My washing machine is making a lot of loud noises recently. Looks like the dependable trusty machine could not last long.

I intended to try to see if I can fix it. But I do also intend to buy another one. Washing machine is not something that I am an expert in. I did not keep up with the technology of washing machine. In all honesty, the impact of selecting a wrong one can be a considerable inconvenience.

I spend some time researching the latest technology. And then look at what is offered out there. There are too many choices. When are too many choices… my brain short circuits and not sure which to choose.

This is when if a product gets more reviews somewhere, I could read the reviews and evaluate better. What I watch out for are the really useful ones that explain certain nuances that we will not notice within the first few days.

There are some glitches that we will only see after some weeks of usage. This is where you see the problem with reviews. They try to solicit the users to review and most of the users’ review only after the initial use.

The truly useful reviews are the ones:

- deliver by someone in the know of the subject area

- have extensive experience using the product for a period of time where you could safely judge

The search is still on. If you have a recent washing machine purchase that is a top loader (I know… research shows front load is more efficient but my dad wants a top loader) do let me know!

Reviews can be quite a Monster

Reviews are a marketing tool whether you like it or not.

Tripadvisor’s review of accommodation and tourist attraction have changed the game. These service providers have sought to improve their offering to ensure reviews are good. These are some areas they might not focus on in the past.

This is because most people see a lot of reviews, as long as overall it is favorable, they will go for it.

When you do not know much, you go with the safe, crowdsource.

But what if a product cannot be evaluated within a certain time frame?

There is this popular site that wishes to do good and help those who are less sophisticated with money stuff to be able to select the right things.

I feel that for some things, such as washing machines, reviews can be really good.

But for some things like investments, it can be a big problem.

You cannot evaluate the performance of funds based only on recent history. In some of Dimensional’s research, the time frame that you need to show whether an active fund has a statistical edge to outperform is more than 20 years.

There will be managers that execute some complex strategies that in a particular year, they do really great.

So if they

- manage to market heavily

- then the next year the fund performance was really good

- the reviews will flow in as highly favorable

- the less sophisticated, seeing there are many review (whether it is good or bad), with the first few as generally good, they will choose this

What you get is a snowball effect.

What I mention has got less to do with technology. In our asset-gathering world, this is true as well.

If we have a period where the market is going up, our Providend clients have a good experience, they feel good. They go and tell their friends how good we are, and it makes it easier for business.

But what if the Year was Bad after the Launch?

Then it will be rather difficult to sell the narrative.

Clients will pull out their money and perhaps tell their friends about the so-so returns (they don’t want to say that it is very poor since ultimately, they were the ones who made the decision to go with X company)

In a review site, it might be different. The number of reviews is still there. Fewer people are leaving reviews. So the average maybe still high.

If we have 3 underperforming years, an active manager may not be poor. They could be just unlucky.

The timing between launching, marketing and performance just happened to be bad.

Thus, asset gathering depends a lot on luck as well.

Going by that research, I wonder if 10 years of good record is a good judge.

The Less Sophisticated Leading More Less sophisticated

You got to know “enough” to be able to tell whether a certain investing platform or product is “good”.

If you do not know enough, a lot of the focus is on frivolous things that impact what you are looking for less.

I was at an Endowus event and a participant was asking Samuel (CIO of Endowus) whether the mobile application is on the cards. I have people giving me feedback that MoneyOwl’s interface is “concerning”.

And I was thinking… these folks should see what I have to live with at Standard Chartered Online banking.

In this realm, it will be long term risk-adjusted returns that suit your risk profile.

In our course of work, we came across some funds that double their client’s money fast. The volatility is crazy. There are also well-performing funds which are low volatility.

You know what… their interface sucks. They practically have no interface.

For one of the well-performing funds, they did close to -30% last year. This year they are up big time.

If you cannot judge this within 1 year, then is the review helping folks make meaningful decisions?

If the crowd does not focus on this, then isn’t the crowd leading people to make the wrong conclusions?

Investing is something finance bloggers like myself spend so much time educating and we know the difficulty in understanding this stuff.

I have to influence more than 3 people to stick the top reviewed Roboadviser after they had less than 1 year of experience.

I do not know whether they will deliver the track record, but man… some of these things… it is not a one year review!

Conclusions… of some sort

I am not sure whether those who know more leave reviews. I find it difficult to do so because you are sticking your guns out and saying this investment is good.

There is this industry speak that what the manager put out in the factsheet… might not be what the manager do ON your actual unit trusts. What is inside is usually a black box to you. For passive unit trusts you can at least see if they are tracking the indexes.

The active funds… you need a level of trust in the manager, unfortunately. I met up with a long lost friend not too long ago.

He told me he puts his money with a certain unit trust fund manager that does things actively (this fund is available to us most likely). The reason is that he knows the people behind, their processes, and they trusted them.

And this is how things are most of the time.

My friend certainly knows what he is doing since he has been trading for years. Now he prefers to let managers manage his money. Active funds.

At the end of the day, the interface may not be the most important, but it has to be serviceable. When you want to see something about your investments, you should be able to review them.

Reviews or not, a lot of people burn in their investments. This is not the only monster out there. That is just the way it is.

We all need to pay our school fees. We just think we can pay less.

I will leave you with this article from Ben Carlson:

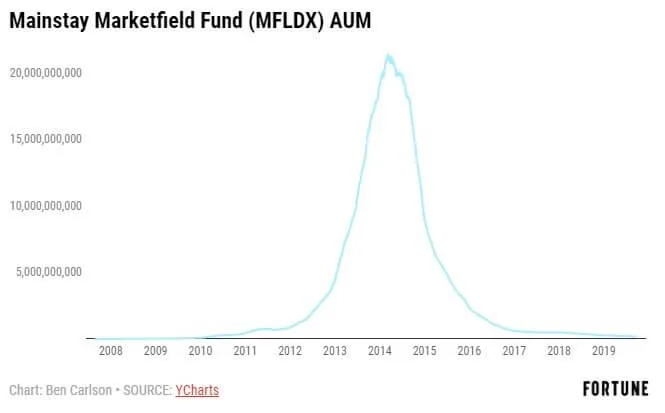

The Mainstay Marketfield Fund (MFLDX) saw strong returns, delivering a return of more than 100% from 2009 through the first quarter of 2014. The S&P 500 was up more than 130% in this time, but the fact that an alternative fund that switches between a number of asset classes and has the ability to short securities was able to keep up attracted huge inflows from investors.

Assets in MFLDX exploded from just $34 million at the outset of 2009 to more than $21 billion by early-2014. So while fund performance merely doubled, assets were up 60,000%. Warren Buffett once said, “Size is the enemy of outperformance,” and the Marketfield Fund was no different.

Since the first quarter of 2014, MFLDX has gone nowhere, losing a total of more than 11% up to now. U.S. stocks are up nearly 80% in this time. The fast money that poured into this fund fled just as fast as it came in. Assets are now under $200 million, down 99% from the highs in 2014.

This is the nature of things. Reviews or not… we all are bound to lose money due to our behaviors.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- The Cheapest Way to Extend Your Laptop to TWODisplay that I Can Find. - April 29, 2024

- My Quick Thoughts on the Net Cash, 4% Yielding Boustead. - April 28, 2024

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024