To liquify the financial markets and the main economy, a lot of money was pumped into the financial system.

The straight forward deduction is that if you create money from out of nowhere, either your currency is going to shit or that inflation will run rampant.

We are not seeing both in the United States right now but a lot of the people are speculating it will be a matter of time.

I wonder whether that will really happen. I say this, because I can’t say I am that competent to make that deduction. Usually, we have to know to a good extent what I am talking about to make that conclusion.

I do think that from what I hear, we have created an interconnected system that will create more 2 standard deviation, 3 standard deviation volatility.

One of my favorite people on the financial blogosphere Cullen Roche of Pragmatic Capitalism explained that when the Federal Reserve infuses money, it is an exchange of very short-term liquid money with long-duration money/bonds.

In a way I understand it but if I cannot illustrate it out well, then maybe I do not understand it as well.

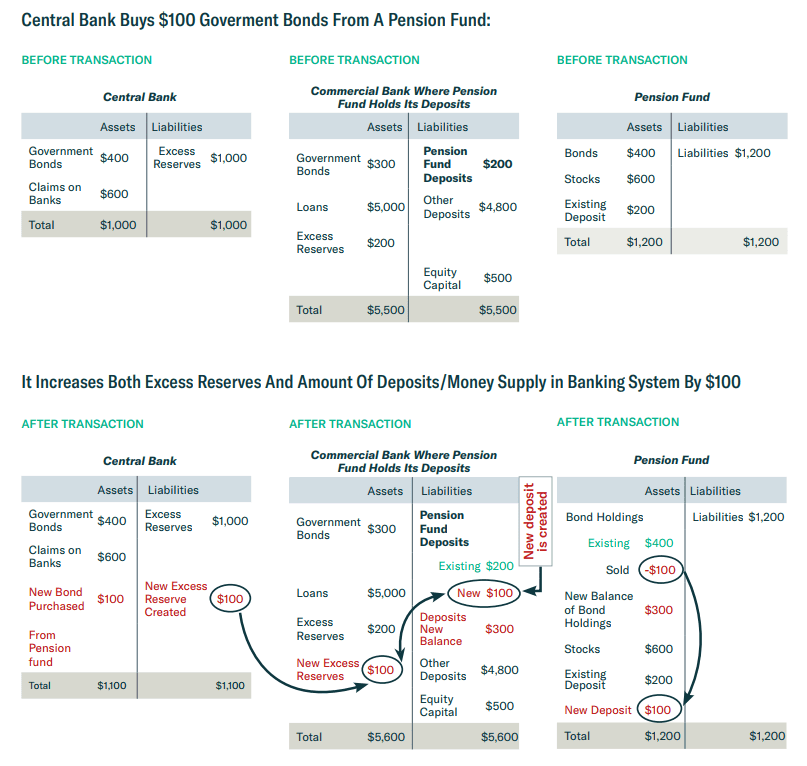

In any case, BCA has a good explanation about what happens when the Central Bank buys back commercial securities from the banks.

It sought to help to explain the relationship of Central banks with the monetary system.

I used to not get the relationship of Central Banks that well but the way to think about them is like the Bank of the financial institutions. They somewhat act as the lender of last resort.

If banks produce the lifeblood of the financial system, then they have to be functioning.

But what if the banks are not functioning?

That is probably the Central Bank’s job to lubricate the system.

The relationship can be best illustrated by observing the balance sheet of the Central Bank and a Commercial Bank as the Central bank announces they will buy commercial loans/bonds.

In the above diagram, the top section shows the balance sheet of a Central Bank and Commercial Bank. The bottom section shows the balance sheet after they decide to purchase $100 worth of bonds that belonged was on the books of the Commercial bank.

The main operating segment for a bank is to take in your deposit by giving you an interest, and then borrowing your deposit out at a higher interest.

To ensure that you can always withdraw your deposit and not have a “run-on-the-bank”, the Central bank will mandate the commercial bank to keep a reserve with them.

If the Central bank mandate a higher level of reserve, the commercial bank can only lend less. If they mandate a lower level of reserve, the commercial bank can lend more. This is one of the ways they regulate the money system.

Now, when there is a crisis of confidence in the financial system, counter parties have a heighten distrust whether each other can honor each other’s financial obligations. What the Central bank can do is to either guarantee certain transactions.

Or they can do something novel which is to buy the securities on the commercial bank’s balance sheet. In this case, the Central bank first said they will purchase the higher quality bonds, then bonds through exchange traded funds.

To do that, they have to create money out of thin air, through money printing, which you can see as New Excess Reserves Created of $100 on the Central banks Liabilities.

In accounting double entry, the matching entry is a $100 New Bond Purchase.

This New Bond Purchase comes from buying over the existing bond held on the assets in the commercial bank. The commercial bank receives $100 in cash.

What you would notice is that

- The Central Banks balance sheet expanded both on the assets and liabilities

- The Commercial Bank balance sheet is the same

- The deposit in the Commercial Bank stays the same.

- What is different is the quality of the Commercial bank’s balance sheet. The bonds were of certain risk. Now that $100 of bonds is replaced by something of higher quality (or less risky)

Net-net the money supply was not affected by these Quantitative Easing operations.

Where money supply will be created, according to BCA, is when Central bank lends to or purchases securities from both the commercial banks and economic agents.

If instead of all deposits, the commercial bank held liabilities in pension fund deposits, then the case might be a bit different.

We introduce the before and after balance sheet of a Pension fund in the third column.

The New Excess Reserve Created at the Central bank is used to purchase additional Pension fund deposits instead of commercial bonds at the commercial banks.

What this does is that the Commercial bank’s balance sheet expands both on the asset and liabilities end.

The subtle difference is instead of improving their own balance sheet, they go get themselves more levered.

The summary is that Quantitative Easing operations put more money into circulation when Central banks purchase assets or lend to non-banks (like the Pension fund). When Central banks purchase assets from commercial banks, no new money is put into circulation.

What actually put more money into circulation, outside of Quantitative Easing is when commercial banks purchase securities from or loans to economic agents (like the Pension fund in the example).

Can We forecast How Much Money is Created Through QE Operations?

One conclusion we may draw from the previous discussion is that we may not know if the money buys back from the commercial banks or from non-bank entities.

Basically, there are no easy way of predicting the percentage of which.

We do know that the Central Banks may just be getting bigger and bigger.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

Mao

Sunday 16th of May 2021

Both Bob and Collin are incorrect. Banks are still constrained by Capital and Liquidity requirements imposed by the regulators. To meet these requirements, banks still need to have customer deposits. Hence, it is not the inconsequential 'money created out of thin air' narrative that you put up.

Mao

Monday 17th of May 2021

Thanks Bob

The issue I had with your/Collin's previous statements is that they implied money is created out of thin air, and a bank can do any amount of lending without requiring any form of funding beforehand. While your statement 'a loan creates the deposit' is technically true as that would be what is recorded on the ledger, it is misleading as a bank still needs to look for "real" deposits/funding, just that this is managed after the fact.

The Liquidity/Capital requirements are also still a constraint on lending as they ensure that a bank has to keep higher liquid assets (reducing capacity to lend), and be more prudent in who they extend credit to.

In most cases, customer deposits are one of the cheapest and most stable forms of funding a bank can have. Hence, their importance in meeting the requirements.

Bob

Sunday 16th of May 2021

@Mao,

Nobody has said that banks do not need to have deposits. The deposits are made simultaneously when loans are created. If the deposits were all withdrawn, the bank would have to sell off its loan book to pay the depositors. But usually customers do not withdraw cash on a net basis, the total number of deposits remains fairly constant, with funds simply moving around from one account to the other inside the banking system.

The Liquidity Coverage Ratio requires the banks to have sufficient liquid assets to cover anticipated 30 days of short term outflows without having to liquidate long term loans. This is not a constraint on lending, as the ratio can be achieved by, for example, retaining shareholder profits.

The Capital Reserve Ratio requires the banks to retain more shareholders funds on the liability side of the balance sheet. This is aimed at preventing bank insolvency if the assets lose value and forces the shareholders to take more of the risk. It is also not a constraint on lending activities.

Essentially as long as there is a willing borrower and the bank is happy with the collateral offered against the loan, a loan and deposit will be made. If this does cause one of the ratio limits to be exceeded, the bank will take retrospective steps to remedy it.

Meeting these two requirements does not require customer deposits. But they are required to balance the entire balance sheet.

Collin

Sunday 25th of October 2020

"The main operating segment for a bank is to take in your deposit by giving you an interest, and then borrowing your deposit out at a higher interest."

This is totally incorrect. Unfortunately, this continues to be taught, even in universities. Commercial banks do not take your deposits to lend out to borrowers. They create money out of thin air by debiting their assets and liabilities simultaneously and reversing the entries as you pay off the loan.

A few resources: https://www.bankofengland.co.uk/knowledgebank/how-is-money-created https://www.youtube.com/watch?v=SkAzDrrKkME

Kyith

Sunday 25th of October 2020

Hi Collin thanks for that. This means that we should not consider the reserve ratio at all?

Bob

Sunday 25th of October 2020

Hi,

I am surprised that you got the basic precepts from Roche, as I believe he has a firmer grasp on this.

Anyway,

1. Banks do NOT lend out from deposits. This age old myth is simply wrong. A loan creates the deposit.

2. Banks are NOT constrained in lending activities by reserve requirements at the central bank.

3. Banks do NOT hold huge quantities of bonds. These are held in the shadow banking system (Main players being pension funds and insurance companies). This means that when the central bank buys bonds the source of these bonds is ultimately the shadow banking system and NOT the commercial banks.

Here's a concise five minute video from the Bank of England addressing these issues, so it has a certain amount of credibility.

https://www.youtube.com/watch?v=CvRAqR2pAgw

Here's Cullen Roche on reserves, see myth #1 ("the Fed has no direct control over the quantity of loans/deposits issued ")

https://www.pragcap.com/common-myths-about-the-federal-reserve/

Kyith

Sunday 25th of October 2020

Hi Bob, thanks for this.