There is this befuddling lifestyle creep math that didn’t hit me until I saw the math.

It is one of those things that if I pose this to you as a question, you would probably know the answer. But I would not have bet that everyone knows the magnitude of the impact.

Nick Magguilli at Of Dollars and Data helped another guy deconstruct the effect of lifestyle creep on your retirement timeline.

We have always been warned that we should be more aware of how we spend our money and not succumb to lifestyle creep if we wish to achieve our financial goals.

To put it simply, if you get a $1,000 salary increase, you have more financial bandwidth. I could choose to alleviate the stress in my life by hiring a maid instead of doing some stuff myself.

That is a kind of lifestyle creep. Necessary for some people but it is also an indicator that your quality of life is going up.

The First FI Math Trap: Assuming The Nature of Our Expenses Do Not Change Throughout Life

For a lot of us thinking about the amount that we need for financial independence or retirement, we would calculate how much of our expenses we are currently spending.

With that amount, say $50,000 a year, you can then work out how much you need to accumulate to so that you can retire in the future.

The issue for many of us is that like it or not, our expenses drift upwards.

So your $50,000 a year expense may become $70,000 a year when you are closer to that retirement goal.

But because you now need $70,000 a year, the sum you need now will need to be larger than the original sum.

What is the solution to this?

Not really a solution but this means that you would have to consistently evaluate how much you spend and what is the corresponding retirement sum.

You may have to routinely update the expense requirement and the amount you need for retirement.

A better way would be to envision your retirement lifestyle and then go through each expense line item to figure out how much you need to spend.

That would be more accurate but we also do not know our future self that well until much later in life (Read the end of history illusion and your retirement). So all this points to the need to routinely re-evaluate how much we need.

The Second FI Math Trap: If you Save More, Lifestyle Creep Will Still be a Drag on Your Financial Independence Schedule

In both their work, the most befuddling thing was that if you save more, you got to be more careful about lifestyle creep, if you wish to retire at the same timeline.

Suppose your expenses are $50,000 a year and based on the 4% withdrawal rate, you would need to accumulate $1,250,000. Let us assume that your current savings rate (out of your net income from work how much you have after spending your money) is 50% of your salary. That will make you a $100,000 a year earner.

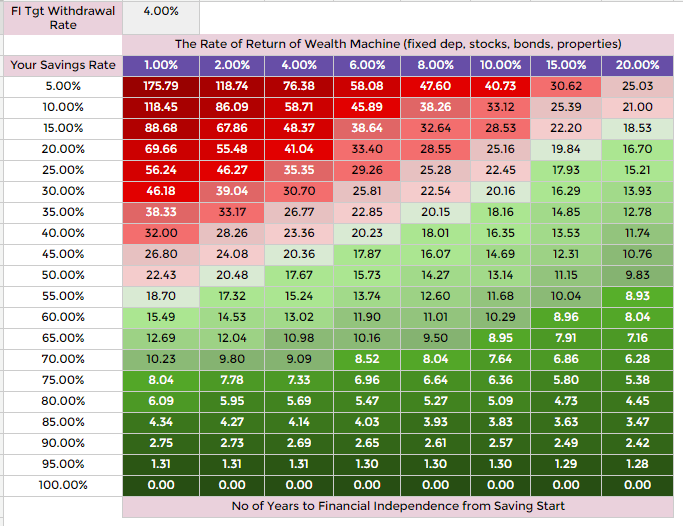

Based on my FI table above, at 50% savings rate, you would probably need around 15 to 17 years.

We all get increments at work and another decision point is how much we choose to spend that.

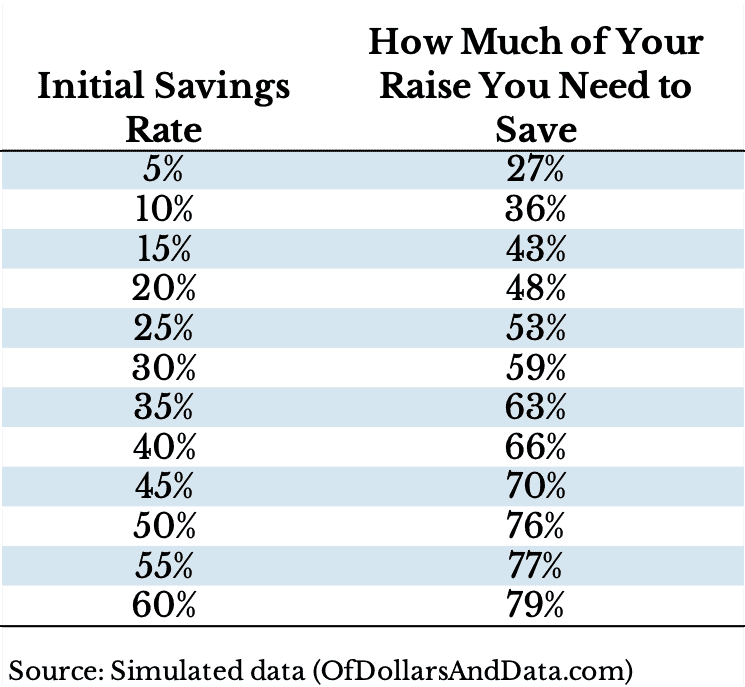

Nick and Nat’s numbers show that if you continue to save only 50% of your salary (it is weird to say a 50% savings rate is only), you would push back your point of retirement by a lot more.

If I were to summarize the math:

- Your expenses go up, and so you would need a larger amount of wealth (this is the first FI Math trap)

- Our ultimate goal is to ensure that we retire around the same time

- If you start off young, a large part of your salary will be earned in the future, and that means your spending rate is going up as well

- But because our original FI timeline is much shorter than traditional retirement…

- Our current savings rate cannot allow us to save a much larger amount for this expanded expense in the same duration

Nick and NAT reach a rule of thumb that if you save 75% of your increment, you can still keep close to your original timeline.

This means that if you get a $1,000 a month increment, put $750 away into investments and spend the other $250.

It Does Not Mean Those With Lower Savings Rate are Let Off the Hook

What about those with lower savings rate? Does that mean they are better off?

In Nick’s article, the guy with the 10% savings rate can save at the same savings rate and the impact to his retirement is “minimal”.

It is minimal because in terms of data science, if you push your retirement from 49 years later to 59 years later, that is just 20% more.

However, I do not think a lot of you would like either 49 years or 59 years.

Unless you find a job or industry that you see yourself in for the rest of your life, aim to pursue Slow-FI, this would not be an ideal outcome.

Conclusion

I always thought that there are two approaches to saving:

- You start off with a high base savings, be more frugal, then you spend your expenses

- You start off with a low base savings, but make sure that your expenses do not expand at an alarming rate

Both are OK.

The important thing is to be intentional about how you deploy your monthly cash inflow. Don’t be a financial zombie.

What is very myopic for me was the magnitude of lifestyle creeps on your future financial goal. We tend to be quite fixated on a magic number we derive some years ago.

We can take this moment to re-compute what would be a revised amount of wealth needed.

If the last time you did it was with your financial planner, then maybe it is time to make an appointment.

However, if you are apprehensive that you would be upsold something from your current adviser because you felt that you trust him or her less, then it is time to do it yourself or find another adviser that is more conflict-free.

Lastly, what was presented in the two articles are very rigid math.

In reality, most of you would not spend and save in a straight-line. But now that you realize that if your best earning years are in the future, you got to keep your spending in check with your values and not keep mindlessly expanding it.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- New 6-Month Singapore T-Bill Yield in Late-April 2024 to Drop to 3.70% (for the Singaporean Savers) - April 18, 2024

- Golden Nuggets from JPMorgan Guide to Retirement 2024. - April 16, 2024

- Be Less Reliant on Banks and Build Stronger Capital Markets by Pushing for Better Shareholder Dividend and Buyback Yield - April 14, 2024

lim

Saturday 26th of September 2020

For those with children, expenses will probably drop after children start working and the savings can cancel out any 'lifestyle inflation'. Similarly, some lifestyle inflation may well be job-related - eg: nice office clothes and shoes etc.

On the flip side, you could also say that an investor can always elect to retire earlier than planned as long as he/she is willing to accept a lower standard of living. (eg: downgrade from condo to HDB /big HDB to small HDB if children are working or no children, and your article's example of hiring a maid - if you retire early and still healthy, you may not need to continue with domestic help).

Kyith

Monday 28th of September 2020

Hi Lim, thanks for the perspective. Can you pinpoint at what age would the expenses drop off? I feel there should be a zone somewhere when your children are older, still burning a hole, but you have more time. Ir are you referring to the part where your children are after 25 years old.

The second one is the early financial independence idea. That is less prevalent because not many people can reduce their standard of living. At the end of the day, it is the mastery of your needs and wants, and the expenses that will give you the most mileage.

retirewithfi

Friday 25th of September 2020

Alternative view with the math proof. https://retireinprogress.com/lifestyle-inflation-and-early-retirement-nat-is-wrong/

Kyith

Saturday 26th of September 2020

Hi retirewithfi, will look into the math. Looks complicated.