I switched my envelope budgeting system over to Actual Budget for one month.

For those who are interested in Actual Budget, I consolidated most of the video guides I do about Actual Budget in this post.

There is one niggling thing that may prevent more to adopt Actual Budget: The lack of a mobile application.

Actual Budget can be install for free on your computer and you can do really nice Envelope budgeting on it.

However, the best thing when our phones got smart is that it allows us to capture our spending transactions when we make the transactions.

Without a mobile application, that becomes a problem.

I feel this is not a deal breaker because I have always capture my transactions in my brain and entering them when I get home at the end of the work day. I feel it is a matter of how motivated you are about keeping your financial house in order.

You could always have a note in your phone to record down.

But I have a better idea.

Many of us use Telegram as a chat application to talk to our friends as well as gain access to certain communities.

We can also built bots to help us do things like… log transactions to Google Spreadsheet.

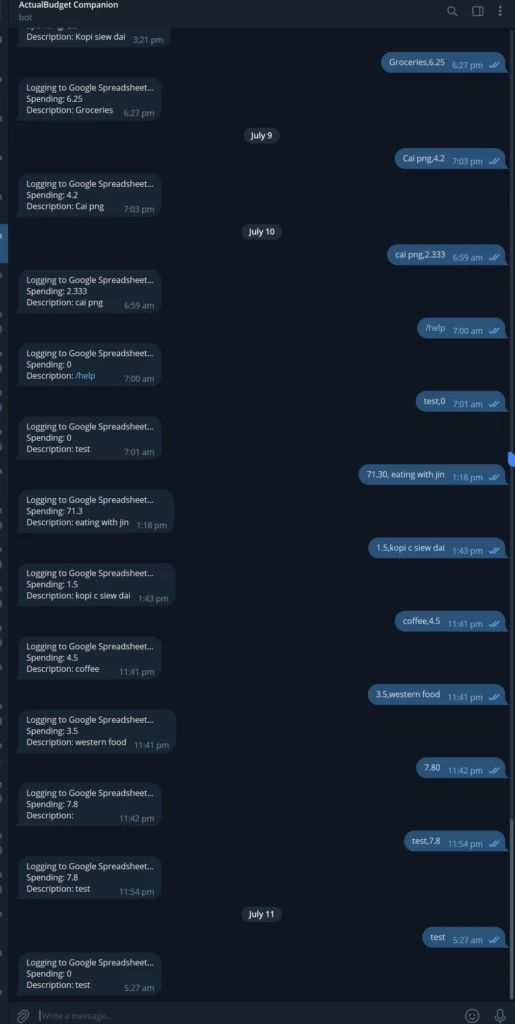

So I created a bot to help me log the spending to a Google Spreadsheet… as if I am chatting with a Spreadsheet.

You can do the same with this chat bot that I created ActualBudget Companion.

This video shows how you can hook your Telegram bot to a Google Spreadsheet:

In this way you can:

- Log spending when and where you spend it.

- Come back or enter it at the end of a certain period and never miss it.

- When you don’t miss transactions you stay on it.

If you realize…. even if you are not using Actual Budget, this is a nifty way for you to chat with a Google Spreadsheet to log your transactions!

Let me know if you encounter any problems.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

- Should I Take Less Risk in My Fixed Income Allocation by Moving Away from a Global Aggregate Bond ETF? - May 5, 2024

- Singapore Savings Bonds SSB June 2024 Yield Climbs to 3.33% (SBJUN24 GX24060A) - May 3, 2024

- New 6-Month Singapore T-Bill Yield in Early-May 2024 to Stay at 3.75% (for the Singaporean Savers) - May 2, 2024