Resale endowment policy is not something new.

However, in the realm of wealth building, it may be less talked about. And therefore, a lot of investors may not be aware about it.

The concept from what I remember originate from UK. UK Tradeable Endowment was a pretty hot concept in the unit trust and investment forums that I frequent when I started investing in 2004 to 2006.

Since then, the talk about UK Tradeable Endowments have died down. In their place, there are some brokers who started dealing with Endowments that can be traded in Singapore.

One of them is REPS Holdings.

In this article, I will do a deep dive on the resale insurance endowment business. The value proposition to you as a potential investor. The risks involved as well.

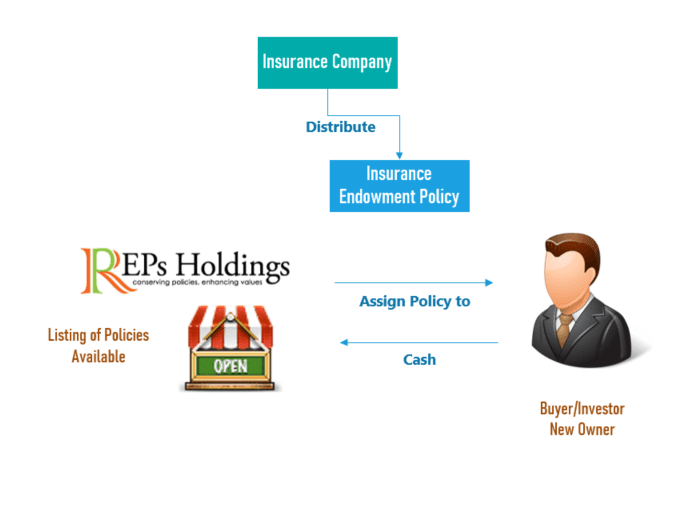

How are Insurance Endowments “Traded” or “Resold”?

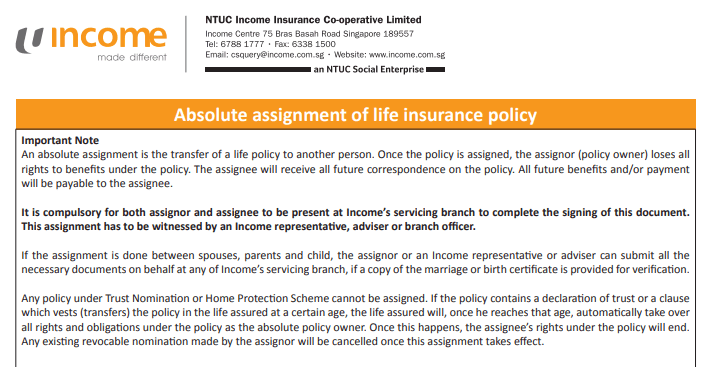

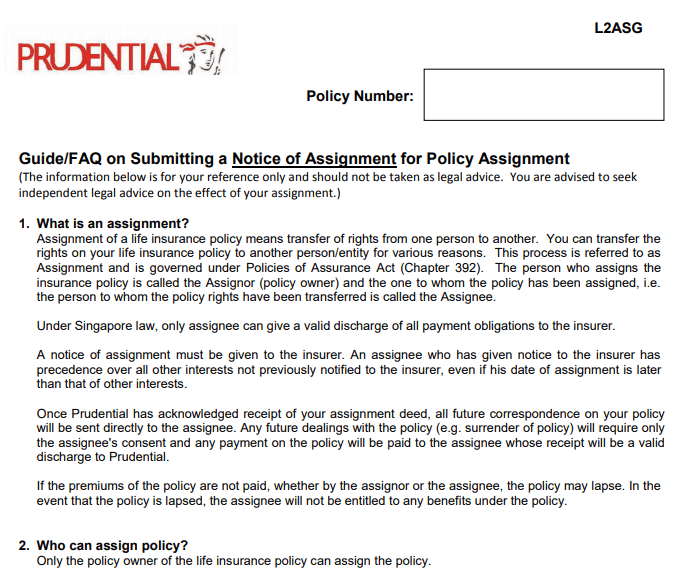

Absolute assignment is a process where a current owner of a policy (we call this the assignor) can legally transfer the rights and benefits of a policy to a new policy owner (we call this the assignee).

For each insurance company, they have their own assignment form that the assignor can fill up with the assignee to transfer the policy.

You can review the assignment forms for the various insurance company here.

The first part of the process is when the original seller assigns the policy to REPs Holdings. REPs Holdings is the assignee in this case:

Once the form is filled, signed and accepted, the policy is assigned to REPS Holdings.

An interested investor would then browse the policies that REPs Holdings have taken over. When the investor found a policy that matches what he or she is interested in, the policy is then assigned to the investor. The investor became the new policy owner.

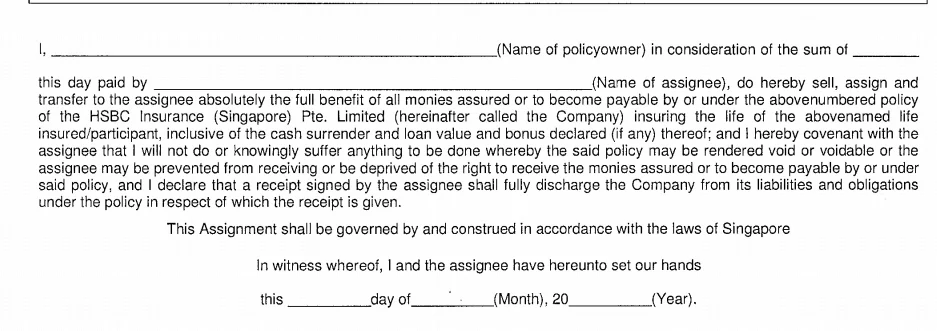

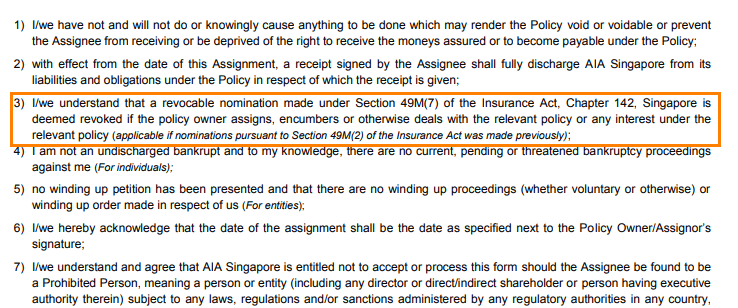

In these assignment forms, we can pick up more things regarding what the assignor is signing over, and what the assignee is taking over.

We learn here that any policy under trust nomination or HPS cannot be re-assigned. So this weeds out some of these policies that are more complex in nature.

We learn all future correspondence and dealings on the policy will only require the new policy owner’s consent.

In HSBC’s assignment form, it provides the clearest take on specifically sell, assigning and transfer of the cash surrender and loan value, the bonus declared.

In AIA’s assignment form, it explains that any nomination of beneficiaries that the assignor made, once the policy is assigned to the assignee, will be revoked.

This means that once the policy is assigned to the new owner, the beneficiary will be the new owner.

How does a policy sold through REPs Holdings look like? A Case Study of a $24,900 Investment

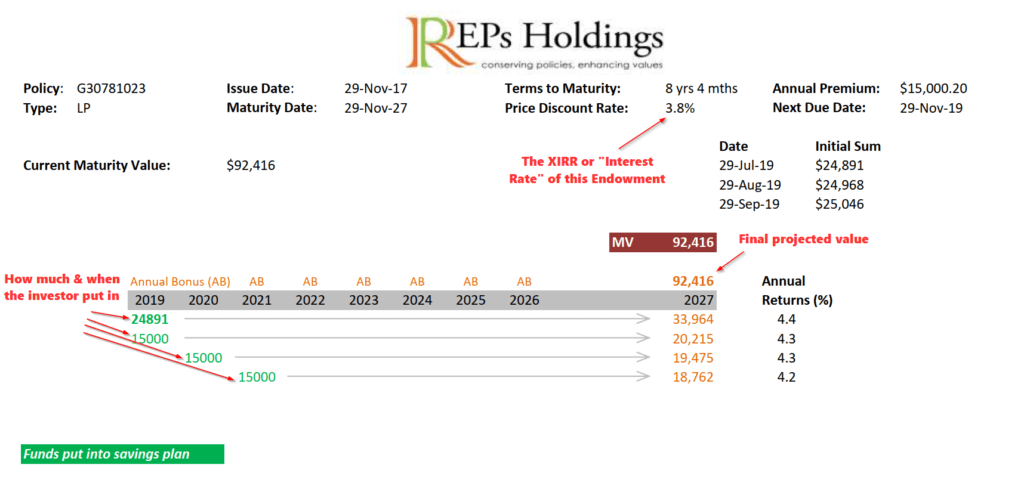

It would be something like an 8-year endowment policy listed by REPS Holdings shown below:

This was originally a 10-year endowment plan (29-Nov-17 to 29-Nov-27). The original owner of this policy sold to REPs Holdings after less than 2 years of owning it.

The surrender value the original owner got when he or she surrendered should be at a loss. The owner surrendered to REPs Holdings instead. In return REPs Holdings is able to give the original owner a better surrender value.

REPs Holdings would typically incubate the policy from 3 year upwards. Some policies have tenure as long as 20 years.

If you are interested in this policy, you can buy from REPs Holdings. The green numbers show the cash flow that you will need to put in.

In this case, the new owner will need to fund $24,891, and 3 x $15,000.

(Do note that this is not a one-time investment. If the policy requires on-going premium payment, you need to be ready to commit. In this case, you can see there are three $15,000 a year payment)

8 years later when the policy mature, the policy will pay out $92,416.

If you would like to know your projected return, you can look at the Price Discount Rate. The 3.8% here, is the XIRR or internal rate of return.

This is typically the way we view and how the insurance company view the “interest rate” of this stream of cash flow. It allows you to compare to other financial assets such as equity, bonds, commercial offices.

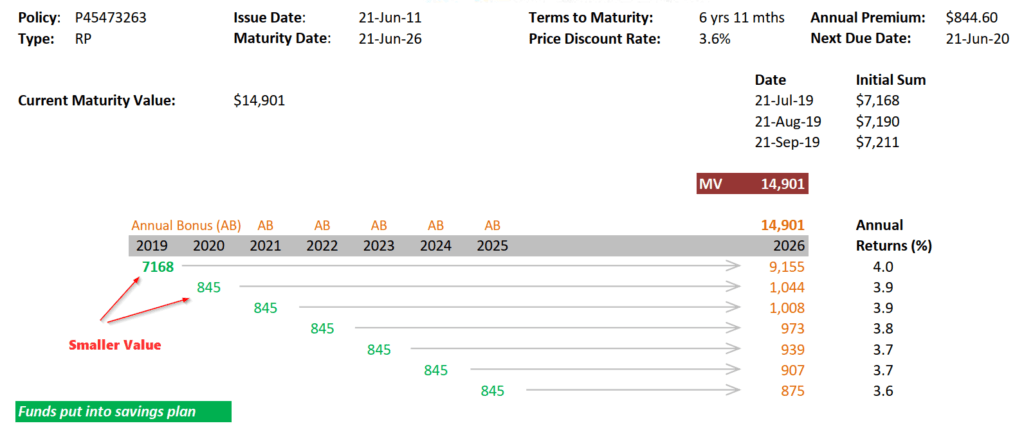

Here is another case study.

This policy is a shorter 6-year maturity that will yield a projected 3.6% XIRR/discount rate.

The main difference is that the cash flow is different. It is a smaller amount.

For some of you, your capital might not be as large as the previous case study.

Since these policies comes in different capital commitments, you will have to choose one that you are comfortable with. (Now you know why I say this is like buying second hand laptops)

How different is this resale endowment versus the traditional endowment

A resale endowment does not have a lot of difference from the traditional endowment:

- There is an assured person (life insured)

- The participating fund, which helps the policy owner invest their money is also the same

- The rate of return is thus the same had the policy not been sold

- In a traditional endowment plan, your actual return may vary from the projected return. This does not change as well

- The recurring premium contributions are also the same

What is different will be your return and margin of safety versus the first owner.

Why are the returns higher?

The returns if you choose to buy this resale endowment is higher because the initial amount you put in is lower.

Going back to this example, the original owner of the policy, for the first 2 years would have paid in total $30,000 in premiums during the first 2 years.

When the original owner surrenders the policy to REPS Holdings or the insurance company normally, the original owner would only get back say $22,000 in surrender value if the original owner chooses to surrender to REPS Holdings.

REPS Holdings resell this policy to you at $24,891. So the premiums you paid, versus the original owner ($30,000) is lower.

When your capital is lower, your discount rate/XIRR is higher than the original owner.

What if the original assured passes away? Who gets the sum assured?

When the policy is sold to REPS Holdings, the original owner will sign a change in assignment form to transfer the ownership to REPs Holdings.

After the sale, REPs Holdings (the new owner) is the only one who is able to claim any death proceed should something happen to REPs Holdings.

Usually the original owner is also the insured person. The original owner can name a few beneficiaries. These are the people who can receive the money should the insured (usually himself or herself) passes away.

Once the policy is assigned to a new owner, all past beneficiaries will be revoked. The new owner is the only one able to claim any death proceeds should something happen to the insured.

In some situations, a mother would buy a policy for her son. The mother is the first policy owner and the son is the insured.

For policies like this, the policy cannot nominate a beneficiary. This is because if anything were to happen to the son, the owner, which is his mother, will automatically be the beneficiary. Thus, nomination is not allowed.

When this policy is resold to you, as the new owner, you are not allowed to name any beneficiaries to the policy as well.

Who Gains, Who Loses?

My readers tend to be more sceptical than most. You are thinking about how this adds up. There should be some party who loses. It cannot be that all parties gain.

So here is the summary:

- The biggest person who loses is the one who surrender the policy. The original owner surrenders the policy at a big negative difference to the premiums he or she paid (the lesson learn is know what you are putting your money into, know how it works, how it fits into your financial net wealth!)

You can liken a resale endowment like a distress debt. REPS Holdings takes over from the original owner at a big discount to the original par value.

There is margin of safety there for them.

Here are the folks that benefit

- The person who purchased the endowment gets a product that he or she understands, matches his or her risk profile, matches his or her time horizon and a decent return

- The insurance agent (that sold to the original owner) and the insurance company still get their commissions as the policy is still in-force

- REPS Holdings earns a profit margin for taking over and reselling the policy

- The original owner who surrendered the policy get a higher surrender value compared to if the owner surrendered with the insurance company

Are the Returns on the RESALE Endowment Guaranteed?

The mechanics of the resale endowment is the same as how the original owner of the policy experiences it.

- The original owner’s returns are partly guaranteed and non-guaranteed

- The returns are dictated by the performance of the insurance company (not REPS Holdings) participating fund

- The original owner will get the reversionary bonus and may get the terminal bonus

- The policy may fall short of expectations when the insurance company cut the bonus. The owner’s returns will be cut lower

When you take over the policy, you will have experienced the same uncertainty as the first owner.

What are the Returns Expectations?

When REPS Holdings take over the policy, they will get the most up to date returns projection from the insurance company to work out the XIRR/Discount Rate that you would get, if you choose to purchase this policy. Remember that if the insurance company cuts the bonus, the returns projection changes.

So REPS Holdings do their best to give the closest projection and not based it on the original projection that the original owner gets when the original owner first bought the policy.

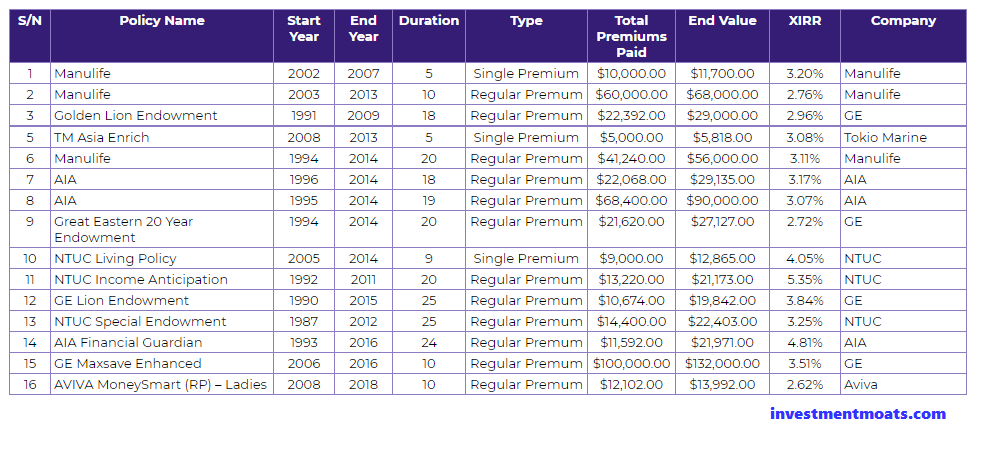

I have written a crowd sourced article in the past, where I tabulated the matured value of readers, friends and family’s insurance endowment plans. You can read it here.

Longer term policies should have a higher return, compared to shorter term policies. However, your experience will very much be determined by the performance of the insurance company’s participating fund.

In the summary table above, taken from my previous article, you can see the returns can vary.

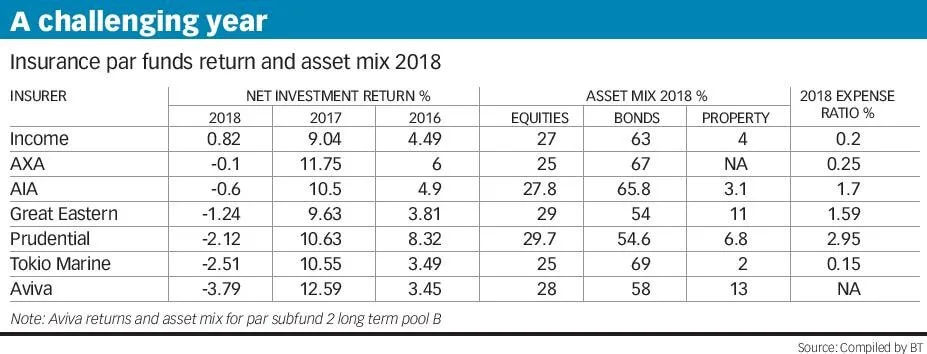

Going forward, the returns of the policy is fundamentally based on the underlying returns of the financial assets in the participating funds. In the table above from Business Times, you can observe the asset mix for different insurer.

If you purchase these resale endowments, your cost is lower than the original owner, so your returns are also higher.

Are REPs Holdings Licensed by MAS?

There are currently no MAS administered regulations which govern the sale, purchase and distribution of Resale Endowment Policies.

This means that if a person purchased a resale endowment policy, the person cannot rely on laws administered by MAS to take action against either REPS Holdings should they encounter any problems with the investment process.

You can however seek recourse under the Consumer Protection (Fair Trading) Act (CPFTA). The CPFTA allows consumers aggrieved by unfair practices to pursue civil remedies before the courts.

Who buys these Resale Endowments?

This is an interesting question.

I asked my representative about this and the folks that likes these policy (and they tend to keep coming back to purchase) are those very conservative wealth builders.

Firstly, they understand how these things work.

Why is this better than the traditional endowment?

- The maturity period tends to be shorter

- They have less risk of surrendering the policy with a bigger loss, versus the premiums that they paid, if they need to surrender the policy. This is because the capital they put in is smaller (than the original owner)

- They get higher return

So it is a no brainer to them.

Unlike the original policy owner, these folks tend to be more composed and assured about using endowments in their wealth building.

How should we view Resale Endowments in our Financial Net Wealth Allocation?

A wealth builder needs to know how the financial assets that goes into their portfolio work. You would have to know the characteristics such as returns, risk, liquidity and the amount of work involved.

And the wealth builder has to view these instruments as part of their overall financial net wealth.

Resale Endowments have the following profile:

- They are illiquid, unless you resell them back to Reps Holdings

- Since majority of the assets are bonds and property, the returns tend to stick close to bond returns, if you hold them to maturity

- They should yield positive expected returns if held to maturity, due to the way they are constructed

- Since their value is not priced so often, on a portfolio basis, they look less volatile

For those who wish to build wealth, and are younger, equities tend to have more market risk, more volatility, and expected to provide a higher return. Resale Endowment can take the role of the bond to reduce the volatility of the net wealth.

Since property is also not revalued so often (at least on a daily basis), the overall net wealth would look less volatile.

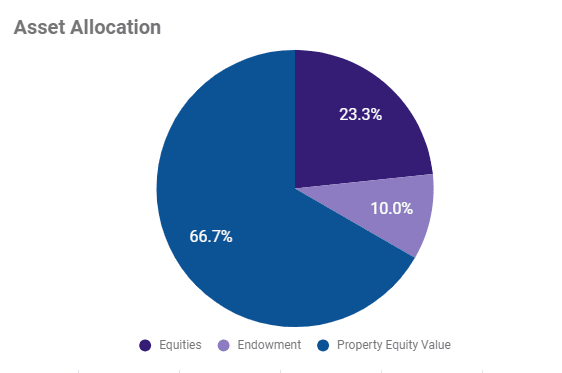

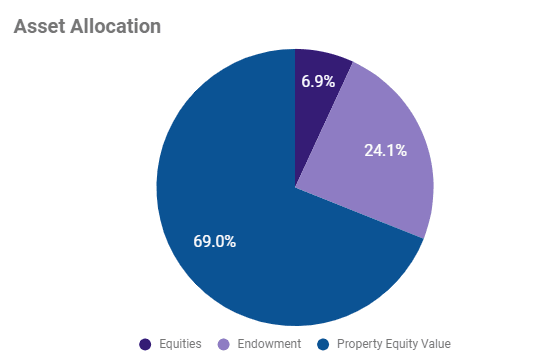

For some of you who are more risk adverse, your financial net wealth can be like this. The volatility to your financial net wealth is going to be very low.

However, you have to take note of the illiquidity of your financial net wealth.

- Your property is less liquid

- Your endowment is also less liquid

If you need to liquidate them, it might not be as easy as liquidating equity, unit trust, bond funds. When you liquidate your property and endowment in an illiquid market, the value that they may fetch might be far less.

Conclusion

REPS Holdings have provided an interesting prospect for those who wish to surrender their policy with a higher value.

As a broker, they have also provided a way for investors with certain risk appetite to purchase policies that meets their rate of return through REPSINVEST.

If you are interested to know more, do contact REPSINVEST here.

This post is Sponsored by REPS Holdings. The views are Kyith’s.

- The Cheapest Way to Extend Your Laptop to TWODisplay that I Can Find. - April 29, 2024

- My Quick Thoughts on the Net Cash, 4% Yielding Boustead. - April 28, 2024

- My Dividend Experience Investing in UCITS iShares iBond Maturing in 2028. - April 23, 2024

Anthony Dass

Friday 24th of July 2020

I have read through and found the whole system very confusing and mind boggling and do not wish to invest in such institutions.

Anonymous

Saturday 27th of November 2021

@Anthony Dass,

A good decision. The author basically is not well versed in financial planning experience. From a financial specialist point of view, it’s not wise and immoral to advise customers to sell their policy to company unless to the last resort. We don’t encourage clients to give up their policy unless unexpected situations then. Also, I would like to correct the author description to the endowment specialist. They are not licensed to be called as a broker under MAS. To me, they are considered as traders to buy in and sell out only. They do not really act as a middle man, only when it comes to the transfer of ownership.