If you have a sum of money in your CPF Ordinary Account (OA), is it better to pay a greater down-payment or to take a larger loan and delay repaying your CPF Ordinary Account?

A reader of mine asked me this question and my answer to him is that based on my past research (you can read Should we repay more of our 2.6% HDB loan to save 0.1%?) it should be better to drag out the loan.

I think the general idea is that if you have more lump-sum in your CPF OA as early as possible, it allows your CPF OA to compound over time. But there are a lot of things I cannot explain why this is the case.

The question today is more clear cut because instead of choosing to consistently repay $XXX a month more towards your mortgage, we are deciding whether or not to contribute more money to downpayment or not to.

I can tell you the answer is that it is mathematically better to take a larger mortgage loan versus making a greater downpayment.

Now, let us look at why this is so.

The Opportunity Costs of Using or Not Using More of Your CPF OA to Pay for Your Home.

This the problem brought in front of me:

- You can take a $400,000 home loan at 1.3% a year in interest rate, and have $200,000 in your CPF OA earning 2.5% a year currently

- You can reduce your home loan to $200,000 but you would have zero in your CPF OA

The pivot amount would be the $200,000 that you have in your CPF OA. In the past, CPF would force you to use all your OA to downpay for the home. What I understand is that this is no longer the case.

The way for you to think about is: What is the max loan that you could take?

Then, how much is in my CPF OA and how much do I want to keep in my OA.

If you choose to take a larger mortgage:

- You would pay more interest over 25/30 years. In theory, the interest that you pay is not fixed. At the start of your loan, you will pay more interest (due to the size of your loan). As your loan becomes smaller the interest is reduced.

- You would have money in your CPF OA to compound at 2.5% a year.

If you look at this math, intuitive this is a no-contest. We should do this since you would earn in excess of 1.2% if we take 2.5% minus 1.3%.

If you make a larger downpayment:

- You pay less interest over 25/30 years

- You will missed out on the 2.5% a year compounding in your CPF OA

So there is a 2.5% a year opportunity cost and your “return” is saving money on the 1.3% a year interest payment.

Net-net you will lose out on 1.2%.

We should always choose taking a large mortgage loan in this case. However, what if interest rate is closer to 2.5%?

What if you are taking a 2.6% a year mortgage loan? Let us see whether we can explore this.

Before we move on, do take note that the decision point is on the amount in your CPF OA that you need to make decision on, not the entire home loan.

Comparing the “Returns” Profile Between the Two Mortgage Financial Decisions

What we can do is to compare the internal rate of return for the two decisions.

Whoever has the higher internal rate of return is mathematically the better decision.

The internal rate of return (XIRR) needs to be computed between two streams of cash flow.

The XIRR, in very layman speak, is the “compounded interest rate per year” that you can earn based on this decision that you take. If we have an XIRR of 2%, you can interpret that this irregular stream of cash inflows and outflows will generate 2% a year compounded.

With this XIRR you can compare to other investments. For example, compare this to putting your money in an endowment plan earning an XIRR of 2.5%.

In this case we can compare the XIRR between both our decisions.

The first stream of cash flow is to not pay more downpayment but to take a larger mortgage. The cash flow would look like this:

- Year 1: Putting $200,000 in CPF OA – Outflow

- Year 2: Interest expense – Outflow

- Year 3: Interest expense – Outflow

- Last Year:

- Get back your $200k principal from CPF OA – Inflow

- Interest expense – Outflow

- Accumulated interest earned from CPF OA over the years from the $200k in OA – Inflow

The second stream of cash flow is to contirbute more to downpayment and have less in your CPF OA:

- Year 1: Paying away $200,000 more to downpayment – Outflow

- Year 2: Interest expense that you saved by down-paying more – Inflow

- Year 3: Interest expense that you saved by down-paying more – Inflow

- Last Year:

- Accumulating $200k in home equity after completely paying off the home – Inflow

- Interest expense that you saved by down-paying more – Inflow

- The opportunity cost of the accumulated interest we could earn from CPF OA over the years from the $200k in OA – Outflow

I decided to plot these two internal rates of return (XIRR) on a chart. The idea is to see how the returns change as time passes.

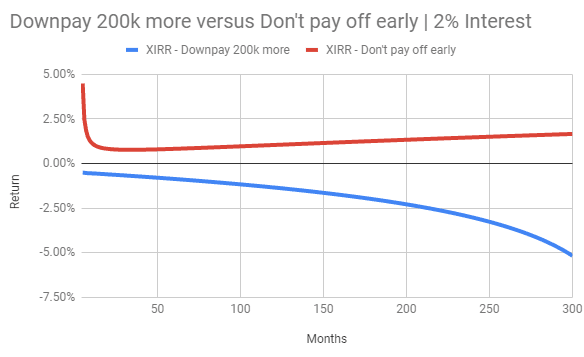

The return graph shows that the return profile of not paying off early is positive while making a greater downpayment is negative.

This more or less is inline with our guess.

Note: to be fair if you down pay more, at each point on the chart, you cannot get back the $200,000 principal (which I am assuming). The reality is that you would build up the equity of your home over time and only in the 300th month do you get $200,000. But let us assume here that even after 1 month, you could get back all your $200,000 equity.

The XIRR at the 300th month if you delay paying a greater down payment is 1.97%. It first dropped from 3.78% to 2.4% to 1.4% in the end of second year before going up.

This has more to do with the irregular nature of the interest payment (larger at the start and smaller at the end)

The XIRR at the 300th month if you use the $200,000 to downpay more is -6.3%. This is pretty crazy. I think the losses were that much because the opportunity was that great.

To give you an idea, after 25 years, the compound interest earned on that $200,000 was $173,000. The total interest expense paid was $35,000.

The conclusion at this point, just don’t increase the downpayment.

Would it be More Sensible to Increase Housing Loan Down Payment if Interest Rate is Higher?

This is a good question to ask.

The most obvious one will be to see if the decision changes if the interst rate is not 1.30% but higher.

Let us take a look.

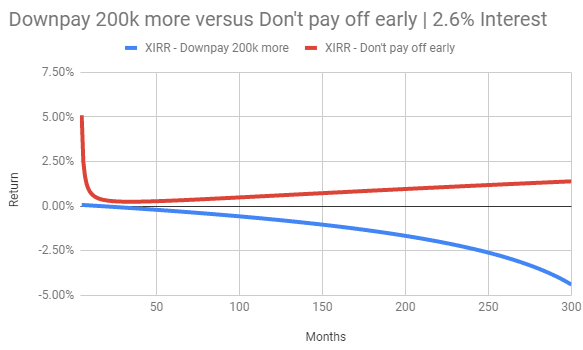

- Don’t down pay more XIRR: 1.67%

- Down pay more XIRR: -5.42

The results start to narrow.

When you take HDB Loan and incur an Interest Rate of 2.6%

Intuitively, at 2.6% interest, the expense is greater than the CPF OA interest of 2.5% a year.

This may tilt the scale in favor of putting more into down payment.

- Don’t down pay more XIRR: 1.41%

- Down pay more XIRR: -4.63

Looks like it is still worth it after 25 years (300 months)!

But notice that at the start in the first six to twelve months, the XIRR return got very closed.

But even at this point, the total interest expense you will pay is $71,000 versus $173,000 in interest earned from the $200,000 in CPF OA.

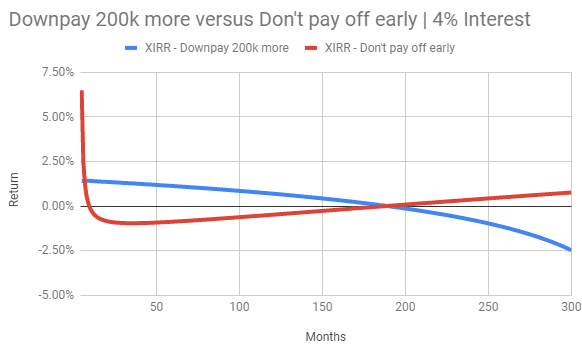

Interest Rate of 4% – In Some Situation, it May Make sense to Contribute More Down Payment instead of Dragging Out the Loan

- Don’t down pay more XIRR: 0.79%

- Down pay more XIRR: -2.66

Ok! Now we are starting to see the blue line overlapping the red line. This indicates that in a certain duration, it may make more sense to minimize the loans you take.

The cross over point is about 15 years or 180 months. However, if your loan is 25 years, it would still make sense to not put omre to downpay your home.

- Total interest income: $173,000

- Total interest expense: $114,000

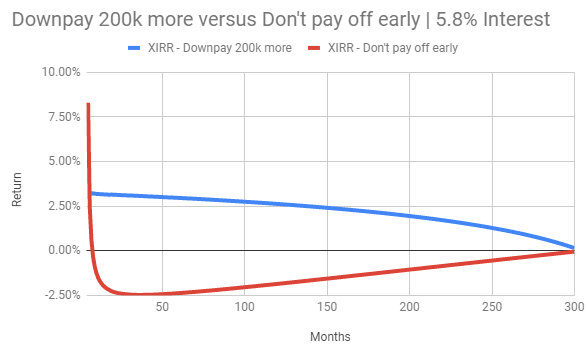

The Interest Rate Which would make more downpayment more worth it: 5.8% a year

If you really want to know at what mortgage interest it will take to make the more downpayment option more attractive, you need to take it to a whopping 5.8%.

- Don’t down pay more XIRR: -0.01%

- Down pay more XIRR: 0.02

- Total interest income: $173,000

- Total interest expense: $173,893

Right at the start, the XIRR for the decision not to downpay more starts working against you.

However, the money in your CPF OA gradually earns more such that you reached the break even point.

What is the Logic Behind This?

I think what worked for not committing more CPF OA to downpayment is similar to why mathematically, you should do lump sum investing than dollar cost averging.

When your returns and interest expense are both certain and you do not expect any volatility, by having more money at the start allows greater compounding effect than if you invest a little by little overtime.

When you choose to contribute more to downpayment, the interest you saved is on the amount of loan left.

As time passes, the amount of loan goes down, so the interest expense saved goes down.

In contrast, your CPF OA earns interest, and as time passes, the interest earns more interest. The power of compounding is very strong.

What May I Have Omitted from my Analysis?

Whenever the math is so befuddling crazy, I start wondering if my model is incorrect.

In this case, I do have a hunch my math is wrong.

If you commit to more downpayment for your home, you also have $200,000 more equity in your home at the start.

This means that if your home value goes up, and you sell off the property, you earn more.

That earns should be factored into my XIRR but I did not.

However, that is an area that is very subjective. How much should I put as the growth rate of the property?

Do I need to do a sensitivity analysis on different property growth rate?

I think if we factor in that equity property growth, I got a sneaky feeling the point where one decision tilt over would be earlier.

This will depend on the growth rate we expect for that property.

What if we are Evaluating Cash instead of CPF OA?

You can just replace the 2.5% return with the growth rate of cash, which is rather low. But if you are an investor, you may be able to earn more than 2.5%.

Your mileage (long term return) will differ based on your sequence of equity return.

Conclusion

The first time I did that analysis of whether it is better to put in more of my income to pay off loans earlier, I got a headache thinking about it.

This time it is more simpler but I think the issue is the same. There are some opportunity costs that is pretty hard to measure.

Some readers might prefer to have a peace of mind when you pay off your loans earlier.

However, I think that you do not have to pay off the loan. As long as you have enough liquidity to last for 3 years of mortgage payments, it may be more than adequate for you to ride out a tough situation.

In the worse scenario, just take the amount that originally was meant to down pay more and pay off a large chunk of it.

Right now, this plan makes more sense because the CPF OA earns 2.5% which is almost 50% more than the interest you can get from bank loan.

The CPF OA is interesting unlike cash in that, you cannot do much with it other than accumulate for retirement, put in investment or pay off your mortgage. With rates low and if you have return options, the decision may be more clear.

If you have another perspective to this problem, do let me know in the comments.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

isaac

Saturday 26th of September 2020

Very good article, Kyith.

This is something I am thinking of lately and yes, when you think about all the figures and factors to consider, it is quite a big headache! I was wondering if you put the HDB appreciation rate as say 2%, how would the math change? If you have time, maybe you can plug in that figure and update us?

And also, you made a very good point, regarding cash vs CPF-OA. I totally agree, if the above example involves the person forking out any cash, whether is it in downpayment or extra $ in monthly mortgage installments, then the math may change dramatically.

Even using a low risk investing method such as the "all weather portfolio" or permanent portfolio, anyone should be able to get 6-8% CAGR with low risk. And for savvy investors, 10-20% CAGR is definitely possible.

isaac

Saturday 26th of September 2020

Actually, if the "assumed" hdb appreciation rate is the same as the CPF interest of 2.5%, then maybe it makes more sense to downpay more and reduce interest expense?

Of course, we will never know for sure what is the hdb appreciation rate whereas the 2.5% CPF interest is definitely confirmed + chop. Even if history is any guide, it would be foolish to think that the future hdb appreciation rate will be like the past. Haha, inconclusive i guess!

Shaun Tan

Sunday 20th of September 2020

Great article! I always find it difficult to figure out stuff related to CPF and this really helps. Hope I've understood correctly, from the first few examples, given CPF OA ir is relatively high compared to current mortgage ir, the returns from leaving CPF OA funds where they are is better than applying it to mortgage.

Personally I've chosen to keep CPF OA very low and I depleted it for property initially and now am using all of it for monthly payment. Reason is qualitative. OA can't be used outside of some very few instances and I want to maximise the amount of cash I have on hand because I value the flexibility cash has. It's both a buffer during bad times (like now!) and can be used for equity investments. To me, these reasons esp the flexibility, outweigh the 2.5%.

Tony

Sunday 20th of September 2020

Thank you, Kyith!

Time to put up the link to your telelgram group!!

Kyith

Sunday 20th of September 2020

Which telegram group?

Sinkie

Saturday 19th of September 2020

For HDB loan you can keep $20K in OA.

For bank loan you can keep all of your OA ... of course provided your salary high enough to qualify for the mortgage ... or you those rich fellers that can use another property as collateral etc.

With the historical low interest rates & the current wide differential between CPF & mortgage rates, it's a no-brainer to get the biggest *safe* loan & longest tenure as possible. No need to calculate.

We've seen this movie before ... back in 2002/2003. Until 2006/2007 when banks revised their rates back to 6% ... then people all KPKB. "Luckily" 2008 GFC came to save the day & return us back to zero rates! Covid is giving us the "double confirm".

Kyith

Saturday 19th of September 2020

The interest rate back then should be much higher. Did it get down to less or near 1% back then?

jim lu

Saturday 19th of September 2020

i skimmed read the analysis but may not be complete. You need to look at impact on an indivoduals total wealth.

1. I did not see any mention of property capital gains ( this becomes tricky as you need to include the leverage effect and allow for different property inflation scenarios).

A Highly leveraged property purchase can lead to higher returns via capital gains.

B. From a total wealth point of view more cpf conts means more left to.save as you wish. in my situation I max CPF conts to service the loan. this way i can unlock my cpf savings from a long term rate of 2.5% as i can use spare savings to invest in long term diversified global ETFs which in the long term earn more than the cpf rate.