US tech giant Microsoft announced their Q1 2021 results yesterday morning.

They achieve per-share profit growth of $1.82, beating analysts’ expectations of $1.54 a share.

The after-market share performance was muted. In fact, it’s nearly 1.5% lower. But due to the broad market fall this morning (28th Oct) the stock is down almost 5% to $203.

It has been consistently drilled into my head at work that the market is forward-looking in theory. And in a few practical cases, it is the case. After-market movements reflect the general crowd’s sentiments towards their expectations of future cash flows.

Microsoft’s results were not too bad in Q1 2021.

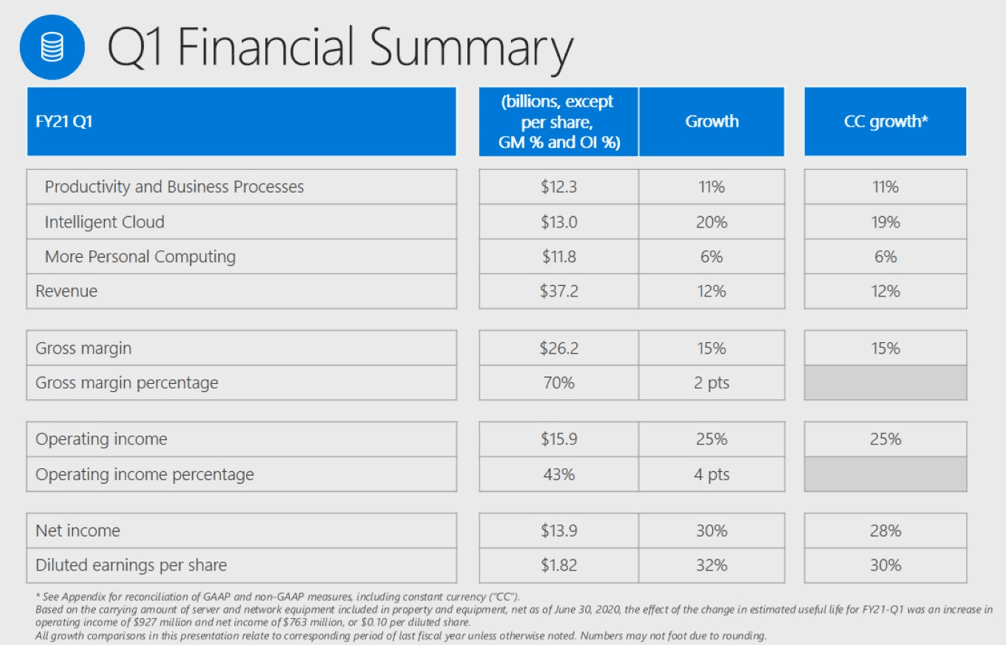

- Revenue was $37.2 billion and increased 12%

- Operating income was $15.9 billion and increased 25%

- Net income was $13.9 billion and increased 30%

- Diluted earnings per share was $1.82 and increased 32%

Revenue growth was decent not astoundingly good. However, where Microsoft did well was that despite their size, they were able to expand their gross margin and operating margin. This is reflected in much greater growth in operating income and other bottom-line figures.

However, we should tamper without expectations as some of these margin improvement was due to some change in how the company handle the accounting of some stuff.

Operating expenses increase by lower than anticipated, driven by a greater than expected COVID-related savings and investments that will be shifted to future quarters.

Azure in Intelligent Cloud

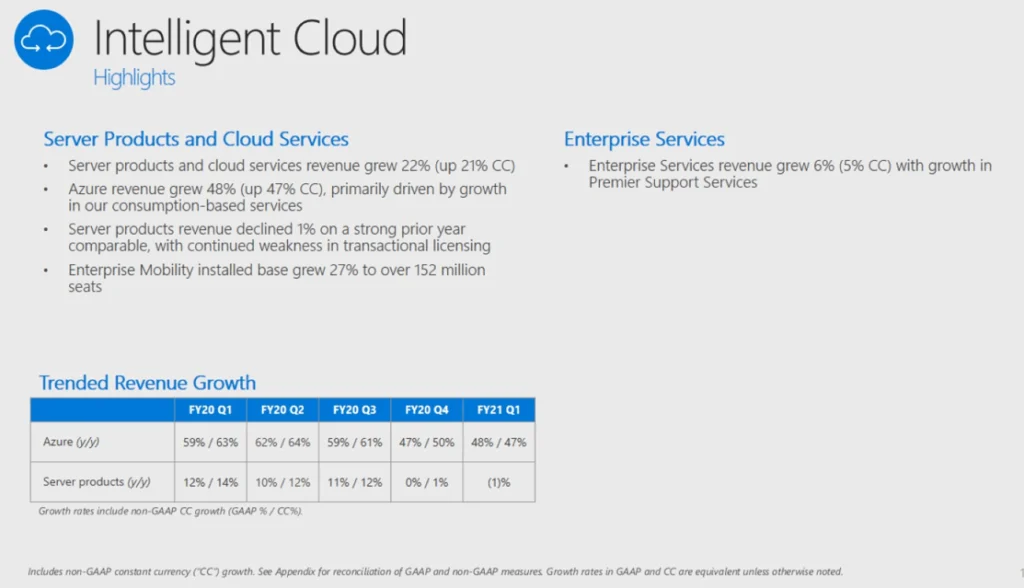

Out of all the results, most likely people are zooming into the performance of its high growth cloud computing segment, Azure, which is parked under the Intelligent Cloud segment.

The Intelligent Cloud segment grew 20% compared to a year ago, but what a lot of people zoomed in on was the growth in Azure. Last quarter, Azure’s growth slowed to a lower than 50% a year growth rate.

This quarter, the Azure growth rate was also below 50% (48%).

In the shorter-term, the market is pricing in their expectation that a part of its value is in an above-average cloud computing growth rate. If Microsoft failed to meet the growth expectation, its share price is going to get beat.

This growth was slightly below estimates.

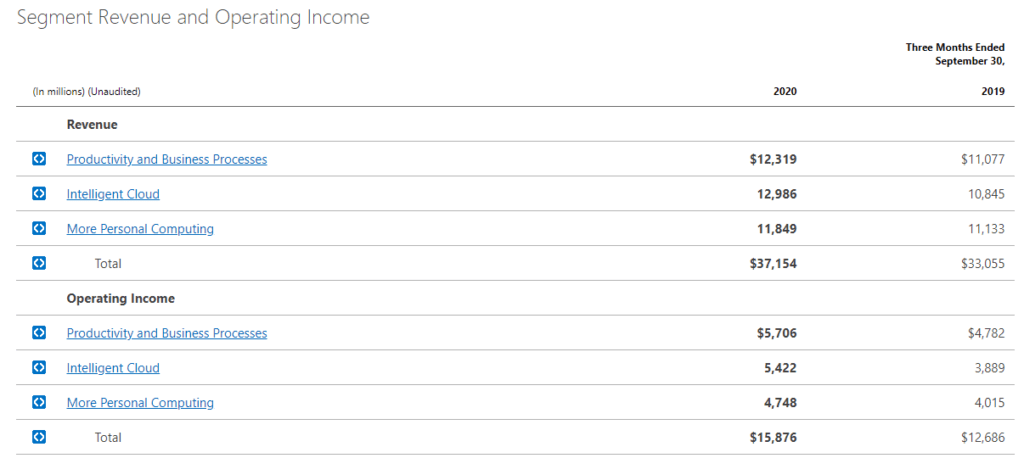

What is surprising to me was that in the Intelligent Cloud segment, the operating margins improved from 36% to 41% year on year.

I thought this should be a big deal, but management mention in the release notes that the gross margin improvement was due to a change in the estimated useful lives of their server and network equipment. If they excluded that, the gross margins would have decreased slightly.

I think nothing to shout about here. What we heard is that they are trying to aggressively grow the Azure segment, giving concession, so if they are able to maintain these margins, it’s already pretty good.

Other Segmentals

Other line items looked decent as well:

- Productivity and Business Processes, which is where Microsoft 365, Outlook, Microsoft Dynamics, and Linked is parked, grew 12%. Operating margin improved from 43% to 46%

- Personal computing, which is where the search, the gaming, windows are, grew a muted 6%. The operating margin improved from 36% to 40%.

- Surface revenue rose 37% versus a year ago

- Bing revenue declined, as the company commented that “search advertising revenue excluding traffic acquisition costs decrease 10%”

- LinkedIn grew 16% versus a year ago

- Gaming revenue grew 22% versus a year ago

Guidance for Q2 2021

Microsoft provided their guidance for next quarter and it seems next quarter.

Here are some of the highlights:

- Consumer PC growth to continue but will be smaller due to seasonably higher sales during Q2

- Commercial cloud gross margin percentage will increase by about 3% year on year due to accounting change

- Capital expenditure should be largely similar to Q1 2021

- Productivity and business processes revenue between $12.75 to 13 billion versus a consensus of $12.65 billion

- Office consumer should grow at single digits but decline sequentially as Office 365 is hit by strong competition and PC seasonality

- LinkedIn will be flat

- Dynamics 365 will be higher but lower than Q1 2021 due to seasonality

- Intelligent cloud revenue between $13.55 to 13.80 billion versus consensus of $13.75 billion

- Azure growth will be driven by the consumption-based business with the per-user side moderating further and on-premises down in the low single-digit range due to comps and transactional weakness

- Personal computing revenue expected to be below consensus

- Windows should decline in the high single-digit range on tough competition

- Xbox content and services to grow at a low 20%

- Microsoft warns of a negative gross margin impact from console sales due to investments in the platform

- The overall cost of goods is expected to be at $13.75-13.95 billion versus a consensus of $13.98 billion

My summary of the above is:

- Revenue guidance is higher than last year and this quarter

- Gross profit will be similar to this quarter

- Operating income will be higher than last year but lower than this quarter

- Net income will also be higher than last year but lower than this quarter

- Gross margin, the net profit margin will be lower than last year and this quarter

- Earnings per share of $1.62 versus $1.49 last year and $1.82 this quarter

Bottomline

Management seems to have guided that the expense structure we saw this quarter may not be repeated in the future.

Thus, if we were to make an estimation of full-year earnings per share it would be safer to annualized $1.62. This will give us estimated earnings per share of $6.48.

At a current share price of around $203, the forward price-earnings of 31.3 times.

Microsoft share price growth for the past few years is a combination of improving and growing earnings and cash flow as well as price-earnings expansion.

Price-earnings expanded due to the market recognising that they have competitive advantages, network effect, economic moat that cannot be replicated easily or they cannot be killed easily,

Price-earnings expanded also because discount rate, a function of interest rate, has gone down from in the past.

Perhaps today’s PE 30 is yesterday’s PE 25.

With ultra-low interest, a business with a strong competitive edge, with pricing power to increase with inflation, maybe today’s high-quality bond.

There is a lot to talk about their competitive advantage, at least from my perspective and if you are interested to hear my point of view, do let me know in the comments.

I think Microsoft is fair if you believe that for the next 3 years, it could at least grow its earnings per share at 10% a year before it reaches lower single digit growth.

In that scenario, it will trade at 24 times PE. In today’s low rate environment, given its competitive edge, you would rather be in this than in a bond.

However, I think a great company will still have a few levers to pull that may prolong that 10% growth. Its free cash flow looks volatile, but I got this feeling its generating far more than its accounting earnings.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.