much price inflation because they can. Regulation cost, land cost, lumber price pushes up prices but it’s also the builders are building healthy profit margins.

The inventory is not going to increase.

The home builders are just going to build off the demand curve.

Construction takes time. The one sector in America that there was an absence of productivity growth was the construction sector.

Would New Home Buyers throw in the Towel and Drop their Buying Interest?

If we look at the purchase application data year over year, after adjusting for the strong COVID growth, the growth is in the mid-single digits year over year.

So this means the purchase applications are going to grow a little higher. If we are suppose to have great home buyer demand, the purchase application data should pick up traction.

So it seems sales are stuck, and this is a problem because if the home price gain is growing at 10-15% a year, we are going to continue to have this kind of price appreciation.

We are starting to see people drop their interest to buy. But because inventory is so low that the prices may continue to increase.

An improvement would be to see the inventory go up or the interest rate go up.

For the market to be healthy, it would be better that we see days-on-inventory creep up from single digit days to double digit days.

Debunking the Stock Market Theory in Housing Market

Logan was asked if home prices were to correct by 5%, would we see people jumping in?

He tried to explain that there is a “stock market theory” that plague a lot of people.

People have this idea that when the velocity of margin debt moves up and down, the stock market gyrates together with it.

So there is also a thinking that when the price of home moves, the property inventory will move in a similar fashion.

This is not the case.

The people that are buying home is on top of the economic food chain.

Nobody panic sells their house.

If the home market is similar to the stock market, and that the prices should correct back to the start of the bubble, prices should go back to 2012 prices.

If that is the case, we are looking at homeowners to sell their home at 80% lower prices from today.

Rich, educated, skilled people are not going to sell their home at a price that is 80% lower!

The Relocation Story

A one-bedroom condo in Miami cost $500,000.

You can buy a home in Idaho for almost $500,000.

For the relocators, the home in those places where they will be moving to is not so expensive. It is easier for them to put a downpayment.

The demographic of people in this moving range are the 30 to 39 year-olds.

This is a problem for places like Idaho because in the past, they never had the population growth to expand the construction.

Logan’s fear is that the United States will start looking like Australia, Canada, New Zealand where they have unprecedented real price gains.

Would People Turn to Companies and Rent for the Long Term?

Logan believes that 33% of the people are going to be lifetime renters while the rest gravitate between renting and owning homes.

In California, you can make $100,000 to $150,000 and you have no chance to buy a home.

People need shelter at the end of the day.

Is the Housing Loan the Most Intelligent Debt to Prolong and Take On?

A 30-year mortgage loan under 3% is the greatest inflation hedge ever.

However, there are group of people who wishes to pay off their mortgage and never have to worry about it again.

This is a personal choice but this is a great inflation hedge.

Cash-Out Refinance – Does it Make Sense?

The fear a lot of people have is what is prevalent in the last housing bubble.

Back then, people are taking out these loans and spending on daily stuff.

We are not seeing that this time and majority of the loans are high quality. Typcally, these people already have pretty good cash flow and while they can do a cash-out refinance to improve their cash flow, Logan do not think this is going to be a big story.

What is the Danger of the Housing Market, in His Opinion?

The danger is for five years, you have 10-15% home price growth.

This makes it difficult for people to purchase a home.

Then you have the case of Australia, New Zealand, Canada where the demand is so good that the housing inventory just would not go up.

Would Baby-Boomers need to Downsize or Encash their home for their Retirement?

Baby boomers have not downsize much.

But in time they will die and the heirs will inherit or do something with it.

This will balance up the supply.

Will Mortgage Rates Stay Low or Below 5%?

The 10-year yield should be anchored and stay low.

The United States is not the kind of growing economy. Even with the highest CPI and PCE rates, the 10-year yield is below 1.6%.

People have this impression that when the FED buys mortgage securities, they are doing it to push down rates.

In Logan’s opinion, they are just trying to create a stable market. When 10-year rates go up, the rates will go up.

If the FED stops buying, the rate might get more volatile. But don’t overthink it.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- The Cheapest Way to Extend Your Laptop to TWODisplay that I Can Find. - April 29, 2024

- My Quick Thoughts on the Net Cash, 4% Yielding Boustead. - April 28, 2024

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

Sinkie

Wednesday 16th of June 2021

Whoa what a coincidence.

I just sold both my rental houses in US recently at almost 3X what I bought them for.

But no, I didn't make big bucks. They are humble older houses which I bought for around US$70K each in 2011 and 2012. Thanks to background info from a US investment source, targeting states & cities with growing populations etc.

At that time I could get them for 11+% gross rental yields & with existing tenants. But net yields around 7%-8% after deducting taxes, mgmt fees, maintenance & repairs. It was pretty much a contrarian investment as most people weren't interested at all.

The most recent net yields are much lower (around 4%) as costs have gone up a lot.

My search criteria then was quite strict but still managed to get quite a number of potential hits, until 2016. Then no more houses fit my criteria, until a very short period of 2 months during March-April of 2020 :P

US housing construction is ramping up, but up till March 2021 the available inventory was still only 2 months(!) (Singapore currently has about 20 months supply of condos/ECs at Q1 takeup rate). Lumber prices (a big component of US home construction) is coming down lately, so should help in lowering new home prices.

I've probably sold the properties off too early & prices may still rise a lot. But this is more of a side gig, which was a bit stressful in the initial couple of years, that has come into a price level that I'm happy to let go of.

Sinkie

Saturday 19th of June 2021

Yup, but I could apply a lot of deductibles e.g. property mgmt fees, advertising costs, maintenance & repairs, insurance costs, legal fees, property tax, etc. Total effective income tax was usually around 5%. From 2018 after Trump's tax cuts, I could deduct another 20% off the rental income for taxation purpose.

The property tax & day to day expenses are much higher than income tax lol.

Oh and I had to pay 15% capital gains tax when I sold. US is a tax specialist nirvana. 😬

Kyith

Friday 18th of June 2021

Hi Sinkie thanks for sharing. Could you share if you would need to pay income tax on those properties in the US? I suppose you engage a property company right to maintain right?