For a long time, many newspaper readers would look forward to SPH’s Sunday Times have an Invest Section.

What is nice about the Sunday Times section is that it contains articles that are lighter, not so business-like, higher on the personal finance content.

That is the content that is more relatable as some past journalists will share their personal investing and money management experiences. Through their sharing, we can see that we are not the only people plagued by money management challenges.

Journalist and financial thought leaders faced these common money challenges as well.

For a long while, Lorna Tan was helming the content for that section.

I didn’t really noticed it, but it was only after she left, someone mentioned to me that there is something very common about her content.

It seems….a lot of her content have something to do with what you can do with your money AND the available government schemes.

When the person told me that, things seemed to start adding up.

It made me wonder whether there is an unstated agenda for SPH to help push more people to actively adopt these government money policies such as CPF Top-up, SRS schemes, Sale and Leasebacks etc.

It is no wonder editorial integrity (from both advertisers and government) was a hot topic during SPH’s press conference where they announced that they will be moving its media business to a not-for-profit entity.

The content did change after Lorna left.

It was more on how as an individual you can gain more power over your money. The journalist did her best to make the money problem and solution more relatable to people.

And that means… your money life do not revolve around CPF RA, CPF Life, CPF Top-up, taxes so much.

But after this journalist left, you start seeing the content go back to so much in-your-face discussion about CPF.

I felt most triggered by this recent commentary by the current Invest Editor Tan Ooi Boon:

Ooi Boon made some money opinions about today’s young adults based on a recent Fullerton Fund Management survey.

What shocked me was how he was able to turn what was a really balanced, positive survey into a rather worrying situation about how young adults looked at their money management.

In general, it is worrying because, in his opinion, the survey finds that young adults are less trusting about the CPF.

One of my friends in our financial fraternity made a comment: “If you take time to observe his writings, you will realize that most of the people should be topping-up their CPF or that CPF is the best thing since sliced bread. And if you do not understand this, something is wrong with you!”

Now let me go on the record and say… before my friends made these comments, I do really like some of the angles that Ooi Boon tries to explore. I feel he tries to discuss more common observations and hearsays Singaporeans have about money.

But the more I read, the more I have a feeling that there is generational gap between a boomer’s world view about money and the younger generation’s world view about money.

Let me highlight a few sections and my comments:

Young Adults Opening Trading Accounts At Tender Ages

Ooi Boon cited the experience of a senior executive of a financial institution related to the young daugther:

This experience is not Ooi Boon’s view, but this experience sets the tone of how the young adults are portrayed throughout the article.

I dunno man, but I would have thought if your 19-year-old daughter wishes to create a trading account, it can be both a positive and negative thing.

If you talked to enough parents, some of them wondered whether their children are able to be more financially conscious.

The daughter may be following her friends to open an account, trade and invest but I feel it shows enough open-mindedness to be more intentional about the money aspect of her life.

And that is a good thing.

The most ironic thing was that the same senior executive of a financial institution made the following comment:”For me, it is worrying because during our time, we may talk about our ambitions but we never actually invested any money at that age.”

Well, isn’t it a positive thing she decided to be more intentional at a young age?

Young Adults Making A lot of Money from Cryptocurrencies. So Financial Education Should Be Applied on Them More Intensely.

The senior executive may be more worries about kids talking about making $5,000 on cryptos.

And in the later part of this article, you will see roughly where Ooi Boon sits when it comes to cryptos.

To him, it is worrying that young people are putting their money in high-risk investments.

The solution? More formalized financial education.

Young adults is going to make different money conclusions.

You cannot stop it.

We often not learn the right money lessons based on the outcome.

I can tell you most people will self-regulate. If you been in enough financial chat-groups, interact with enough folks from different age group, you will understand that while the young adults can be adventurous, in due time they would learn that investing, speculation is not as simple as they originally think.

And this is normal.

We start off being wildly idiotic with some of our ideas but like a thermostat, we fail and adjust accordingly, like with a lot of other things.

In our time, it wasn’t cryptos. During my time, my seniors in the army told me the tales of how they lost money investing in technology stocks or unit trust.

Is the solution financial education for that? I am not sure.

Apparently, hedge funds or those folks who should know what they are doing, whom people entrust their money to, also invest in those stocks that fell dramatically!

So does education help?

You tell kids porn is bad. Kids get curious and actively seek out what the deal is about porn.

The scary thing is… to your horror… your kid would dive even deeper into it.

A lot of folks doubled down more because they have the time to research and understand these things better than their parents.

The deeper they dive down this rabbit hole, the more they might be convinced traditional finance is broken and they should stay away from it.

Finally, financial education is really limited.

There are enough who took business, accountancy during their graduate days. That provides a fundamental understanding of stocks, bonds, risk, returns.

Even during my time, I have peers who went through personal finance modules in their poly days (that is probably timestamped around 1998).

And still there are enough people who made poor financial decisions.

Heck, even financial bloggers like ourselves made daring and stupid decisions from time to time!

If you provide education too early, when there is little practical needs, it ends up like a good to know info.

Some of the best lessons learned partly from traditional, standard financial content but by doing & executing.

Their own poor or good executions will teach them things are not so simple.

If you got money to lose, better lose it when the money you have is a smaller portion of your lifetime net wealth. And that is usually when you are younger.

We NEED to Learn and Invest on Our Own and be less reliant on Government Guarantees

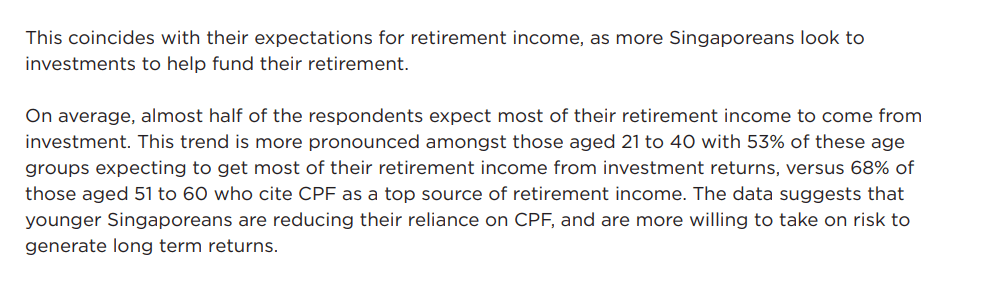

The main bulk of Ooi Boon’s gripe is that the data shows young adults are less reliant on CPF:

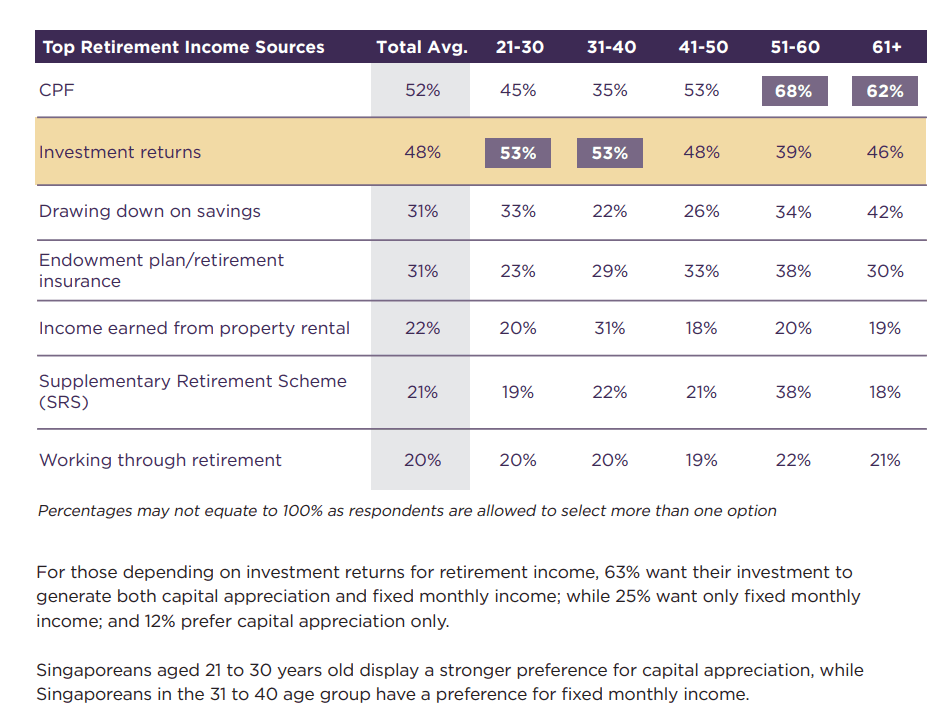

I am going to pick out the portion of the survey that talked about retirement and CPF:

I dunno what is your interpretation, but I find the survey quite uplifting.

For a long while, we wonder if Singaporeans can weed themselves from property and fixed deposits.

One of the big problems was the absence of fundamentally sound investment solutions.

Nowadays, young adults have a bunch of solutions that I considered fundamentally sound enough. Or the solutions lean closer to that.

So it is uplifting that young adults are finally breaking free of that cash or property stranglehold.

Yet, there is such an emphasis on how young adults not seeing CPF as a good source of retirement.

The way I intepret that survey is the survey is asking where their retirement income source is coming from.

The young adults feel more empowered to rank investment returns more than other sources.

That’s it.

If you asked me 45% is still a pretty good number.

You know what is worrying?

Take a look at those 31 to 40 year old cohort. These folks… should be more sensible than the 21 to 30 year old cohort right?

So why do they think less of their retirement income source will come from CPF?

Perhaps… They realize that their income needs are so great that CPF is not enough.

Or it could be… even with age maturity… they are still wildly ignorant about the benefits of CPF. If this is the case, should we worry about the young adults or we should worry about everyone?

I work in a firm where we serve the accumulators who came in when they are around 35 to 45 years old. They are definitely in the upper quartile or 25% of Singaporeans. Most likely the 1-5% in income and net wealth for that age group.

Most of them know that CPF is an integral part of their retirement income. But they also know that they cannot put all their money into CPF.

So their income sources would have to come from other places.

As a quite rule of thumb, imagine you are retiring today. How much income do you need?

$2000 a month? or $4000 a month?

My experience is that most people have a poor estimation of their retirement lifestyle. So they based it on their current lifestyle.

And as a young adult, their spending will be $3000 to $7000 in today’s money. If you look at two person’s CPF today, it will come to half that. The rest will have to come from somewhere.

This is just natural.

I have this philosophy.

It is better a person learns about volatility and returns and make it integral part of their life.

Avoiding volatility is not the way.

Stocks, cryptos, scams, bonds, property, REITs can be volatile. But returns and volatility is the natural part of finance.

What is freaking abnormal is trying to make people take less risk by putting their wealth in a locked-up system where the returns are guaranteed 2.5% and 4.0% , in a world where yield to maturity is around 1% for intermediate duration bonds and the expected future rate of return of balanced portfolio is closer to 4.0%.

There are enough people asking whether it is sustainable to keep paying 4% or not. I won’t go into that argument today.

But that is a valid question to ask if you are recommending young adults to lock in their money indefintely with so little flexibility of getting out isn’t it?

Young Adults Should Know they have CPF as an Income Source. They are choosing their own Retirement Definition

Ooi Boon made this startling comment:

How can you make this kind of inference?

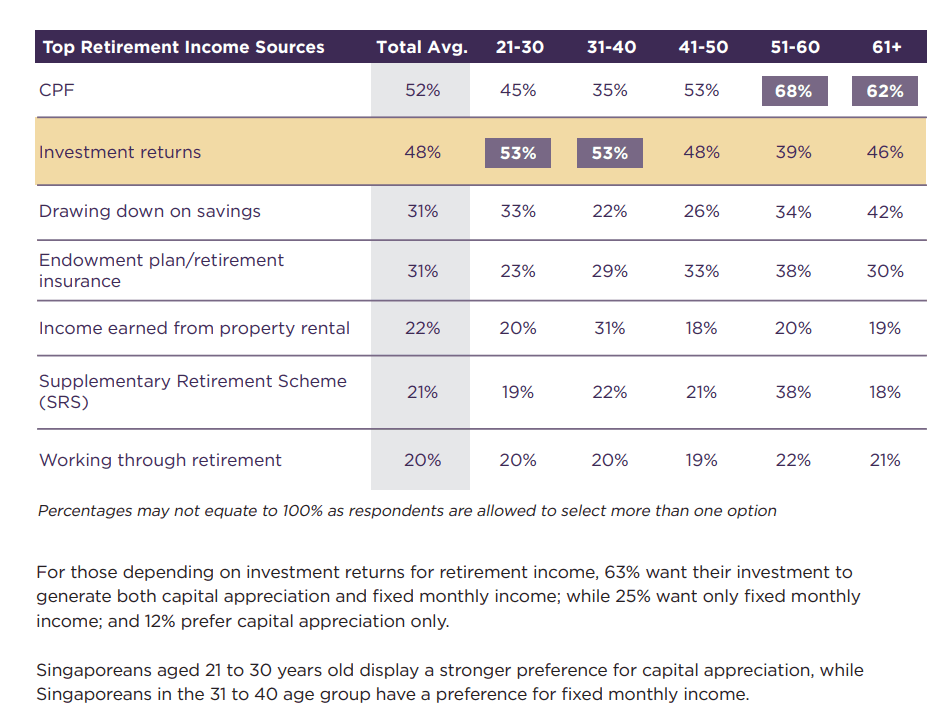

Let me show you that table again:

Observed that almost ALL the cohorts stated one of their income sources is to work through retirement. All of them showed around 20%.

So does that mean almost all probably don’t know about CPF Life? Cannot be right (on this note, my colleague, Chin Yu, client adviser at Providend will feel very irritated that he spelt Life with lower case. LIFE is suppose to be short for something but I would be more forgiving about that as I made the same mistake countless of time.)

The theme of the Fullerton survey is partly how Singaporeans are rethinking retirement.

In this part of the report we can understand the respondent’s thinking better:

Perhaps, working is seen as an integral aspect of people’s lives. There are less people perceiving retirement as a stage where work stops permanently.

And this could influence their response.

Summary

I do think you should take a look at the Rethinking Retirement – How digital technologies and COVID-19 are reshaping the way Singaporeans approach retirement.

Maybe I have the opposite view to Ooi Boon but I felt the report was more empowering and uplifting.

Certainly, the report is less centered upon CPF.

And that is how things are supposed to be. (Admittedly, Fullerton Fund Management as a fund house has a bias to accentuate investment returns.)

There were points where the young people read Lorna’s content in the past and complain: “Why the heck is it always the same spew?”

A famous financial writer (that I cannot remember) once said that his job is to say the same thing over and over again, but in different ways.

In the same way, as wealth advisers a lot of what we do is something similar.

The wealth axioms or truisms do not change much over time. Earn well, optimize your expenses and build wealth wisely. (You can read a whole slew of them in my Wealth Foundations series here)

But man, I think to help the man on the streets on money management, there has to be more than the governmental policies.

The more I hear about these things, the more I felt that the media is less independent and the government is trying to exert influence through the paper.

You cannot fault people from asking you about editorial independence.

I dunno if you remember how you were like when you are a young adult. I would probably be classified as one who graduated not too long ago.

I thought that I know the world until I was humbled by a lot of life and investing experience. But who do I pay attention to?

People who share their stories. People who preached less. People who gave me tactics that seemed closer to what solved my problems in life, work and investing.

The more you say the young adults are clueless, the less receptive they are to what you recommend and would petulantly do the opposite.

This is my fear for some of our clients as well.

Some of them shared with us their concern whether their children would be good stewards of the wealth that would eventually passed down. I dunno what is the conversation they have with them but I certainly hope it is not like telling them “You have to do this. This is the only way.”

Finally, cash flow can be rather precious to young adults.

If we are worry about the freelancers where it is not mandatory for them to contribute to CPF OA and SA, perhaps Invest should shift the conversation to more applicable tactics for them to manage their money better.

There are responsible freelancers out there looking for guidance.

And Sunday Times still has a pretty good reach.

This article should come out on a Saturday. Let us see if the Sunday Times Invest this week involves CPF or some governmental policies again.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

- We Invest into Popular Funds When They Are Popular, Exactly When They Started Turning to Shxt. - April 22, 2024

- Meal Prep 2.0 – Cooking Your “Go-to” Meal that You Look Forward to Eating Everyday. - April 21, 2024

J

Sunday 13th of June 2021

i used to buy sunday times to read the invest portion. until it became boring reading the same cpf schill

Sinkie

Saturday 12th of June 2021

Well, SPH does have an unspoken mission to be constructively nation-building. Their senior mgmt are all vetted & approved by govt beforehand, just like the chiefs of stat boards & govt agencies & GLCs.

Back in the 1990s & earlier, their editors & mgmt used to have weekly face-to-face meetings with MITA on what to emphasise & what red lines not to cross. Occasionally, the minister sits in when there's particularly important message to press upon the people. Dunno if they still do this, but the basic ethos should still be present.

Regarding having compulsory financial literacy in school --- 2 groups will emerge - one will immediately forget everything once submitting their final exam/test paper; the other will go straight into crypto defi farming/staking to beat the financial repression that the S'pore govt has allowed for the country for almost 20 years now.

This financial repression is one of the key reasons, if not THE key reason, for many financial scams (and not-quite-scams) in the last 20 years, including land banking, timeshare, MLM, oilpods, gold schemes, "better-than-the-bank" endowments, property decoupling, sell-1-hdb-get-2-condo, minibonds, high notes & other "AAA" and "AA" financial products. They target people looking for 5% yields, not necessarily to strike million dollar toto.

Regarding 31-40 group having lower expectation of CPF --- likely becoz this group has recently bought their first home & depleted their CPF-OA for it. And for the next 25 years having monthly mortgages that is higher than their CPF-OA contributions.

Regarding the older folks having higher expectations for CPF --- likely becoz they realise they don't have enough liquid cash savings or investments. Their largest assets are basically the home they're staying in, plus the money inside their CPF.

Sometimes Occam's Razor is the best starting point to analyse.

Kyith

Saturday 12th of June 2021

Hi Sinkie, i agree with most of your inference. Those are my thoughts too. I am not sure about the earlier history but based on various accounts of those who left SPH, that is not too far off.

Thinknotleft

Saturday 12th of June 2021

If Lorna's content are mainly on Govt schemes and finance, I feel that it is a good thing. Most people may not be aware of the benefits like tax deduction of SRS, CPF top-ups in mid-2010s. I recalled learning about CPF RA shielding after reading her article. Before her acticle, I had no clue on CPF shielding. Her articles can be useful, if you do not really know the schemes, as it gives you more knowledge and options in personal finance. If you know the scheme, then her article belongs to 'skip' category.

On survey results on top retirement income sources, one can interpret the results in different ways and each way can be somewhat logical: 1) Around 45% of 21-30 yrs old cohort feel that CPF is top retirement income sources, which is lower than the cohorts aged 41 yrs old and above. This may be because 21-30 yrs old feel more uncertainty of their future income or the eventual CPF balances, as their starting salary is not high, they may use CPF to buy house in future etc.

2) Lower % of 31-40 yrs old cohort feel that CPF is top retirement income sources. This may be because they have low CPF balances after using CPF to pay off housing loans or buy house.

3) Higher % of 31-40 yrs old cohort feel that property rental income is top retirement income sources. Again, this could be because they just bought a home and feel that they can rent out a room for income.

4) Higher % of older cohorts feel that CPF is top retirement income sources. This may be because they had/will contribute large sum to CPF LIFE. It may be also that they feel that CPF Life income may be more certain and less volatile compared to investment income (after going thro a few recessions)

5) Higher % of 51-60 yrs old cohorts feel that SRS is top retirement income source. SRS started in 2001. Those 51-60 yrs old will be around 31-40 yrs old at that time. At 31-40 yrs old, one will have higher income and thus higher income tax. It is also at the age where you are not too conservative to try out new stuff. So 31-40 yrs old cohort found SRS more enticing when it was rolled out and started SRS early and accumulated more in SRS, compared to other cohorts.

Kyith

Saturday 12th of June 2021

Hi Thinknotleft, thanks for the analysis. I think Lorna only open the bag of SA Shielding in her last post before she left. That is sort of a national service.

A

Saturday 12th of June 2021

Hi Kyith Thank you another nice write up. A few points to add on: - Lifelong Income For The Elderly (CPF LIFE) - CPF has been changing / morphing over the years. By the time todays young adults reach their 50s/ 60s, CPF will be a very different animal then what it is now. Just as it was in our parents time and for us. - The gig economy is replacing many traditional jobs. Which means the proportion of self employed is growing . CPF contributions is different for this group.

Keeping writing. Cheers A

Kyith

Saturday 12th of June 2021

Hi A,

Thanks for pointing those out. I guess the only constant is change. Change in itself, is a volatility that we got to learn to adapt and make the best of.

retirewithfi

Saturday 12th of June 2021

Yes to BlackCat's comment. Young adults get their finance news/education from TikTok, Youtube, Twitter, Reddit or whatever platforms their generation prefer and this platform flavor changes all the time. The readership of Straits Times has been falling for a while now.